Why Else Would I Owe Taxes This Year Heres What To Look For

If youre wondering, why else would I owe taxes this year? The first question you should ask yourself is what other changes were there in my tax situation?

It could be one big change or several changes that made an impact:

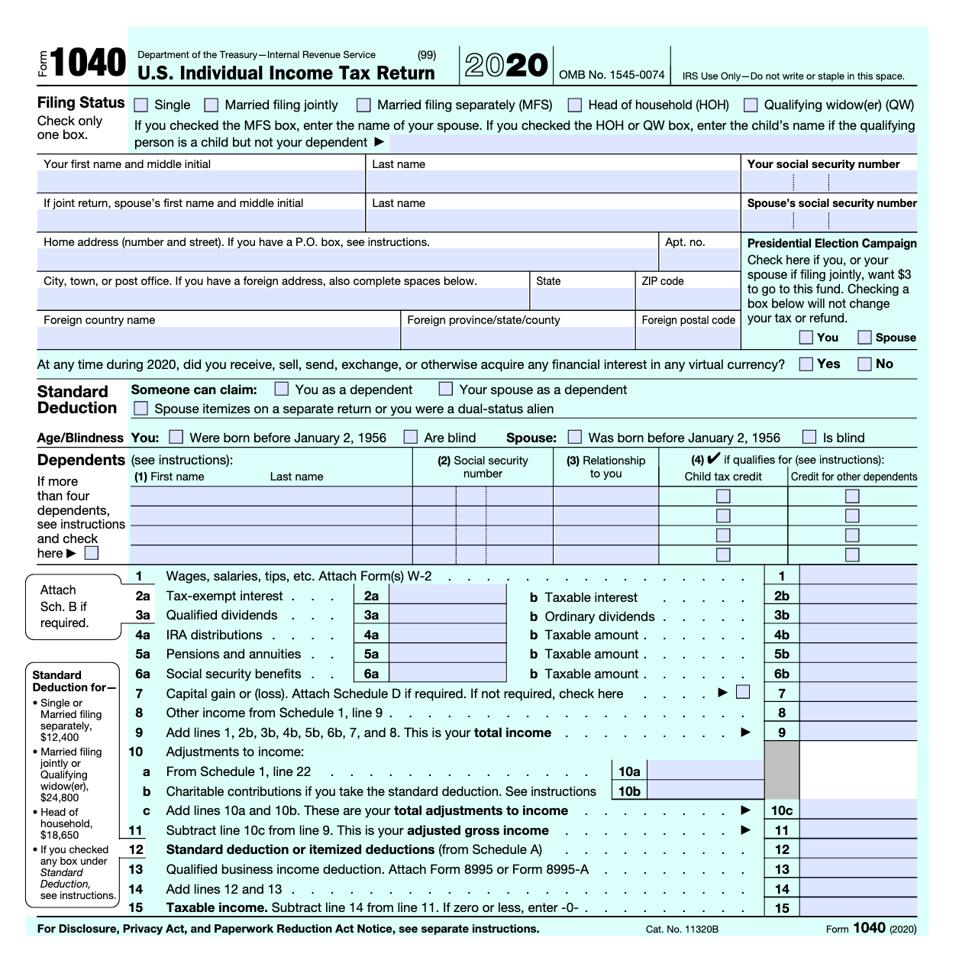

- Filing changes But big life changes, such as marriage, divorce, retirement or adding a dependent can affect the your tax situation such as the filing status for which you are eligible and other aspects of how you are taxed. For example, changing from Head of Household to Single will affect your tax bracket and the credits and deductions you can take. If youre married, be sure you understand the difference between the status of .

- Older children To claim the Child Tax Credit, your child must have been under age 18 at the end of the year. If they no longer qualify, you no longer can get the Credit. This significant drop can mean a great deal to your bottom line and may answer the question of why do I owe taxes?

- Other changes in your life can impact your eligibility for various types of credits and deductions. For example, changes in your income might affect whether you qualify for the Earned Income Credit. Or, if youre a college student, maybe you were previously able to claim the American Opportunity Credit, but due to an enrollment status change are no longer eligible.

We Have Made It Easier For You

We continue to make it easier for you to comply. Starting July 2022, we will be assessing a significant number of taxpayers automatically.

We auto-assess based on the data we receive from employers, financial institutions, medical schemes, retirement annuity fund administrators and other 3rd party data providers. If you have not yet received your IRP5/IT3s and other tax certificates like medical certificate, retirement annuity fund certificate and other 3rd party data that are relevant in determining your tax obligations, you should immediately approach your employer or medical scheme or retirement annuity fund or other 3rd party data providers to make sure that they have complied with their submission requirements.

If You Have Overpaid Tax

You may have overpaid tax if you become unemployed or are out of work sick.Find out more about claiming a taxrefund if you are unemployed or out of work sick.

You may also have overpaid tax if your tax credits are incorrect or youhavent claimed tax relief for certain expenses. Find out more about the taxcredits and reliefs you may be entitled to claim.

