California Amending Regs To Clarify How Petitions For Alternative Apportionment Are To Be Considered By The Ftb

The California Franchise Tax Board voted to proceed with adopting certain proposed amendments to California Code of Regulations, Title 18, section 25137 which permits a taxpayer to petition for the use of an alternative apportionment method, if the standard allocation and apportionment provisions do not fairly reflect the extent of a taxpayers business activity in California. There was limited formal guidance as to how such petitions were to be considered by the FTB, so the proposed amendments are aimed at addressing that issue.

May 2, 2020

California Franchise Tax Board To Hold Sixth Interested Parties Meeting Regarding Market

The California Franchise Tax Board will hold a sixth interested parties meeting to solicit public input regarding additional proposed amendments to Californias market-based rules regulation . The sixth IPM will be held telephonically on Friday, June 4, 2021, at 10:00 a.m. To attend, interested parties need to RSVP to the FTB by May 28, 2021, at the email address set forth in the notice. Instructions on how to participate in the sixth IPM are set forth in the notice as well. The proposed amendments to be discussed include: added definitions of asset management services and of professional services examples to be included in the regulation addition of a special rule for certain professional services and a change to the applicability date .

May 13, 2021

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page, you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Also Check: How To Find 2020 Tax Return

Can Collections Take Your Federal Tax Return

These debts include past-due federal taxes, state income taxes, child support payments and amounts you owe to other federal agencies, such as federal student loans you fail to pay. As a result, the collection agencies that your other creditors hire to obtain payment from you cannot intercept or garnish your tax refund.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: Penalty For Filing Taxes Late If I Owe Nothing

Wheres My State Tax Refund North Carolina

Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. If 12 weeks have gone by and you still havent gotten your refund, you should contact the Department of Revenue.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

You May Like: Do Seniors On Social Security Have To File Taxes

Read Also: Sales Tax And Use Texas

More Tax Refund Checks In 202: These States Are Sending Out Payments This Week

Coloradans are getting rebate checks for up to $1,500 this week. Your state might be issuing payments, as well.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Many states are addressing rampant inflation and the growing threat of a recession with tax rebates and stimulus checks: California will issue a “middle-class tax refund” worth as much as $1,050 starting in October.

A number of states are issuing payments in August: Colorado Gov. Jared Polis signed legislation speeding up rebates worth up to $1,500 to get them in the hands of taxpayers as early as this week. “Rising prices, gas prices, grocery prices — we’re all experiencing this and we said, ‘Why should the government sit on your money for a year?'” Polis told KKTV. “Let’s get it back quick, easy, as quick as possible.”

In all, at least 18 states have issued or are in the process of sending out checks. Read on to find out which ones are sending rebates and stimulus checks, how much eligible taxpayers can expect to get and when they should arrive.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

You May Like: Sale Of Second Home Tax Treatment

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

Recommended Reading: Free Irs Approved Tax Preparation Courses

How Do You Check If Youve Paid State Taxes

If you want to make sure your state taxes were paid, contact the California Department of Revenue to see if your payment was received. The contact information is as follows:

If you dont pay California income taxes, you will likely incur penalties and fees. This is the case when you dont:

- File on time

- Have enough taxes withheld from your paycheck

- Pay electronically when youre required

- Have insufficient funds to pay

View the California states Penalty reference chart for more information.

