An Overview Of All The Tax Returns The Executor Might Need To File On Behalf Of The Deceased Person Or The Estate

Taxes are a big part of an executor’s responsibilitiesand may seem like the most intimidating part. The good news is that you probably won’t be dealing with any complicated tax issues. Also keep in mind that you can hire experts to help you with tax questions and use estate funds to pay for their services.

File The Estates Income Tax Return

While the deceased persons Social Security number is their taxpayer identification number for purposes of the income youll report on their 1040, you have to use a different identifier if an estate income tax return is required. Thats because tax law considers a persons estate to be a separate entity from the deceased person for tax purposes. Once all the heirs and beneficiaries of the estate have received their final distribution of the estates assets, the estate ceases to exist and its tax obligations end.

Before filing Form 1041, youll need to obtain a tax ID number, or EIN, for the estate. You can apply for an EIN online, by fax or by mail.

The deceased persons estate is taxed similarly to the way the person was taxed while they were living. Most deductions and tax credits allowed to individuals are also allowed to estates. But the estate is also allowed to claim a deduction for distributions to beneficiaries.

The estates first tax year begins when the decedent dies. You can choose to file a short-year return that ends on December 31 or the end of any other month that ends in an initial tax period of 12 months or less.

Form 1041 is due by the 15th day of the fourth month after the tax year-end if the personal representative chooses a fiscal year for the estates accounting period or by April 15 of the following year if they choose a calendar year accounting period.

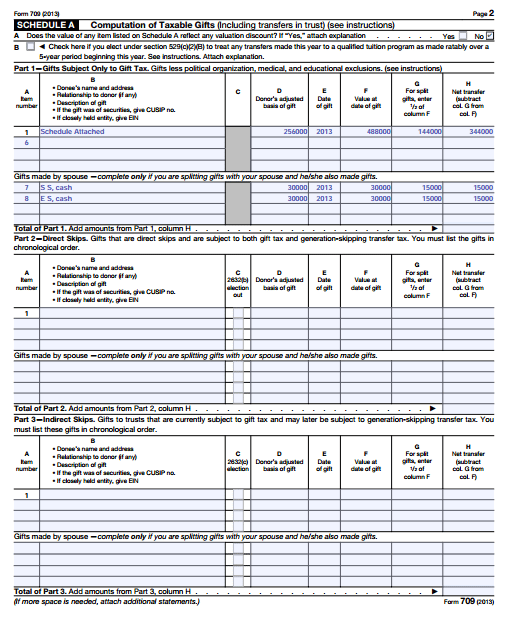

Line 7 Worksheetsubmit A Copy With Form 706

Taxable Gift Amount Table

| Amount in Row , Line 7 Worksheet over… | Amount in Row , Line 7 Worksheet not over… | Property Value on Amount in Column A | Rate on Excess of Amount in Column A |

| 0 | |||

| 40% |

How to complete the Line 7 Worksheet.

.Remember to submit a copy of the Line 7 Worksheet when you file Form 706. If additional space is needed to report prior gifts, please attach additional sheets..

Table of Basic Exclusion Amounts

| Period | |

| 1977 | $30,000 |

| 1977 | $120,667 |

| $4,769,800 |

Note.

In figuring the line 7 amount, do not include any tax paid or payable on gifts made before 1977. The line 7 amount is a hypothetical figure used to figure the estate tax.

Special treatment of split gifts.

These special rules apply only if:

-

The decedent’s spouse predeceased the decedent

-

The decedent’s spouse made gifts that were split with the decedent under the rules of section 2513

-

The decedent was the consenting spouse for those split gifts, as that term is used on Form 709 and

-

The split gifts were included in the decedent’s spouse’s gross estate under section 2035.

If all four conditions above are met, do not include these gifts on line 4 of the Tax Computation and do not include the gift taxes payable on these gifts on line 7 of the Tax Computation. These adjustments are incorporated into the worksheets.

Lines 9a Through 9e. Applicable Credit Amount

Line 9a, basic exclusion amount.

In 2022, the basic exclusion amount, as adjusted for inflation under section 2010, is $12,060,000.

Line 9b, DSUE.

Don’t Miss: How Old Do You Have To Be To File Taxes

Who Is Responsible For Filing The Returns Of A Deceased Person

To be legally authorized to file returns on a deceased persons behalf, you must be their personal representative either the executor or administrator of the estate or anyone in charge of the individuals property. In many cases, this person may be identified in the deceased persons will as executor of the estate. If there isnt a will or the executor named in the will cant or wont fulfill their duties, the court will appoint someone as administrator.

A surviving spouse can file a joint return with the deceased person if a personal representative hasnt been appointed before the due date for filing the return the year of the deceased persons death. But if the surviving spouse remarries before the end of the year in which the taxpayer died, then they cant file jointly with the deceased spouse.

If you are the deceased persons personal representative and make a mistake, either by not filing at all or filing the tax return incorrectly, the IRS may assess penalties, so youll want to take the responsibility seriously.

