Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employeeâs wages.

Do any of your employees make over $147,700? If so, the rules are a little different, and they may owe additional Medicare tax. Read more at the IRS.gov website.

The Additional Medicare Tax

Since 2013, an additional Medicare tax of 0.9% has been applied to unmarried employees who file an individual tax return and whose Medicare wages exceed $200,000. The additional Medicare tax applies to income over $250,000 for married taxpayers who file a joint return and to income over $125,000 for married couples who file separate returns.

Employer Payroll Taxes Vs Employee: What’s The Difference

Though the business still remits payments for both employer- and employee-paid payroll taxes, you should look at the origin of the money differently.

On a businesss profit and loss statement, employer payroll taxes are listed separately as payroll taxes . Employee-paid taxes are always included in salary expense or wage expense.

Employee-paid taxes come out of employee salaries and wages. Employee-paid payroll taxes appear on each employees pay stub to explain how the business arrived at the paycheck amount.

When Stephanie agreed to hire Matt, she did not need to consider employee payroll taxes because theyre included in the $60,000 annual salary she offered.

Employer-paid payroll taxes dont affect your employees paychecks. When Stephanie hired Matt, she had to think about the labor burden of his employment, which comprises employer-paid payroll taxes.

You May Like: How To File Free Taxes

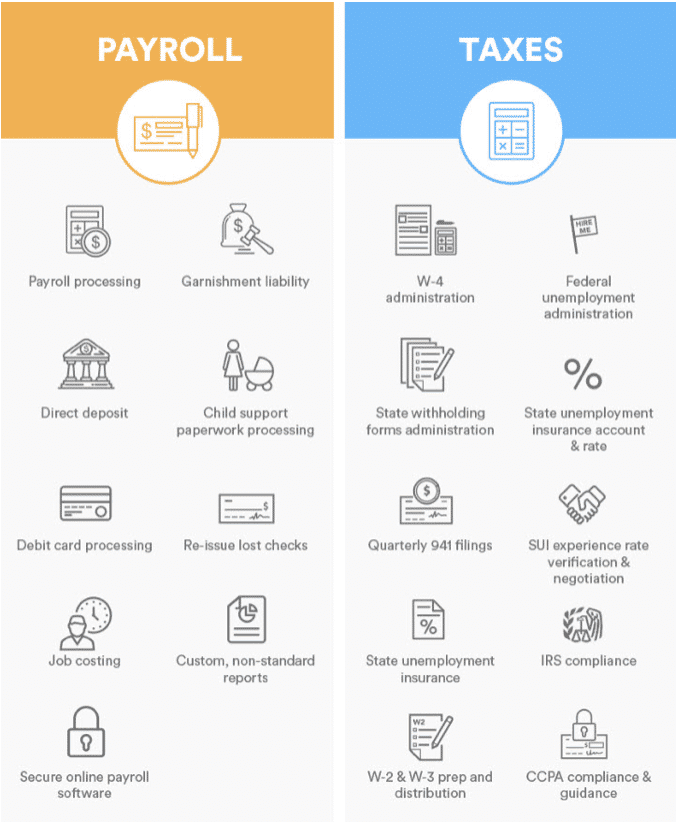

Federal Payroll Return Requirements

Along with actually depositing your federal payroll taxes, you also have an obligation to file periodic returns that show how you computed your tax liabilities. As is true for deposits, the returns you must file for your income and FICA taxes are different from the returns you file for your FUTA taxes.

Is Payroll Tax Flat Or Progressive

Unlike the individual income taxing system, payroll taxes are flat and not progressive. It means that every business organization employee pays the same tax percentage regardless of income. Progressive tax systems do not have fixed tax rates, and the Internal Revenue Service charge employees and employers based on their income.

The commission charge higher-income individuals high percentages, and lower-income earners pay lower rates. But in a flat system such as payroll taxes, the Internal Revenue Service assigns one tax rate to all taxpayers.

Read Also: Aarp Foundation Tax-aide Site Locator

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. In this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Other Employer Payroll Tax Requirements

As the pay periods go by and tax money is withheld from employees paychecks , businesses may eventually have to file quarterly tax returns with federal, state and local governments. The deadline for filing IRS Form 941, Employer’s Quarterly Federal Tax Return is usually the last day of the month following the end of a quarter. So, if the first quarter of the year ends March 31, then the first Form 941 would be due April 30. Payments can be made via the Electronic Federal Tax Payment System® .

