Your Security Is A Top Priority Now And Always

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 10/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Edition Pricing: Actual prices are determined at the time of payment, print, or e-file and are subject to change without notice. Add sales tax for applicable orders. Offers may end at any time and promotional offers may not be combined.

Explore Our Financial Education Program

The Financial Education Program is a series of short modules and videos designed to take you through the benefits available to you and the responsibilities you have as a New York State taxpayer. You can start anywhere in the series or review all the modules. This is for youlet us know what you think!

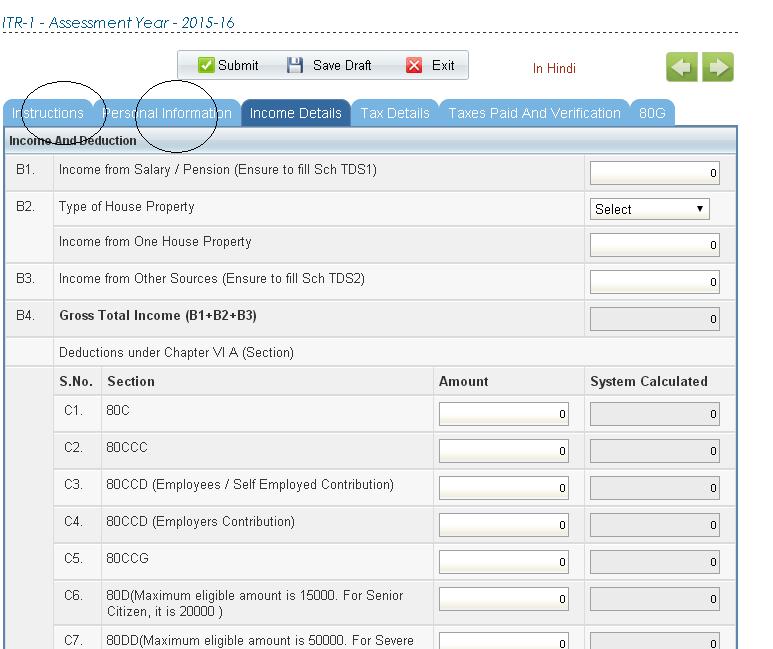

Income Tax Return Login Portal

ITR Login Portal : All the individuals who are citizens of India or Non-Residential Indians s and have an income through salary, business, sale of property, equities, or any form of income need to file an Income Tax Return on the official website of the Income Tax Department every financial year. The Income Tax Department has launched the ITR E-Filing Portal for the easy filing of Income Tax Returns . If they fail or delay in filing an Income Tax Return Login, then they are liable to pay a penalty. The E-Filing ITR Login Portal can be used by any tax payer. He just needs to register on the E-Filing portal and log in to the ITR Login portal with the credentials. After completing the ITR Login portal, the income taxpayers can select the method of their filing in the ITR login portal. There are various forms for different categories of ITR payers, one of the commonly used forms for ITR filing is form 16A. The last date for ITR e-Filing is 31st July 2022.

| Event |

Recommended Reading: Roth Ira Contribution Tax Deduction

How To File Your Personal Income Tax A Step

7,958,099

- Make sure the CAPS Lock is off.

- Clear your browser cache and cookies.

- Make sure the internet connection is avaiable and youre definitely online before trying again.

- Avoid using VPN.

- In case you have forgot your password then follow these instructions.

- If you still cant get into your account, contact us and well be in touch to help you as soon as we can.

Co-Authored By:

Also Check: Synthetic Fixed Income Securities Inc

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. Its safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Recommended Reading: Free Ohio State Tax Filing

Login Income Tax Malaysia

Looking for Login Income Tax Malaysia Login? Get direct access to Login Income Tax Malaysia through official links provided below.

- Step 1. Go to Login Income Tax Malaysia page via official link below.

- Step 2. Login using your username and password. Login screen appears upon successful login.

- Step 3. If you still cant access Login Income Tax Malaysia then see Troublshooting options here.

Added by: Kbir Maguregui

Free Income Tax Preparation And Filing

IRS-certified volunteers are ready to assist residents in the Green Valley area with free income tax preparation and e-filing. There are four locations to choose from, and operations differ slightly at each location.

The Volunteer Income Tax Assistance program will operate sites at the GVR East Center, St. Francis-In-The-Valley Episcopal Church and the Sahuarita Food Bank. AARP Tax-Aide will operate a tax site at La Posada.

Tax preparers in both programs go through a rigorous training and certification process, then must pass IRS certification tests before they can meet with clients. The difference between the two tax programs is their primary customer focus. Both will prepare and e-file tax returns for anyone who falls within IRS guidelines. Neither program can prepare business returns, but many self-employed individuals can utilize the free tax service. Due to Arizona being a community property state, neither program can prepare Married Filing Separately tax returns. Neither program can prepare returns containing farm income. VITA has income restrictions, AARP does not.

Don’t Miss: Irs Self Employment Tax Calculator

Maine Revenue Services Is Pleased To Announce The Implementation Of The Maine Tax Portal For Detailed Information Visit This Link

Please visit www.maine.gov/reemployme to electronically file your Unemployment Contributions Report, Form ME UC-1.

If assistance is needed with the ReEmployME system, please contact the Maine Department of Labor at 207-621-5120 or .

If an electronic payment or refund is requested that is funded from or destined to a source outside of the U.S. or will pass through foreign banks, then payments coming in and refunds going out need to be processed in paper check form.

NOTE: Tax return forms and supporting documents must be filed electronically or submitted on paper. Do NOT submit disks, USB flash drives, or any other form of electronic media. Electronic media cannot be processed and will be destroyed.

Have You Heard About The Homeowner Tax Rebate Credit

The homeowner tax rebate credit is a one-year program providing direct property tax relief to eligible homeowners in 2022.

If you’re a homeowner who qualifies, we’ll automatically send you a check for the amount of the credit. Your amount will depend on where your home is located, how much your income is, and whether you receive Enhanced or Basic STAR.

Recommended Reading: What Is The Tax Year

How To Login Into The Income Tax E

The taxpayers need to e-file ITR, for that register yourself and log into the Income Tax e-filing website. Once you have access to the portal you can see a variety of services offered by the income tax department.

Users can follow the steps to log in into income tax e-filing.

Step 1: Click on the income tax e-filing portal

Step 2: Click on the Login here option.

Step 3: On the income tax login page, you have to provide your User ID , enter the password and captcha code and click login.

For users who wish to login through netbanking follow the following steps:

Step 1: Click on the login through netbanking option and you will see a list of banks that offer income tax login through their internet banking website.

Step 2: Select the suitable bank to get redirected to the respected banks internet banking site login page.

Step 3: Enter your netbanking login credentials and complete the login process.

Note: Update your PAN card details with your bank to login through netbanking.

Deadline Approaching To Claim State Tax Refunds Before They Move To Unclaimed Propertycontinue Reading

BATON ROUGE Thousands of Louisiana taxpayers have until Thursday, Oct. 6 to claim millions of dollars in state income tax refunds before the Louisiana Department of Revenue transfers them to the states Unclaimed Property fund.

In August, LDR sent Notice of Unclaimed Property letters to 20,400 individual and business taxpayers. So far, approximately 4,000 have responded to claim their refunds. The remaining approximately $9.5 million in funds will be transferred by law to the Unclaimed Property Division of the state treasurers office later this month if not claimed by Oct. 6.

If you received one of the letters but havent responded yet, simply complete and return the attached voucher to LDR. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

Don’t Miss: Tax Assessment Procedures Domestic Judgement Registry

Did You Receive A 1099

Deadline For Renewing Transaction Privilege Tax License Less Than Two Weeks Away

Phoenix, AZThe Arizona Department of Revenue is advising businesses to renew their transaction privilege tax licenses, which are due January 1, 2023, and penalties will be assessed for all renewals after January 31.

Businesses are required to have a current TPT license and to renew the license before continuing to conduct business in Arizona.

You May Like: How Do Deductions Work On Taxes

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

What Is An Income Tax Return

Income tax return is a form filled by an individual or agency to declare the net tax liability, report the gross taxable income and claim tax deductions. It is mandatory for those who earn a certain amount of money in a financial year to file IT returns to the income tax department of India.

Organizations, Hindu Undivided Families , salaried employees and self-employed are required to file ITR. It has details related to the personal and financial data of the taxpayers. Its an insight into their assets, income and applicable taxes paid.

