What Taxes Do 1099 Workers Have To Pay

Your taxes will consist of income taxes, and Social Security and Medicare taxes .

The vast majority of 1099 workers are sole proprietors. A sole proprietorship is a one-owner business. The business owner personally owns all of the assets of the business and controls its operation. If you’re running a one-person business and haven’t incorporated or formed a limited liability company, you’re automatically a sole proprietor.

When you’re a sole proprietor, you and your business are one and the same for tax purposes. Businesses that are sole proprietorships don’t pay taxes or file tax returns directly. Instead, you must report the income you earn or losses you incur on your own personal tax return, IRS Form 1040, which is due each year by April 15. If you earn a profit, the money is added to any other income you have.

Who Should Receive A 1099 Form

Form 1099 is used to report certain types of non-employment income to the IRS, such as dividends from a stock or pay you received as an independent contractor.

Businesses must issue 1099s to any payee who receives at least $600 in non-employment income during the year. However, there are exceptions to the $600 threshold rule. For example, a 1099 is typically issued by a financial services provider if a customer earned $10 or more in interest income.

How To File A 1099 Form

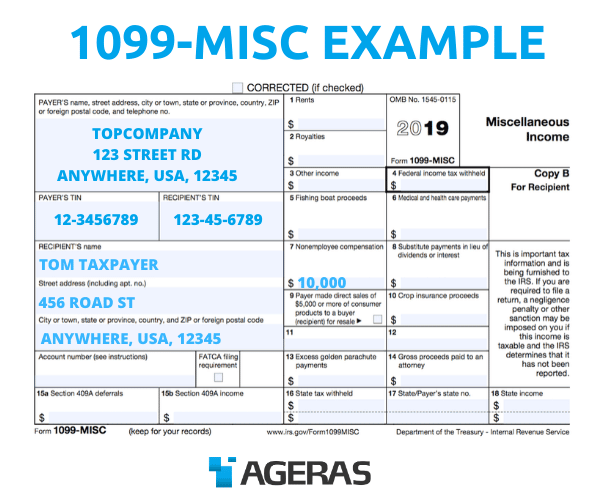

There are two copies of Form 1099: Copy A and Copy B.

If you hire an independent contractor, you must report what you pay them on Copy A, and submit it to the IRS. You must report the same information on Copy B, and send it to the contractor.

If youâre an independent contractor and you receive a Form 1099, Copy B from a client, you do not need to send it to the IRS. You report the income listed on Copy B on your personal income tax return.

Form 1099-NEC, Copy B

Read Also: Can Property Taxes Be Deducted

What Is The Difference Between 1099 And 1040

The difference between 1099 and 1040 forms is that a 1099 form is an information return for income not subject to tax withholding.

This includes income such as interest, dividends, capital gains, and rental income. The 1040 form is the official tax return that taxpayers have to file with the IRS each year to report taxable income and calculate their taxes due.

The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due. Being aware of tax terms as well as both 1040 and 1099 rules is beneficial.

Image: Envato Elements

Gather The Required Information

Before you can complete and submit a 1099, youâll need to have the following information on hand for each independent contractor:

- The total amount you paid them during the tax year

- Their legal name

- Their taxpayer identification number

The standard method for acquiring this information is to have each contractor fill out a Form W-9. As a best practice, you should have a W-9 on file for each of your independent contractors. Having contractors fill out a W-9 should be one of the first administrative tasks you complete after engaging their services.

Check your bookkeeping records to confirm the total amounts you paid to each contractor during the tax year.

Once you have all of the required information, use it to fill out Form 1099-NEC.

Recommended Reading: Is Home Insurance Tax Deductable

Why You Cant Set Your S Corp Salary Too Low

Before you get too excited, letâs make one thing clear: You canât set your personal salary at $1 to avoid paying FICA taxes on the rest of your business income.

Sadly, the IRS saw through that potential loophole immediately. They keep a pretty close eye on S corporations and require that all salaries be âreasonable compensationâ for the work done.

Itâs up to each business to determine what counts as âreasonable,â depending on the nature of your work. But a few factors will include:

- How important the person is to business operations

- How much time is being spent at their job

- âHow much education and experience they bring to the table

In Rasheedaâs case, sheâs the only employee. And without her artistic talents, Purrfect Pet Portraits would have to close up shop. It only makes sense for most of the business profits to go into her pockets.

What Is A 1040 Form How To File And Different Types

Are you an aspiring entrepreneur or business owner looking to ace your taxes? Great news: the Internal Revenue Service makes filing an annual income tax return easier than ever with the 1040 Form.

While it may seem a bit complicated at first, this form is actually quite simple once you understand what goes into it and how to file accordingly.

In this article, well explore everything there is to know about the 1040 Form so that you can effectively fill it out, maximize your tax benefits and get paid!

