How Long It Takes To Get Your Tax Refund

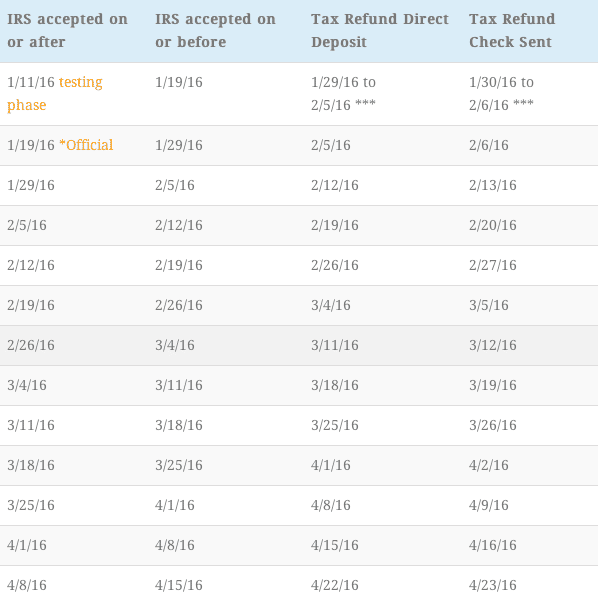

Nine out of 10 tax refunds are issued within 21 days, according to the IRS.

Twenty-four hours after filing your refund online, you can access the IRS Where’s My Refund tool to get daily updates on your tax refund status. Paper filers have to wait six months or more before the tool becomes available.

The tool shows progress in three phases:

Once your refund is approved, you will be given a date to expect your refund on by the IRS.

Those who file their tax return online and sign up for direct deposit get their tax refund fastest, per the IRS.

Most states estimate that state tax refunds are issued within 10 weeks of processing.

I Live Outside The Netherlands And Have Filed My Return When Will I Receive A Tax Decision

We understand you would like to know when you will receive our tax decision upon filing your return. Unfortunately theres no way to indicate when exactly that will be.

Officially the processing time for your return may take as much as 3 years. We must have definitively imposed the income tax return for 2021 by 31 December 2024 at the latest. However, usually it wont take that long at all.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns that we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

The CRA may take longer to process your return if it is selected for a more detailed review. See Review of your tax return by the CRA for more information.

If you use direct deposit, you could get your refund faster.

Don’t Miss: How To Pay Irs Online For 2021 Taxes

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2022. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refunds. Refunds should be processed normally after this date.

Note: There may be delays for the 2021 tax year. The IRS continues to work through a backlog of tax returns , including those with errors and amended returns.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

You May Like: States With No Estate Tax

Why Havent You Received Your Refund

The CRA may keep all or part of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Read Also: How Long To Receive Tax Refund 2022

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 2 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

Getting Tax Relief If You Owe Money

If you go through the tax filing process and come out owing the government money, there are options for getting tax relief. You can negotiate directly with the IRS and state revenue agencies, or hire a tax relief company to negotiate on your behalf.

If you owe less than $10,000 and your case is not complicated, you may be better off dealing directly with the IRS. Otherwise, tax relief experts such as tax attorneys and enrolled agents can save you time and improve your chances of negotiating generous terms on your tax settlement.

Some of the top companies to help with getting relief for taxes owed are:

You May Like: How To Become Tax Preparer

Free File Available January 14

IRS Free File will open January 14 when participating providers will accept completed returns and hold them until they can be filed electronically with the IRS. Many commercial tax preparation software companies and tax professionals will also be accepting and preparing tax returns before January 24 to submit the returns when the IRS systems open.

The IRS strongly encourages people to file their tax returns electronically to minimize errors and for faster refunds as well having all the information they need to file an accurate return to avoid delays. The IRS’s Free File program allows taxpayers who made $73,000 or less in 2021 to file their taxes electronically for free using software provided by commercial tax filing companies. More information will be available on Free File later this week.

I Have Received My Tax Refund By Money Postal Order How Long Is It Valid And How Can I Collect It

You received your tax refund by postal money order and you don’t know how to collect it?

In order to collect your postal money order, you must go to a post office. You must do so within three months of the date of issue of your postal money order the date of issue appears on the postal money order. The post office will give you your refund in cash.

What to do if my postal money order is no longer valid?

If your postal money order is no longer valid, you should then contact us.

Read Also: Are Hsa Contributions Pre Tax

When Will My Refund Be Available

Keep in mind that it may take a few days for your financial institution to make your deposit available to you, or it may take several days for the check to arrive in the mail. Keep this in mind when planning to use your tax refund. The IRS states to allow for five additional days for the funds to become available to you. In almost all cases, a direct deposit will get you your tax refund more quickly than in five days, and in some cases, it will be available immediately.

What Are The Alternatives To Getting The Ird To Calculate My Tax Return

1. Get a professional tax accountant to complete your tax return

- Hiring a tax accountant to fill out an IR3 and communicate with the IRD can be a cost-efficient and stress-free way to get a tax refund without the hassle.

- See our detailed guide on choosing an accountant here to learn more.

2. Do Your Tax Return Yourself

- The IRD makes it easy to DIY your income tax return . They have created an online form that saves time and reduces hassle.

- However, the process can get increasingly complex if you have multiple incomes and deductions that you need to make.

