States With Low Sales Tax

There are several other states that, while continuing to impose sales tax, have a lighter sales tax than normal.

According to The Washington Post in 2014, other states that had lower sales tax include Hawaii , Wisconsin , Wyoming , and Maine . Others with low sales tax include Alabama , New York , Oklahoma , and South Dakota is around 4.5% as well.

Many Taxpayers Can File Their State And Federal Tax Returns For Free

IRS Tax Tip 2021-10, February 1, 2021

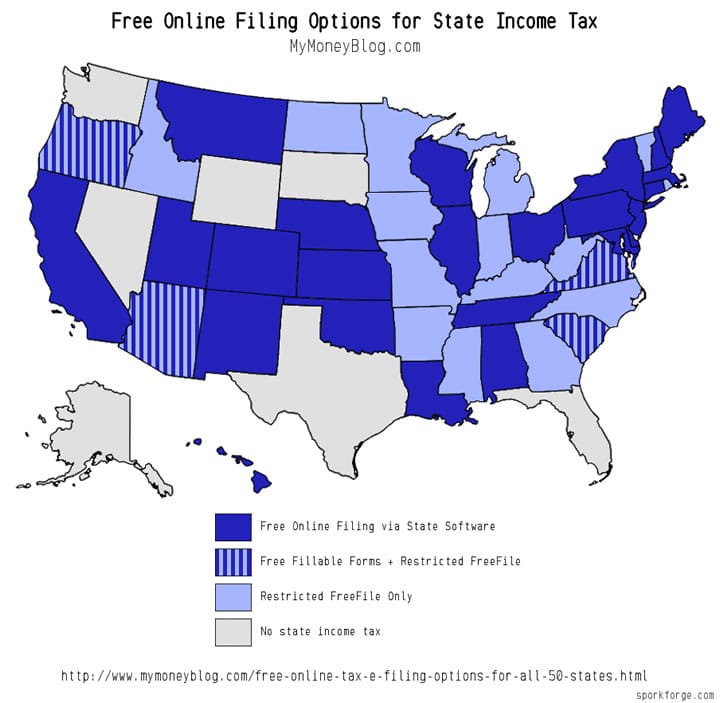

As taxpayers get ready to file their federal tax returns, most will also be thinking about preparing their state taxes. There’s some good news for filers wanting to save money. Eligible taxpayers can file their federal and, in many cases, their state taxes at no cost.

Taxpayers whose adjusted gross income was $72,000 or less in 2019 can file their 2020 federal taxes for free using IRS Free File. Many of them can also do their state taxes at no charge. They do so through Free File offered by the IRS.

What Is Sales Tax

Sales tax is a tax applied to the sale of goods or services – traditionally charged to the final user .

For example, companies rely on the government to define nexus – the physical presence of a company in a state – when determining taxes for online retailers. Some employees can constitute a nexus in a state if they work primarily out of that state – like Amazon for example. In New York state, recent laws called “Amazon laws” require companies to pay sales tax even if they aren’t based in a specific state.

However, other kinds of sales tax, like excise and value-added tax, add on to the consumer’s budget. Excise tax, sometimes colloquially coined “sin tax,” are taxes on products like cigarettes or alcohol.

Value-added tax essentially charges incremental tax for each level of production of an end good. However, in the U.S., conventional taxes are primarily used.

According to USA Today, Americans generally pay a sales tax of between 2.9% and 7.25% of the price of the good in most states.

Recommended Reading: New Mexico Tax Deadline 2022

Iowa Tax Free Weekend

When: Aug. 5 at 12:01 a.m. Aug. 6 at 11:59 p.m.Whats Tax Free: Clothing or footwear selling for less than $100 is not taxed over the weekend.

Fine Print: Note that backpacks are still taxable, as they dont count as clothing. If youre unsure of which items count as clothing, check out this list. A note for BOGO shoppers: If youre using a buy one, get one free deal, its the cost of both items that determines if you get them tax free. For example, if boots are buy one, get one free, and the first pair costs $110, youll pay tax you cant average the cost and insist each pair is just $55.

What Does It Mean To Live In A State With No Income Tax

At the most basic level, living in a state with no personal income tax means that youll get to keep a little bit more of your paycheck. And if youre currently living in a state with high personal income tax rates like California , it can seem tempting to pack your bags and book a one-way ticket to Washington. However, moving to a state without an income tax does not mean that you will be excused from paying other taxes. If you meet the income qualifications for filing a federal return, youll still be expected to do so by the tax-filing deadline.

Read Also: Tax Preparer Santa Ana Ca

What Is Income Tax

Income tax is a tax imposed by a government on income generated by individuals and businesses. This tax is within the governments authority to generate revenue in order to pay for public services like schools, police and fire departments, programs like Social Security, and infrastructure such as roads and highways. Generally, taxpayers must file a state income tax return annually to determine their tax obligations. Individuals that do not earn income in states that are subject to state income tax may be paying other taxes to generate revenue for the state.

