Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Tax Day 2021 Deadline: The Last Day You Can File And How To Get An Extension

The IRS has officially postponed the deadline for 2021.

With millions of Americans still struggling to navigate COVID-19 and its impact on the economy, the IRS has elected to once again postpone the date that your federal income tax return is due. The new deadline of May 17, which will give you an extra month or so to get your paperwork in order this year, isn’t quite as generous as last year’s extension, which ran to July 15 — but, if you’re playing catch-up, it’s better than nothing.

Still, the clock is ticking for all of us — including the millions of taxpayers that will be facing an array of new, and potentially complicated, tax issues. They include unemployment insurance claims, stimulus check income and questions about eligibility for the home office deduction, just to name a few.

As such, the best thing you can do is to start now. Filing early means a quicker turnaround on your refund and getting any missing stimulus money faster.

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2023.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year. Partnerships and S-Corps filing deadlines are typically either March 15 unless they operate on a fiscal year. A six-month extension to September 15 can be requested using Form 7004. |

You May Like: Filing State Taxes For Free

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Is There A Deduction For 529a Able Accounts For 2021

In addition to the allowable subtraction for contributions to a 529 College Savings Plan, certain individual taxpayers may also take a subtraction for contributions made during the taxable year to a 529A, Achieving a Better Life Experience Account , during the taxable year on behalf of the designated beneficiary to the extent that contributions were not deducted in computing federal adjusted gross income.

For tax year 2021, taxpayers may subtract the amount contributed during the year up to a total of $2,000 per beneficiary If you are married filing separate returns, either you or your spouse may take the subtraction, or you may divide it between you, but the total subtraction taken by both of you cannot be more than $4,000 per beneficiary.

Recommended Reading: How To Pay Nanny Taxes

How Much Does It Cost To Pay Arizona Income Tax With A Credit Card

2.35% convenience fee, minimum of $1.50, to make a tax payment with a credit card. $3.50 convenience fee to make a tax payment with a debit card. Note: To determine if you have a Visa Corporate debit card or a Visa Consumer branded debit card, please contact your financial institution that issued the card.

File Electronically And Choose Direct Deposit

To speed refunds, the IRS urges taxpayers to file electronically with direct deposit information as soon as they have everything they need to file an accurate return. If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing.

