Returns Filing Due Dates On Extension

- Corporate excise taxpayers receive an automatic extension of time to file their tax returns as long they have paid the greater of 50% of the total amount of tax ultimately due or the minimum corporate excise by the original due date for filing the return.

- If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment. There are no zero extensions, a payment must be made in order to file an extension.

- Filing an extension with the IRS does not count as filing an extension for Massachusetts.

- An extension is an extension of time to file not to pay, any amount due will incur interest even if a valid extension is on file.

Also Check: What Is Individual Tax Identification Number

Dont Wait Until The Deadline To File Your Taxes

Even though you have until April 18 to file your federal tax return, you shouldnt wait until the last minute. For starters, the sooner you file, the quicker you get your refund. The IRS typically sends out 90% of refunds within 21 days after people file electronically and link their bank accounts, according to the tax-filing software company Turbotax. However, this year may be slower. The IRS announced it is facing a backlog of about 20 million pieces of correspondence that are creating what the Biden administration calls the most challenging tax season in the agencys history.

Some Americans wont be eligible for refunds, though. And if you owe taxes, filing by the deadline is even more important. Even if you request a deadline extension , you must pay whatever you owe by the official deadline. If you cant afford to pay in full, you can set up a tax payment plan with the IRS. Added interest and penalty charges may still apply. So if you can pay what you owe, you should do so as soon as possible. Or at least pay as much as you can to avoid hefty penalty and interest charges.

Eric Bronnenkant, head of tax at digital investment advisor Betterment, says another top reasons to file early is to avoid identity theft.

A fraudster can illegally file on your behalf and claim your refund. From there, Bronnenkant says it would likely be difficult to get it back.

Deadline For Texans To File Income Taxes Is Tuesday June 15

TEXAS â Texans, if youâve been putting it off, know that the window for filing your 2020 federal income taxes is almost closed.

In fact, the deadline to submit to the IRS is Tuesday, June 15.

You may recall that back in February the tax-filing deadline was extended for Texans in the wake of the devastating winter storm that caused millions of people to lose power. Homes and properties were damaged across the state.

Typically, the deadline is April 15 but the IRS wanted Texans to have more time to assess damage prior to filing.

âThe June 15 deadline also applies to quarterly estimated income tax payments due on April 15 and the quarterly payroll and excise tax returns normally due on April 30. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17,â the IRS said in a statement.

The IRS further said that if you live in an area of Texas that was declared a disaster, you will automatically be provided with penalty and filing relief. If you donât live in a disaster area and need financial relief, youâre asked to call the IRS at 866-562-5227.

For a list of eligible areas in and outside of Texas, click here.

Don’t Miss: How To Get My Tax Return From Last Year

The Bottom Line On The Tax Filing Deadline

So thats the who, when, and where of tax deadlines this year. Now you know the last day to file taxes. Are you planning on filing as soon as possible or waiting until the 15th of April?

If youve found yourself in a situation where you owe the IRS and dont have the money to pay it all at once, dont panic. Make sure to file your return on time so you can avoid the 5% per month failure to file penalty.

Pay as much as you can afford by the tax deadline to reduce the amount youll pay in penalties and fees, and set up a short-term or long-term payment plan to further reduce your failure to pay penalties.

Finally, consider adjusting your W-4 withholding amounts and/or making estimated tax payments to ensure you dont find yourself in the same situation again in the future.

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Read Also: How Long Do Taxes Take To Process

What If I Owe The Irs

If you didn’t know you had to pay the IRS by April 18, you will likely face a “failure to pay” penalty. The same will occur if you paid the IRS in April but didn’t estimate correctly and still owe more.

The IRS says the penalty for these situations is 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid. The penalty is capped at 25% of your unpaid taxes.

Take a taxpayer who failed to pay $1,000 in taxes that they owed by the April 18 deadline. In this case, the taxpayer will face $30 in penalties for the non-payment $5, or 0.5% of the $1,000, per month during the six months between April 18 and the October 17 extended filing deadline.

