What Irs Form 5498 Shows

To put it succinctly, tax form 5498 shows you all of the contributions made to your HSA. This form is what the trustee or administrator of your HSA uses to report all of your contributions including the ones made by: you, your employer, your spouse or other loved one, or transfers from IRAs and rollovers from the previous year.

Here is a box-by-box guide to what youll see on your personal tax form 5498:

- Box 1: Contributions to an Archer MSA that count towards the previous tax year’s contribution limits. If you dont own an Archer MSA that is also administered by this trustee or administrator, this box will be blank.

- Box 2: This box shows all contributions made in the past calendar year to your HSA, and includes any qualified distributions from your IRA to fund your HSA. It also includes any contributions made in the past year which were applied to the previous tax year.

- Box 3: Your 5498-SA is distributed after tax day so it reflects all contributions made in the current calendar year for the previous tax year.

- Box 4: Any rollover contributions from the previous year that were received by the administrator in in the current year.

- Box 5: The fair market value of your HSA, Archer MSA or MA MSA.

- Box 6: The correct boxes should be checked .

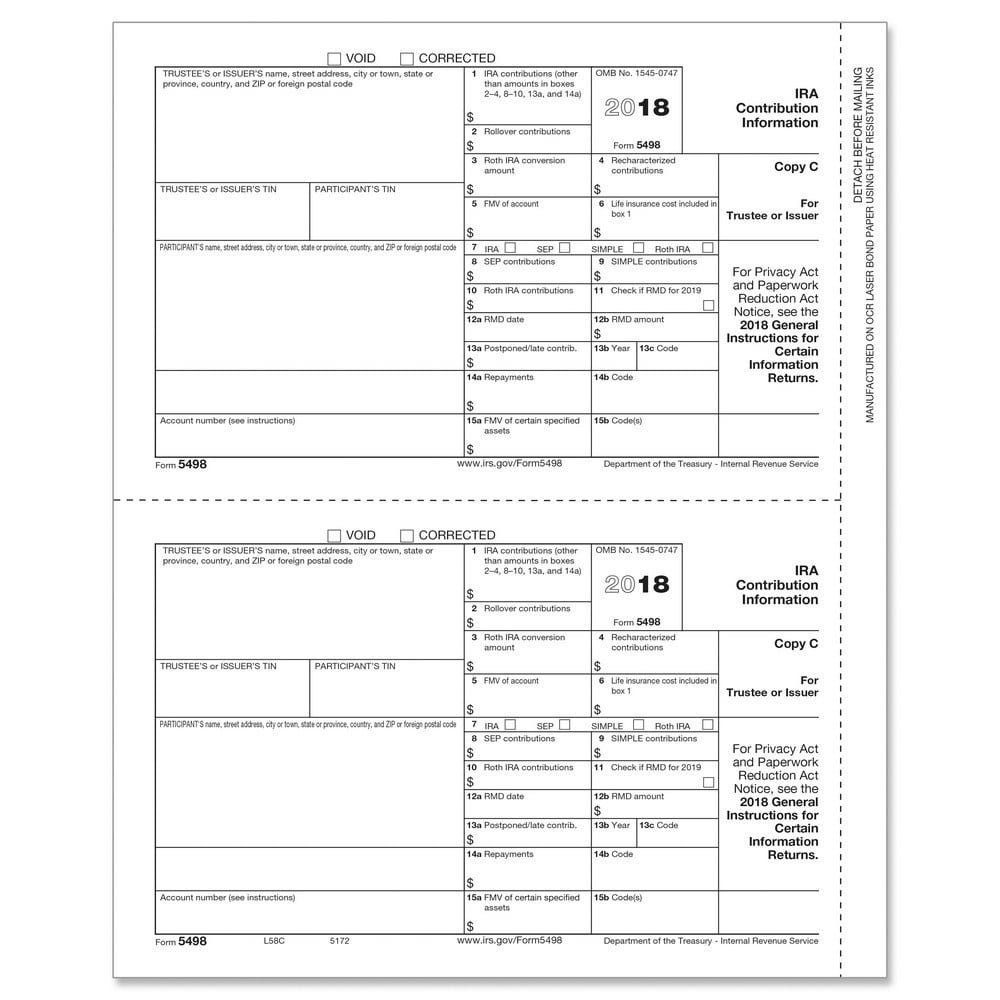

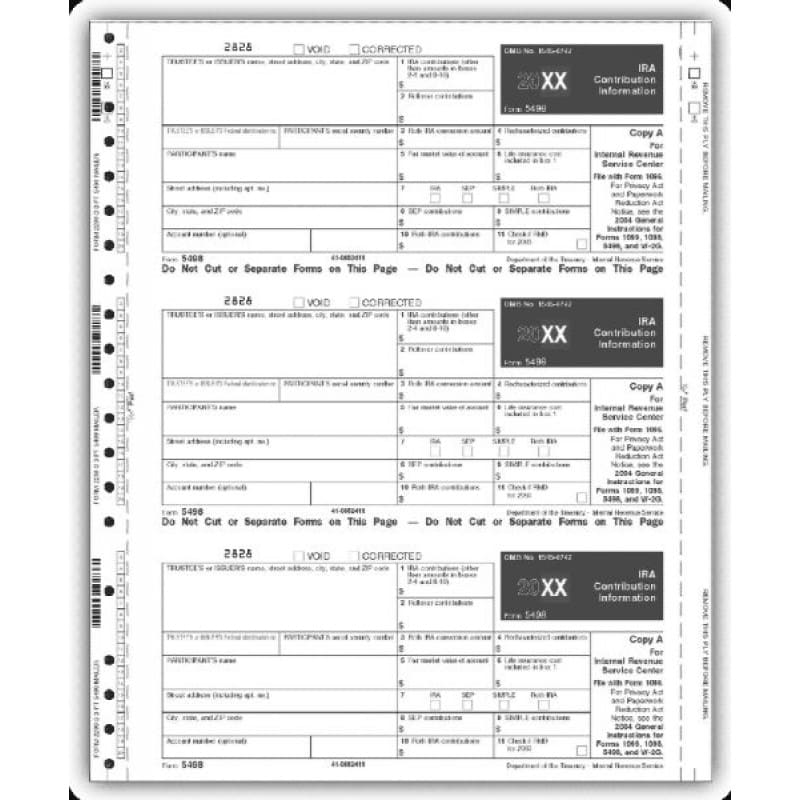

What Information Is Reported On Form 5498

The following information is reported on :

- Trustees name and address

- Box 3 – Roth IRA conversion amount

- Box 4 – Recharacterized contributions

- Box 5 – FMV of account

- Box 6 – Life insurance cost included in box 1

- Box 7 – Type of IRA

- Box 8 – SEP contributions

- Box 10 – Roth IRA contributions

- Box 11 – Check if RMD for 2021

- Box 12a – RMD date

- Box 15a – FMV of certain specified assets

How Do I Report Non

Report non-deductible contributions to a Traditional IRA on Form 8606, which is filed with your federal tax return. If you are not required to file a federal income tax return for the year, Form 8606 should be filed separately. If you have made nondeductible contributions, failure to file a Form 8606 may result in greater tax liability when you take distributions from your IRA . You may also be subject to a penalty for failure to file Form 8606. Refer to the IRS Instructions for Form 8606 for more information.