Read Also: Tax Burden By State 2022

Why Do I Owe If I Didnt Owe Last Year

If you owe taxes that you didnt owe last year, it may be due to some changes in your life, such as:

Older Children A change that was made in the tax reform was the Child Tax Credit increase. It is $2,000 for children who qualify. Nevertheless, only children who were less than 17 years old at the end of the year will be able to claim the credit. Otherwise, you can only claim a $500 credit for the other dependents.

Job Changes Has there been any job change for you or your spouse? If so, a new Form W-4 should have been completed. If you made some changes in how you filed it, it may be why it affected your situation.

Side Job If you are a contract worker or freelancer, then you will have to pay quarterly taxes too. You will be responsible for keeping up with payments since you have no paycheck withholding. You may owe taxes to the IRS if you are a freelancer and you havent been paying the estimated quarterly taxes.

Income changes or students who were previously able to claim the American Opportunity Credit, yet became ineligible due to an enrollment status change may also affect the tax situation.

Filling Changes If you went through a divorce, marriage or you got a dependent, the filing status for which you are eligible and the way youre taxed can change. This might affect your tax bracket thats why you might owe taxes now.

Making More Of The Income Of The Wealthiest Taxable

Policymakers can change the tax code in several ways to treat some or all of the unrealized capital gains of the wealthiest households as taxable income. One is to make the gains taxable each year, as Senate Finance Committee Chairman Ron Wyden and others have proposed by shifting to a so-called mark-to-market system for taxing capital gains.

President Biden proposes a more modest approach. He would leave deferral in place so that, each year, wealthy people with large unrealized capital gains would continue to pay no tax on the increase in their wealth while they are alive. Instead, Biden would require that the wealthiest people pay income taxes on this untaxed income from unrealized capital gains when they die. Specifically, his proposal would eliminate stepped-up basis at death for unrealized capital gains of more than $1 million for an individual or $2 million for a married couple .

By letting wealthy people avoid paying tax on their unrealized gains during their lifetime, the Biden proposal to tax these gains at death would still result in a lower effective tax rate than if the gains were taxed each year, just as wage earnings are taxed each year. The conservative Tax Foundation has noted the benefit of deferral to wealthy households, explaining in 2019 that deferral matters a great deal. This is because deferral allows a taxpayer to delay paying tax for years even while the asset appreciates and earns income.

Also Check: How To Not Owe Taxes

Should I Claim 1 For Myself

If you prefer to receive your money with every paycheck rather than waiting until a specific time every year, claiming 1 on your taxes could be your best option. Claiming 1 reduces the amount of taxes that are withheld, which means you will get more money each paycheck instead of waiting until your tax refund.

Why Do Allowances Matter For Taxes

Firstly, allowances directly affect the amount of tax to be withheld from your paycheck. Unlike your belief that there will be no tax payable at the end of the year, you might end up with a tax bill instead of a big refund once your tax return is processed.

If youre claiming zero allowances, it will increase the amount of tax withheld and decrease the income youre taking home. At the end of the year, youre entitled to a refund from the government.

However, if youre claiming too many allowances, your withheld tax becomes very low, and you will have to pay the tax bill and a penalty for underpaying your withholding tax.

What is the conclusion?

Claiming no allowances at all or claiming too many allowances can hurt your tax return and income. Therefore, its important to understand how to claim allowances when filling out your Form W-4.

Read Also: Travel Trailer Tax Deduction 2021

That Money Could Also Be Used For Financial Emergencies Or Paying Down Debt

The money also isn’t there for you if you really need it. If you have a financial emergency, those funds could potentially have been used to cover your costs. Unfortunately, the IRS won’t send you back the money you prepaid early just because you need it. As a result, you could be forced to put expenses on a to cover the emergency.

If you have debt you’re paying off, sending in extra money to the IRS also means you won’t have that cash to make extra payments on your debt during the year. Even if you use the lump sum tax refund you get to pay down your balance, you’ll have missed out on the chance to save on interest since you’ll have been making higher monthly payments the whole time.

There’s little reason to incur the opportunity costs associated with overpaying your tax bill especially when it’s easy to adjust your withholding with your employer to avoid having too much taken out. The best tax software can help you figure out what you’ll owe and how much to have withheld.

TAXES 2022: How to use your refund to get yourself on firmer financial ground

Refigure Your Tax Liability

Okay, so heres the math part. You need to calculate your tax withholding. This is kind of a two-step process. First, find out how much federal taxes are withheld from your paycheckjust income tax. Ignore Social Security and Medicare taxes. You can find this info on your W-2 or on a paystub. If youre using a tax total from a paystub, youll need to multiply that number by the number of pay periods per year to get your total tax withholding.

For example, lets say youre single and make $50,000 a year. You get paid twice a month , and your income tax withholding is $150 per check. That means your total withholding is $3,600.

Next, youll need to estimate your tax liability, or the amount of taxes youre responsible for paying. The IRS also has an online tax withholding estimator to help you with this. Or, if you just did your taxes and have the forms handy, you can see your tax liability there.

Then, just take your tax liability and subtract your withholding to see how much you underpaid your taxes. Once again, if you just filled out your taxes and wound up owing money to the IRS, you should know that number without having to do any math.

