Wisconsin’s Sales Tax By The Numbers:

Wisconsin has alower-than-average sales tax, includingwhen local sales taxes from Wisconsin’s 99 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

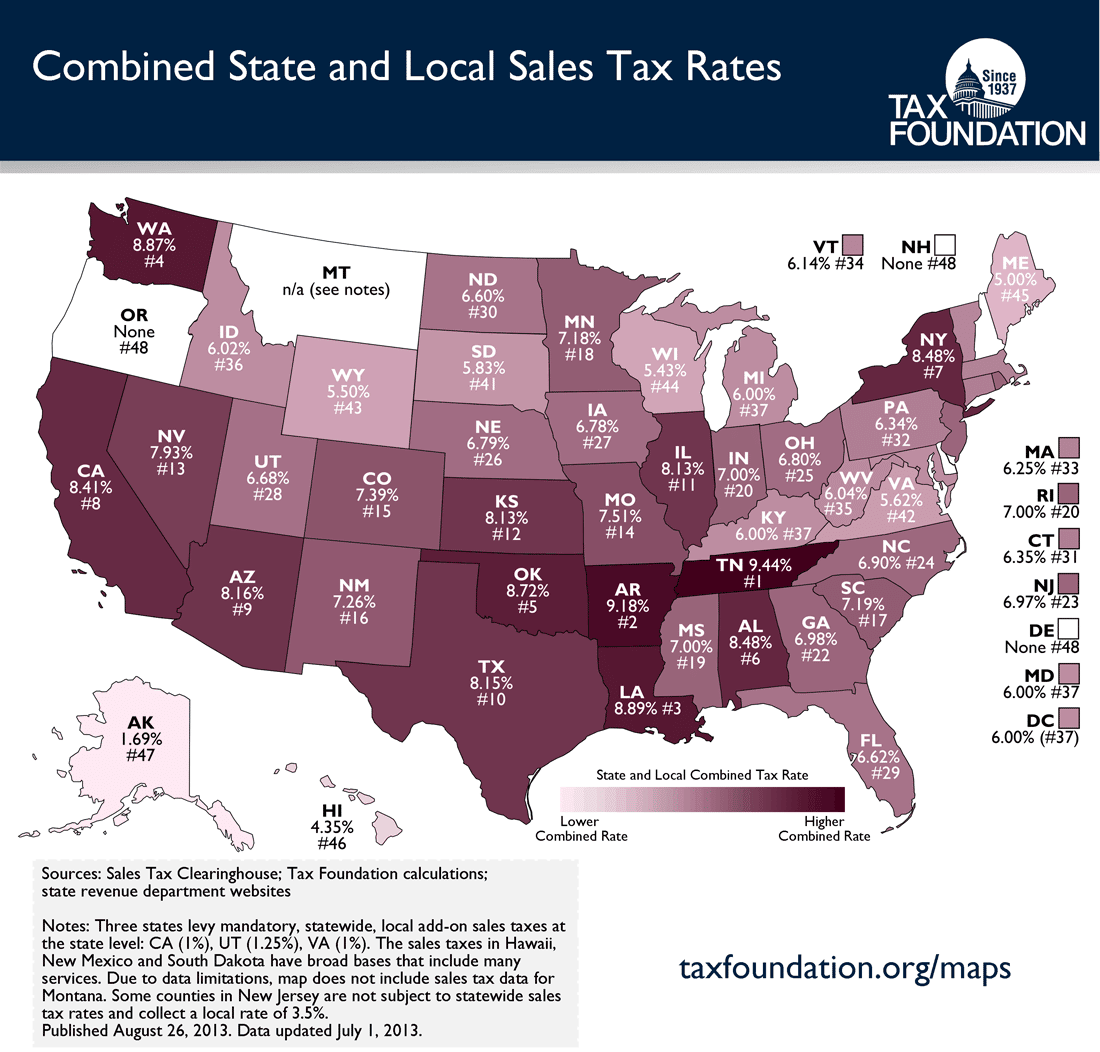

Ranked 42nd highest by combined state + local sales tax

Ranked 32nd highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 12th highest by state sales tax rate

Ranked 27th highest by per capita revenue from the statewide sales tax

Wisconsin has a statewide sales tax rate of 5%, which has been in place since 1961.

Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from 0% to 1.75% across the state, with an average local tax of 0.481% .The maximum local tax rate allowed by Wisconsin law is 0.6%.You can lookup Wisconsin city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Wisconsin. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Wisconsin Sales Tax Handbook’s Table of Contents above.

Wisconsin Sales And Use Tax Exemption Certificate

A sales tax exemption certificate can be used by businesses who are making purchases that are exempt from the Wisconsin sales tax. You can download a PDF of the Wisconsin Sales and Use Tax Exemption Certificate on this page. For other Wisconsin sales tax exemption certificates, go here.

Buyers who holds this certificate claims that they are exempt from paying sales tax on items that they purchase from a seller. Sellers should keep a record of this certificate to prove tax- exempt status.

Sourcing Sales Tax In Wisconsin: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale .

Wisconsin is a destination-based state. This means youre responsible for applying the sales tax rate determined by the ship-to address on all taxable sales.

Recommended Reading: Federal Tax Credit Heat Pump

Sales And Use Tax For Sales Of Goods And Services

Wisconsins sales tax rate of 5 percent is the same as the use tax rate. Business taxpayers must pay the use tax if they purchase taxable tangible personal property and do not resell it but instead use it or store it.

Individuals must also pay the use tax if they purchase taxable goods and do not pay the tax on them. This is a common occurrence if a person buys something from a marketplace seller or another online store that does not meet the physical or financial nexus for taxable retail sales in Wisconsin.

Dry Cleaning Facility License Fee

Dry cleaners must pay a license fee of 2.8 percent of their gross receipts from the previous three months. The fee only applies to dry cleaning apparel and household fabrics, not formal wear that the dry cleaning facility rents to the general public.

Dry cleaners also have to pay a dry cleaning products fee of $5 per gallon of perchloroethylene sold and $0.75 per gallon for any dry cleaning product sold that is not perchloroethylene.

Don’t Miss: Who Does Taxes For Free

Discretionary Sales Tax Rates

Sixty-eight Wisconsin counties elected to adopt a 0.5-percent county tax that applies to retail sales, leases, licenses, and rentals of tangible personal property. The tax is in addition to the state tax.

The counties subject to the 0.5-percent tax are listed by the Wisconsin Department of Revenue and include

Examples Of Purchases Subject To Use Tax

Read Also: Filing Taxes As An Llc

Franchise And Income Tax

Wisconsin has a franchise tax and an income tax it imposes on businesses. A business pays one or the other not both. At the state level, the tax provisions are almost the same. It is at the federal level that the tax is different.

The franchise tax of 7.9 percent applies to domestic corporations that have nonexempt income and businesses not organized under Wisconsin law .

The only exception to the franchise tax, other than paying income tax, is where taxation is exempted by statute or barred by federal law.

The income tax is also 7.9 percent levied on foreign corporations that are not subject to the franchise tax and own property in Wisconsin. The income tax also applies to businesses that have exclusively foreign or interstate commerce.

What Is Exempt From Sales Taxes In Wisconsin

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how Wisconsin taxes five types of commonly-exempted goods:

Clothing

OTC Drugs

For more details on what types of goods are specifically exempt from the Wisconsin sales tax see Wisconsin sales tax exemptions. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in Wisconsin? Taxation of vehicle purchases in particular are discussed in the page about Wisconsin’s sales tax on cars.

Read Also: Tax Credits For Electric Vehicles

Obtaining A Permit Requirements

Retailers that sell taxable tangible personal property, services, and products in or into Iowa must obtain a sales and use tax permit. Learn more about permit requirements and whether you need to collect sales or use tax. Businesses that make taxable purchases without paying sales tax may also need to obtain a sales and use tax permit to remit use tax on those taxable purchases.

If a person makes retail sales from more than one location, each location from which taxable sales of tangible personal property, specified digital products, or services will occur shall be required to hold a permit.