After the year is over, employers typically need to issue Forms W-2 to employees and Forms 1099-MISC to independent contractors. They might also have to file three additional forms:

- Form W-3 reports the total W-2 earnings from all employees to the Social Security Administration

- Form 1096 is a summary and transmittal form that accompanies other IRS forms

Read Also: When Are Business Taxes Due

What Happens If I Fail To Pay The Right Amount To Hmrc

Should you fail to pay the right amount to HMRC, you run the risk of paying interest and penalty payments.

As an employer, you are legally responsible for completing PAYE tasks, even if you choose to outsource them to a third party.

It is vital that all business owners, big or small, understand payroll and PAYE tax properly so that penalties can be avoided and staff remain paid correctly and on time.

How To Pay Federal & State Payroll Taxes

Its best to set aside money for employment taxes each pay period, even if youre only required to send payment monthly. You definitely need to withhold money from your employees paychecks each period.

You will either need to deposit payroll taxes on a monthly or semiweekly basis. If you owed $50,000 or less in taxes for the prior year, you can pay monthly anything more than that puts you on a semiweekly pay schedule. If youre a new employer, youre automatically placed on a monthly deposit schedule. For employers with very little payroll tax obligation , deposits can be made quarterly with the 941 tax return.

Read Also: What Is Form 5498 For Taxes

What Taxes Does The Employer Pay Employer Taxes Explained

When you look at your paycheck, you probably notice a percentage of taxes taken out of your paycheck. Yes, your employer pays for some, but the employee has some responsibility too. Employers handle the administrative responsibility for the payment of taxes, whether by paying or having it deducted from your paycheck. Still, in some cases, they also handle paying certain taxes. Lets explore how payroll taxes work and what the employer versus the employee is responsible for when it comes to paying.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that âemployee-paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees.

State and local payroll taxes are governed at the state and local levels, and payroll tax rates and rules vary by jurisdiction. To find out more about payroll tax in your state and local area, check out the Federation of Tax Administratorsâ list of each stateâs taxing authority.

Also Check: How Much Foreign Income Is Tax Free In Usa

Payroll Taxes Youre Responsible For As An Employer

As an employer, you are required to deduct the appropriate amount of taxes from your employees checks and pay them on their behalf. There are also employer payroll taxes you are solely responsible for:

- Employers share of FICA taxes

- Federal unemployment tax act taxes

- State unemployment tax act taxes

- Workers compensation

Payroll Taxes For Employees

If an individual is an employee, the employer must withhold payroll taxes, including federal and state income taxes. The amount withheld depends on the amount of wages paid, the filing status , the number of pay periods, and the number of allowances claimed by the employee. Each employee is required to give the employer a signed Form W-4 that indicates the filing status and number of personal allowances claimed. The employee completes a worksheet provided with Form W-4, to assist with the computation of the correct number of personal allowances. An employee can claim fewer personal allowances but cannot claim more because the employee will be underpaid and subject to underpayment penalties.

Also Check: What Is The Sales Tax

Is Payroll Tax Income Tax

Payroll tax is not income tax the critical difference is that employees pay both, while employers only pay payroll taxes. The Internal Revenue Service enforces income taxes on citizens. Employers withhold income and payroll taxes on employees’ paystubs when they make the payroll. Income and payroll taxes affect employees differently.

What Is The Difference Between Payroll Tax And Income Tax

The main difference between income and payroll tax is who pays which and what the taxes fund. Payroll taxes are paid by employees and employers to fund Social Security, Medicare, and social insurance programs. Local income taxes are paid by employees to fund public services like transportation, education, and defense.

You May Like: How To File Taxes Free

A Payroll Tax Withholding Example

Lets say a business has an employee named Bob who is married, has two children and a spouse who also works. How would his federal tax withholding each pay period be determined if he earns $1,000 per week?

First, see if Bobs wages need to be adjusted. Since he isnt claiming any additional income from investments, dividends or retirement and hes chosen the standard deduction, his wages remain $1000.