Read Also: How Does Tax Write Off Work

I Have An Ira So Why Didnt I Receive Form 5498

If you have an active IRA, then you might wonder why you didnt receive a copy of your IRS Form 5498. If this happens, then its likely the result of one of three issues:

- You did not make any contributions to your IRA over the tax year

- You do not actually have an IRA contract

- Your trustee or custodian has an incorrect mailing address on file for your contract

If none of these factors apply to you, then contact your trustee to learn more about why you did not receive this tax document.

What Are The Parts Of The Form

- Identifying information: On the left-hand side of the form, the trustee provides their address and tax identification number. The form also lists the account holders name, tax identification number, address and account number in this area. On the form, the account holder is referred to as the participant.

- Box 1: The total amount of contributions made by the account holder to an Archer MSA account are entered here. If the account in question is an HSA, the trustee leaves this box blank.

- Box 2: The total amount of contributions made to an Archer MSA or HSA during the tax year are entered here.

- Box 3: Contributions made to an Archer MSA or HSA between the end of the tax year and the tax filing deadline are reported here.

- Box 4: The total amount of any rollovers made to the HSA or Archer MSA go here.

- Box 5: Trustees enter the fair market value in this box. The FMV is the total value of the account at the time the form was completed.

- Box 6: The trustee checks a box here to report whether the account is an HSA, Archer MSA or Medicare Advantage MSA.

Don’t Miss: How Long To Get Tax Return

Who Uses Form 5498

Form 5498 can help you determine your tax deduction for qualifying IRA contributions youve made, but youre not necessarily entitled to deduct the entire amount listed for traditional IRA contributions.

The IRS sets contribution limits for IRAs. These limits are $6,000 per year if youre under age 50, or $7,000 per year if youre age 50 or older. The limit is the same for tax years 2021 and 2022. IRA contribution limits are subject to change periodically to keep up with inflation.