But the IRS also charges interest on penalties and the tax agency just raised that rate to 6% on October 1 from 5% previously.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Small Business Income Tax Calculator

Dont Miss The Tax Filing Deadline

When you work in the US, youll be taxed on your income and if you earn over a certain amount, you must file a tax return. In 2021 for example, if you are under 65 and single, you must file a tax return if you earn $10,350 or more. The deadline for filing your 2021 tax return is April 15, 2022. You must prepare it and post it to the IRS.

You May Like: Local County Tax Assessor Collector Office

Who Qualifies For The Illinois Income Tax Rebate

The income tax rebate is for Illinois residents who filed individually in 2021 and earned under $200,000 — or filed jointly and made under $400,000.To be eligible for the income tax rebate, though, you must have filled out an IL-1040 form by You can submit it electronically through MyTax Illinois or mail in a paper form.Residents with dependents must also complete the 2021 Schedule IL-E/EIC form.

Don’t Miss: Long-term Hotel Stay Tax Exempt

What If I Need More Time

Don’t let a looming tax deadline force you to rush through the tax filing process and make a mistake on your return. Simply request an extension.

The IRS grants an automatic six-month extension of the tax filing deadline to anyone who requests it. You can request an extension electronically with TurboTax or use Form 4868.

Just keep in mind, the tax extension gives you more time to file your return, not more time to pay the tax you owe. You’ll need to estimate the amount you owe and make your payment by the tax filing deadline.

Tax Return Deadline : How To Estimate Refund Claim Stimulus Money And More

Your 2020 income taxes are due on May 17. Heres everything you need to know.