Recommended Reading: How To Pay Taxes Quarterly

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If youre a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Income Tax E Filing Online Login

Searching for income tax e filing online login? Use official links below to sign-in to your account.

If there are any problems with income tax e filing online login, check if password and username is written correctly. Also, you can contact with customer support and ask them for help. If you don’t remember you personal data, use button “Forgot Password”. If you don’t have an account yet, please create a new one by clicking sign up button/link.

- e-Filing Home Page, Income Tax Department, Government of India. LOADING.

- Status:Page Online

Don’t Miss: How Much Is Sales Tax In Michigan

Three Arrested On Charges Of Defrauding State Disaster Relief Programcontinue Reading

BATON ROUGE Three Louisiana residents face felony charges after allegedly defrauding a state program that offers sales tax refunds on personal property destroyed in a natural disaster.

Based on a Presidential declaration, citizens can apply for a refund of sales tax they paid on items lost during a declared disaster.

Starr Carbo, Johnnie Mae Ricard and Erica Williams, all of Westwego, are charged in connection with fraudulently preparing and submitting Natural Disaster Claim for Refund of State Sales Taxes Paid forms following Hurricane Ida in 2021.

Investigators with the Louisiana Department of Revenue say the three women, working for Global Tax Service, charged clients as much as $110 to prepare and submit the sales tax refund form using false information and inflating the value of the losses. The companys clients told investigators they had not provided the information that was submitted on their behalf.

Carbo, Ricard and Williams were booked into the East Baton Rouge Parish Prison on charges of Injuring Public Records, which can result in a sentence of up to five years and fines of up to $5,000.

LDR wants the citizens of Louisiana to know that the Natural Disaster Claim form is available for free on its website, revenue.louisiana.gov.

LDR is committed to preserving the funds available to those who qualify for this program and continues its investigation into disaster related fraud, said Secretary of Revenue Kevin Richard.

How To Submit Income Tax 2019 Through E

- http://www.smartouch.com.my/income-tax-2019/

- e Filing Malaysia income tax 2019 is an electronic application on filing of Income Tax Return Form through internet. It is a new and effective method of e filing malaysia income tax 2019 returns online and has electronic income tax 2019.

- Status:Page Online

Don’t Miss: What Is California Tax Percentage

Itr Filing Deadline 31st December:

Income Tax Return: 31 , 2022 . . 2021-2022 2022-23 31 , 31 , , 5,000 .

234F , 31 5,000 10,000 . 1,000 .

How To Register For Ezhasil E

- https://www.hasilnet.org.my/how-to-register-for-ezhasil-e-filing-for-individual/

- Before you can complete your Income Tax Returm Form via ezHASiL e-Filing, the first step you have to take is to Register at ezHASiL e-Filing website. Please bear in mind that you must be registered as Taxpayer prior to registering for ezHASiL e-Filing.

- Status:Page Online

You May Like: How To Check If Taxes Were Filed

How Do I Enroll For E

To use e-Tax, you need to get your ttconnect ID

Register for your ttconnect ID in three simple steps:

1. Complete and Submit the ttconnect ID Registration Form online. Ensure your BIR number is included in the registration form.Once completed and submitted, you should receive an email notification with additional registration details. If you do not receive any such notification please send an email to info.ttconnect@gov.tt 2. Activate your ttconnect ID . 3. Visit a ttconnect Service Centre with the following forms of valid Identification / Documentation, as well as your ttconnect ID, in order to complete the registration process. Make sure to indicate to the Customer Service Representative that you are registering for e-Tax.

BIR Number Verification

- Advice of BIR or Advice of BIR and Acct Numbers

Once you have a ttconnect ID, you can visit to begin using e-Tax!

Income Tax E Filing Login Malaysia

Searching for income tax e filing login malaysia? Use official links below to sign-in to your account.

If there are any problems with income tax e filing login malaysia, check if password and username is written correctly. Also, you can contact with customer support and ask them for help. If you don’t remember you personal data, use button “Forgot Password”. If you don’t have an account yet, please create a new one by clicking sign up button/link.

Don’t Miss: What Can I Write Off On My Taxes

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose AGI is $73,000 or less qualify for a free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form. You should know how to prepare your own tax return using form instructions and IRS publications if needed. It provides a free option to taxpayers whose income is greater than $73,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

IRS Free File Program offers the most commonly filed forms and schedules for taxpayers.

Other income