Workshop: California State Income Tax Filing

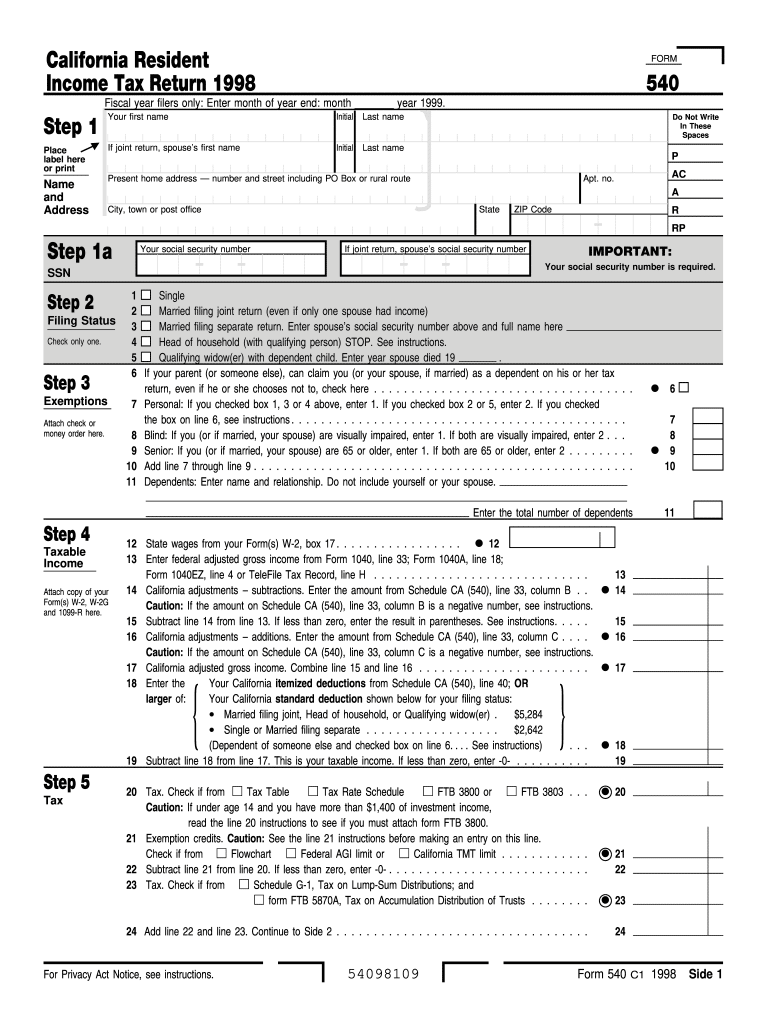

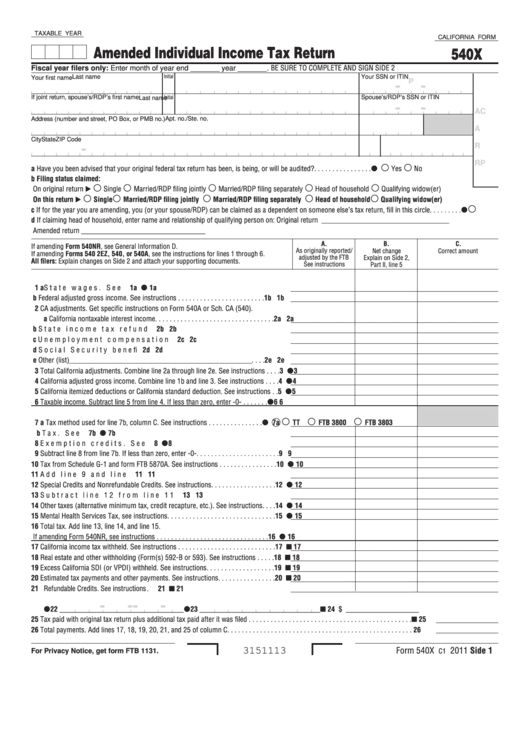

Attend of the workshop during March or April to learn about the California state’s filing requirements. A member of the California Franchise Tax Board will present these workshops to assist you with filing any required state tax forms. We recommend completing your federal tax return before attending one of these workshops. Students or scholars who are considered nonresidents for California state tax filing will complete and file California Tax Form 540NR those who are considered residents for California state tax filing will complete and file California Tax Form 540.

The 2022 workshops have concluded. The next-year workshop information will be posted here in the beginning of 2023.

Don’t Miss: Amended Tax Return Deadline 2020

California Amends And Adopts Regulations Related To Other Tobacco Products

In November 2016, California voters approved Proposition 56, which included electronic cigarettes in the definition of other tobacco products . Effective April 6, 2021, California has amended State regulation on wholesale cost of tobacco products : which now: defines the terms electronic cigarettes, sold in combination with, and tobacco products clarifies the scope of manufacturing costs in determining the wholesale cost of tobacco for a manufacturer or an importer that is also a distributor and provide examples of items that are and are not considered tobacco products. Further, California has also adopted a Regulation on tobacco product manufacturers , which among other things: defines the term tobacco product manufacturer provides that a retailer who mixes, blends, or combines a tobacco product that is not in a form suitable for human consumption, such as liquid nicotine, and other ingredients and components to make a product that is suitable for human consumption is a tobacco product manufacturer and provides that a retailer who is not a licensed manufacturer, importer, or distributor must purchase its tobacco products from a licensed tobacco products distributor or wholesaler. If you sell OTPs in California and have questions about local taxation issues, please reach out to Withums State and Local Tax Group.

