How To Pay Estimated Taxes

You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. You can also make your estimated tax payments through your online account, where you can see your payment history and other tax records. Go to IRS.gov/Account. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2022 federal tax return, or

- 100% of the tax shown on your 2021 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2022. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

The 4 Methods For Making Federal Tax Deposits Electronically

To submit your federal tax deposits electronically, you have four different options. They include:

You May Like: Hr Block Free Tax Filing

How Federal Tax Brackets Work Calculate Your Effective Tax Rate

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their effective tax rate.

Instead of looking at what tax bracket you fall in based on your income, determine how many individual tax brackets you overlap based on your gross income.

Figuring that out is easier in practice:

- Example one: Say youre a single individual who earned $40,000 of taxable income in the 2022 tax year. Technically, youd be aligned in the 12 percent tax bracket, but your income wouldnt be levied a 12 percent rate across the board. Instead, you would follow the tax bracket up on the scale, paying 10 percent on the first $10,275 of your income and then 12 percent on the next chunk of your income between $10,276 and $41,775. Because you dont make above $41,775, none of your income would be hit at the 22 percent rate.

That often amounts into Americans being charged a rate thats smaller than their individual federal income tax bracket, known as their effective tax rate.

- Example two: Say youre a single individual in 2022 who earned $70,000 of taxable income. You would pay 10 percent on the first $10,275 of your earnings then 12 percent on the chunk of earnings from $10,276 and $41,775 , then 22 percent on the remaining income .

- Your total tax bill would be $11,017. Divide that by your earnings of $70,000 and you get an effective tax rate of roughly 16 percent, which is lower than the 22 percent bracket youre in.

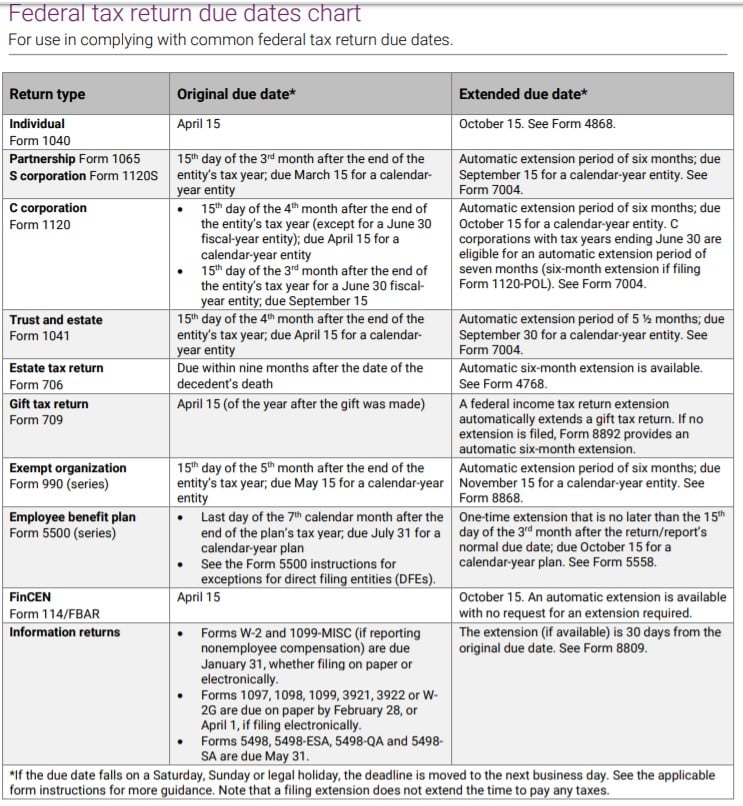

State Tax Return Due Dates

Unless you live in a state with no income tax, don’t forget that you probably have to file a state tax return as well. Most states synch their income tax return deadline with the federal tax due date but there are some states that have different deadlines . State rules regarding tax filing extensions may differ from the federal rules, too. Check with the state tax agency where you live to find out when your state tax return is due and/or how to get an extension.

Read Also: Are Property Taxes Paid In Arrears

Federal Income Tax Withholding Social Security And Medicare Tax Deposits

For taxes reported on Forms 941, 943, 944, or 945, there are two deposit schedules: monthly and semi-weekly. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use. The deposit schedule you must use is based on the total tax liability you reported on forms previously during the specified lookback period. The lookback period is different based on the form type. See the instructions for the form itself or Publication 15 for more information about the lookback period and how to determine which type of depositor you are.

