How And When To Pay Your Bill

You dont need to pay your Self Assessment tax bill immediately.

The deadline for paying any tax you owe in addition to tax you may have paid through your 2021 to 2022 Payments on Account and your first 2022 to 2023 Payment on Account is 31 January 2023.

If you file your tax return early, you will know how much you owe and can then choose a payment option that works for you.

You can now make Self Assessment payments quickly and securely through the HMRC app. You can also check if a repayment is due by checking your personal tax account.

If Youre Worried About Your Tax Bill

If you are worried about how to pay your bill or whether you can afford to pay it, we can help.

We want to work with you to find an affordable way for you to pay the tax you owe, for example paying what you owe in instalments.

Contact us about Self Assessment

- phone: 0300 200 3310

- alternative ways to contact us

When Can I File My Taxes

As the end of the year approaches, tax filers start to wonder when they can file their taxes.

For those who like to get a head start on their taxes, heres a look at when you can file income taxes in 2023.

The answer for most people is that they can file their 2022 taxes in mid-to-late January 2023. That is the normal time frame.

However, you may be able to file your taxes early.

Don’t Miss: New York State Tax Login

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How Do I Prevent Tax Fraud

Its easy to procrastinate filing your taxes, but putting it off makes you more vulnerable to fraud. If a scammer gets hold of your Social Security number and you havent filed a tax return yet, they could easily file a fake one in your name to get a refund.

Scam calls are ubiquitous during tax season. Keep in mind that if the IRS needs to get in touch with a taxpayer, it sends a letter not an email, not a phone call, and definitely not a message over social media. Especially when its investigating cases of tax fraud or performing an audit.

Never return a phone call from someone claiming to be with the IRS. Instead, individuals should call the IRS directly at 1-800-829-1040, and businesses should call 1-800-829-4933.

The US Department of Justice says the IRS never discusses personal tax issues through unsolicited emails or texts, or over social media. Always be wary if you are contacted by someone claiming to be from the IRS who says you owe money.

If you receive an unexpected and suspicious email from the IRS, forward it to .

Recommended Reading: Washington State Capital Gains Tax 2022

What If You Miss A Date

Youll probably be hit with a financial penalty, if only an extra interest charge, if you dont submit a tax return and make any payment thats due by its appropriate deadline. The late-filing penalty for a 1040 return is 5% of the tax due per month as of tax year 2020, up to a cap of 25% overall, with additional fees piling up after 60 days. The IRS says you should file your return as soon as possible if you miss a deadline.

Dont Miss: When Are Oregon State Taxes Due

Getting Someone To Help You With Your Tax Return

There are several ways you can ask for help with your tax return. You can appoint a relative, friend or an accredited accountant to complete and send your tax return to HMRC on your behalf.

If you decide this is the best option for you, you will need to notify HMRC.

Find out how to get help with Self Assessment tax returns.

Even if you authorise someone to act on your behalf, it is still your responsibility to make sure your tax return is correctly completed and submitted on time.

Handing over sensitive personal information, even inadvertently, puts you at risk. Someone using your Government Gateway account could steal from both you and HMRC, and leave you having to pay back the full value of any fraudulent repayment claim made on your behalf.

If you appoint a tax agent, they can access the information they need to deal with your tax affairs using HMRCs agent digital services. Your agent should never need to log in as you, or ask you to share your Government Gateway user ID and password with them.

Also Check: How To Pay Doordash Tax

Very Important Information For The Self

Many Canadians get confused by the self employment tax deadline. You have to be very careful when filing and or making payments under this type of return. The Canada Revenue Agency catches many filers based on this information we have next.

If you owe money on your Self Employment tax return, the payment is due by April 30! Or in this case for 2022 it is due by May 2, 2022.

Do you see the difference with the filing date? You see the self employment return is not due till June 15, however the payment is due earlier on May 2, 2022. Many Canadians ask the basic question as in how can that be if I don’t file until June 15? The answer is that you need to know your tax liability by May 2, 2022, make payment then you can take your time to file the return itself on June 15. So at Accufile we always recommend that you put your Self Employment return together by the initial deadline of May 2, 2022. Then you will know what is owing in tax, and then make payment. You can then file your return anytime between the payment date and June 15, 2022.