To obtain a permit, apply through the Department’s Business Registration System.

Season Filers, Temporary Businesses, and Event Sponsors

The Department does not issue temporary tax permits. A permanent tax permit allows you to conduct taxable sales or perform taxable services in Iowa at any time during the year. You may request to be a seasonal return filer if you only make sales in Iowa for 4 or less months each year. Contact the Department to register as a seasonal filer.

Direct Pay Permit

Some qualified purchasers, users, and consumers of tangible personal property or taxable services may remit the tax directly to the Department rather than to their suppliers. Learn more about Direct Pay Permits.

Not sure whether you need a permit? Call Taxpayer Services at 800-367-3388 or 515-281-3114.

Misplacing A Sales Tax Exemption/resale Certificate

Wisconsin sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Wisconsin Department of Revenue may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Recommended Reading: Federal Small Business Tax Rate

Updating Wisconsin Certificate Of Exemption Status Number

As a result of a change in Wisconsin Law , the Wisconsin Department of Revenue has reviewed all Certificate of Exempt Status numbers issued in the past and has issued a new 15-digit CES number beginning with 008 to qualifying organizations.

- Retailers: May accept a 6-digit or 15-digit CES numbers from organizations making purchases exempt from Wisconsin sales and use tax through June 30, 2022. Beginning July 1, 2022, only the 15-digit number is acceptable.

- Organizations with a CES number:May use a 15-digit or 6-digit CES number until June 30, 2022. Beginning July 1, 2022, only the 15-digit CES number is valid.

- Effective , all organizations making purchases from the University of Wisconsin that qualify to make purchases exempt from Wisconsin Sales and Use Tax must provide the University of Wisconsin a new CES with the new 15-digit CES number required by Wisconsin Law.

- If the University of Wisconsin does not receive a new CES with the 15-digit CES prior to any purchase, applicable Wisconsin Sales and Use Tax will be withheld and remitted to the Wisconsin Department of Revenue, without exception. After applicable Sales and Use Tax is submitted to the Wisconsin Department of Revenue, the University of Wisconsin cannot refund the Sales and Use Tax, but the purchaser must contact the Wisconsin Department of Revenue for any applicable refunds.

Wisconsin Sales Tax Software

If you operate within the State of Wisconsin or if you believe you have sales tax nexus within the State, there are a number of factors to keep in mind when collecting sales tax here. To help streamline this process, TaxTools offers a range of features such as data review and sorting. The TaxTools sales tax software solution is a good fit for those with e-commerce websites or other online or out-of-state businesses that want to streamline their sales tax collection in a single interface. Contact us today to learn more or to signup for a free trial.

Don’t Miss: California Llc First Year Tax Exemption

Taxable And Exempt Shipping Charges

Wisconsin sales tax may apply to charges for shipping, handling, delivery, freight, and postage. Generally, if the sale is taxable, these charges are taxable if the sale is tax-exempt, the shipping and handling charges are most likely exempt as well.

If a shipment includes both taxable and exempt property, tax applies to the percentage of the delivery charge allocated to the taxable property if no allocation is made, the entire shipment is taxable. Separately stated charges for direct mail are generally exempt.

There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in Wisconsin and sales tax should be taken directly to a tax professional familiar with Wisconsin tax laws.

Determining Sales Tax Nexus In Wisconsin

Before proceeding, if you are located outside the State of Wisconsin, you must determine if you have sales tax nexus in the State. Nexus is how the state determines if you have physical presence sufficient to require you to collect and pay sales and use tax. For those who operate solely within the state, this is easy you have sales tax nexus because this is where you operate.

For merchants located outside of Wisconsin, you will need to consider the following, any of which may mean you have nexus in the state:

- Any goods or inventory located in a warehouse within the state

- A physical location or office in Wisconsin

- An employee who is physically present in the state

- Any property you own either as a business or individual in the state

Wisconsin provides a detailed description of what constitutes nexus in the state on their website here.

For those that sell their goods through Amazon FBA, there is a single fulfillment center in Wisconsin, located in Kenosha. If your goods are housed in this warehouse, you may have nexus and will be subject to the 5.5% sales tax that applies in Kenosha County.