Second, look at the weekly pay period bracket table on 15-T. For married filing jointly with the Form W-4 Step 2 checkbox withholding option, the tentative withholding amount is $88.

Third, account for tax credits. Bob has two children, so he may get $4000 in tax credits. Divide this number by 52 since hes paid weekly and subtract the result from $88 . The result is $11.08.

Finally, if Bob requested an additional $1000 withheld from his taxes each year on his Form W-4, divide that number by 52. The result is $19.23, which when added to $11.08, equates to a final withholding amount of $30.31 per pay period.

Where To Get More Information On Employee And Employer Taxes

For information on federal employment taxes, see IRS Publication 15 and Publication 15-T.

For state employment tax information, you may contact the state agency that administers the tax. Depending on the type of tax, this may be the state revenue agency or the state workforce agency.

The state revenue agency may also be able to provide you with applicable local employment tax information. Or, you can contact the local taxation department directly.

We hope this checklist will give you some peace of mind when it comes to navigating the rocky road of employee and employer taxes.

Also Check: Tax Filing Deadline 2021 Extension

Different Types Of Taxes In India

- Tax on Corporate Income Current corporate income tax rates are applicable for resident businesses and non-resident businesses, plus a surcharge, resulting in a total tax rate.

- Income Tax Rate Payroll taxes in India are calculated based on salary slabs. In India, there are four main pay scales. According to 2022-2023, they are:

|

Gross Revenue |

|

|

More than INR 1,000,000 |

Notice: Individuals having total taxable income over INR10 million are subject to a 10% surcharge on the total tax payable and a 3% education surcharge is also applied to the taxes that are payable.

- Payroll Tax There is no payroll tax considered as of now.

- Sales tax In India, sales tax is levied on the supply of the majority of movable commodities, certain intangible products, as well as taxable goods and services. Taxable individuals are subject to the output tax on the taxable supply they make as well as the VAT on the items they receive .

- Withholding Tax Certain classifications of income received by non-residents are subject to withholding tax in India.

|

Dividends |

Withholding tax does not apply. But theres a chance that a 15% dividend distribution tax will be imposed. |

|

Royalties |

|

|

1% plus surcharge and cess |

According to any applicable double tax treaties, a discounted rate can be provided.

What Is Your Employer Tax Registration Number And Where Can It Be Found

Your employer tax registration number, also called your employer identification number , is a way for the Internal Revenue Service to identify your business. You can find this number on your W-2 form in Box b. It should be a nine-digit number separated in the following way: NN-NNNNNNN. This is important to point out to your employees when they fill out their employee taxes as well.

Don’t Miss: Mail Tax Return To Irs Address

How Can I Set Up Paye Payroll

Setting up your PAYE payroll isn’t the hardest thing in the world. While many companies may choose to employ the services of an accountant to help them along the way, others prefer to go at it alone. Either way, it is always best to have your own PAYE credentials.

However, before setting up a PAYE payroll, several administrative tasks will need to be completed:

-

Register as an employer with HMRC and receive a login for PAYE Online. This usually takes five working days following registration.

-

Choose your payroll software. This will allow you to record employee details, calculate pay and deductions and report to HMRC. PayFit is a government-approved payroll provider and is listed on the GOV.UK website.

After setting up your PAYE scheme, you also have the following ongoing obligations:

-

Record and keep records of all money paid to employees. The records must be accurate as these will be reported to HMRC.

-

You must inform HMRC about your employees and let them know of any changes that occur.

-

Record pay, make deductions and report to HMRC either on or before each payroll run.

How Much Do Employers Pay In Payroll Taxes

So, how much is payroll tax? The cost of payroll taxes largely depends on the number of employees you have and how much you pay your employees. Why? Because payroll taxes are a percentage of each employees gross taxable wages and not a set dollar amount.

Payroll tax includes two specific taxes: Social Security and Medicare taxes. Both taxes fall under the Federal Insurance Contributions Act , and employers and employees pay these taxes.

Payroll tax percentage is 15.3% of an employees gross taxable wages. In total, Social Security is 12.4%, and Medicare is 2.9%, but the taxes are split evenly between both employee and employer.

