To Preserve Eligibility For Long

By transferring home ownership toan irrevocable trust, though, a person can keep the home until it passes to thechosen beneficiaries. This is whats meant by the term Medicaid trust. Forthis to work, the house must be in the trust at least five years beforeMedicaid support is tapped. Before selling and buying a new house with theproceeds, the beneficiaries should know that the trust must sell thehouse and the trust must be buying another to keep the value protectedby the trust.

What Is The Downside Of An Irrevocable Trust

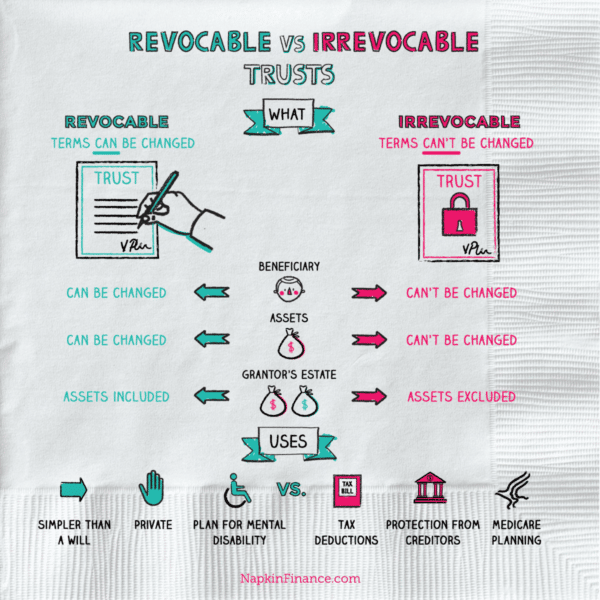

The downside to irrevocable Trusts is the inability to modify them. You also cant serve as your trustee. Once you have established the Trust and transferred the assets, you no longer control them.

Here at Hess-Verdon & Associates, we work with various types of irrevocable trusts therefore, we highly recommend working with an estate planning attorney specializing in advance estate planning. Feel free to call us today to discuss your options at 888-318-4430.

What Is An Irrevocable Trust

An irrevocable trust is a special type of trust used to protect assets. Unlike other trusts, once you move assets into the irrevocable trust, you cannot return them to the original owner. It is a separate legal entity with its own taxpayer identification number.

In essence, the move is permanent until the trustee distributes assets to named beneficiaries or their heirs. Because asset moves are permanent, irrevocable trusts provide asset protection when someone sues the original owner or they have other financial liabilities.

Also Check: Are Real Estate Taxes The Same As Property Taxes

Illinois Estate Tax And Gift Tax Explained

In order understand how we use irrevocable trusts to minimize estate tax, letâs first explain how estate tax works and how it interacts with gift tax. Estate tax is taxed both on the federal and the state level in Illinois. It is a tax on the value of a deceased personâs estate over and above that individualâs remaining lifetime gift and estate tax exclusion limit. The lifetime gift and estate tax exclusion limit for Illinois estate tax is $4 million as of the writing of this article. The federal estate tax lifetime exclusion limit is about $11.4 million. For more on estate tax generally, check out our article: How to Avoid Estate Tax.

Now letâs discuss how lifetime gifts impact your lifetime estate tax and gift tax exclusion limit. You can give up to $15,000.00 annually to a particular individual without any gift or estate tax ramifications. Gifts above this annual threshold reduce your lifetime exclusion limit for both estate and gift tax–it is a unified limit. If this limit is used up during your lifetime, then any further gifts above the annual exclusion amount will be subject to gift tax.

The idea is that the government does not want people to simply give away their assets during their lifetime to avoid estate tax. The government wants large amounts of assets that are transferred from your estate, whether during or after your lifetime, to be subject to either gift tax or estate tax. But there is a workaround: Irrevocable Trusts.

Contact Us To Discuss How We Can Help You Experience The Full Possibility Of Your Wealth

Please tell us about yourself, and our team will contact you.

Your Recent History

Important Information

This material is for informational purposes only, and may inform you of certain products and services offered by private banking businesses of JPMorgan Chase & Co. . Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations.

Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at for assistance. Please read all Important Information.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

IMPORTANT INFORMATION ABOUT YOUR INVESTMENTS AND POTENTIAL CONFLICTS OF INTEREST

LEGAL ENTITY, BRAND & REGULATORY INFORMATION

Also Check: Is Auto Insurance Tax Deductible

How Much Tax Will Be Payable On The Sale Of A House Held In Trust

If the house is held in trust, the amount of tax that will be payable on the sale will depend on the terms of the trust. If the trust is a charitable trust, the tax will be payable on the sale of the house will be exempt from tax. If the trust is a non-charitable trust, the tax will be payable on the sale of the house will be at the rate of 20%.