Wisconsin enacted an economic nexus law following the Supreme Courts ruling in 2018. They revised it starting in February 2021, removing the 200 transaction threshold for remote sellers. This means only remote sellers that sell $100,000 or more in gross sales in the previous 12 month period are required to collect and remit sales tax in Wisconsin.

You May Like: Federal Tax Married Filing Jointly

Paying Tax To Another State

If possession of tangible personal property or a specified digital product is taken in another state and sales tax has already been paid to the other state, no additional tax is due if the tax paid is the same or more than Iowa’s state rate. If the tax is less, the purchaser owes Iowa the difference. It is the purchasers responsibility to show where delivery took place and that the appropriate sales tax has been paid.

Avoid Costly Audits And Penalties And Understand The Law And Proper Recordkeeping

Sales and use tax laws are confusing and constantly evolving to adapt to an ever-changing market. Businesses often struggle to keep up with and take advantage of new applications and developments. This topic is intended to best position businesses to understand when and where they are subject to Wisconsin’s sales tax jurisdiction, what transactions are taxable, and what possible exemptions might apply. You will be able to identify areas of potential risk, and should the business be subject to an audit, this information will familiarize you with the process and best practices of defending against an audit.

Live Webinar – November 29, 2022

Corporate Tax Updates for 2023

Live Webinar – January 5, 2023

Understanding IRS Form 1099-NEC and Form 1099-MISC

Recommended Reading: Deadline For Filing 2020 Taxes

Wisconsin Sales Tax Rates

The following sales and use tax rates apply in Wisconsin at the state and local level:

- The state sales tax rate in Wisconsin is 5.0%.

- There is an additional sales tax of between 0.10% and 1.75% depending on where tax is being collected in the state for a maximum rate of 6.75% in certain cities.

The sales tax rates will depend on where you are located and what type of transaction is being completed.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Wisconsin sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Read Also: Irs Address To Mail Tax Returns

Wisconsin Sales Tax Exemptions

What is Exempt From Sales Tax In Wisconsin?

The state of Wisconsin levies a 5% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions can impose additional sales taxes of 0.6%. The range of total sales tax rates within the state of Wisconsin is between 5% and 5.6%.

Use tax is also collected on the consumption, use or storage of goods in Wisconsin if sales tax was not paid on the purchase of the goods. The use tax rate is the same as the sales tax rate. Returns are to be filed on or before the 20th day of the month following the month in which the purchases were made. For example, purchases made in the month of January should be reported to the state of Wisconsin on or before the 20th day of February. For more information on Wisconsin sales tax exemptions please visit the sites shown below.

How Often Should You File

- Annual filing: If your business collects less than $900.00 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing: If your business collects between $900.01 and $7200.00 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $7200.00 in sales tax per month then your business should file returns on a monthly basis.

Note: Wisconsin requires you to file a sales tax return even if you have no sales tax to report.

Also Check: Loudoun County Personal Property Taxes

File Your Sales Tax Return

Now that youve registered for your Wisconsin seller’s permit and know how to charge the right amount of sales tax to all of your customers, you are all set to file your sales tax return. Just be sure to keep up with all filing deadlines to avoid penalties and fines.

Recommended: Accounting software can help simplify your business tax returns as well as help with payroll and bookkeeping. Try our recommended accounting software today to save thousands of dollars on your taxes.

Sales Tax Payment And Filing Date:

Information provided with registration is base on the remote sellers filing frequency . The department will be notified remote sellers about the frequency of filing tax returns based on the annual amount of their taxable sales.

Tax returns filed via My Tax Account or Telefile and payments made by ACH Debit must be received by 16 oclock.

Annual and quarterly returns must be filed by the last day of the month following the end of the reporting period.Monthly sales tax returns are required to file by the 20th of the month following the end of the reporting period.

When the regular due date falls on a day off, the due date is extended to the business day immediately following the weekend or legal holiday.

Recommended Reading: How To Check On Status Of Tax Refund