Tax Deadlines: January To March

- : Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070.

- :Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

- : Your employer has until Jan. 31 to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- :Deadline for employees who earned more than $20 in tip income in January to report this income to their employers. You can use Form 1070 to do so.

- : Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions and Form 1099-MISC, unless the sender is reporting payments in boxes 8 or 10.

- : Deadline for businesses to mail Forms 1099 and 1096 to the IRS.

- : Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by Jan. 18, 2022.

- : Deadline for employees who earned more than $20 in tip income in February to report this income to their employers.

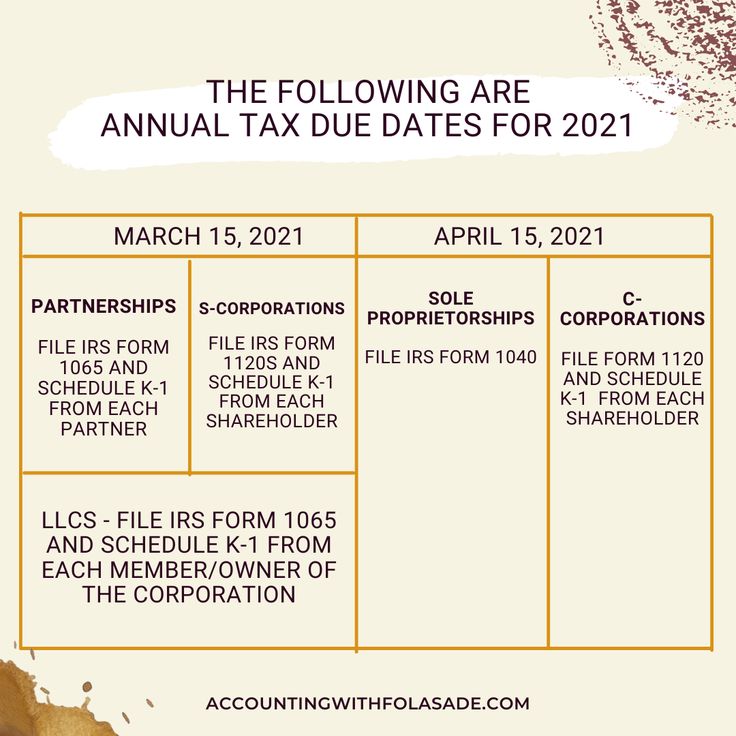

- :Deadline for corporate tax returns for tax year 2021, or to request an automatic six-month extension of time to file for corporations that use the calendar year as their tax year, and for filing partnership tax returns or to request an automatic six-month extension of time to file .

- : Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.

You May Like: Income Required To File Taxes

Have You Heard About The Homeowner Tax Rebate Credit

The homeowner tax rebate credit is a one-year program providing direct property tax relief to eligible homeowners in 2022.

If you’re a homeowner who qualifies, we’ll automatically send you a check for the amount of the credit. Your amount will depend on where your home is located, how much your income is, and whether you receive Enhanced or Basic STAR.

What If I Need More Time

Don’t let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS typically grants a six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or use Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You’ll need to estimate the amount you owe and make your payment by the tax filing deadline even if you file an extension.

Recommended Reading: How To Protest Property Taxes In Collin County

When Are 2022 Taxes Due

The due date for filing your tax return is typically April 15 if youre a calendar year filer. Generally, most individuals are calendar year filers.

For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday. You could have submitted Form 4868 to request an extension to file later during the year.

If you have a business that operates on a fiscal year basis, your return is typically due on or before the 15th day of the third or fourth month after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

The last day to do taxes isnt the only important tax deadline to know, however. There are several other important tax deadlines you should know for 2023. If you’re wondering, “When are taxes due, anyway?” Here are the important dates at a glance.

When Are Taxes Due If I File An Extension

If you file Form 4868 and receive the automatic six-month extension, you will have until Oct. 17, 2022, to submit your 2021 tax return.

If you already know that youll need an extension, plan on filing Form 4868 sooner rather than later. That way, if anything goes wrong with your application, youll have plenty of time to fix any errors and resubmit it ahead of the April 18 tax deadline. This also ensures you have time to get your documents together for your extended deadline in October. The IRS website has all the forms, deadlines and information youll need.

Recommended Reading: Florida Total Sales Tax Rate

Forms Filed Quarterly With Due Dates Of April 30 July 31 October 31 And January 31

- File Form 941, Employers QUARTERLY Federal Tax Return, if you paid wages subject to employment taxes with the IRS for each quarter by the last day of the month that follows the end of the quarter. If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return. See Publication 15, Employer’s Tax Guide, for more information.

