Unable To View This Article

This could be due to a conflict with your ad-blocking or security software.

Please add japantimes.co.jp and piano.io to your list of allowed sites.

If this does not resolve the issue or you are unable to add the domains to your allowlist, please see this FAQ.

We humbly apologize for the inconvenience.

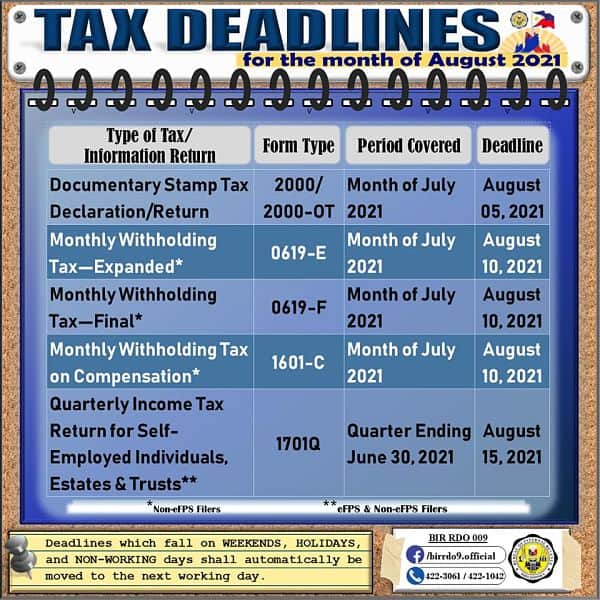

How To File Your Tax Return Electronically

You might want to e-file your late return if you haven’t missed that deadline as well. Many taxpayers can e-file at IRS Free File if their AGIs were under $73,000 in 2021. Some other rules can apply as well, imposed by the individual software providers that participate in the Free File Alliance.

The IRS will accept e-filed returns until November. It will announce the exact November cutoff date sometime in October 2022.

What Is The Penalty For Filing Business Taxes Late

If youre running an S-Corporation or a partnership, the tax penalty is fairly steep. If you file your business taxes late, you will face a penalty of 5% of your taxes you owe per month for the first five months. In total, that means that the penalty you could face may reach up to 25% of your total tax bill. Youll also be charged interest by the IRS until youve paid the balance off in full.

Don’t Miss: What Is Form 5498 For Taxes

Free Tax Help For Small Business Owners And Self

If you own a small business or are self-employed, the CRA offers free liaison officer services by phone or videoconference. Liaison officers can make it easier to file by helping you understand your tax obligations, answering your questions, and making sure you are aware of possible business deductions. For more information, go to our Free tax help for small business owners and self-employed individuals page.

Corporations And Exempt Organizations

Use Corporation Estimated Tax to make your estimate payments. Visit Instructions for Form 100-ES for more information.

| Type | |

|---|---|

| 1st quarter estimated tax payment | 15th day of 4th month after the beginning of your tax year |

| 2nd quarter estimated tax payment | 15th day of 6th month after the beginning of your tax year |

| 3rd quarter estimated tax payment | 15th day of 9th month after the beginning of your tax year |

| 4th quarter estimated tax payment | 15th day of 12th month after the beginning of your tax year |

Also Check: When Is Tax Free Day

Strong Relationships = Tax Savings = Roi

Forget the everything is digital talking points from global consulting firms. Business is about people exchanging dollars for value. So its best to know the people youre paying, right?

Now, what do I mean when I say relationship? I mean a business relationship between you and your CPA. Relationships come in all sizes and colors. Nothing special.

So, when I say strong relationships, I mean a business and personal relationship that both parties value. These relationships are ongoing, reciprocal, honest, and highly profitable.

Chancellor Delivers Plan For Stability Growth And Public Services

The Chancellor has today announced his Autumn Statement, aiming to restore stability to the economy, protect high-quality public services and build long-term prosperity for the United Kingdom.

- From:

- 17 November 2022

- Chancellor unveils a plan for stability, growth, and public services.

- Tackling inflation is top of the priority list to stop it eating into paycheques and savings, and disrupting business growth plans.

- To protect the most vulnerable the Chancellor unveiled £26 billion of support for the cost of living including continued energy support, as well as 10.1% rises in benefits and the State Pension and the largest ever cash increase in the National Living Wage.

- Necessary and fair tax changes will raise around £25 billion, including an increase in the Energy Profits Levy and a new tax on the extraordinary profits of electricity generators.

Jeremy Hunt outlined a targeted package of support for the most vulnerable, alongside measures to get debt and government borrowing down. The plan he set out is designed to fight inflation in the face of unprecedented global pressures brought about by the pandemic and the war in Ukraine.

The Chancellor of the Exchequer Jeremy Hunt said:

Working age benefits will rise by 10.1%, boosting the finances of millions of the poorest people in the UK, and the Triple Lock will be protected, meaning pensioners will also get a rise in the State Pension and the Pension Credit in line with inflation.