So, how much is the employer cost of payroll taxes? Employer payroll tax rates are 6.2% for Social Security and 1.45% for Medicare.

If you are self-employed, you must pay the entirety of the 15.3% FICA tax, plus the additional Medicare tax, if applicable .

Recommended Reading: After Tax Contribution To 401k

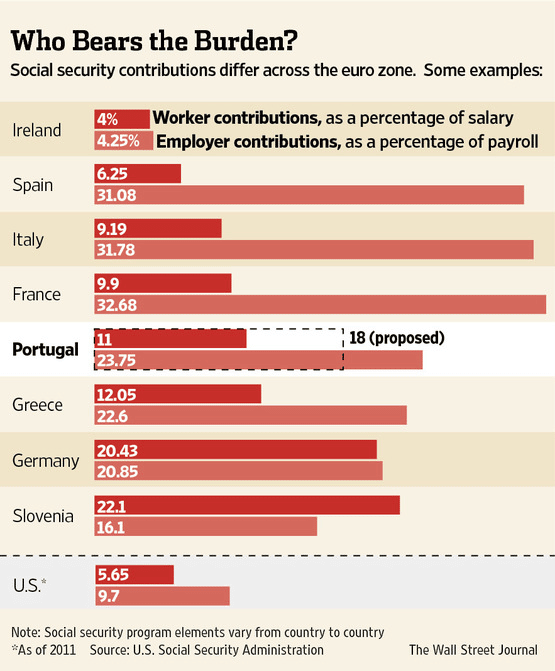

Arguments For And Against The Social Security Tax Cap

Proponents of increasing or eliminating the limit on earnings subject to the Social Security payroll tax argue that it would make the tax less regressive and be part of a solution to strengthen the Social Security trust funds. An analysis from the Congressional Budget Office estimated that phasing out the tax cap by subjecting earnings below the current taxable maximum and above $250,000, would have raised over $1 trillion in revenues from 2019 through 2028. Another argument is that removing the taxable maximum would adjust for the fact that higher-income individuals generally have longer life expectancies and thus receive Social Security benefits for a greater amount of time.

Opponents argue that increasing or removing the taxable maximum would weaken the link between the amount individuals pay in Social Security taxes and the amount they receive in retirement benefits. Opponents also contend that while low-income earners may pay a greater share of their income in Social Security taxes than those who are wealthier, they also receive a disproportionate share of government transfer payments that are not subject to the tax. Those opponents cite programs that have been created to at least partially offset the regressive nature of the Social Security payroll tax.

Futa Tax Deposit Rules

Generally, you must deposit your federal unemployment taxes on a quarterly basis. However, if your quarterly FUTA tax liability is $500 or less, you don’t have to deposit it. Rather, you may carry it forward and add it to your FUTA liability for the next quarter. If your liability for the last quarter of the year is $500 or less, you have the option of either depositing the tax or remitting it with your annual return.

Assuming your quarterly FUTA tax liability is more than $500, you must make your quarterly FUTA deposits by the last day of the month that follows the end of each quarter:

| Ending date of quarter |

Read Also: Best Place To Do Your Taxes

Payroll Taxes Have A Larger Impact On Lower

Payroll taxes are regressive: low- and moderate-income taxpayers pay a bigger share of their incomes in payroll tax than do high-income people, on average. The bottom fifth of taxpayers paid an average of 6.1 percent of their incomes in payroll tax in 2021, according to Tax Policy Center estimates, while the top fifth paid 5.7 percent and the top 1 percent of taxpayers paid just 2.1 percent. About two-thirds of taxpayers pay more in federal payroll taxes than personal income taxes. These figures include the employer and employee shares of the payroll tax.

However, if one looks at the overall impact of Social Security and Medicare the benefits they provide as well as the taxes they collect these programs are progressive. Social Security benefits represent a higher proportion of a workers previous earnings for workers at lower earnings levels and while all Medicare beneficiaries are eligible for the same health care services, high-income beneficiaries pay more in Medicare taxes and premiums. Low-income Medicare beneficiaries are also eligible for help paying for their premiums and cost sharing. Variation in state laws and practices makes it difficult to assess the distributional effect of UI.