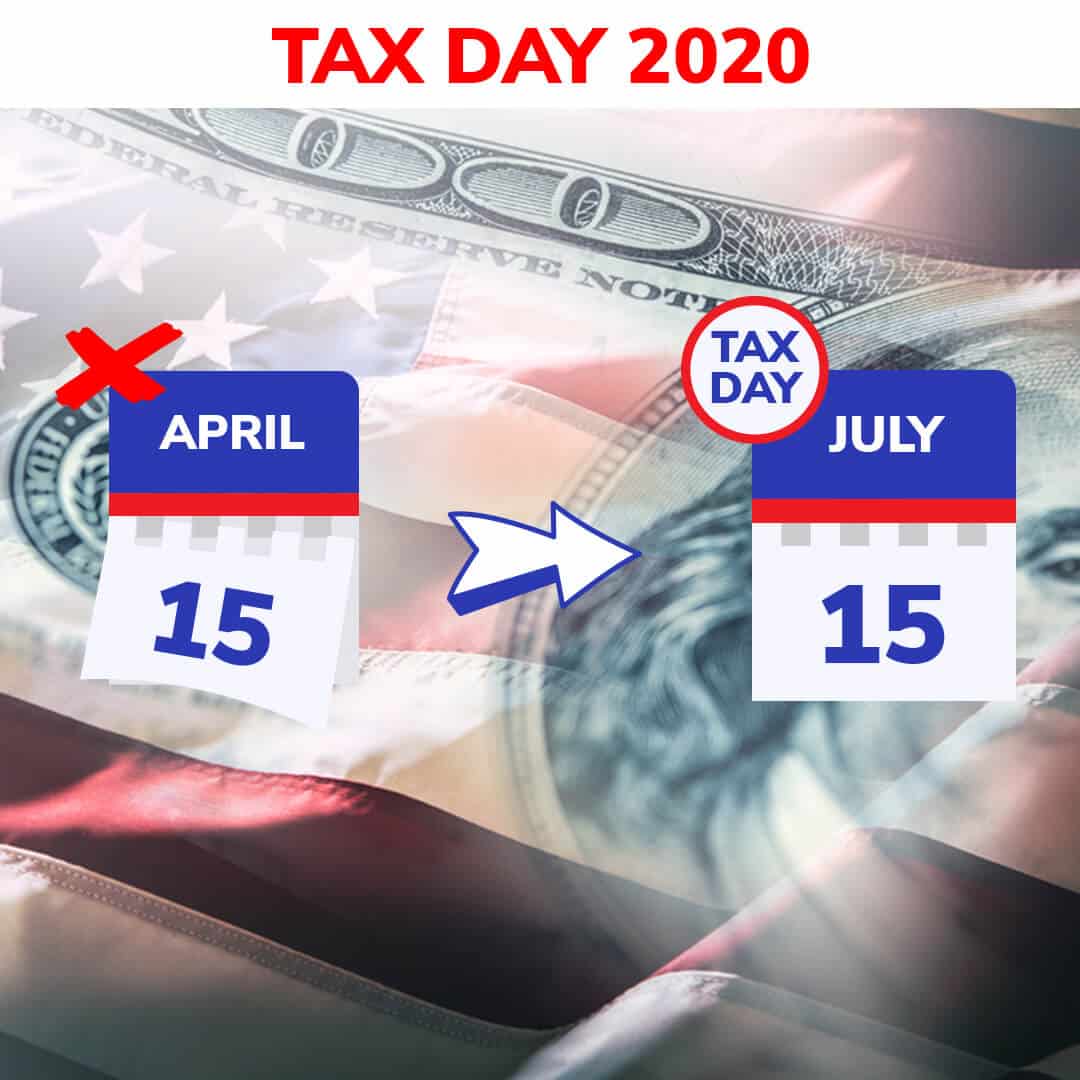

Lets start with the good news: You still have some time to get your taxes done. In 2021, the IRS has once again postponed the income tax due date. Last year, the deadline was extended to July 15 due to the pandemic this year, youll have until midnight on May 17 to get your paperwork filed. The bad news: You may need that extra time more than ever, given that your taxes may be more complicated than usual, wrapped up in new and potentially thorny issues including unemployment insurance claims, stimulus check income and pandemic-driven changes in residence.

Also Check: Is Nursing Home Care Tax Deductible

Also Check: Highest Sales Tax By State

What’s The Deadline For Filing An Extension

You still have to submit your request for an extension by April 18 . But you will have until Oct. 17, 2022, to file a completed 2021 tax return.

Keep in mind that filing an extension doesn’t push back when you need to pay the IRS: To avoid late penalties, you still need to submit an estimate of what you owe. An extension just gives you more time to complete your return.

Your state may have a different tax deadline than the IRS does.

Withholding Tables Changed Under The New Tax Law Some Filers May Owe Taxes While Others Could See A Bigger Refund

Your tax situation can change over time for example, if you get married, buy a home, or have a child so its always a good idea to review your W-4 tax-withholding form at the start of a new year. With the new tax law this year, its even more important.

Read more: Heres a look at what the new income tax brackets mean for every type of US taxpayer this year

The IRS says it has worked with payroll providers to make the change as seamless as possible for taxpayers, but refunds may be different for some taxpayers this year and some may owe an unexpected tax bill if they didnt review and adjust their withholding, according to the IRS.

According to the New York Times, a Treasury Department analysis provided to the Government Accountability Office estimated that compared to last year, about 4 million fewer filers will receive refunds this year, while about 4 million more filers will have a balance to pay on their taxes due to the new withholding system.

Meanwhile, a team of UBS analysts projected that most married filers with two children would see a pretty sizeable boost in their refunds for 2018 compared to 2017, especially those making under $40,000 a year and those making between $125,000 and $400,000.

Some tax deductions have changed under the new law as well. The standard deduction will nearly double and some itemized deductions have changed. You can see a full list of changes on the IRS website.

Also Check: Aarp Foundation Tax-aide Site Locator

How Can I Make Sure I Get My Refund As Fast As Possible

Each tax filing is as unique as the individual it represents. To help expedite the tax refund process, consider one or more of the following tips:

- Visit us at any H& R Block office to ensure your return is ready to file when e-file opens.