Lets go back to our example. Say your tax liability is $4,300. If you subtract your $3,600 withholding from your $4,300 liability, that means you underpaid your taxes by $700.

Also Check: How To File Taxes Without W2 Or Paystub

Half Of The Child Tax Credit Was Prepaid In 2021

Under the American Rescue Plan of 2021, advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. This was a new thing, and the idea is that instead of receiving a credit back when you file your tax return, parents would receive the money immediately to pay for child care and expenses.

However, the tax credit phases out over certain incomes, so many people who made more income in 2021 would have been ineligible, but they got the check anyway. Now they have to pay the money back that they received in error.

This program has been discontinued, but some who received the payments but were not actually eligible for the full amount of the credit now pay the money back with the filing of their tax return.

Why You Might Get A Tax Calculation Letter

You might get a tax calculation letter if you either owe tax or are owed a refund because you:

- were put on the wrong tax code, for example because HMRC had the wrong information about your income

- finished one job, started a new one and were paid by both in the same month

- started receiving a pension at work

- received Employment and Support Allowance or Jobseekers Allowance

Also Check: How To Get Extension On Taxes 2021

Change In Filing Status

If you were previously married and filing jointly and your spouse did not earn any income, you would need to earn more money by yourself to be in a higher tax bracket. However, if you get divorced and are now filing as single you could earn less money but still be in a higher tax bracket causing you to owe the IRS money.

Alternatively, you may have had a dependent child last year but now your child is 18 and no longer considered a dependent child. This too could cause you to lose a child tax credit, increasing your tax liability.

IRS Publication 505 lists additional reasons why your withholding may be insufficient due to a change in your circumstances.

Many Earned New Or Higher Self

Many people have reassessed their life choices as a result of the Covid crisis. The wave of Americans changing jobs and careers over the last couple of years has been referred to as the Great Resignation, the Great Reshuffle, the Big Quit and the Covid Pivot.

This has led many to start a business that they have dreamed of and change their work life. What many did not realize was that as a W-2 employee, your income taxes are generally withheld throughout the year, and employment tax is paid by your employer. As an independent contractor or self-employed business owner, you need to make those tax payments yourself, and you may be subject to self-employment tax which you may not have been responsible for in the past.

If this applies to you, this could be another reason you may have had a higher tax bill this year.

Read Also: Montgomery County Texas Tax Office

How Will I Know Why I Owe Taxes

The easiest way to keep track of your tax refund or bill and see the itemized reasons why your tax refund might have gone up or down is through a financial professional or service company.

This service could either be offered through an online filing system or with an in-person chat with a tax professional who can go through your taxes with you.

Income Tax Brackets Are Also Higher In 2022

For 2022, income tax brackets were also raised to account for inflation. Your income bracket refers to how much tax you owe based on your adjusted gross income, which is the money you make before taxes are taken out, excluding itemized exemptions and tax deductions.

While the changes were slight, if you were at the bottom of a higher tax bracket in 2021, you may have bumped down to a lower rate for your 2022 tax return.

Read Also: How Long Does Taxes Take To Process

Do You Have To Pay The Child Tax Credit Back In 2022

Important: If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return, you may have to repay the excess amount on your 2021 tax return during the 2022 tax filing season unless you qualify for repayment protection.

Key Takeaways On Owing State Taxes

As long as you hit that threshold at which the state levies taxes, theres little you can do except pay whats due. Concealing income or willfully defaulting on these liabilities is a recipe for disaster. The tax authorities have a lot of data at their disposal to figure out if they are being taken for a ride.

Its understandable why a lot of people are confused about owing state tax. They feel that their tax liabilities are all taken care of once they have paid federal income taxes and business taxes. Taxation is a complex field that can be difficult to understand because of all the different factors in play.

As responsible citizens, it remains our responsibility to ensure that we comply with all of our tax liabilities, whether federal or state. As long as you keep doing that, youll have little reason to be concerned about the tax authorities making your life difficult.

Also Check: When Do I Have To File Taxes 2021

Capital Gains Were Unusually Large In 2021

In 2021, the market hit record highs. This doesnt apply to retirement accounts, but if you sold investments in a taxable brokerage account either to rebalance or to buy property, you potentially incurred a taxable capital gain on the sale for which tax was not withheld. This would have appeared on your 1099 from your investment account.

Many mutual funds also had large capital gains distributions in 2021. Those distributions are often re-invested in the fund and remain in the account, but are still taxable. This is an area of confusion for many investors because money never leaves the account, and doesnt leave the fund, but capital gains are taxed.

This issue made the news in recent months and maybe one more reason you owe money on your taxes this year.

Refigure Your Tax Liability And Withholding As Needed

Making sure youre having enough tax withheld or paid in estimated taxes is never a finished task.

Whenever your situation changes you get married or divorced, you take on a freelance project, for example recalculate your income if necessary and go through the Form W-4 section under the Next Year main tab in TaxAct again.

Its a little more work than just paying too much or hoping for the best, but it pays off by giving you a lot more peace of mind about your standing with the IRS.

Read Also: Va State Tax Refund Status

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.