If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Addresses For Forms Beginning With The Number 1

|

Form Name |

Address to Mail Form to IRS: |

|---|---|

|

Form 11C Occupational Tax and Registration Return for Wagering |

Department of the Treasury |

|

Form 1040-C U.S. Departing Alien Income Tax Return |

Department of the Treasury |

|

Form 1040NR U.S. Nonresident Alien Income Tax Return Exception Estates and Trusts filing Form 1040NR |

Department of the Treasury |

|

Form 1040NR U.S. Nonresident Alien Income Tax Return |

Internal Revenue ServiceCharlotte, NC 28201-1303USA |

|

Form 1040NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents |

Department of the TreasuryInternal Revenue ServiceAustin, Texas 73301-0215 |

|

Form 1040NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents |

Internal Revenue Service |

You May Like: How Much Is Stock Taxed

What Number Can I Call To Actually Reach Someone At The Irs

I filled 1/20 and haven’t heard a thing… What number can I call to reach someone at the IRS? I see people saying they’ve spoken with someone however I am unable to find a number that works… I call the number on the IRS site and it says due to high call volume I cant speak to anyone… someone help! I am losing my mind…

@jamiemoore wrote:

Call the IRS: 1-800-829-1040 hours 7 AM – 7 PM local time Monday-FridayWhen calling the IRS do NOT choose the first option re: “Refund”, or it will send you to an automated phone line.So after first choosing your language, then do NOT choose Option 1 . Choose option 2 for “personal income tax” instead.Then press 1 for “form, tax history, or payment”.Then press 3 “for all other questions.”Then press 2 “for all other questions.”- When it asks you to enter your SSN or EIN to access your account information, don’t enter anything.- After it asks twice, you will get another menu.Then press 2 for personal or individual tax questions.It should then transfer you to an agent.

File A Tax Extension Request By Mail

Its also possible to file Form 4868 in paper form. You can download the form from the IRS website or request to have a paper form mailed to you by filling out an order form on the IRS website. Alternatively, you can call the IRS at 800-829-3676 to order a form. Your local library or post office may also have copies.

Notably, if you are a fiscal year taxpayer, you can only file a paper Form 4868.

If you recognize ahead of time that youll need an extension, dont wait until the last minute to submit Form 4868. The earlier you get it in, the more time youll have to fix any potential errors that may come up before the deadline passes and the extension door closes.

Also Check: Can The Irs Take My Inheritance For Back Taxes

Recommended Reading: Penalty For Not Paying Taxes Quarterly

Where To Send Returns Payments And Extensions

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still file a paper or “snail mail” tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

Mailing Address For Where To Send 1040 Form To Irs

What should I do if there is no instruction page for the federal return? I got specific instructions where to mail the state return but nothing on what to do with the 1040.

@jdelbruck wrote:

What should I do if there is no instruction page for the federal return? I got specific instructions where to mail the state return but nothing on what to do with the 1040.

Use this procedure to view/print/download your tax return to include the Federal Filing Instructions page.

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account –

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2021 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year’s return.

You May Like: How To Avoid Capital Gains Tax On Stock

How Do I Send My Tax Return By Mail

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS. Mailing Tips

What Do I Need To File Taxes By Mail

Include all necessary tax forms for the IRS if you file by mail: your Form 1040 or 1040-SR, any schedules, and any other additional forms you have to fill out for your particular return. You should also include a check if you owe any taxes, or you can use IRS Direct Pay to make payment online from your checking or savings account.

You May Like: When Do We Get Tax Returns 2022

Where Do I Mail My Amended Tax Return

Use IRS Form 1040-X to file an amended tax return. You can e-file this return using tax filing software if you e-filed your original return.

If you are filing Form 1040-X because you received a notice from the IRS, use the address in the notice. Otherwise, use this article from the IRS on where to file Form 1040X. Find your state on the list to see where to mail your amended return.

You May Like: Whats The Property Tax In Texas

Who Is Eligible For California Stimulus Checks

To be eligible to receive the payment, you must meet the following criteria:

- Meet the California adjusted gross income limits described here

- Were not eligible to be claimed as a dependent in the 2020 tax year

- Were a California resident for six months or more of the 2020 tax year

- Are a California resident on the date the payment is issued

Don’t Miss: Aarp Foundation Tax-aide Site Locator

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With , you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- USPS Tracking® included

- 13 business day delivery

- USPS Tracking® included

- 15 business day delivery

- Extra services available

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

Do Not Send

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.

Read Also: Federal Small Business Tax Rate

When Do I Need To Post My Tax Return By

You must submit your federal tax returns once a year. The deadline for this submission is known as tax day and it marks the end of the financial year.

The next Tax Day is in April 2023. Currently, Tax Day 2023 is scheduled for April 15th.

Typically, Tax Day is on April 15th, but if it falls on a Sunday or a holiday, it can be pushed back to April 18th.

When you are posting your tax returns, it is recommended that you put them in the mail at least two weeks before the deadline.

Georgia Senate Candidate Herschel Walker Getting Tax Break In 2022 On Texas Home Intended For Primary Residence

Republican Herschel Walker is getting a tax break intended only for a primary residence this year on his home in the Dallas, Texas, area, despite running for Senate in Georgia.