Annual Tax Filing Deadlines For 2023

Individuals and Families – Annual personal income tax filings are due on Tuesday, April 18, 2023. The majority of people file a 1040. Since April 15 falls on a Saturday, and Emancipation Day falls on Monday, April 17, 2023, the tax deadline is moved to April 18, 2023.

Corporations – C corporations also file on April 18. S corporations and partnerships file on March 15.

If you already filed your tax return, you can see when to expect your tax refund here.

Read Also: What Are Allowances For Taxes

Tips For Preparing To File 2022 Federal Income Tax Returns

January 17, 2023Edward A. Zurndorfer, Certified Financial Planner

The recent start of calendar year 2023 means that the start of the 2023 tax filing season is not far away. The IRS announced that the 2022 federal income tax filing season will officially start January 23, 2023.

During January, federal employees and retirees will be getting via regular mail or email their 2022 tax documents that they will need to in order to prepare their 2022 federal and state income tax returns. This column presents 10 recommendations for federal employees and retirees for getting ready to either prepare their tax returns themselves or getting their documents and information together in order for a paid preparer to prepare their returns in the most efficient and least costly way.

The following recommendations are not listed in any particular order of importance:

1. Make every effort to electronically file ones tax returns, rather than filing a paper tax return.

2. Check 2022 W-2 wage forms, 1099 forms and K-1/K-2/K-3 statements when they are received.

2022 W-2 forms will be made available online or mailed to employees by January 31, 2023. 1099 forms should be made available online or mailed out to recipients no later than February 15, 2023. Partnership K-1/K-2/K-3 statements may not be available until at least March 15, 2023.

3. Beware of the April 18, 2023 filing deadline for filing 2022 federal income tax returns.

6. Advice for gig economy entrepreneurs and workers.

File A Tax Extension Request Online

IRS e-file is the IRS electronic filing program, which allows you to send tax forms, including Form 4868, directly to IRS computers. You can get an automatic extension to file your tax return by filing Form 4868 electronically through IRS e-file on your own, using free or commercial tax software, or with the help of a tax professional who uses e-file.

In any case, you will receive an email acknowledgment you can keep with your tax records.

If your adjusted gross income is below a specified figure$73,000 for 2021you can use brand-name software at no cost from Free Filea free service that provides taxpayers with federal tax preparation and e-file options.

If your income is above the threshold, you can use the IRS Fillable Forms tool. There are also some tax software companies that offer free filing under certain conditions.

You May Like: Do You Have To Claim Stocks On Taxes

Also Check: How Long Does It Take For The Tax Refund

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000 and starting with tax year 2022, $50,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