Suppose you had a flush year and threw an additional $3,000 into your IRA. If $9,000 is reported in Box 1 of Form 5498, your deduction is still limited to $6,000. If youre age 50 or older, it’s limited to $7,000.

Not only can you not take a deduction for the excess $3,000 you contributed, but you’d owe 6% excise tax on the extra contribution for every year it remains in your account until you withdraw it.

Who Receives Form 5498

There are three copies of each Form 5498 that is issued. They contain identical information and they each go to different parties:

Copy A: Copy A goes to the Internal Revenue Service.

Copy B: Copy B goes to the taxpayer. This is the copy you should expect to receive from your IRA trustee or IRA custodian.

Copy C: Copy C is retained by the IRA custodian.

Recommended Reading: How To Read Tax Return

What Is Irs Form 5498

OVERVIEW

If you made contributions to an IRA in the preceding tax year, you can expect to receive IRS Form 5498.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

You can expect to receive IRS Form 5498 if you made contributions to an IRA in the preceding tax year. The “custodian” of your IRA, typically the bank or other institution that manages your account, will mail a copy of this form to both you and the Internal Revenue Service. If you have an IRA but made no contributions for the year, the custodian generally won’t send you a Form 5498 unless you have a required minimum distribution from the account.

Information To Include On Form 5498

Although you are not personally required to input any information into Form 5498, its important to know the type of data that youll find in the different fields. Form 5498 looks similar to Form W-2, which employers use to report their employees earnings. It has a variety of fields for different types of information. The top of the form requires information on the IRA account number, the trustee, and the plan participant. The fields on the bottom of the form seek details on the contributions made during the year. Here is an overview of what to include in each box of Form 5498:

On the left side, youll first find contact information about the trustee in charge of overseeing your account. This includes the following information about the company:

Then, youll see the same information entered about you, or the person who owns the IRA.

Also Check: Credit Karma Tax Return 2020

What You Should Do With This Information

The first thing you should do after receiving this form is to ensure all of the information on it is accurate. Why? Because this is the information that the trustee or administrator of your HSA has reported to the IRS. If its inaccurate or different than what you reported on your tax return, it could cause you massive headaches. If you see a discrepancy between what you reported on your taxes and what you see on Form 5498, you should contact your trustee or administrator immediately to make sure all of your contributions have been recorded and coded correctly.

Be mindful of over-contributing to your HSA. If you contributed more than the HSA contribution limits set by the IRS for that year, but those excess contributions were repaid to you by your HSA trustee or administrator, they should not be included in your contribution amount. Since you have to pay income taxes on any excess contributions, in addition to a 6% tax penalty, its important that the number reported in Box 2 only reflects the money you left in the account.

If it was your HSA trustee or administrator who made the error, they will issue you a Corrected Form 5498. If the error was on your end, you will need to file an amended tax return.

If, after checking the information, everything looks accurate, you should keep this form with your other tax documents in the event you face any other inquiries in the future.

Why Is There A Check In Box 11 Of Form 5498

The checkbox is to alert you to take a required minimum distribution afte you reach the age of 70 ½.

If you were 70½ or older in the previous tax year, federal law requires that you begin taking minimum distributions from your TIAA-CREF Traditional, Rollover or SEP IRA account in the following calendar year.

If you are taking your first payment in the calendar year after you turn 70½, two distributions are required for that year. The first payment must be taken by April 1 and the second by December 31.

Your total annual required distribution must be withdrawn by December 31 of the following year.

Need help?TIAA offers solutions for distribution requests. Please call us at weekdays, 8 a.m.-10 p.m. and Saturdays, 9 a.m.-6 p.m. . We’ll discuss all of your options to help you make the decision thats right for you.

You May Like: Sale Of Second Home Tax Treatment

Does My Accountant Need Form 5498

Most likely, not. Form 5498 is an informational form and not required to file a tax return.

If you do Roth conversions, you may need your Form 5498s, as well as your old tax returns. That will help your your tax preparer properly calculate your tax liability.

More importantly is that you have this documentation in the case you are audited. Talking with an auditor when you have all the facts in hand is a much different story than when you think you know the numbers. Having your Form 5498s and tax returns allows you to avoid tap-dancing in front of the examiner.

Where Do I Put My 1099

Youll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means youll use it to report income on your federal tax return. If the form shows federal income tax withheld in Box 4, attach a copy Copy Bto your tax return.

Read Also: Look Up State Tax Id Number

Irs Form 5498 Explained

The IRS requires the institution that maintains your IRA to use Form 5498 to report to you and the IRS any IRA contributions, rollovers from certain types of employer-sponsored retirement plans to IRAs , re-characterization of IRA contributions, conversions of Traditional IRAs to Roth IRAs, the December 31 fair market value of your IRA account and certain other information.

