California Tax Tables And Personal Income Tax Rates And Thresholds In California

Each year, the state of California publishes new Tax Tables for the new tax year, the California Tax Tables are published by the California State Government. Each of these tax tables contains rates and thresholds for business tax in California, corporation tax in California, employer tax in California, employee tax in California, property tax in California, sales tax in California and other tax rates and thresholds in California as well as providing instruction and guidance for changes to specific California state tax law and/or tax legislation.

These tax tables are then, amongst other things, used to calculate California state tax and associated payroll deductions. The changes to the California tax tables can be long and often contain information that , whilst important for the correct calculation of tax in California, is not relevent to the majority of California taxpayers who pay most of their direct tax via their salary income. The California state tax tables listed below contain relevent tax rates and thresholds that apply to California salary calculations and are used in the California salary calculators published on iCalculator. The California state tax tables are provided here for your reference.

Which Are The California Taxes

The taxes a Californian citizen has to pay include the state income tax, the local income tax, and the general ones: the FICA tax and the federal income tax.

|

Tax type / Filing status |

|

|---|---|

|

7.65%: Social security + medicare taxes |

|

|

Federal income tax |

Progressive tax brackets from 10% to 37% |

|

Deductions in USD |

|

|

Progressive tax brackets from 1% to 12.3% |

|

|

Local tax |

Only San Francisco has a local tax: 0.38% paid by the employer . |

|

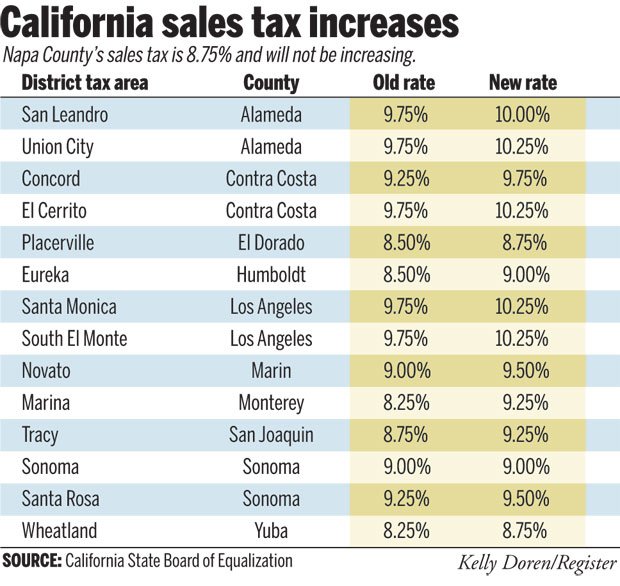

Sales tax |

7.25% – 10.75%: Tax paid for the sale of certain goods and services. |

The California tax calculator already includes all the specifics indicated above however, since we want to make everything crystal clear, we will include the next table: tax brackets for the California state income tax. You should check the tax bracket calculator in case you need more information about the federal income tax.

Single filers California tax brackets 2022. It also applies to married/registered domestic partners who fill separately.

|

Tax rate |

|

|---|---|

|

$4803 Standard deduction or personal exemption is structured as a tax credit. |

$129 credit |

|

$93.25 + 2% of the amount over $9,325 |

|

|

$348.87 + 4% of the amount over $22,108 |

|

|

$860.23 + 6% of the amount over $34,893 |

|

|

$1672.75 + 8% of the amount over $48,436 |

|

|

9.3% |

$2694.99 + 9.3% of the amount over $61,214 |

|

10.3% |

$26,081.79 + 10.3% of the amount over $312,687 |

|

11.3% |

$32,522.79 + 11.3% of the amount over $375,222 |

|

12.3% |

|

|

$1,000,001 or more |

$106,868.89 + 13.3% over $1,000,001 |

How To Calculate Salary After Tax In California In 2023

The following steps allow you to calculate your salary after tax in California after deducting Medicare, Social Security Federal Income Tax and California State Income tax.

Don’t Miss: New Jersey Tax Refund Status

Myftb: The Window To Your Info Ftbcagov

The window to your information MyFTB

MyFTB is a secure online service allowing you to:

- View estimated tax payments, recent payments made, and the total balance due on your account.

- Look up your California wage and withholding and FTB-issued 1099-G and 1099-INT records.

- Update your mailing address and phone number.

- Pay online with Web Pay.

- Link to additional services offered by the FTB:

- File your tax return with CalFile

- Apply for an installment agreement

- Check your refund status

- Request a paper copy of your filed tax return

- Sign-up for estimated tax payment email reminders

Go to ftb.ca.gov and login or register for MyFTB.

Other Situations When You Must File

If you have a tax liability for 2019 or owe any of the following taxes for 2019, you must file Form 540.

- Tax on a lump-sum distribution.

- Tax on a qualified retirement plan including an Individual Retirement Arrangement or an Archer Medical Savings Account .

- Tax for children under age 19 or student under age 24 who have investment income greater than $2,200 .

- Alternative minimum tax.

- Deferred tax on certain installment obligations.

- Tax on an accumulation distribution from a trust.

Don’t Miss: Self Employed Tax Deductions Worksheet

Income Tax In California: How Is It Calculated And Collected

If you are resident in California, or if you are a non-resident but do business in California, you are required to submit an income tax return if you have earned over a certain threshold. The threshold is subject to change, but you can see a recent chart here.

Calculating your income tax can be done on your own or with the help of a professional service. The FTB offers an online tax calculator to make things easier. You need to know your filing status, which can be one of these five:

- Head of household

- Qualifying widow

You also need to know which form you will be using to file. There are three different forms, and which one you use will depend on the amount of your taxable income, your filing status, your residency status .

The three forms are:

- Form 540 NR: Long or Short

You can find full details of which form you should choose on the FTB website. Once youve used the form to find your taxable income, simply enter it into the calculator to find out how much you owe.