Qualifying Health Care Coverage Penalties

Californians who did not have qualifying health insurance throughout the year are subject to a penalty of $800 or more when they file their state tax returns. The penalty for a dependent child is half that of an adult a family of four could face a penalty of $2,400 or more. If you had health coverage in 2021, check the Full-year health care coverage, box 92, on your state tax return to avoid penalties.

Recommended Reading: Property Taxes In Austin Texas

Understanding Your Refund Status

As you track the status of your return, youll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Why Do I Owe Federal Taxes But Get A State Refund

If you paid more taxes to the state government than your actual tax liability, you will be eligible to receive a state tax refund. Federal taxes are levied annually by the IRS on your total income so even if you received a refund for paying more than what you were required by the state, you may still owe federal taxes on your total income.

Read Also: How Is Property Tax Paid

More Help With Taxes In California

Understanding your tax obligation is critical to optimizing your tax outcome. Thus, its critical to understand how to deduct California state tax from your federal taxes as an itemized deduction.

So, get help! Use Tax Pro Go, virtual tax prep offered by H& R Block. With this service, well match you with a tax pro with California tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest!

Taking California tax laws into consideration, we can make sure you are supported when it comes to taxes no matter where you file.

Related Topics

When can you take a meal allowance as part of business travel deductions? Learn more from the tax experts at H& R Block.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

You May Like: Corporate Tax Rate In India

How Much Do I Make After Taxes In California

The income tax rates in California range from 1% to 12.3% with a 1% surcharge on taxable incomes of $1 million or more. The state has a progressive marginal tax rate which means that the higher your income the higher the rate you will pay.

To calculate your paycheck after taxes in California, take a look at the various deductions that will be made in addition to the state income tax to figure out your actual tax situation. This includes FICA and State Insurance Taxes that cover Social Security, Medicare, State Disability Insurance Tax, etc.

Theres an abundance of California paycheck calculators online that can instantly let you know how much you make after taxes.

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

Don’t Miss: What Is Self Employment Tax

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your zip code.

If you e-filed, you can generally start to see a status four days after the Oklahoma Tax Commission receives your return. Paper filings will take longer and you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Don’t Miss: Local County Tax Assessor Collector Office

Wheres My State Tax Refund Ohio

The Department of Taxation for Ohio provides an online form to check your refund status. To see the status, you will need to enter your SSN, date of birth and the type of tax return. You also need to specify if it is an amended return.

According to the Department of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. However, paper returns will take significantly longer. You can expect processing time for a paper return to take eight to 10 weeks. If you are expecting a refund and it doesnt arrive within these time frames, you should use the check status form to make sure there arent any issues.

The Earned Income Tax Credit

The Earned Income Tax Credit helps low-to-moderate-income working taxpayers get more money back when they file their federal income tax return.

Federal forms and instructions for previous years are available for downloading.

- 4868 -automatic extension of time to file as an individual.

or order forms by phone: Call

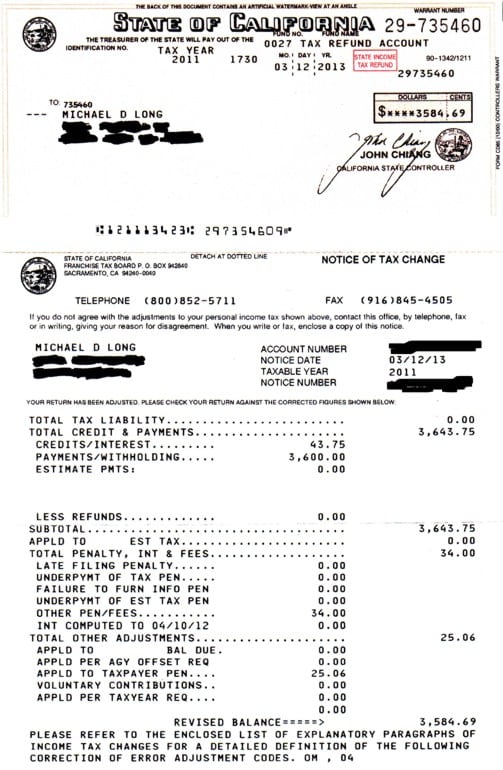

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.