Further information

You May Like: H& r Block 2022 Tax Software

What Is The Business Tax Filing Deadline For 2022

The deadline for annual business tax filing depends on your business structure and the companys tax year. For most corporations, annual tax returns need to be filed by the 15th day of the fourth month following the end of the companys tax year. That would mean April 15th, if you companys tax year ends on Dec. 31. Business organized as partnerships or S Corporations, have three months after the end of their tax year to file. Taxes for sole proprietors are due with their individual tax returns, typically, on April 15th. If any of these deadlines falls on a holiday or over a weekend, normally, taxes are due on the following business day.

Due Dates For Partnerships

If your business is organized as a partnership, your income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. For example, if your partnership is a calendar year taxpayer, with a December 31 year end, you must file a 2022 tax return or extension request by .

You May Like: How Long Does Your Tax Return Take

Tax Filing Deadlines In 2022

Deadlines for filing taxes typically fall within the same, general range. When it comes to filing your 2021 tax return, these are the dates you need to know about.

- Receiving your W-2 Form: Your employer has until Jan. 31, 2022, to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- Individual income tax returns: April 15 falls on a weekday in 2022, but it is Emancipation Day which is celebrated in Washington, D.C., causing all businesses and government offices to close. Therefore, the filing deadline for your 2021 personal tax returnForm 1040 or Form 1040-SRis Monday, April 18, 2022 .

- Partnership and S-corporation returns:Returns for partnerships and S-corporations are generally dueMarch 15. If you request an automatic six-month extension, though, this date is Sept. 15.

- Corporation income tax returns: For corporations, the due date is April 18, 2022. The extended deadline is Oct. 17, 2022. The deadline for C-corp returns is typically the 15th day of the fourth month following the end of the corporation’s fiscal year if the corporation operates on a fiscal year, rather than a calendar year.

Corporate Income Tax Filing Season 2022

The deadline for filing your Corporate Income Tax Return / Form C) for the Year of Assessment 2022 is 30 Nov 2022.

Form C-S is for companies that:

- Are incorporated in Singapore

- Have an annual revenue of $5 million or below

- Derive income taxable at the prevailing Corporate Income Tax rate of 17% and

- Are not claiming the following:

- Carry-back of Current Year Capital Allowances/ Losses

- Investment Allowance

- Foreign Tax Credit and Tax Deducted at Source

Form C-S is for companies that qualify to file Form C-S and have an annual revenue of $200,000 or below.

Form C is for companies that do not qualify to file Form C-S or Form C-S . Financial statements, tax computations and supporting schedules must be filed together with Form C.

Read Also: How To File Taxes For 2020

Tax Dates By Business Type

Tax dates change depending on the type of business that youre running. Its crucial that you know how your business is categorized so that your taxes make it in on time. Here are the due dates for 2022 taxes for different types of business:

What if you are self-employed? Self-employed individuals must pay estimated quarterly tax payments on an individual tax return. This has to happen four times throughout the year according to the IRS. The deadlines are as follows:

Remember, these dates are crucial so you can save money on taxes and not have to pay penalties! Penalties can add up quickly, and really cause a loss in your businesss income.

When Are Taxes Due

For most taxpayers, the main income tax return deadline for 2021 tax returns is April 18 aka IRS Tax Day 2022. The deadline was changed from the usual April 15 because thats the date of Emancipation Day, which is treated like a federal holiday for tax filing purposes, in Washington, D.C. Most state deadlines also fall on April 18 this year, but you should check with your state to confirm.

The deadlines differ for individuals versus businesses, and it depends in part on whether you use a calendar year or a fiscal year. If youve already missed a deadline, file and pay your taxes as soon as possible to stop additional interest and penalties from accruing.

Recommended Reading: What Is The Small Business Tax Rate For 2021

What Are The Benefits Of Getting Started On Your Taxes Early

Tax season is stressful. One of the great benefits of getting started on your taxes early is stress minimization. A mental weight is lifted when you know your tax filing is completed ahead of the due date and you can focus on your business instead of tax obligations.

What if you owe tax? First, by getting started early, you know how much you owe the IRS and have time to put together a payment plan. You donât actually have to pay the money owed until the due date. By completing your tax forms and filing them, you can figure out the best ways to come up with the funds rather than go into panic mode on April 14.

Your tax professional likely has more availability to help early filers as well. Getting an appointment with a tax professional is much easier in January or February than in March or April. In fact, getting ahead on your tax prep can save you money in the long run, too. You avoid IRS penalties and, by avoiding any last-minute rush fees, you will often pay less for tax preparation.

Have Clear And Concise Bookkeeping

Bookkeeping involves recording and managing your businesss financial transactions, such as sales, purchases, expenses, and payments.

Good bookkeeping is crucial for a business. Having your books well organized will not only make tax filing season that much easier but will help you make well-informed decisions for your brands growth. Additionally, it will benefit you if the IRS ever audits your business. And, with the IRS announcing in 2021 it would be increasing the number of small businesses it audits, sound bookkeeping is crucial.

You can use a Shopify Balance account to make tracking your businesss finances more manageable. Having a cash management account within the Shopify ecosystem means you can manage your business and its money from the very same place.