There are currently nine states in the U.S. that do not have a state income tax:

You May Find More Highly Rated Issuers By Searching Nationally

We suggest focusing on an average credit rating of AA/Aa for an attractive balance of risk and reward in today’s environment. That means having some lower-rated munis, but the bulk of the munis in your portfolio should carry higher ratings. It’s easier to find highly rated munis if you live in a state like California, New York or Texas, where there are large numbers of AAA- and AA-rated bonds, as illustrated in the chart below. It’s more difficult if you live in a state like New Jersey or Illinois, where the majority of bonds are lower than AA-rated. Consider diversifying nationally if you live in a state with fewer highly rated options.

You May Like: North Carolina Capital Gains Tax

If You Choose To Live In These States Every Penny You Earn Is Safe From State Income Tax But That Doesnt Mean You Wont Have To Pay Other State And Local Taxes

Everyone hates paying taxes. So why dont we all live in one of the nine states without an income tax? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming dont tax earned income at all. If youre retired, that also means no state income tax on your Social Security benefits, withdrawals from your IRA or 401 plan, and payouts from your pension. That sounds pretty darn good to me!

But, of course, no state is perfect. The states without an income tax still have to pay for roads and schools, so residents still have to pay other taxes to keep the state running . And sometimes those other taxes can be on the high end. New Hampshire and Texas, for example, have some of the highest property taxes in the country. So, if youre thinking of moving to a state without an income tax, continue reading to see some of the other taxes youll have to pay in those states. Maybe the state youre in right now wont look so bad.

Overall Rating for Taxes: Mixed Tax Picture

State Income Taxes: New Hampshire doesnt tax earned income, but currently theres a 5% tax on dividends and interest in excess of $2,400 for individuals . The tax on dividends and interest is being phased out, though. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026. The tax will then be repealed on January 1, 2027.

Sales Tax: New Hampshire has no state or local sales tax.

Inheritance and Estate Taxes: There is no inheritance tax or estate tax.

States Without A Sales Tax

Sales taxes are actually “sales and use” taxes. If sales tax isn’t charged on a purchase, the buyer may be charged use tax, which is a tax on the use, storage, or consumption of an item. Sales tax is remitted by the seller, while use tax is remitted by the buyer.

Only five states don’t impose any sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. Alaska is often added to this list, too however, the state’s rules are a bit complex.

Delaware doesn’t have a sales tax, but it does impose a gross receipts tax on businesses. Delaware’s gross receipts tax is a percentage of total receipts from goods sold and services rendered within the state, and it ranges from 0.0945% to 0.7468%, as of February 2022. It’s not technically charged to consumers, but its effect can nonetheless be felt in the sales prices of goods and services.

Also Check: Tax Deduction For Charitable Donations

What If You Earn Income In Other States

You must still report income earned in other states on your home state tax return if you live in a state that does levy an income tax, even if that income is earned in one of the tax-free states. It works both waysif you live in a tax-free state and earn income in a state that does tax earnings, you must file a non-resident return in that state, even though you don’t live there.

You Could Earn A Higher Yield Even Without State Tax Breaks

Some out-of-state muni bonds offer higher yields than in-state munis, even after accounting for any state income taxes.

It depends on where you look, though. The table below shows the yields investors in certain states would have to earn on out-of-state munis compared with the yield on an index of 10-year munis issued by their home state to compensate for the lack of state income tax breaks. This assumes the investors are in their home states’ highest marginal state tax bracket. The difference in yield is expressed in basis points . Florida, Texas and Washington don’t have state income taxes, so there’s no spread.

Don’t Miss: How To Not Owe Taxes

The 5 States Without Sales Tax

Sales tax is a large revenue driver for 45 states and the District of Columbia. According to the Tax Foundation, the average taxpayer will pay just over $1,000 per year in sales tax. In the 2020 fiscal year, income from state retail sales taxes totaled $340 billion. This makes up roughly a third of all state tax revenue, second only to income tax. Sales taxes are a key way to fund government initiatives.

While the states below do not charge sales tax, in some cases, counties and cities within these states can charge their own taxes.

Sales Tax Holidays: Shop Tax

These tax-free shopping events apply to back-to-school supplies, electronics, clothing and more.

Courtney Johnston

Editor

Courtney Johnston is an editor for CNET Money, where she manages the team’s editorial calendar, and focuses on taxes, student debt and loans. Passionate about financial literacy and inclusion, she has prior experience as a freelance journalist covering investing, policy and real estate. A New Jersey native, she currently resides in Indianapolis, but continues to pine for East Coast pizza and bagels.

With prices continuing to climb in the US, buying school supplies may cost a little extra this year. A recent CNET survey found that inflation is impacting the back-to-school shopping plans of 85% of Americans, with 47% planning on buying only essentials.

One way to try to save money this back-to-school season is with state sales tax holidays. Some states hold tax-free events, usually lasting a few days, where participating states pause or reduce state and sometimes local sales taxes. The suspended tax breaks only apply to specific categories, such as books, clothing, computers and athletic gear.

While 16 of the 18 state sales tax events have already ended, there are two remaining — Connecticut and Maryland. In addition, five states offer tax-free shopping all year round. See below for details. You can also check out our map and state-by-state descriptions below to find out if your state already participated and which items were tax-free.