- Consider e-filing versus traditional paper filing.

- Complete a tax return that is free of any errors or miscalculations. This means carefully reviewing personal information such as your name, social security number, home address and bank information, if applicable.

File Your 2018 Tax Return

The IRS estimates that unclaimed refunds from 2018 may total up to $1.5 billion. If you were due a refund for the 2018 tax year but didn’t file a tax return, you only have until April 18 to submit that old Form 1040 and claim your money. So if you havent filed, get to work! Miss the tax deadline, and the U.S. Treasury gets to keep your money.

Don’t Miss: How To Pay Taxes Quarterly

File Electronically And Choose Direct Deposit

To speed refunds, the IRS urges taxpayers to file electronically with direct deposit information as soon as they have everything they need to file an accurate return. If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing.

Most individual taxpayers file IRS Form 1040 or Form 1040-SR once they receive Forms W-2 and other earnings information from their employers, issuers like state agencies and payers. The IRS has incorporated recent changes to the tax laws into the forms and instructions and shared the updates with its partners who develop the software used by individuals and tax professionals to prepare and file their returns. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms .

Tax Day For Maine And Massachusetts Residents

Residents of Maine and Massachusetts got an extra day this year until April 19 to file their federal income tax return. Why? Because Patriots’ Day, an official holiday in Maine and Massachusetts that commemorates Revolutionary War battles, fell on April 18 this year. So, for the same reason Tax Day was moved from April 15 to April 18 for most people , the IRS couldn’t set the tax filing and payment due date on April 18 for taxpayers in those two states. As a result, the deadline was moved to the next business day for Maine and Massachusetts residents, which was April 19.

Don’t Miss: Haven T Received Tax Return

What If I Don’t File By October 17

People who fail to file their return by the extended tax deadline will face harsher penalties. The IRScharges 5% of the unpaid taxes for each month that a tax return is late or 10 times more than the underpayment penalty. It caps the penalty at 25% of your unpaid taxes. The tax agency also charges interest on the penalty.

Why Are Taxes Due April 18 Instead Of April 15 This Year

Tax Day is usually on April 15. But when a tax deadline falls on a Saturday, Sunday or holiday, it’s pushed back to the next available business day. April 15 was on a Friday this year, so the weekend rule didn’t apply. But Emancipation Day was observed in the District of Columbia on April 15. The holiday honors the end of slavery in Washington, D.C. Since April 15 was a legal holiday in D.C., the IRS couldn’t require tax returns to be filed that day. The next business day was April 18 so that became the new federal income tax filing deadline this year for most people.

Recommended Reading: State Of California Sales Tax

How To Avoid Owing The Irs

While owing taxes to the IRS isnt necessarily the end of the world, we can all agree that its a situation youre better off avoiding. Luckily, there are some steps you can take to make sure you dont find yourself in this undesirable position in the future.

Two of the best options are adjusting your W-4 and paying quarterly estimated taxes.

How to Adjust Your W-4

One of the most common reasons why people find themselves owing money to the IRS is that they didnt have enough withheld from their paycheck.

Even if your withholding was once correct, major life changes like a marriage or divorce may throw this off. If youve started a side business, this will also impact the amount of taxes you owe. Whatever the reason, you can fix your withholding by completing a new Form W-4.

Before you do this, I suggest using the IRS Tax Withholding Estimator. Then, once youve determined the appropriate withholding amount, complete the Form W-4 Employees Withholding Certificate and provide it to your employer.

How and When to Pay Quarterly Taxes

If you have a significant amount of income coming in from your side business, then theres a good chance youll owe extra taxes. While it would be easier to calculate it at the end of the year and make one lump-sum payment, income taxes are a pay-as-you-go system.

For this reason, youll need to estimate the amount of taxes you owe each quarter and send a payment off to the IRS.

The schedule for making estimated tax payments is as follows: