Paychecks And Retirement Benefits Are Safe From State Taxes If You Live Here

by John Waggoner, AARP, Updated March 9, 2022

En español | Saving for retirement is important, but saving money in retirement is important, too. One possible way to save money is to move to a state with no income tax. For retirees, that can mean no state tax on Social Security benefits, pensions and other sources of retirement income.

Nine states Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming have no income taxes. New Hampshire, however, taxes interest and dividends, according to the Tax Foundation. It has passed legislation to begin phasing out that tax starting in 2024 and ending in 2027.

Read Also: Do You Pay Income Tax On Unemployment

Alaska Wyoming Montana And Delaware Have Lowest Effective Tax Rates

Alaskans of all income levels enjoy the lowest effective tax rates in the nation. The effective tax rate in Alaska for low income individuals is 5,4%, the rate for middle-income individuals is 4.5% and that of high income individuals is a mere 3.83%. Wyoming came in second place nationwide, with a 7.68% effective tax rate for low income people, a 6.65% rate for mid-income and a 3.98% rate for wealthier families. Delaware also offers low effective tax rates across the board at only 5.43% low-income folks, 5.7% for middle-income people and 6.14% for high-income individuals. Montana also has relatively low effective tax rates, at 6.10% for low income people, 6.59% for middle-income and 6.42% for high-income families.

FTX, one of the largest crypto exchanges in the world, teeters on the edge of collapse as executives try to engineer a bailout. However, there is much more to the world of digital currencies than just currency. Blockchain technology presents a multitude of possibilities within asset management, including tokenization. Blockchain experts say its only a Read More

How Do Property Taxes Affect Rental Income Flow

Some might wonder why they need to look for states that do not have property tax for investing in real estate. Well, you should understand that there are many expenses associated with owning a property. Rental fees may vary depending on factors such as the cost of renovations and/or repairs. There are also other expenses like mortgage payments and the real estate property tax for which a property owner is responsible. All these expenses can have a considerable impact on rental income flow.

Every investor wants to maximize their properties potential cash flows such that they generate rental income that covers all these expenses and leave something extra as profit. So, if you end up purchasing property in tax-burden states, you may ultimately be decreasing your cash flow potential. You can potentially save more money by investing in real estate located in tax-friendly states.

Also Check: How To Add Sales Tax On Square

Property Tax As Source Of General Revenue

In our property taxes comparison by state, New Jersey, Connecticut, and New Hampshire have the highest median property taxes paid. So, it makes sense that property tax represents a significant share of the general income of these states. In this category, the positions are different as Coonecticut has the highest percentage of 61.76. New Hampshire comes in second with property tax representing 61.61% of its revenue. Finally, New Jersey and its 61.01% hold the third place. Arkansas property tax is only 11.8% of the states income, placing the jurisdiction at the bottom.

States With No Personal Property Tax On Vehicles

Well, now we know that there are no states with no property tax, but there are many states where there is no personal property tax on vehicles.

Here is a list of them:

If you live in one of these states and purchase a vehicle out-of-state, you may still be required to pay the personal property tax in your home state.

If youre considering purchasing a vehicle in one of the aforementioned states without personal property tax on vehicles, its important to keep in mind that sales tax will likely apply. The amount of sales tax varies by state.

For example, as of 2016, Alabama has a 4 percent sales tax, while Colorado has a 2.9 percent sales tax.

When it comes to vehicles, personal property taxes and sales taxes are the two most common types of taxes levied by states. If youre interested in purchasing a vehicle in a state without personal property tax on vehicles, be sure to research the states sales tax rate before making your purchase.

Also Check: Amend My 2020 Tax Return

Aggregate & Local Property Tax Stats

- 2020: In 2020 the average single-family home in the United States had $3,719 in property taxes, for an effective rate of 1.1%. This raised $323 billion in property taxes across the nation.

- 2019: In 2019 homeowners paid an average of $3,561, raising $306.4 billion.

- Local Data: ATTOM Data Solutions provides a county-level heat map.

Where Can I Live And Pay Less Taxes

Everybody wants a lower tax bill. One way to accomplish that might be to live in a state with no income tax. As of 2021, our research has found that seven statesAlaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyominglevy no state income tax.

Recommended Reading: What Does Payroll Tax Mean

Also Check: What Does It Mean To Write Off Taxes

Cigarette Tax Rates By Jurisdiction

The following table lists American state and territory tax rates :

| Excise tax per pack |

|---|

The above table does not include the federal excise tax on cigarettes of $1.01 per pack, cigarette taxes levied by individual municipalities , or sales taxes levied in addition to the retail price and excise taxes.

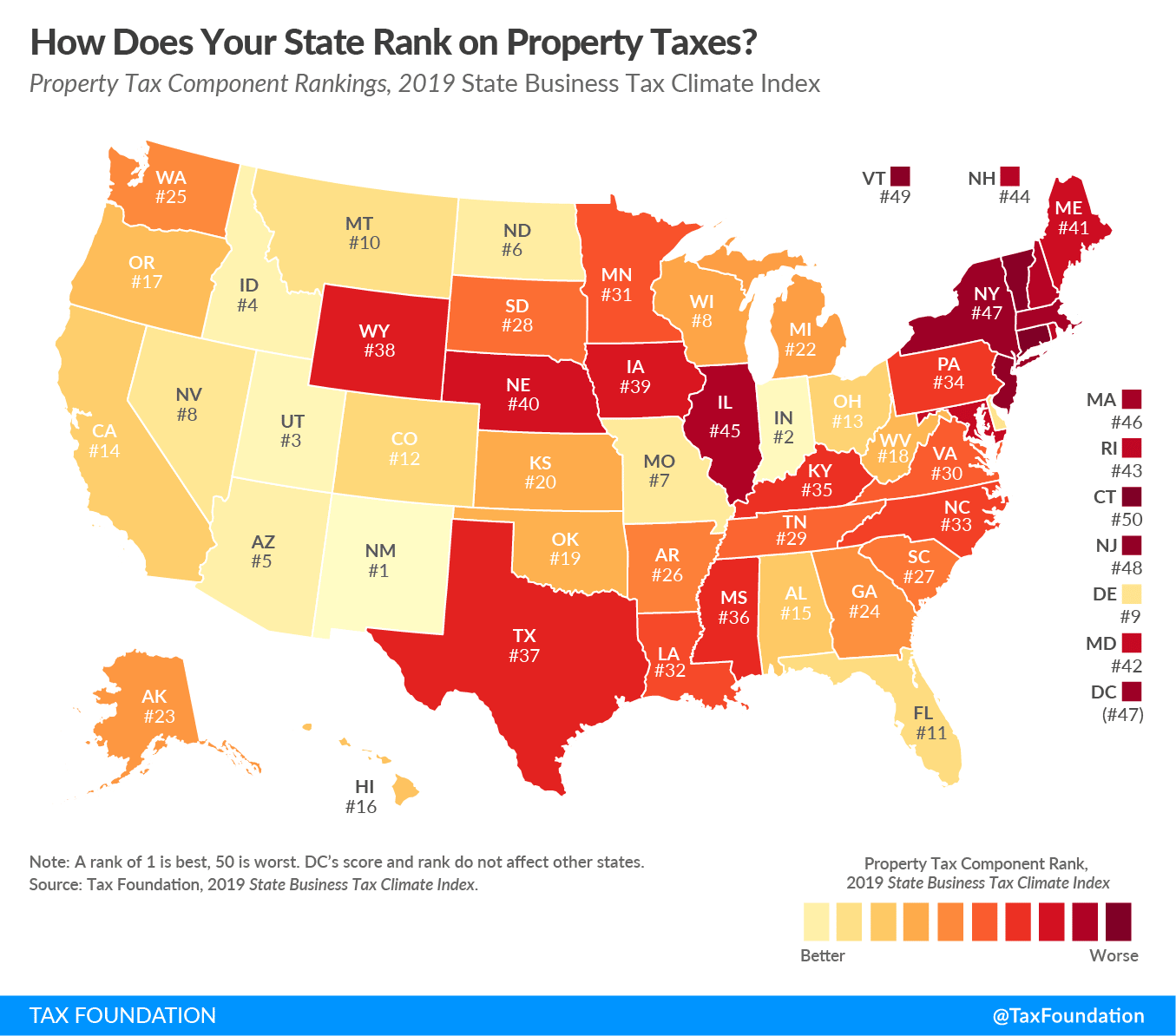

How High Are Property Taxes In Your State

Todays map takes another look at property taxes, this time focusing on states effective tax rates on owner-occupied housing. This is the average amount of residential property taxes actually paid, expressed as a percentage of home value.

Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account in order to give a broader perspective for property tax comparison.

States tax real property in a variety of ways: some impose a rate or a millagethe amount of tax per thousand dollars of valueon the fair market value of the property, while others impose it on some percentage of the market value. While values are often determined by comparable sales, jurisdictions also vary in how they calculate assessed values.

Some states have equalization requirements, ensuring uniformity across the state. Sometimes property tax limitations exist which restrict the degree to which ones property taxes can rise in a given year, and sometimes rate adjustments are mandated after assessments to ensure uniformity or maintenance of revenues. Abatements are often available to certain taxpayers, like veterans or senior citizens. And of course, property tax rates are set by political subdivisions at a variety of levels: not only by cities and counties, but often also by school boards, fire departments, and utility commissions.

Recommended Reading: Why Am I Paying Medicare Tax

States With The Lowest Property Taxes In 2022

Oceanfront home on Oahu Hawaii at sunset. Though Hawaii has high home values, its effective property … tax rate is the lowest in the country.

getty