Don’t Miss: South Carolina Income Tax Rates 2021

Which States Tax Social Security And Retirement Accounts

Where you live when you retire can have a major effect on your long-term retirement plans. Managing taxes is an important part of retirement planning, so choosing a state with favorable tax treatments of your retirement account withdrawals and Social Security benefits is a good place to start.

Here are all the states that dont tax retirement account distributions whatsoever:

In addition to the above states, Alabama and Hawaii do not tax pension plan withdrawals. However, they do tax withdrawals made from 401s and traditional individual retirement accounts .

When it comes to Social Security, 38 states dont tax benefits in any way. The 12 states that do tax Social Security to some degree include:

How To Use This Us Sales Tax Map

Remember that within each category of services, states can still have drastically different regulations. For instance, both Florida and Iowa are marked as taxing business services, even though Iowa taxes a wide range of these services and Florida only taxes security and detective services.

For more details about the specific tax liability of your business in individual states, consult state Departments of Revenue for additional information.

You May Like: What Percentage Of Tax Should I Withhold

States With No Income Tax : Which States Can Save You The Most

Almost everyone hates paying taxes, but what can you do, as the old adage says, there are only two certainties in life: death and taxes. Well, you can avoid some legally by moving to a state with no or a very low state income tax rate.

For this list, we ranked the States based on their state income tax rate, state-based sales tax rate, corporate income tax rate, average home value, average annual household income, and cost of living.

The ranking is based on the average annual household income equalized based on the cost of living in that stateless personal taxes. We also accounted for annual property taxes by subtracting from the equalized household income the effective property tax based on the median home value.

How The 9 States With No Income Tax Stack Up

Americas largest state is also considered one of the most tax-friendly. When Alaska repealed its personal income tax in 1980, it began to tax companies involved in oil and gas production at high rates to generate revenue. The states mean effective property rate is 0.98%, and Alaskas overall state and local tax burden is 5.8%, the lowest in the nation. On the downside, Alaska is remote and expensive in other ways. U.S. News & World Report ranks Alaska an overall 47 out of 50 on its affordability list, making it the fourth-lowest ranking state in the country. Contributing factors include higher-than-average housing costs and a steep cost of living relative to median family incomes. Most residents can receive an annual stipend, the Alaska Permanent Fund Dividend, of up to $2,000, which might help offset some costs.

This southern state is a popular retreat for vacationers and retirees alike. Florida generates most of its revenue from state and local sales tax and tuition through state universities. This makes for an overall state and local tax burden of 8.8%. While cost of living might not be a deal-breaker for most people, Floridians may still have to contend with a competitive housing market and prices. U.S. News & World Report ranks the state at 41 out of 50 for housing affordability.

Note: State, local and property tax data come from tax policy nonprofit the Tax Foundation and is for the 2019 calendar year, the most recent year for available data.

Also Check: How To Report Coinbase On Taxes

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them

“Thirteen of the 45 states with a sales tax still impose it on groceries.”State policymakers looking to make their tax codes more equitable should consider eliminating the sales taxes families pay on groceries if they havent already done so, or at least reducing these taxes or partially offsetting them through a tax credit. Thirteen of the 45 states with a sales tax still impose it on groceries. Of those, ten offer a lower tax rate for groceries than the general sales tax rate or provide a tax credit to offset some or all of the sales tax on groceries. Only Alabama, Mississippi, and South Dakota still tax groceries at the full state sales tax rate.

Sales taxes on groceries have an especially harmful impact on income and racial inequities since low-income families tend to spend a larger share of their income on groceries. The lowest-income fifth of families spend almost twice the share of their annual income on food at home that the highest-income fifth do: 10.3 percent versus 5.7 percent. Overall, the higher the income bracket, the smaller the share spent on food at home. For the lowest-income families, food at home is the third-highest expenditure category as a share of income, after housing and transportation. For the highest-income families, it is the fifth, after housing, transportation, pension and Social Security contributions, and health care.

Paying Taxes Is A Part Of Life For Most Americans And While Everyone Is Subject To The Same Irs Tax Laws When They File Their Federal Tax Return Annually They Dont Necessarily Pay The Same State Income Taxes

Why? Where you live and work affects the state tax laws that apply to you. Some states dont have any income tax at all and you may be tempted to relocate to one thinking the move will reduce your overall tax obligation.

While the thought of living in a state where income taxes arent taken from your paycheck may be appealing to those who live in states where their income is taxed, theres usually a give and take. States may need to make up for a lack of income tax revenue in other ways. For example, some states have higher sales tax rates or rely on money from tourism to help fund budgets. Others have local taxes levied by municipalities or counties.

Before you consider a move to a state with no personal income tax, its important to know all the details and how they could impact you.

Keep in mind, just because you live in a state that doesnt have an income tax doesnt necessarily mean you wont file a state income tax return. If you live in one state and work in another, you may have to file an income tax return in the state where you earn your paycheck. Likewise, if you moved during the tax year and previously worked in a different state, youll likely need to file with that state. Its important to check each states tax laws to find out the details.

Don’t Miss: Standard Tax Deduction Vs Itemized