My father transferred his 50% interest in the home he shared with his wife to a trust, which my mother referred to as a successor. Because we are selling the house, the trust will receive less than half of its fair market value. Can a trust claim a capital loss since the trust did not use the house as a residence? We do not know for certain whether or not this property falls under the investment category. A knowledgeable estate and tax attorney may be able to make the case. If you own a trust or other assets, you might want to find out if a tax code provision is available to you in order to sell the trust.

Case Study: Trust Distribution Strategy

In this example, a widower with his own assets is also the beneficiary of several trusts that were funded upon the death of his spouse. Taken together, the accounts hold $25 million in investable assetsto which the widower has varying levels of access:

Withdrawal strategy:Minimize taxes

To minimize future transfer and income taxes to the extent possible, the widower worked with his advisors to implement a strategy for his spending, investing and gifting:

We can help

We understand that trusts can be complex, with many considerations to take into account. Your J.P. Morgan team, along with our Wealth Advisors, Wealth Strategists and Trust Officers, can work with you and your tax advisors to create a distribution strategy that both meets both your day-to-day spending needs and your longer-term estate plans.

1For the purposes of this discussion, we assume that the trust, grantor and beneficiaries are all U.S. entities or individuals. The outcomes may vary for foreign trusts, grantors and/or beneficiaries.

2The GST exemption is the same amount as the U.S. estate and gift tax exclusion: currently, $12.06 million and twice that for couples. However, these amounts are scheduled to be cut roughly in half when the current legislation expires at the end of 2025, unless Congress acts otherwise. In 2022, the GST tax rate is 40%.

4The GST Non-Exempt Trust is subject to the GST when distributed to a grandchild or more remote descendant.

Read Also: Highest Sales Tax By State

Who Owns Property In An Irrevocable Trust

Asked by: Seth Mills

Irrevocable trust: The purpose of the trust is outlined by an attorney in the trust document. Once established, an irrevocable trust usually cannot be changed. As soon as assets are transferred in, the trust becomes the asset owner. Grantor: This individual transfers ownership of property to the trust.

Selling A House In A Trust After Death

Before the grantors passing, the house is in a trust that becomes irrevocable or in a trust that becomes irrevocable at the grantors death. At the moment, the trustees are in charge of distributing the trusts assets to the named beneficiaries.

When looking to sell a home through a trust, there are some steps that can be taken that may be difficult to follow. It is not enough to simply find a buyer and sign over the deed. The sale must go smoothly if the steps need to be taken. The deed must be signed by the buyers Trustee. Once the sale price has been agreed upon, the buyer must pay it. When an irrevocable trust is in place, the grantor does not have the authority to change the trust agreement without the beneficiaries consent. A trust houses value can be significant, so you must ensure that the transaction is handled properly. If you require assistance in completing a trust or estate case, an experienced trust or estate litigation attorney can assist you. You can have a free consultation with Bochnewich Law Offices right away.

Read Also: Tax Id Numbers For Businesses

Q: Will I Owe Federal Gift Taxes On Property Contributed To A Trust

A: The creation of a trust, or the contributing of property to a trust may or may not have gift tax implications, which would require the filing of Form 709, Gift Tax Return. For gift tax purposes, a gift is complete to the extent the donor has irrevocably parted with dominion and control over all or part of the transferred property, whether directly or indirectly, leaving the donor without the power to change its disposition, whether for the benefit of the donor or for the benefit of others. Where a grantor trust has been established, generally no gift tax would be due on property contributed. In situations where an Inter Vivos irrevocable trust is the recipient of property contributed, a gift tax return would generally be due. Testamentary trusts would be subject to estate and gift tax rules/filing requirements.

Irrevocable Trust Capital Gains Exclusion

An irrevocable trust is a type of trust that cannot be changed or terminated by the settlor. This type of trust is often used for asset protection or to minimize estate taxes. One of the benefits of an irrevocable trust is that it can help to avoid capital gains taxes. When assets are transferred into an irrevocable trust, they are no longer considered to be part of the settlors estate. This means that any capital gains on the assets will not be subject to estate taxes.

Long term care is becoming a concern for people as they age. Many parents are hesitant to transfer such assets directly to their children or other family members due to the fear of relinquishing control over them. Individuals have significant control over their assets when they create an income-only trust. As you can see, the husband and wife are trustees of their primary residence in this example. In addition, as trustees, they would retain a significant amount of control over the assets transferred to the trust. The children are better able to gain independence and control during their lives when they are given a say in the decisions that affect their lives. They decided to transfer their home to a nominee trust, with the beneficiary schedule being the income-only trust established by the nominee trust.

You May Like: Property Taxes In Austin Texas

Q: May A Trust Deduct Contributions To A Charity

A: A simple trust cannot. A complex trust may, but the deduction must meet rules similar to those for deductions by individuals and be explicitly allowed in the trust instrument. Trusts that claim a charitable deduction generally must also file Form 1041-A, U.S. Information Return for Trust Accumulation of Charitable Amounts. In a grantor trust, the deduction would be attributable to the grantor and be governed by IRC Section 170, charitable deduction rules.