Property taxes are tricky. Property tax rates can vary by county, municipality, township, and school district. Another interesting aspect of property taxes is the terminology and the way they are often calculated. In many states, counties use whats called a millage rate, in which the tax rate of one mill represents a tax liability of $1 per $1,000 of assessed value of the property one one-thousandth, hence the term mill.

Thus, when it comes to figuring out the states with the lowest property taxes, there is no statewide property tax rate which states can be ranked against. Instead, the best approach to identifying the states with the lowest property taxesis to determine the effective property tax rate: The real dollar amount paid in real estate taxes as a percentage of the median home value for a state.

In a recent study, analyzed all 50 U.S. states in order to determine which states had the lowest taxes. The study took into account personal income tax rates, state sales tax rates, and effective property tax rates, calculating the latter based on the median amount of real estate taxes paid and the median home value reported in the Census Bureaus 2020 American Community Survey Five-Year Estimates, the latest data available.

Read on to find out the states with the lowest property taxes in 2022.

Which States Dont Have Income Tax

There are a few states in the US that do not have an income tax. These states are:

There are also a couple of states that have no state tax on general income, but they do tax specific types of income like interest or dividends. These states are:

So if youre looking to move to a state with no income tax, you have a few options!

Don’t Miss: Tax On Sale Of Rental Property

Local Authorities Set Taxes

In the Lone Star State, local government entities are responsible for determining your property tax, not the state. Your local property taxes help pay the salaries of firefighters and police, finance public schools, libraries, playgrounds, roads, and streets and pay for emergency medical services.

Though you may like seeing your tax dollars at work in your community, local government property taxes can be poorly administered, regressive, and vary by geographical region and property type. You may end up paying higher rates than you would for a similar home in the next neighborhood over just by virtue of your specific local governments priorities.

Texas cannot regulate or intervene in property taxation, even to increase funding for public education. It is up to local authorities to determine how much of your taxpayer money goes toward each service, and you may end up paying for services you dont use or dont believe are necessary.

Additionally, since the local government relies on property taxes as a source of revenue, Texans face stiff penalties for failing to pay these taxes on time.