Publicly available tax records reviewed by CNNs KFile show Walker is listed to get a homestead tax exemption in Texas in 2022, saving the Senate candidate approximately $1,500 and potentially running afoul of both Texas tax rules and some Georgia rules on establishing residency for the purpose of voting or running for office.

Walker registered to vote in Atlanta, Georgia, in 2021 after living in Texas for two decades and voting infrequently. In Texas, homeowner regulations say you can only take the exemption on your principal residence.

Walker took the tax break in 2021 and 2022 for his Texas home even after launching a bid for Senate in Georgia, an official in the Tarrant County tax assessor office told CNNs KFile. The Walker campaign did not respond to CNNs repeated requests for comment. Walker is set to face Democratic Sen. Raphael Warnock in a runoff election in December after neither candidate earned more than 50% of the vote in Novembers midterm election.

Politicians in the pastin Texas have landed in hot water over improperly taking the exemption, including then-Gov. Rick Perry, and have typically agreed to pay back taxes.

Recommended Reading: Capital Gains Tax Calculator New York

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the Out of Country circle on Page 1 of Form D-400. Out of the Country means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Also Check: Are 529 Contributions Tax Deductible

You Can Extend Your Filing Deadline But Not Your Payment Deadline

Tax deadlines have a way of creeping up on you, so filing for a tax extension might be something you need to do at some point in your life.

If you need more time to prepare your returnwhether you are busy with school, travel, or a family emergency, or are simply disorganizedyou can request a six-month filing extension by submitting the proper form to the Internal Revenue Service . Of course, theres also a deadline for that, but the good news is that getting an extension is easier than you might think. Heres what you need to know, from dates and forms to special rules.

Major Tax Services Are Sending Your Data To Meta And Google

A new report claims that Metas tracking Pixel has been used to collect your financial information when using popular tax filing services to send in your return. This is disturbing news for taxpayers that likely assumed these online tax services were keeping such information locked up securely.

The types of data collected vary but are said to possibly include your filing status, adjusted gross income , and the amount of your refund . This information would be quite useful in targeting advertising to those with disposable income and help determine which people to target when tax refunds arrive. As if this wasnt bad enough, your name, phone number, and the names of dependents such as your children are being obfusticated then sent to Meta by some tax filing services. According to the report by The Markup the obfustication is reversible.

The tax filing services named by this report included H& R Block, TaxAct, and TaxSlayer, some of the largest and most trusted companies to offer online filing services to U.S. taxpayers. Another major service, TurboTax, uses ad tracking but apparently doesnt send sensitive private data. Its not just Meta involved in this privacy issue. TaxAct is supposedly sending similar tax filing data to Google as well.

Editors’ Recommendations

Don’t Miss: How Late Can I File My Taxes

The Takeaway: Follow Instructions On All Irs Communication

With any luck, the IRS will quickly iron out any issues with your latest tax forms, and youll get a refund immediately. Overall, if youve received a CP05 notice, just follow the directions provided promptly and dont be afraid to seek the guidance of a professional.

The tax man cometh:

Stay on Top of the Latest Investing News and Trends

Can I File A Tax Extension Electronically Free Of Charge

Yes, you can. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS Free Fillable forms, assuming they are comfortable handling their taxes. If thats not the case, there are several tax-software companies that offer free filing under certain conditions.

You May Like: How Much Is Tax In Alabama

Don’t Miss: Penalty For Filing Late Taxes

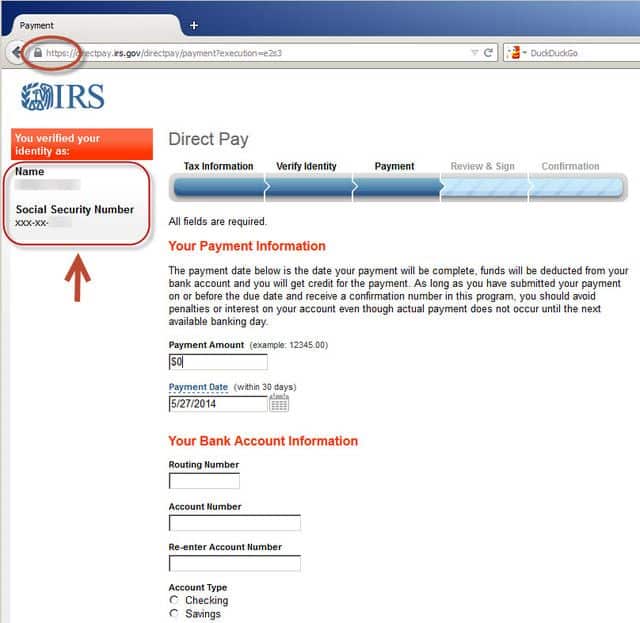

How To Make An Irs Payment: 10 Ways To Pay Your Taxes

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Writing a check was the only way to pay the IRS back in the day. Now there are a ton of options.

Heres an overview of some common ways to make an IRS payment, what theyll cost you, and the pros and cons of each IRS payment method.