Don’t Miss: Will Property Taxes Go Up In 2022

Stay On Top Of A New Address

Whether or not the payer has your correct address, the information will be reported to the IRS based on your Social Security number . As a result, it’s important to update your address directly with payers.

Taxpayers don’t include 1099s with their tax returns when they submit them to the IRS, but its a good idea to keep the forms with your tax records in case of an audit.

Does Treasury Still Use The Term Wage Statements To Refer To W

You may find that Treasury staff use the terms “wage statements” and “income record forms” interchangeably. However, wage statements are technically a subset of income record forms. Wage statements refer to Michigan copies of Forms W-2, W-2 C. Income record forms are Michigan copies of Forms W-2, W-2 C, W-2 G, 1099-R, 1099-MISC, and 1099-NEC.

Read Also: Personal Tax Return Due Date 2022

How Do I Respond To A Notice For A Missing Form 1099

If you didnt include your 1099-R on your individual income tax return, youll usually be writing the IRS a check. But you may not owe as much as your notice says.

Since you didnt tell the IRS about your retirement withdrawal, it usually assumes the worse that you made an unqualified early withdrawal and owe the full taxes and penalties.

If you did have a qualified reason for your withdrawal, you can send back an explanation letter to the IRS. Theyll take off any penalties and taxes that you didnt owe and only charge you for what you did owe. In some cases, they may ask for additional documentation first.

What Do I Need To File My 1099

A big part of learning how to file 1099 taxes, is learning what things you will need in order to file them.

Aside from just your 1099 forms and your W-2 forms , you will need to have a few other things to get you through filing taxes.

You need to have ready all of your important documents such as your social security card. You will also want to have any receipts for expenses that are business related.

You will also want to bring along your 1040 tax forms, as well as any other tax forms you have received from any other source of income throughout the year. Like social security benefits, student loans, real estate, etc

If you have all of these required things with you when you go to file your taxes, you will be able to get through it smoothly.

Also Check: How Much Can You Inherit Without Paying Taxes

What Is Magnetic Media Filing And Who Is Required To Use It

Magnetic media is a federal reporting schema developed to communicate W-2 and 1099 data without sending physical form copies. Treasury accepts physical or electronic magnetic media in the formats specified by the Internal Revenue Service’s Publication 1220 or the schema specified by the Social Security Administration’s Specifications for Filing Forms W-2 Electronically . Each of these federal publications are updated annually.

Do I Qualify For A Form 1099

| Tax Year | ||

|---|---|---|

| 2022 | 2023 | More than $20,000 gross sales from goods or services AND more than 200 transactions in the calendar year. |

In the United States, the state where your taxpayer information is associated will determine your qualification for a Form 1099-K. In most states, accounts meeting both of the following criteria qualify for a Form 1099-K and must be reported to the IRS by Square:

More than $20,000 in gross sales from goods or services in the calendar year

AND more than 200 transactions in the calendar year

Square may report, solely within its discretion, on amounts below these thresholds to meet state and other reporting requirements:

Recommended Reading: How Do Trusts Avoid Taxes

If You Dont Receive Your 1099

eServices

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

If you want a copy of your 1099-G

If you want us to send you a paper copy of your 1099-G, or email a copy to you, please wait until the end of January to contact us. You must send us a request by email, mail or fax. After we receive your request, you can expect your copy to arrive within 10 days.

Request a mailed copy of your 1099 via email

Include the following in your email

- Claim ID, also referred to as Claimant ID in letters

- Current mailing address

- Phone number, including area code.

Do not include your Social Security number in an email. Email may not be secure. Instead, you should use your Customer Identification Number or claim ID.

Where to find your claim ID

- In your eServices account. Click on the Summary tab and look under My Accounts.

- At the top of letters we’ve sent you.

Be sure you include the email address where you want us to send the copy. Email us at .

If you request an emailed copy, well send it to you via secure email and well include instructions for accessing the form. If we need to contact you, well use the phone number, address or email you provided.

Request a mailed copy of your 1099 via mail or fax

Include the following in your letter or fax

How To Claim Tax Savings On Your 1099 Income

If you want to save money with these tax tricks, youâll need to fill out some forms.

Donât want to deal with all that paperwork on your own? File through Keeper. Weâll help you claim all your savings and take care of every form for you, so you can get on with your life.

If youâd rather file your own business taxes, though, read on to make sure you donât miss out on any savings.

You May Like: How Much In Taxes Do I Owe

Your Form 1099 Is Easy To File If You Know The Fundamentals

If you’re a freelancer or independent contractor who’s preparing your taxes yourself, you’ll need to complete a Schedule C Form 1040.

This form will require you to input all of your information from your 1099.

Again, you should receive your 1099 by January 31 for any business or company you worked for that paid you more than $600.

You should also, by this date, receive any other applicable 1099s listed previously for all other types of income you earned.