Deemed Proceeds Of Disposition For Capital Property Other Than Depreciable Property

The rules for calculating the deemed proceeds for depreciable property are explained in Deemed proceeds of disposition for depreciable property. If there is a transfer of farm or fishing property to a child, see Deemed proceeds of disposition for farm or fishing property transferred to a child.

Principal residence

If the deceased owned property that was their principal residence, there is a deemed disposition of the property on death. A principal residence designation must be made by completing page 2 of Schedule 3, Capital Gains in 2021 and Form T1255, Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual.

Where the principal residence is transferred to the deceaseds spouse, common-law partner, or testamentary spousal or common-law partner trust , the CRA does not require you to make a principal residence designation for the period before death. Instead, the disposition must be reported and the designation may be made by the surviving spouse, common-law partner, or the trust at the earlier of the time of actual disposition or death of the surviving spouse. Therefore, a record should be kept of the years for which the deceased individual would have been eligible to make a principal residence designation for the particular property.

For a transfer to a spouse or common-law partner, the deemed proceeds are the same as the property’s adjusted cost base right before death, if both of these conditions are met:

Example

Tax Tip

Also Check: Sale Of Second Home Tax Treatment

Who Pays Estate Tax

If you must file an estate tax return, whether at the federal or state level, the estate is responsible for the taxes. In other words, the executor or beneficiaries arent responsible for the tax liability.

The executor, however, is responsible for filing the proper tax returns and paying the taxes due on time . The money comes directly from the estate before the executor can distribute assets to any beneficiaries.

Beneficiaries, in most cases, dont pay inheritance taxes on the money earned from an inheritance. The IRS doesnt consider it earned income. However, if the inheritance earns an income after the beneficiary takes possession, then the beneficiary will pay taxes on the earnings.

Who Must File Form 706

Form 706 is filed by the executor of the estate if the decedent has passed during the tax year and the estate value exceeds a certain threshold. To file Form 706 in 2021, the combination of the gross value of the estate and the value of federally taxable gifts must exceed $11.7 million. For 2022, the threshold is 12.06 million. This Form must be filed within nine months of the decedent’s death, or an extension should be filed through Form 4768.

Also Check: How To File Free Taxes

Filing Requirements For California Estate Tax Return

A California Estate Tax Return, Form ET-1, is required to be filed with the State Controller’s Office, whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service . However, after January 1, 2005, the IRS no longer allows the state death tax credit therefore, a California Estate Tax Return is not required to be filed for decedents whose date of death is after December 31, 2004.

Pursuant to Revenue and Taxation Code section 13302 the amount of California estate tax is equal to the maximum allowable amount of the credit for state death taxes, allowable under the applicable federal estate tax law. Generally, this amount would be shown on either line 13 or 15 of the Form-706.

The California Estate Tax Return must include a complete copy of the IRS Form 706 and all related schedules. The return should mailed to:

State Controller Sacramento, CA 94250-5880

NOTE: The return should not be mailed to the Franchise Tax Board.

California estate taxes are due and payable by the estate’s executor on or before nine months following the date of death. Checks shall be made payable to the State Treasurer and mailed to the State Controller’s Office at the address listed above.

Pursuant to Revenue and Taxation Code section 13510, the penalty for failure to file a California Estate Tax Return is five percent per month or portion thereof, not to exceed 25%.

Form : The Estate’s Income Tax Return

The income tax return form for estates is IRS Form 1041. It’s also called a “fiduciary” return, because you file it in your capacity as executor of the estate. The Form 1041 return is similar to the personal income tax return, Form 1040, that we all file every April 15. There’s a “Decedent’s estate” box at the top the form, which you should check.

The executor of the estate is responsible for filing a Form 1041 for the estate. The return is filed under the name and taxpayer identification number of the estate. On it, you’ll report estate income, gains, and losses, and will claim deductions for the estate. You don’t have to include a copy of the will when you file the return.

Read Also: Do Retirees Need To File Taxes

The 4ws Of Estate Tax: Who When Where And What

People who acquire properties through inheritance have some boggling questions in their minds which need to be clarified to prevent potential difficulties in the future as the term estate tax in itself is an unfamiliar or a technical term for many of us. This article provides clarifications to some of these primary estate tax queries.

| 4W’s | People Required to File and Pay Estate Tax Return |

|---|---|

| WHO | The executor, administrator or any of the legal heirs are required to file estate tax return as a condition precedent for transfer of ownership in the name of transferee. |

It covers all cases of transfers subject to estate tax or regardless of the gross value of the estate, estate consisting of registered or registrable property such as real property, motor vehicle, shares or stock or other similar property, which necessitate the clearance from the Bureau of Internal Revenue.Section 90 of the NIRC, as amended by TRAIN Law

This is required for either resident or non-resident of the Philippines. In the absence of an appointed, qualified or acting executor or administrator, the law allows any person in actual or constructive possession of any property of the decedent.Section 91 of the NIRC, as amended by TRAIN Law