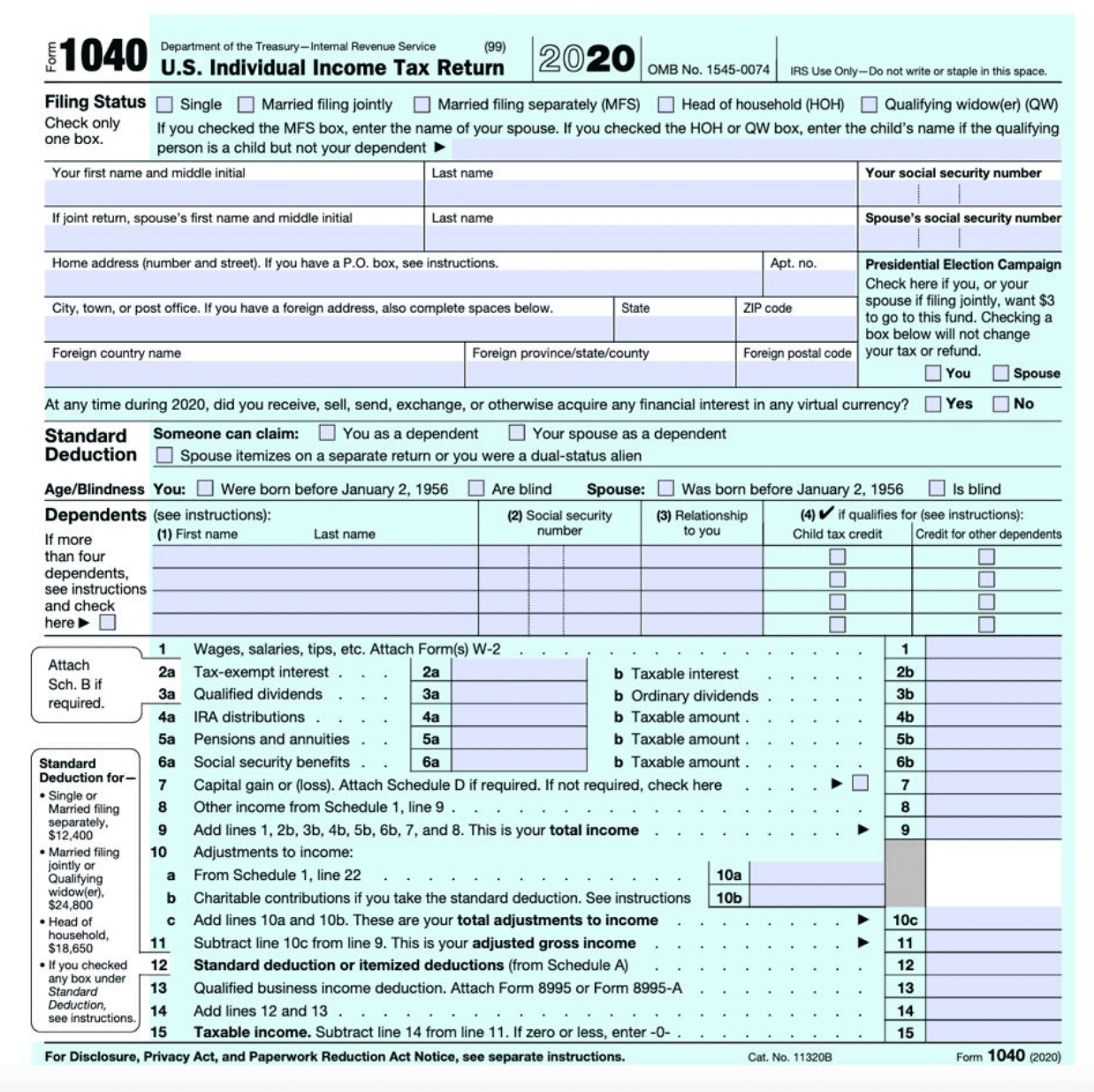

Most individual taxpayers file IRS Form 1040 or Form 1040-SR once they receive Forms W-2 and other earnings information from their employers, issuers like state agencies and payers. The IRS has incorporated recent changes to the tax laws into the forms and instructions and shared the updates with its partners who develop the software used by individuals and tax professionals to prepare and file their returns. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms .

Don’t Miss: Personal Property Tax In Wv

What Happens If I Don’t File Taxes But Dont Owe

If you fail to file your taxes on time, you’ll likely encounter what’s called a Failure to File Penalty. The penalty for failing to file represents 5% of your unpaid tax liability for each month your return is late, up to 25% of your total unpaid taxes. If you’re due a refund, there’s no penalty for failure to file.

What Is The Department Doing To Help Prevent Fraud

Because fraudsters work hard to devise new ways to steal identities and money, the Department continues to experience attempted tax refund fraud. The Vermont Department of Taxes works with the IRS, other state revenue departments, and companies and trade associations in the tax and financial services industries to develop and implement new procedures to help protect taxpayer money.

Submitting false W-2 information is a favorite tactic of fraudsters. Because of this, the Department continues efforts to validate wage withholding information with filings and payments by employers. The Department has emphasized the February 1 due date for employers to file W-2 information. Filing this information electronically with the Department by the due date prevents a frequent source of refund delay. Learn more about identity theft and fraud.

Recommended Reading: Do I Pay Taxes On Social Security

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can put this on your tax return and make the actual contribution by the new deadline.

What Is The Best Way To File My Tax Returns And Other Documents

More than 87% of all returns filed in Vermont are e-filed. Electronic filing through a commercial software vendor or your tax preparer is a secure way to file federal and Vermont returns. On average, e-filers get their refunds about two weeks faster than filers using paper forms because returns transmitted electronically get to the department more quickly, with fewer errors, and are more easily processed.

The Department continues to make improvements to make online filing easier for all taxpayers. You may use commercial tax software or a tax preparer to e-file Vermont personal income tax, but some filings may be made for free through myVTax as follows:

- Homestead Declaration

- Landlord Certificate

- An extension to file personal income tax

Don’t Miss: States That Don T Have Income Tax

Can I File My Income Taxes Sooner Than May 17

Yes. And the sooner you file, the faster you will get your refund — if one is owed. Most refunds are issued within three weeks — though this year, with the IRS still working through a backlog of stimulus payments, it might take longer. The agency began accepting returns on Feb. 12, 2021.

Read more:When will you get your tax refund? Possible dates and how to track it

What If I Owe More Than I Can Pay

Don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Read Also: Calculate Capital Gains Tax On Property Sale

When Will Tax Refunds Arrive

If you have a federal tax refund coming, you could get your money back in as little as three weeks. In the past, the IRS has issued over 90% of refunds in less than 21 days. If you want to speed up the refund process, e-file your 2022 tax return and select the direct deposit payment method. That’s the fastest way. Paper returns and checks slow things down considerable.