On the Form 1040, as a contractor, you’ll complete several fields and also be asked to list out deductions considered both ordinary and necessary to your job or for your employment.

But what is ordinary and what’s considered necessary?

These are the ways the IRS defines these two terms.

Ordinary expenses are defined as those expenses that are typically also incurred by other individuals in the same field or line of work as you.

Necessary expenses are expenses that are essential for you to be able to complete your job.

Examples of ordinary and necessary expenses include uniforms, software for your computer, brochures or promotional materials, and even holiday cards for clients.

When you have an expense that’s both ordinary and necessary, you can include it as a deduction on your taxes.

Once you complete your deductions and all other applicable fields of the Form 1040 tax form, it’s time to re-verify your information.

Go back and make sure everything looks correct.

What’s The Due Date For Tax Returns In 2023

Federal tax returns based on your 2022 income will be due by April 18. The IRS said the filing deadline is extended by three days. This year, April 15 falls on Saturday and April 17, a Monday, is the Emancipation Day holiday in the District of Columbia and taxpayers will get an extension even if they don’t live in the District of Columbia.

More:2023 tax season could be better but huge backlog of 2022 returns may create challenges

Also Check: Do You Have To Pay Taxes On Life Insurance

File An Amended Return Before The Irs Contacts You

If you realize that you left off a Form 1099-R or made other mistakes on your tax return, you usually want to file an amended return instead of waiting for an IRS notice.

If you amend and pay the extra taxes by April 15th, you wont owe penalties or interest.

If you amend and pay after April 15th, youll likely owe penalties and interest for not paying enough taxes by the original deadline. But if you wait for the IRS to contact you, the penalties and interest will usually be bigger since youll be paying even later.

The IRS takes 8+ weeks to process amended returns. In some cases, theyll send you a letter before they process your amended return. Check that their changes are the changes you already made on your amended tax return then reply back that you already amended your taxes.

If their changes are different than yours, youll need to review why. Often, it will be that they didnt know that you had a qualifying withdrawal without seeing your amended tax return. If its something else, you may want to contact a tax professional.

Forms For Investment Income

As mentioned above, you may or may not receive a 1099 form for a specific tax year. Your investment company or financial institution will look at your account activity for the year to determine if you should receive a form. If you dont have a certain type of income activity in that year, you wont get that 1099 type.

For example, if you didnt take money out of your retirement account last year, you wont receive a 1099-R this year .

Also Check: How To Pay Taxes On Stocks

Submit Copy A To The Irs

Copy A of Form 1099-NEC must be submitted to the IRS by January 31, regardless of whether you file electronically or by mail.

When you file a physical Form 1099-NEC, you cannot download and submit a printed version of Copy A from the IRS website. Instead, you must obtain a physical Form 1099-NEC, fill out Copy A, and mail it to the IRS.

Learn how to get physical copies of Form 1099-MISC and other IRS publications for free.

Does Michigan Participate In The Combined Federal/state Filing Program

Yes, Michigan participates with the CF/SF Program. This means that the Internal Revenue Service shares certain income record form information, automatically satisfying a taxpayer’s filing requirement with Treasury. The exception to this general rule is Form 1099-NEC. While Form 1099-NEC is included in the CF/SF Program beginning tax year 2021, Michigan requires the state copy be filed directly with Treasury.

In order for a taxpayer or their service provider to take advantage of this program, they must apply with the IRS and remit eligible income record forms electronically through the Filing Information Returns Electronically System.

Read Also: How Much Taxes Taken Out Of Check

Dont File Your Taxes Early Says Irs Wait For Form 1099

Wealthy Millennials Arent Banking on Stocks: Heres What Theyre Investing In Instead

Typically, the IRS begins accepting tax returns in mid-to-late January for the prior year. For instance, last year, tax season for 2021 began on January 24, 2022.

But you may want to wait to file this year, according to tax experts and the IRS. More taxpayers could receive a form 1099-K reflecting income from third-party payment network transactions this year.

In other words, if you received money from gig work, the sale of goods and services, or other payments not processed as friends and family through Venmo, Zelle, or PayPal, you may receive a 1099-K form reflecting this income.

Third-party payment processors do not have to mail out 1099-K forms until January 31, 2022. You should wait until late February or early March to be sure youve received the appropriate 1099-K forms in the mail before filing, tax experts told CNBC.

If you dont wait to receive your 1099-K form and file your taxes, you could owe taxes on income received. If you receive a 1099-K after you file your taxes, you will need to complete an amended tax return.

For 2022, anyone who earned just $600 in aggregate through a third-party payment network will receive a 1099-K form. The old threshold, prior to 2022, was more than $20,000 in income over 200 or more transactions. This money does not include payments processed from friends and family.

More: Should I Sell Anything in December To Help With My Taxes?

No Matter How You File Block Has Your Back

You May Like: What Is The Maximum Tax Refund You Can Get