There Are Several Important Dates Taxpayers Should Keep In Mind For This Years Filing Season:

- IRS Free File opens. Taxpayers can begin filing returns through Free File partners tax returns will be transmitted to the IRS starting Feb. 12. Tax software companies also are accepting tax filings in advance.

- Earned Income Tax Credit Awareness Day to raise awareness of valuable tax credits available to many people including the option to use prior-year income to qualify.

- IRS begins 2021 tax season. Individual tax returns begin being accepted and processing begins.

- Projected date for the IRS.gov Wheres My Refund tool being updated for those claiming EITC and ACTC, also referred to as PATH Act returns.

- First week of March. Tax refunds begin reaching those claiming EITC and ACTC for those who file electronically with direct deposit and there are no issues with their tax returns.

- Deadline for filing 2020 tax returns.

Don’t Miss: How To Report Tax Fraud To The Irs

When Are 2022 Taxes Due

The due date for filing your tax return is typically April 15 if youre a calendar year filer. Generally, most individuals are calendar year filers.

For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday. You could have submitted Form 4868 to request an extension to file later during the year.

If you have a business that operates on a fiscal year basis, your return is typically due on or before the 15th day of the third or fourth month after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

The last day to do taxes isnt the only important tax deadline to know, however. There are several other important tax deadlines you should know for 2023. If youre wondering, When are taxes due, anyway? Here are the important dates at a glance.

Also Check: When Do Taxes Have To Be Filed By

Key Information To Help Taxpayers

The IRS encourages people to use online resources before calling. Last filing season, as a result of COVID-era tax changes and broader pandemic challenges, the IRS phone systems received more than 145 million calls from January 1 May 17, more than four times more calls than in an average year. In addition to IRS.gov, the IRS has a variety of other free options available to help taxpayers, ranging from free assistance at Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country to the availability of the IRS Free File program.

“Our phone volumes continue to remain at record-setting levels,” Rettig said. “We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.”

Last year’s average tax refund was more than $2,800. More than 160 million individual tax returns for the 2021 tax year are expected to be filed, with the vast majority of those coming before the traditional April tax deadline.

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically. To avoid delays in processing, people should avoid filing paper returns wherever possible.

Don’t Miss: State Of California Sales Tax Rates

How Can I Make Filing My Tax Return Easier

You should always opt to file your tax return electronically. Furthermore, you should opt for direct deposit to guarantee your refund is received quickly. It is also advised that you check out the IRS.gov website for the latest updates on the tax laws. You do not need to call the agency directly.

For 2021, be aware that you may be able to claim the Recovery Rebate Credit as part of the two stimulus programs authorized by Congress during 2020.

The majority of people have already received Economic Impact Payments, but if you did not receive the maximum amounts and you were eligible, you can claim the remainder of what you are owed through your 2020 tax return.

If you have already received the maximum stimulus amount, you do not need to include any information regarding these payments on your 2020 return.

The first Economic Impact Payment was valued at $1,200 for individuals, $2,400 for taxpayers who are married and filing jointly, as well as $500 per qualifying child. The second stimulus payment was half these amounts for taxpayers but $600 per qualifying child.

Qualifying children born in 2020 also qualify under the terms of the stimulus program.

If you are eligible for stimulus payments but are not usually required to file a tax return, you can use TurboTax to claim your stimulus money.

Stimulus payments are not a taxable payment. You can still get a stimulus check if you owe taxes. The IRS will not offset any unpaid taxes against the stimulus provided by the government

What You Need To Know For The 2022 Tax

Ottawa, Ontario

Canada Revenue Agency

Last year, Canadians filed almost 31 million income tax and benefit returns. Having the information you need on hand to file your return makes the filing process that much easier. We want to help you get ready, so you are in good shape when it comes time to file your return this year.

Here you will find information on filing options, COVID-19 benefits, and whats new for this tax-filing season.

Read Also: How Long To Receive Tax Refund 2022

Tax Deadline 202: When Is The Last Day To File Taxes

One of the most important things to remember as a taxpayer are the deadlines for filing your taxes. The Canada Revenue Agency sets strict due dates for returns and payments. Filing your return on time helps you avoid any interest or penalties and get your refund earlier. Weve rounded up all the major dates that matter for your taxes to make this season stress-free.