Who Sets Home Value

After looking at the example above, youre probably wondering who exactly determines why person A and person B in the example above paid what they did in property taxes last year. The entities that set home values in each state are tax assessors, and they are typically government agents who value your property every one to five years. They will look at other similar properties in your market and compare recent sales prices to determine your propertys value. Unique formulas are also involved, and as you might imagine, this involves a lot of complicated math.

These tax specialists look at numerous other factors unique to each state and properly calculate tax rates. It might be that Person Bs condo was located a short distance from a popular tourist attraction, or perhaps Person As home is valued at a higher value but local property taxes are considerably low for that area. You can expect your tax bill to go up if you add any value to your home, such as by adding a pool or building a second story. Most states offer an appeal process so that there is some recourse if you feel like your property value assessment is unfair or unreasonable.

You May Like: Irs Free Tax Filing 2022

States That Charge No State Individual Income Tax

What is individual income tax? Most of the states in the United States impose a personal/individual income tax on residents. These taxes are deducted from the salary, wages and other source of income of residents.

For household that earn high income, residing in a state that doesnt charge personal income tax can be a huge plus. Just know that states that charge low income taxes often make up for it by increases taxes in another way, like, for instance, by having high sales or property taxes.

Below are the seven states in the U.S. that doesnt charge state personal income tax:

Together with these seven states, Tennessee and New Hampshire have no tax on earned income. However, the states charge tax on income from interest and dividends, so, not everyone is free from this.

Recommended Reading: What Is Adjusted Gross Income On Tax Return

What States Have The Highest Property Taxes 2022

The state with the highest property tax rate is New Jersey. Homeowners in New Jersey may pay more than $8,000 per year in property taxes, depending on the value of their home. Though this may sound steep, the next highest states arent far behind, with average effective property tax rates near or above 2%.

These states include:

Average Effective Property Tax Rate: 2.49%

Median Home Value: $335,600

Annual Taxes On a Median-Priced Home: $8,362

2. Illinois

Average Effective Property Tax Rate: 2.27%

Median Home Value: $194,500

Annual Taxes On a Median-Priced Home: $4,419

3. New Hampshire

Average Effective Property Tax Rate: 2.18%

Median Home Value: $261,700

Annual Taxes On a Median-Priced Home: $5,701

4. Connecticut

Average Effective Property Tax Rate: 2.14%

Median Home Value: $275,400

Annual Taxes On a Median-Priced Home: $5,898

5. Vermont

Average Effective Property Tax Rate: 1.90%

Median Home Value: $227,700

Annual Taxes On a Median-Priced Home: $4,329

Also Check: Capital Gains Tax Calculator New York

States Without Property Tax In 2022 Ranking Lowest/highest

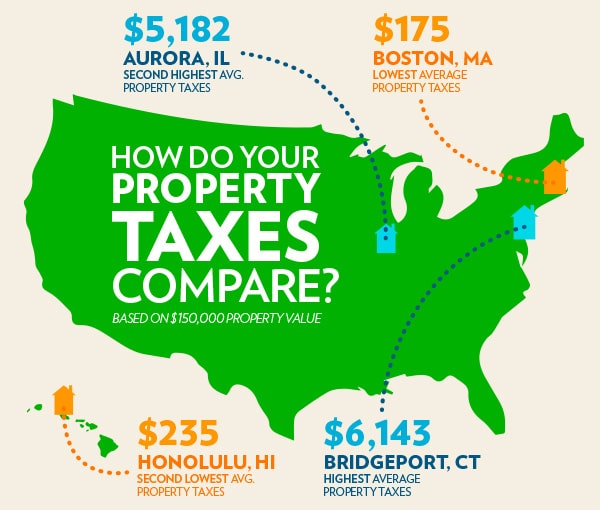

The average homeowner in the U.S. pays nearly $2,400 in property taxes each year, according to Business Insider. However, thats an average number.