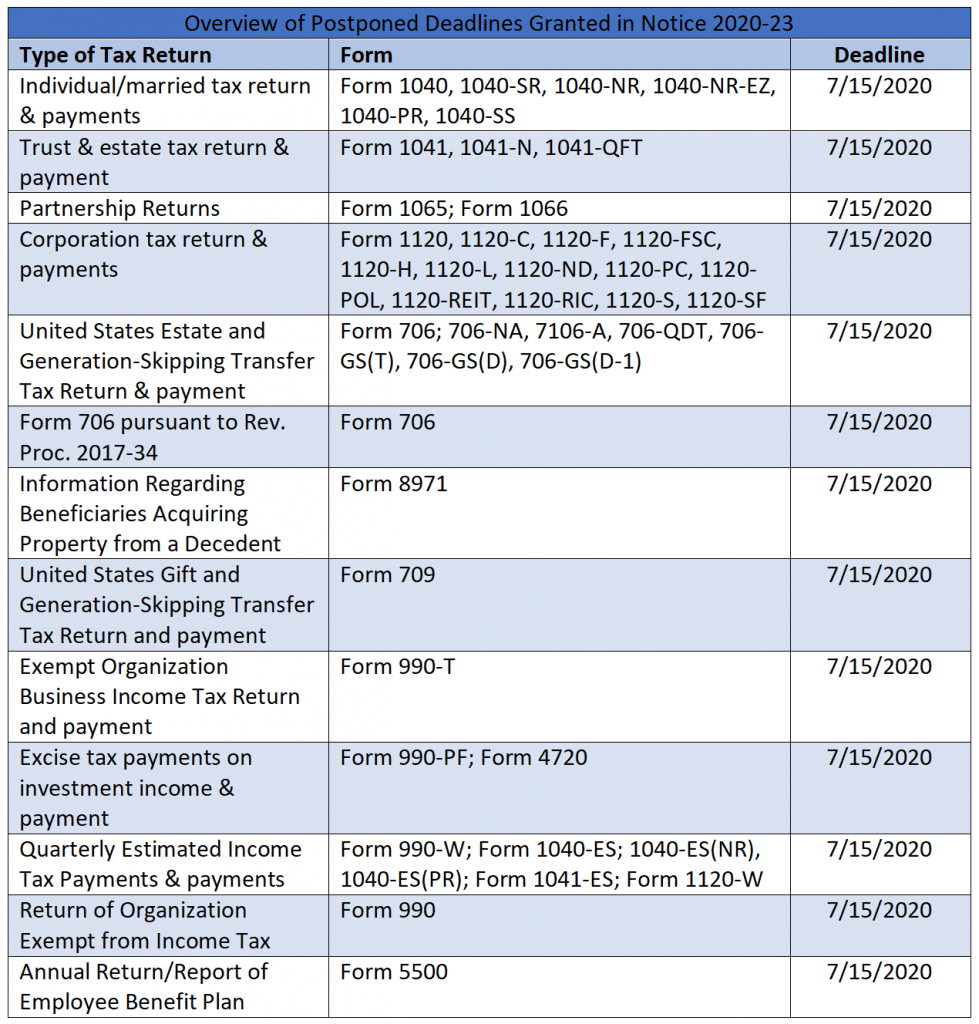

Filing And Payment Deadline Extended To July 15 2020

The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak. The filing deadline for tax returns has been extended from April 15 to July 15, 2020. The IRS urges taxpayers who are owed a refund to file as quickly as possible. For those who can’t file by the July 15, 2020 deadline, the IRS reminds individual taxpayers that everyone is eligible to request an extension to file their return.

Don’t Miss: When Is Cut Off For Taxes 2021

Protecting Yourself From Fraud

While tax scams are nothing new, the pandemic gave rise to a new set of fraud cases, specifically around COVID-related support programs, like the Canada Emergency Response Benefit . COVID-19 phishingemail scams gave hackers and con artists the personal and/or banking information to claim the benefits.

If you suspect you are a victim of fraud, collect any relevant documents, and that can include your T4, T4As, bank statements, receipts of any related transactions, as well as any emails, or text messages related to the scam. Immediately report the fraud or the scam to the Canadian Anti-Fraud Centre and to the police. Also change all of your passwords right away for any financial accounts that you think may have been targeted, as well as your email addresses, too.

You May Like: Where Can I Mail My Tax Return

Should I File My Taxes Early

If you have all your paperwork in order and you’re getting a refund, then it makes sense to file as soon as possible, said Joe Burhmann, senior financial planning consultant at eMoney Advisor. “From a planning perspective, the IRS likes that.” If you owe money, though, you might want to wait a bit.

“It gives you a bit more time to hold onto your money,” Burhmann said. “And it gives you time to figure out how to pay whether that means getting a loan, putting it on credit cards or something else.”

Even if you’re not filing immediately, you should prepare your taxes as soon as possible.

“Knowledge is always a good thing to have,” Burhmann said. “Make sure you’ve gotten your 1099 and know what you’re going to be dealing with.”

Recommended Reading: H& r Block Free Tax Filing 2022

Tax Deadline For Quarterly Estimated Payments

If you’re self-employed, an independent contractor or have investment earnings, you might be curious about another set of deadlines: quarterly estimated payments. The IRS requires these quarterly estimated tax payments from many people whose income isnt subject to payroll withholding tax.

For estimated taxes, the answer to “When are taxes due?” varies. The year is divided into four payment periods, and each period has its own payment due date. Check below to see the dates for 2022.

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

This Filing And Payment Relief Includes:

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15, 2020, are automatically extended until July 15, 2020. This relief applies to all individual returns, trusts, and corporations. This relief is automatic, taxpayers do not need to file any additional forms or call the IRS to qualify.

This relief also includes estimated tax payments for tax year 2020 that are due on April 15, 2020.

Penalties and interest will begin to accrue on any remaining unpaid balances as of July 16, 2020. You will automatically avoid interest and penalties on the taxes paid by July 15.

Individual taxpayers who need additional time to file beyond the July 15 deadline can request a filing extension by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004.

Read Also: Roth Ira Contribution Tax Deduction