Alternatives To An Irrevocable Trust

Other trusts are also will substitutes. If your house is putinto a revocable trust, the home transfer avoids the time and cost of probate,and your beneficiaries have immediate access to the house. There are severalother strategies to avert probate, including looking at your titlevesting options.

Or you might consider:

- A Revocable Trust. Create a revocable trustto pass a home to non-spouse beneficiaries, and you can take that asset back ifnecessary. Revocable trusts ultimately bypass probate yet stay within theowners control, in the owners estate, and under the owners social securitynumber throughout life. They can hold assets for a child or children, anddistribute their value in increments, as young adults reach the specified ages.

- A Life Estate. As a life tenant,an owner can live at home for life, then pass a beneficiary the remainder interestin the property. By passing from one resident owner to the next in the form ofa remainder, the home circumvents probate. The title has both names on it, butonly one has the right to live in it at a time.

- An Enhanced Life Estate Deed. Some statesallow enhanced lifeestate deeds, also called lady bird deeds. These arerevocable. They enable their life tenants to sell or take loans out on theproperty if they so choose, change the remainder beneficiary, or take back theinterest.

Recommended Reading: States With No Tax On Retirement Income

Do Irrevocable Trusts Qualify For The $250000 Exemption

One of the major benefits of home ownership is the ability to avoid the first $250,000 in capital gains profit when selling your home. For married couples filing jointly, the exemption is $500,000. To qualify, the home must be your primary residence for two of the last five years.

But what happens when you transfer your home to an irrevocable trust? Who pays the capital gains tax on the sale of a home in an irrevocable trust? Because the irrevocable trust is not a natural person, it is typically not allowed to use the $250,000 exemption. So, while this trust provides legal and financial protection, you lose out on tax benefits. Youll have to decide which is more important to you.

The Irrevocable Trust Differs From A Living Trust

Trusts can hold assets, including houses, for chosenbeneficiaries. The trustee is the party who handles the trusts expenses,who hires an accountant to files its taxes , and who servesas a dependable steward on behalf of the beneficiary.

The trustee can be a competent adult or a corporation. Thereare lawyers and professional services available to manage trusts.

As a homeowner, you could be the trustee for your own livingtrust, also called a revocable trust. The revocable trustremains under your control and your personal tax ID, and you can take the houseout of it or change the beneficiary as you see fit. You may end the trust, removethe house from the trust, or change your designated beneficiaries.

But once the house title is conveyed to the irrevocabletrust, youve given it up to the trust, which will own it throughout your life.You cannot change the beneficiary from, say, your child to a charity. Youcannot modify the terms, such as the timing in the agreement for your child toreceive the assets. And you may not, of course, revoke this kind of trust.

Selling the house during or after the trust creators life is not the trust creators role but rather the trustees job to initiate, ifthe homes title is not ultimately conveyed to the beneficiaries. The trusteecan hire a real estate agent. Most do, as hiring a professional will assure thebeneficiaries that the transaction was professionally handled.

Recommended Reading: Irs Address To Mail Tax Returns

The Tax Implications Of Passing On Gains Through A Trust

Beneficiaries can pass assets along to another party without having to pay taxes on the gains through trusts. The trust distributions, on the other hand, are subject to capital gains taxation, so its critical to be aware of these consequences. In most cases, the beneficiary must pay taxes on the gains, lowering the amount of money they can receive. Allowing gains to be passed through a trust can be a wise way to reduce your tax liability, but you should know the tax implications before doing so.

The Good: The Only Benefits Irrevocable Trusts Offer

1. Minimizing the Burden of Estate Taxes: Wealthy people who are willing to gift money every year can use these funds to purchase life insurance in an irrevocable life insurance trust that may help them avoid paying estate taxes when they die. Another is a grantor retained annuity trust, which gives the creator a set income stream for several years and may allow some of the principal to go to family members estate tax free. They may also create a charitable remainder unitrust, which pays income to family now and leaves the remaining trust funds to a charity at their death. Only in rare instances may the trustee and the beneficiary be the same person in estate tax savings trusts, and you must at a minimum have a disinterested party serving as a co-trustee who has the power to overrule your directions.

2. Helping Those with Disabilities Qualify for Government Benefits: Disabled beneficiaries on Medicaid and Supplemental Security Income have stringent income and asset limitations if they own or receive too much money they can lose these government benefits. Irrevocable trusts can shelter income and assets, so these limits are not exceeded. The trustee of these Medicaid trusts can never be the creator. Just like estate tax savings trusts, the beneficiary has been divested of substantial control over the trust, so the government benefits continue to be provided, because the trust funds are not included as the beneficiarys own assets and income.

Recommended Reading: What If I Already Paid Taxes On Unemployment

What Happens When You Sell A House In An Irrevocable Trust

Capital gains are not income to irrevocable trusts. They’re contributions to corpus the initial assets that funded the trust. Therefore, if your simple irrevocable trust sells a home you transferred into it, the capital gains would not be distributed and the trust would have to pay taxes on the profit.