However, don’t expect your refund before mid-February if you claim the earned income tax credit or the additional child tax credit. By law, refunds for returns claiming these credits must be delayed. This applies to the entire refund, not just the portion associated with the credits. According to the IRS, its “Where’s My Refund” tool should provide an updated status for your refund by February 18 if you claim one of these credits. The IRS also expects most refunds that are held up because the earned income tax credit or additional child tax credit was claimed to be available in bank accounts or on debit cards by February 28 if you chose direct deposit and there are no other issues with your return.

What If I Owe The Irs But Can’t Pay

If you find yourself in this situation, you have a few options available, such as:

- installment agreements

- “offers in compromise”

You can also simply file your return and wait for the IRS to bill you, but don’t be surprised if the bill includes interest and penalties. Typically, the failure-to-pay penalty is less than the failure-to-file penalty so you likely should file even if you can’t pay the tax.

Also Check: File Sales Tax In California

When Are 2022 Taxes Due

The due date for filing your tax return is typically April 15 if youre a calendar year filer. Generally, most individuals are calendar year filers.

For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday. You could have submitted Form 4868 to request an extension to file later during the year.

If you have a business that operates on a fiscal year basis, your return is typically due on or before the 15th day of the third or fourth month after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

The last day to do taxes isnt the only important tax deadline to know, however. There are several other important tax deadlines you should know for 2023. If you’re wondering, “When are taxes due, anyway?” Here are the important dates at a glance.

Did You Receive A 1099

Also Check: State Of North Carolina Income Tax

I Need Help Filing My Taxes Where Can I Get Income Tax Preparation Assistance

Arizona Department of Revenue does not offer tax preparation assistance. offer free assistance to the elderly and other individual taxpayers that need to file their income tax electronically.

To expedite the processing of your income tax return, we strongly encourage you to use the bar-coded fillable Arizona tax forms or electronically file. Electronic filing information is available on our .

If You Are Getting A Refund

This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRSas about three out of four taxpayers do every yearthen there is no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension. However, this might not be the case for state taxes.

That’s not to say there aren’t very good reasons for filing on time. Even if you have a refund coming, consider the following:

- You can’t get your money back until you file, so you should file as soon as you can to get your money as soon as possible.

- The statute of limitations for the IRS to audit your return won’t start until you actually file your return. So, the sooner you file, the sooner the clock starts ticking.

- Some tax elections must be made by the due date, even if you have a refund coming. This applies to a very tiny percentage of taxpayers.

Read Also: When Are Quarterly Tax Payments Due

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- Electronically filing and choosing direct deposit is the fastest way to get your refund. When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.

- If you already have an account with a bank or credit union, make sure you have your information ready â including the account and routing number â when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

- You can learn more about choosing the right prepaid card here.

Will My Refund Be Issued By Paper Check Or Electronically

Previously, the Department might have issued you a paper check, even if you selected to receive your refund by direct deposit or prepaid debit card. This protection helped the Department avoid sending your money to an account or debit card that is controlled by a criminal.

While the Department honors taxpayer requests to issue a refund electronically, there may be situations in which we will determine its safer to issue a paper check. In some cases, we may send a letter requesting verification of taxpayer identity instead of automatically changing your request to a paper check. The letter instructs you to go to myVTax, select Return filing verification, and enter the verification code included on the letter. This verifies your request and allows us to proceed with processing your refund.

Recommended Reading: What Date Do You Have To File Your Taxes By

What’s The Deadline For Filing 2022 Tax Returns

The IRS says it expects to receive more than 168 million individual tax returns this year. The deadline to file for most Americans is Tuesday, April 18, 2023. That’s because April 15 is a Saturday and the next weekday, April 17, is recognized as a holiday, Emancipation Day, in Washington, DC.

According to the IRS, “by law, Washington, D.C., holidays impact tax deadlines for everyone in the same way federal holidays do.”

Residents of California impacted by severe storms have until May 15 to file their taxes.

If you’re serving in the military abroad, including in a combat zone or as part of a contingency operation in support of the US Armed Forces, you may be granted additional time to file your return.

How To Track Your Tax Refund Status With The Irs

If you expect a tax refund this year, you can track your tax refund status with the IRS Wheres My Refund online tool or the IRS2Go mobile app.

Youll need to input your Social Security number, filing status and your expected refund amount. The IRS updates your tax refund information within 24 hours after e-filing and updates the tool daily. If you filed your tax return by mail, expect longer processing times and delays.

If you dont have access to online tools, you can also contact the IRS by phone at 800-829-1040 to obtain the status of your refund.

Don’t Miss: Mass Tax Connect Phone Number