- To find out more information about filling out an IR3 form, check out the IRDs site linked here.

Recommended Reading: What Percent Of Your Check Goes To Taxes

Why Havent I Received My Tax Refund On Time

You will receive a tax refund on time if you receive it by the end of the second month after you receive your tax assessment notice . Example: if you receive your tax assessment notice on January 15th 2021, you should receive your tax refund by March 31st 2021.

Did you receive your tax assessment notice more than two months ago and you havent yet received your tax refund? Here are some of the reasons why you may not receive your tax refund on time.

You mentioned a wrong bank account number

We have refunded you on the wrong bank account number:

Find out how to communicate or change your bank account number in order to receive your tax refund.

The FPS Finance lacks information on my situation for a timely tax refund

In order to be able to make a tax refund in time, we sometimes need additional information. This is the case, for example, if:

- you are the heir of a deceased person who was entitled to a tax refund

- Your tax refund concerns a joint ownership between several people

- You live abroad and do not have a Belgian bank account in order to receive your tax refund

I have debts to other public authorities

If you have additional debts to other public authorities, we can withhold all or part of your tax refund in order to clear your debts. If this is the case, we will send you a letter outlining your situation and the action we have taken to remedy it. A contact point is always mentioned on the letter.

How Long Does It Take To Receive My Tax Refund

Approximately 90% of taxpayers will receive their refunds in less than 21 days from the day their tax return was accepted by the IRS. Most people receive their refunds in an average of 10-14 days.

Your bank will usually make your payment available within one to three days of receiving the payment from the IRS. Checks may take longer to clear your bank.

Read Also: Tax Preparer Santa Ana Ca

When To Expect Your Refund If You Claimed The Earned Income Tax Credit Or Additional Child Tax Credit

- You choose to get your refund by direct deposit

- We found no issues with your return

However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Additionally, your financial institution may need time to accept your direct deposit or issue a debit card. Many institutions dont process payments on weekends or holidays. So, if you file early, be aware of federal and local holidays that may affect how soon you get your refund.

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Don’t Miss: Are 2022 Tax Forms Available

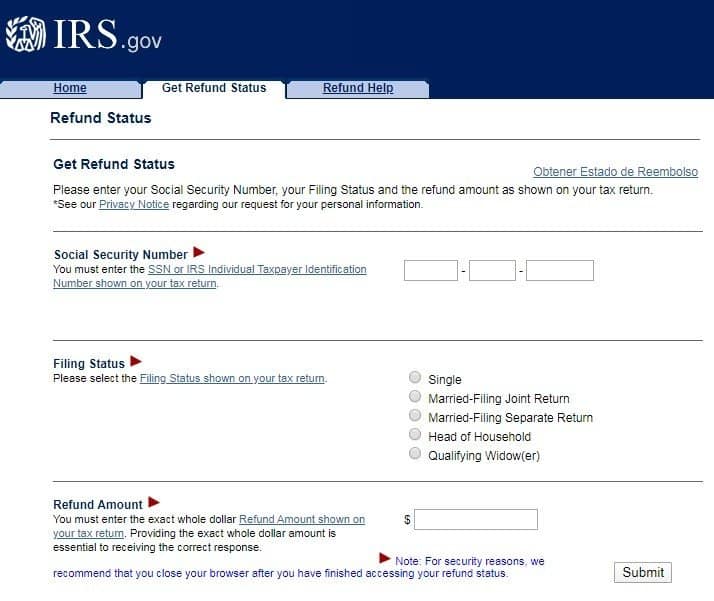

How Can I Track My Refund Using The Where’s My Refund Tool

To use the IRS tracker tools, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

If You Qualified For The $125 Atr

If you were eligible for the $125 ATR, you were automatically eligible for the $200 ATR.

You should have received either:

- two direct deposits

- a direct deposit and a check or

- one combined check totaling $325 for both ATRs .

Whenever possible, DOR issued combined payments for taxpayers who filed joint tax returns in 2020.

DOR is unable to update banking information for taxpayers who changed bank accounts between refund periods.

Recommended Reading: When Is Business Tax Due 2022

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: Calculate Capital Gains Tax On Property Sale

The Expanded Child Tax Credit Has Expired

Depending on the age of your child, you watched the annual Child Tax Credit boosted from $2,000 to either $3,000 or $3,600. If you opted to accept the first half of that credit between July and December 2021, you received the back half after filing your 2021 tax return.

Republican lawmakers voted against extending the expanded Child Tax Credit and the program expired in December 2021. As you estimate the amount of your refund this year, remember that, like Cinderella’s pumpkin at midnight, the Child Tax Credit is back to its pre-pandemic level of $2,000 per child.

What Do I Have To Do To Receive My Share Of The Deceased Persons Tax Refund If I Am Not An Heir Who Cannot Be Totally Disinherited

If you inherit, you can receive your share of the What you have to do depends on the relationship you had with the deceased and the amount to be refunded. You can find this amount on the deceased persons tax assessment notice .

I am not the partner, child, grandchild or parent of the deceased person: I am an heir who cannot be completely disinherited .

Send the necessary documents as soon as possible to the Collection Team . We will then ensure that the payment is made properly and on time.

Read Also: Property Taxes In Texas Vs California