If you want to keep your books yourself, theres plenty of accessible and easy-to-use small business accounting software that allows you to do this and they integrate with your Shopify store.

And, if you find you’re spending too much of your time on bookkeeping, or you’re not confident in doing so, it could be worth paying a professional bookkeeper to take this task off your hands.

Don’t Miss: States With No Tax On Retirement Income

Due Dates For Corporations

If your business is organized as an S corporation, the income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. If the business is a C corporation then the extension is due by the 15th day of the 4th month after the end of your tax year.

For example, if your C corporation is a calendar year taxpayer with a December 31 year end, you need to file a 2022 tax return or extension request by .

S Corporation Tax Deadlines And Forms

The IRS tax return deadline for S corporations, also known as S-corp, is due on March 15, 2022. â

Forms include the U.S Income Tax Return for S Corporations known as the Form 1120S and Schedule K-1 . â

These tax forms need to be submitted to the International Revenue Service so that S Corporations can understand their tax liability, find out how much business tax they owe, and report each partyâs share of the corporation’s income, deductions, credits, etc.

Additional Links for S corporation

Don’t Miss: Where To Put 1098 T On Tax Return

Several Tax Deadlines Apply To Both Small Business Owners And Self

What youll learn:

Most individuals and small business owners know that there are certain tax-related filing deadlines every year. Many people, however, do not know what meeting those deadlines entails. The following answers to common tax questions provide an overview of the important dates and compliance deadlines for the 2022 tax year and key filing and reporting dates for the 2023 calendar year.

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Is Gross Before Taxes Or After

Japan To Raise Taxes For Rich With Annual Income Of 3 Billion

- Finance Minister Shunichi Suzuki speaks at a meeting of the Liberal Democratic Party’s tax panel in Tokyo on Tuesday. | KYODO

The government and ruling parties are considering raising taxes for the superwealthy whose annual income totals ¥3 billion or more including gains from financial assets, sources said Tuesday.

The move is aimed at correcting the situation known as the ¥100-million wall, in which the income tax burden ratio starts to decline when annual income tops ¥100 million, the sources said.

Wed like to increase the tax burden on people whose annual income averages some ¥3 billion, Yoichi Miyazawa, chairman of the ruling Liberal Democratic Partys Research Commission on the Tax System, told reporters at the LDPs headquarters in Tokyo.

When Are Taxes Due For 2022 Tax Year Dates You Need To Know

Tax season is full of questions concerning your wages, your claims, your filing status and how to report pandemic-related stimulus and unemployment payments on your returns. But even after those are answered, one burning question remains: When are taxes due?

Find Out: Heres How Much Cash You Need Stashed If a National Emergency Happens

You might not like paying taxes, but you certainly wont like paying interest, late filing fees and late payment fees if you miss the deadline to file taxes for tax year 2021. The Internal Revenue Service has several deadlines to file taxes and pay your taxes due, so its important you are aware of all applicable dates.

Don’t Miss: Are Gofundme Donations Tax Deductable

C Corporation Tax Deadlines And Forms

The IRS tax return deadline for C corporations, also known as C-corp, is due on April 15, 2022. â

Forms include the U.S Corporation Income Tax Return known as Form 1120 .âThis tax form needs to be submitted to the International Revenue Service so that C corporations can understand their tax liability and find out how much business tax they owe.

Additional Links for C corporation

Filing Your Tax Return Electronically

If you choose to file electronically on your own, there are a variety of NETFILE-certified software products that meet your needs. Some of the software products are free.

For the 2021 tax year, prior to filing your tax return electronically with NETFILE, you will be asked to enter an Access code after your name, date of birth, and social insurance number. This unique code can be found to the right, beneath the notice details box on the first page of your previous notice of assessment . If you are registered for My Account, you can also use Auto-fill my return in certified tax software to retrieve your NETFILE access code. Your access code will let you use information from your 2021 tax return when confirming your identity with the CRA. Your access code isnt mandatory when filing your 2021 tax return, but without it youll have to rely on other information for authentication purposes.

Don’t Miss: Someone Filed Taxes In My Name

Keep Up With Due Dates

Utilize the IRS Tax Calendar, an online resource that has options to add filing and payment dates into your calendars or be sent them through email. Make preparing, filing, and paying your taxes a routine part of your business activities and address any missteps or missed dates immediately.

About the Author

Tammy Farrell CPA CFE

Tammy Farrell is a Certified Public Accountant and Certified Fraud Examiner who enjoys researching the nuances of accounRead more

Recommended Reading: How To File Taxes Free

Requirements For Federal Excise Tax

Pay special attention to which types of excise tax forms you may be required to file.

- File Form 720 if you are required to pay quarterly Federal excise tax returns

- File Form 11-C if you need to file for wagering income

- File Form 2290 if your business uses heavy highway vehicles

Furthermore, you must file these forms each quarter of the calendar year, with due dates as follows:

- for first quarter

- for second quarter

- for third quarter

- for fourth quarter of the previous year

Recommended Reading: What Is California Tax Percentage