Leeway may be allowed in cases where the Commissioner otherwise permits.

| 4W’s | The Process |

|---|---|

| WHAT | Triplicate copy of the designated BIR form for Estate Tax Return shall be filled up completely, under oath and filed by the people within the time and place prescribed by law. |

A Guide To Estate Taxes

If you’re responsible for the estate of someone who died, you may need to file an estate tax return. If the estate is worth less than $1,000,000, you don’t need to file a return or pay an estate tax. Massachusetts estate tax returns are required if the gross estate, plus adjusted taxable gifts, computed using the Internal Revenue Code in effect on December 31, 2000, exceeds $1,000,000.This guide is not designed to address all questions which may arise nor to address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings or any other sources of the law.Updated: May 11, 2022

Recommended Reading: How Much In Taxes Do I Owe

Goods And Services Tax/harmonized Sales Tax Credit Received After The Date Of Death

Generally, GST/HST credit payments are issued on the fifth day of the month in July, October, January, and April. If the fifth day falls on a weekend or a federal statutory holiday, the payment will be made on the last business day before that day. If the deceased was receiving GST/HST credit payments, the CRA may still send out a payment after the date of death because they are not aware of the death. If this happens, you should return the payment to the tax centre that serves your area.

Note

The CRA administers provincial and territorial programs that are related to the GST/HST credit. If the deceased was receiving payments under one of these programs, you do not have to take any further action. We will use the information provided for the GST/HST credit payments to adjust the applicable provincial or territorial credit program payments.

What if the deceased was single, separated, divorced, or widowed and received the GST/HST credit?

If the recipient died before the scheduled month in which the CRA issues the GST/HST credit, payments will no longer be issued in that person’s name or to that person’s estate.

If the recipient died during or after the scheduled month in which the CRA issues the credit and the payment has not been cashed, return it to the CRA so that they can send the payment to the person’s estate.

What if the deceased’s GST/HST credit is for the deceased and their spouse or common-law partner?

What if the deceased is an eligible child?

How To Determine An Estates Value

To determine an estates value, you must know the gross value or value before any liabilities for tax purposes. An estates gross value is the value of all of its assets at the time of death. The executor can also choose to value the estate six months after the death too if that helps lower your tax liability.

Recommended Reading: When Is Tax Returns Due

Filling In The Return

Youll usually need details of the deceaseds bank and savings accounts, for example:

- bank statements

- National Savings bonds or certificates

If the deceased was employed or receiving a pension youll usually need:

- work or pension payslips

- details of any expenses paid by the employer

- confirmation of any state pension

Youll also need details of any other income they had, for example if they rented out property or ran their own business.

Contact HMRCs Bereavement helpline if you need help completing a return for someone who has died or if you cannot find their records.

File The Final Form 1040

The final Form 1040 covers the period from Jan. 1 of the year in which the person died through the date of their death. You must file and pay any tax due by the standard tax filing deadline of the following year. If you need more time, you can request an extension of time to file the Form 1040.

The deceased persons income will be taxed just as it would have been if they were still living. The same tax rates apply, and they can claim the same deductions and credits.

Youll need to write the word DECEASED, plus the persons name and date of death, across the top of the Form 1040 and complete it using the deceaseds personal information, including their Social Security number and address.

Since youll be signing the deceaseds final tax return on their behalf, you need to complete IRS Form 56 and attach it to the final Form 1040. And if youll be claiming a refund that would have been due to the deceased person, youll likely have to file Form 1310 unless you meet these requirements.

- Youre the deceased persons spouse and filing a joint return or an amended joint return.

- Youve been appointed by a court or are a certified personal representative filing an original return on behalf of the deceased. Youll need to attach a copy of the court certificate confirming your appointment to the return.

Don’t Miss: Taxes On 2 Million Dollars Income

Net Capital Losses In The Year Of Death

To apply a net capital loss that was incurred in the year of death, you can use either Method A or Method B.

Method A – You can carry back a 2021 net capital loss to reduce any taxable capital gains in any of the three tax years before the year of death. If you are applying it against taxable capital gains realized in 2018, 2019, or 2020, you do not need to make any adjustment because the inclusion rate is the same in all three years. The loss you carry back cannot be more than the taxable capital gains in those years. To ask for a loss carryback, complete “Section III – Net capital loss for carryback” on Form T1A, Request for Loss Carryback, and send it to your tax centre. Do not file an amended return for the year to which you want to apply the loss.

After you carry back the loss, there may be an amount left. You may be able to use some of the remaining amount to reduce other income on the final return, the return for the year before the year of death, or both returns. However, before you do this, you have to calculate the amount you can use.

From the net capital loss you have left, subtract any capital gains deductions the deceased has claimed to date. Use any loss left to reduce other income for the year of death, the year before the year of death, or for both years.

If you claim any remaining net capital loss in the year of death, you should claim it as a negative amount in brackets at line 12700 of the final return.

Note

Example

You can use Method A or Method B.

Note