The fact is that property taxes vary significantly from place to place and can have a negative effect on cash flow if a real estate investor isnt careful.

In this article well look at the states with highest and lowest property tax rates, discuss how property taxes work, and offer some tips on keeping property taxes as low as legally possible.

Per Capita Property Tax

D.C. leads the way in the property tax per capita by state category with $3,500. New Hampshire and New Jersey, naturally, follow with per capita property taxes of $3,310 and $3,277. Connecticut is the only other state whose per capita property tax by state is over $3,000 . Alabama, Oklahoma, and Arkansas have the lowest property tax per capita. In Alabama, the per capita amount paid is only $582, while in Oklahoma and Arkansas, its $731 and $741, respectively.

Recommended Reading: How To Pay Estimated Taxes

Recommended Reading: How To File State Taxes

Ranking The Lowest Property Tax States

How much are you paying in property taxes? Depending on where you live, your property taxes may be modest, or they may actually be higher than your mortgage payment. If you’re feeling the property tax pinch, maybe it’s time to seek a little tax relief by moving to a less costly region. This list of the 15 states with the lowest effective property tax rates may inspire you to pack your bags and head southor to the islands.

How The Appraiser Arrives At Value

The values of recently sold homes in your area can be taken into account when calculating value. The appraiser will compare your home to others similar to yours and value it based on those sales prices, using a method known as the market approach.

The cost approach is based on how much it would cost to replace your home, although this method is used less frequently with residential properties.

Don’t Miss: When Are Business Taxes Due

Listing The Lowest Property Tax States

There are several reasons why this data could be of major significance to you.

Property taxes could be gobbling up a huge chunk of your income, leaving you with less for your home payment, bills, savings, and investments. The information could also help you know how to maneuver when property taxes are due.

Either way, read on to find out the states with the lowest property taxes in the US.

The ranking is based on property tax data shared by Roofstock in August 2022. The median household income figures are sourced from statistics aggregator World Population Review.

1. Hawaii

- Annual taxes paid on homes priced at typical value: $2,391

- Median annual household income: $83,173

According to Roofstock data, Hawaii has the lowest property taxes in the USA. Home insurance costs are also the lowest in the country.

However, it still has the highest typical home value of all the 10 states featured in this list, meaning that residents could still be slapped with a hefty tax bill.

Hawaii having the lowest property taxes is a surprise considering it perennially ranks among states with the highest cost of living, according to data shared by the Bureau of Economic Analysis .

2. Alabama

- Annual taxes paid on homes priced at typical value: $1,097

- Median annual household income: $50,800

Like Alabama, Louisiana is another state where residents enjoy both low property tax rates and home prices below the national average.

5. South Carolina

Also Check: How To Report 1099 K Income On Tax Return

Low Property Taxes Near Houston

The primary counties comprising the Greater Houston area include Harris, Montgomery, Fort Bend, Galveston, and Brazoria. With median home values of about $140,000 and effective average tax rates hovering right around two percent, taxpayers in Galveston and Brazoria counties generally pay the lowest total property taxes in the area. However, homebuyers considering more expensive luxury homes might look to Montgomery County and its average effective tax rate of 1.99 percent, the lowest in the five-county region. Its also worth considering individual city taxes to find the cities with the lowest property taxes near Houston.

Harris County

The city of Houston lies within Harris County, by far the most populous of the five-county Greater Houston region. Median Harris County property taxes total about $3,040 yearly on homes with median appraised values of around $132,000. The average Harris County property tax rate is effectively 2.31 percent of fair market value.

Fort Bend County

Median property taxes in Fort Bend County are around $4,260 on homes appraised at a median value of $171,500. That puts the effective average Fort Bend County property tax rate at about 2.48 percent.

Brazoria County

Brazoria County homeowners pay around $2,850 yearly in property taxes on homes with a median appraisal of $140,300. The Brazoria County property tax rate averages 2.03 percent.

Galveston County

Montgomery County

You May Like: Mail In Federal Tax Return