Key Takeaways

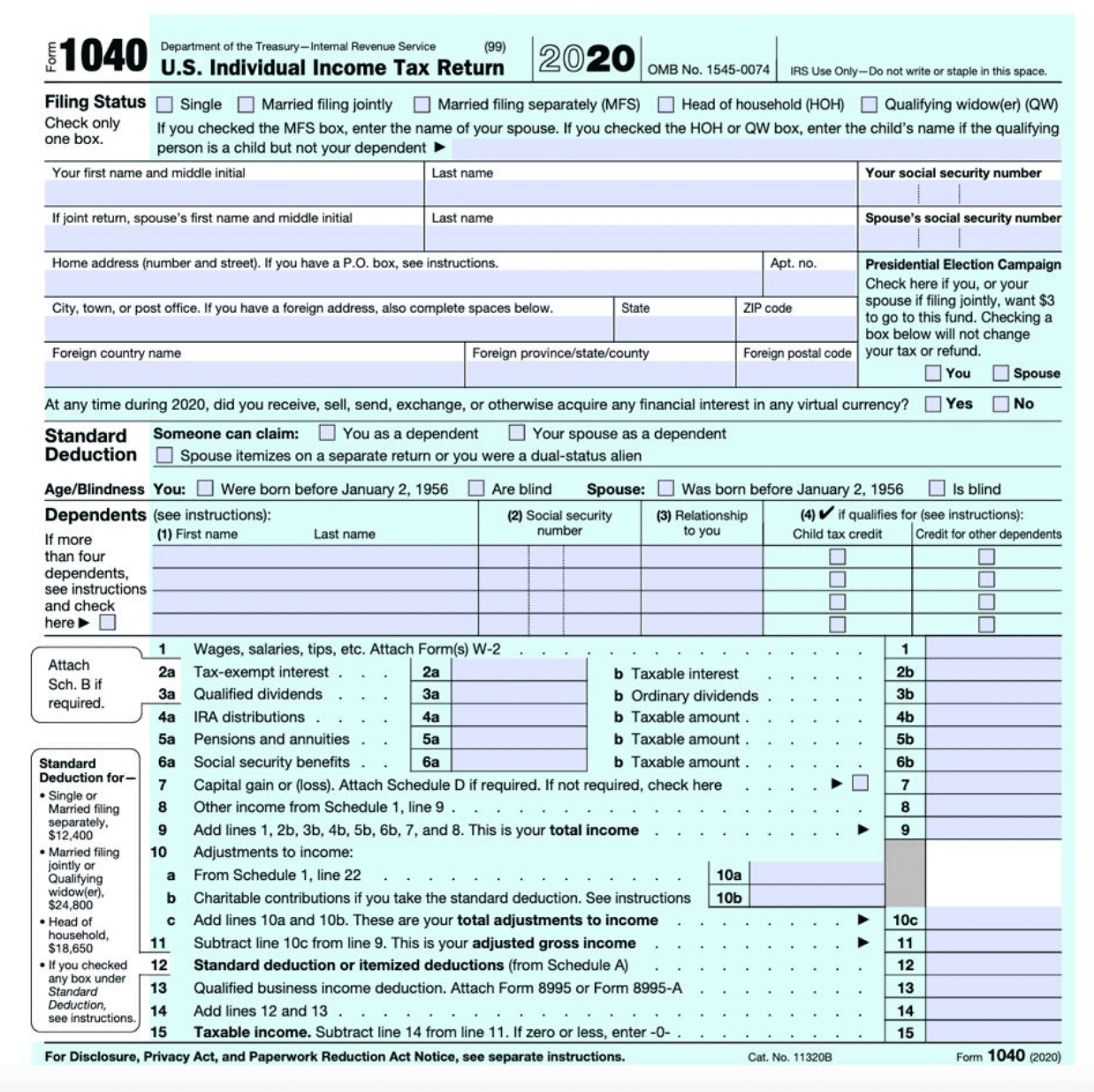

How To File Taxes In 7 Steps

While the method you choose to file your taxes can vary based on your income and how complicated your return is, here are seven steps that anyone can follow.