What Types Of Transactions Does It Cover

Form 5498 is used to report certain changes made to your account during the tax year. This can include the following types of transactions:

- Recharacterizations

This form will also detail the year-end fair market value of your IRA account. Note that for Inherited IRAs, Form 5498 are generated on behalf of the deceased, as well as any beneficiaries.

In terms of recharacterizations, keep in mind that as of January 1, 2018, the Tax Cuts and Jobs Act prohibits you from recharacterizing a rollover or conversion to a Roth IRA. However, you can recharacterize a contribution that youve made to one type of IRA to another type. If you wish to do so, then contact your IRA trustee and instruct them to transfer your contribution amount, including any earnings, to the different contract type.

You May Like: Are Municipal Bonds Tax Free

Expert Tax Advice And Guidance You Can Trust

IRS Form 5498 is just one of many different tax documents that youll need to understand closely in the coming months. If youre unsure how to proceed or what the information means, then were happy to walk you through it.

Our team of qualified tax attorneys is well-versed in every aspect of tax law, and well break everything down so theres no confusion. When youre ready to get started, feel free to contact us to discuss your tax-related questions.

Learn More About Your Taxes

What You Must Do Before Starting Your Conversions

The most important thing that you do is to discuss the strategy with your accountant before you start doing conversions. You want to achieve 3 things:

Also Check: Last Day To Sell Stock For Tax-loss 2021

Take Our Quiz: Are You Saving Enough For Retirement

Form 5498 reports your contributions to a traditional or Roth IRA, or a SEP or SIMPLE account, for 2014. It also reports whether you rolled money over from another retirement plan, such as a 401, into an IRA or converted a traditional IRA to a Roth. Plan custodians must send these forms by May 31 to anyone who made a contribution, rollover or conversion for 2014.

You dont need to file this form with your tax return because the custodian sends a copy both to you and to the IRS. But its important to review the document for errors. Mari Adam, a certified financial planner in Boca Raton, Fla., has seen a variety of mistakes that plan custodians needed to fix, such as reporting an IRA contribution as a rollover . Another client consolidated several retirement plans and rolled them into an IRA, but the 5498 didnt show the rollover.

When Is The Form Due To The Irs

Form 5498 is required to be filed and furnished to the IRS no later than May 31 of each year that follows the tax reporting period. This is the case regardless of whether the forms are filed on paper or e-filed.

Why the later date? Put simply, taxpayers can make carryback contributions to their IRA accounts up until the tax filing date of the following year. To allow time for these calculations, the due date is later than the traditional tax return deadline.

In 2021, the IRS extended this deadline to June 30. However, that does not appear to be the case for 2022.

Plan administrators should use Form 5498 to report contributions to traditional, ROTH, Simplified Employee Pension IRAs, and Savings Incentive Match Plan for Employees IRAs. They dont have to file this form, however, if the plan holder didnt make any contributions or take any distributions during the year. Here are the basic guidelines for when you need to use this form:

Recommended Reading: Pay My Car Tax Online

Roth Ira Conversions And Recharacterizations

Box 3 reports conversions to Roth IRAs. The amount converted to this type of IRA does not limit the amount that can be contributed annually to an IRA, including a Roth IRA.

As of Jan. 1, 2018, you can no longer recharacterize conversions to a Roth IRA. However, you can recharacterize contributions made to one type of IRA as having been made to the other type of IRA. To do this, simply instruct the trustee of the institution holding your IRA to transfer your contribution amount plus earnings to a different type of IRA, either with the same trustee or a different trustee. Recharacterized contributions are entered in Box 4 of Form 5498

Withdrawal And Distribution Information

Anyone who is 72 and older must take required minimum distributions from the account each year. So must surviving spouses and minor children who inherit an IRA, and elect not to roll it over into an account of their own or withdraw funds on a five-year schedule.

RMDs for the current year are based on the account holder’s age and on the fair market value of the account as of Dec. 31 of the prior year. For example, the accounts value on Dec. 31, 2019, determines the RMD for 2020. This amount is reported in box 5 of Form 5498.

The form notes whether an RMD is required for the year in which you receive the formfor example, the 2019 form notes whether an RMD is necessary for 2020. Form 5498 also reports the amount of the RMD that should be taken, based on certain calculations made by the trustee , and the date for the RMD .

To facilitate RMDs, the form is required to be furnished by January 31 , showing the accounts value as of the previous December 31. The form showing the value of the account as of Dec. 31, 2020, for example, must be furnished by Feb. 1, 2021 .

Also Check: What Do You Need To Do Your Taxes