Step 1: Gather your paperwork. Before you prepare to file your taxes, you should gather all the paperwork youll need. This can include a W-2 form from your employer, earning and interest statements from investments and receipts for charitable donations and other write-offs if you plan to itemize.

Step 2: Decide how to file. While you can file a tax return through the mail, the IRS suggests filing online for faster processing and speedier refunds. You can also utilize a professional to help, take advantage of tax software or file using the time-honored paper and pen.

Step 3: Select the appropriate filing status. Your filing status will be based on whether youre single, married or head of your household, along with other less common tax situations. Youll also want to claim any dependents which is typically a qualifying child or relative as part of your return.

Step 4: Determine whether you are itemizing or taking the standard deduction. Most taxpayers with basic returns can use the standard deduction for 2021, which is $25,100 for married couples filing jointly and $12,550 for single taxpayers and married individuals filing separately.

Step 7: Finish the process by tax day. Submit your tax return by the tax deadline for your state to avoid potential penalties and interest.

Read Also: How Long Will My Tax Return Take

Delays Expected For 2021 Filing Season

Most California tax lawyers suggest that you not be surprised by delays this year. Filers, accountants, and IRS agents are usually busy at tax time, but the current tax season is plagued with several additional issues that may slow things down. In a Monday briefing, IRS officials said that at the beginning of the average tax season, they sometimes have as many as 1 million backlogged returns. However, this year, that number has been multiplied several times over.

IRS Commissioner Charles Rettig said last week that delays with both the processing of returns and tax assistance occurred because the IRS was busy overseeing various pandemic relief efforts that Congress passed last year. These included the issuing of Economic Impact Payments, which were distributed in three rounds, and the advance distribution of money for the Child Tax Credit.

Rettig stated that despite significant efforts by IRS personnel, the latter were unable to respond to an unprecedented number of calls and are still working through 2020 tax returns that were filed last year. He openly admitted that, in many cases, the agency could not enforce certain laws or deliver the level of service taxpayers need and deserve.

Give Yourself Time And Make Sure Youre Registered

Remember to give yourself enough time to do this ahead of the deadline, to allow for your UTR to be posted to you.

If this is your first time completing a tax return, you will need to register for Self Assessment and then HMRC will send you your UTR.

If you are completing a Self Assessment return because you are self-employed, then you will also need to register your self-employment with HMRC.

You May Like: Tax Id Numbers For Businesses

Turbotax Federal Free Edition

Like H& R Block, TurboTax has a Free tax filing option that allows you to file your federal return and one state return for free. However, the free option only supports simple returns with form 1040. The free option includes one free state return. In addition, TurboTaxs free option supports form 1040 with some child tax credits.

Whats Changed For Taxes In Canada 2022

Similarly, take note of the following tax deductions and credits that have been tweaked on this years return:

- Increased Home-Office Expenses Deduction: Last tax year, the government introduced an easier flat-rate method to claim a deduction for home-office expenses, given that millions of employed Canadians worked remotely during the pandemic. Since those work-at-home conditions have continued for many of us into 2021, the simplified claim will apply again this yearwith the maximum tax deduction increasing to $500 .

- Enhanced Eligible Educator School Supply Tax Credit: This existing tax credit, which allows teachers and early childhood educators to claim a 15% refundable tax credit on up to $1,000 of eligible supplies, is bumping up to a 25% credit. This will apply even if the teachers used those supplies at home rather than in the classroom/daycare.

Read Also: Sales Tax Calculator For Tennessee

Its Never Too Late To Get Help

With nearly 60 years of experience preparing and filing all sorts of Canadian taxes, H& R Block has tax solutions that will fit your needs and gives you access to the largest network of reliable Tax Experts.

Although our offices are busier in April than in January, H& R Block Tax Experts are here for you all year round whether its your first time filing, if you need to catch up on returns from previous years, or anything else tax season sends your way. We can even review up to three of your past returns looking for money that others may have missed through our Free Second Look service. By filing with H& R Block, you can be sure youll get the most out of your return, with our Maximum Refund GuaranteeTM.