For many taxpayers, your state income taxes will be withheld from your paycheck, based on the withholding allowances you chose on Form DE4. If you filled out the form correctly, it is likely that when you file your income tax return, you will not owe additional taxes, and might even get a refund.

Filing Your California Income Tax Return

As we mentioned before, almost every resident in California must file an income tax return. There are many different ways to file your California state taxes online, starting with the FTBs free online portal, CalFile. Even if your taxes are being withheld at the proper rate, and even if you expect a refund, you have to file or you could face a penalty.

The deadline for filing your California income tax return is April 15. If you do not owe any tax or are owed a refund, you have an automatic 6-month extension until October 15. If you are non-military living or traveling abroad on tax day, you get another 2 month extension, making the final deadline December 15. Military personnel may qualify for additional extensions.

If you miss the deadline to file and ignore reminder notices from the FTB, you could face a Failure to File penalty of 5% of the tax due for every month that the return is late, up to a maximum of 25%.

If they suspect fraud, the penalty jumps from 5% to 15% and from 25% to 75% respectively. The minimum penalty is the lesser of $135 or 100% of the tax required to be shown on the return.

Don’t Miss: When Is Tax Returns Due

Voting Is Everybodys Business

You may register to vote if you meet these requirements:

- You are a United States citizen.

- You are a resident of California.

- You will be 18 years old by the date of the next election.

- You are not in prison or on parole for the conviction of a felony.

You need to re-register every time you move, change your name, or wish to change political parties. In order to vote in an election, you must be registered to vote at least 15 days before that election. If you need to get a Voter Registration Card, call the California Secretary of Stateâs voter hotline at 800-345-VOTE or go to sos.ca.gov.

To register to vote in California, you must be:

- A United States citizen and a resident of California,

- 18 years old or older on Election Day,

- Not currently in state or federal prison or on parole for the conviction of a felony, and

- Not currently found mentally incompetent to vote by a court.

Pre-register at 16. Vote at 18. Voter pre-registration is now available for 16 and 17 year olds who otherwise meet the voter registration eligibility requirements. California youth who pre-register to vote will have their registration become active once they turn 18 years old.

If you wish to receive a paper Voter Registration or Pre-Registration Application, call the California Secretary of Stateâs Voter Hotline at 800-345-VOTE or simply register online at RegisterToVote.ca.gov. For more information about how and when to register to vote, visit sos.ca.gov/elections.

Itâs Your Right Register and Vote

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: What Do You Need To Do Your Taxes

Updates To The California State Tax Calculator

The following updates have been applied to the Tax calculator:

- Selectable Tax year

- Tax calculations allow for Tax-Deferred Retirement Plan

- Tax calculations allow for Cafeteria or other Pre-Tax Plans

- Selectable Tax year

- Updated to apply Medicare and Social Security deductions as Pre-Federal Tax calculation Thank you Justin Duel

The California State tax calculator is as good as the feedback, your support, requests and bug catches help to improve the accuracy of the tax calculator for all.

This CA State Tax Calculator balances ease of use with transparency of salary calculation but is provided for example purposes only. Remember that you should always seek professional advice and audit your CA State and Federal tax returns.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Pay Capital Gains Tax

Which Form Should I Use

Tip: e-file and you wonât have to decide which form to use! The software will select the correct form for you.

Were you and your spouse/RDP residents during the entire year 2019?

- Yes. Check the chart below to see which form to use.

- No. Use Form 540NR. To download or order the California Nonresident or PartâYear Resident Income Tax Booklet, go to ftb.ca.gov/forms or see, âWhere to Get Income Tax Forms and Publications.â

| Form 540 2EZ

Form not included in this booklet. If you qualify to use Form 540 2EZ, see âWhere To Get Income Tax Forms and Publicationsâ to download or order this form. |

Form 540 |

|---|

If you qualify to use Form 540 2EZ, you may be eligible to use CalFile.

Visit ftb.ca.gov and search for calfile. Itâs fast, easy, and free.

If you donât qualify for CalFile, you qualify for e-file.

Go to ftb.ca.gov and search for efile options.

California State Controller’s Office: Paycheck Calculator Download

The Internal Revenue Service redesigned the Form W-4, Employeeâs Withholding Certificate, to be used starting in 2020.â¯â¯ It also issued regulations updating the federal income tax withholding tables and computational procedures in Publication 15-T, Federal Income Tax Withholding Methods. The State Controller’s Office has updated the Employee Action Request, STD. 686 form, to reflect the redesign. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll.⯠The Paycheck Calculator below allows employees to see how these changes affect pay and withholding.⯠Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck. ⯠If you would like to update your withholding, please contact your Human Resources office.

â¯If you have Microsoft Excel or a spreadsheet software application that can read an XLS file, you can download a spreadsheet that will do paycheck calculations. This may be useful if you are considering changing your federal or state tax withholding, deferred compensation, or tax-sheltered annuity amounts.

â¯If you have difficulty viewing the input calculation screen, press and hold the “Ctrl” key then tap the F10 key to maximize the viewing screen.⯠Forâ¯a full-screen view of the Excel file, double-click the title bar area.â¯

| Tax Year |

|---|

Read Also: Irs Status Of Tax Return

Refund Or No Amount Due

Line 115 â Refund or No Amount Due

Did you report amounts on line 110, line 112, or line 113?

- No

- Enter the amount from line 96 on line 115. This is your refund amount. If it is less than $1, attach a written statement to your Form 540 requesting the refund.

- Yes

- Combine the amounts from line 110, line 112, and line 113. If the result is:

- Less than line 96, subtract the sum of line 110, line 112, and line 113 from line 96 and enter on line 115. This is your refund amount.

- More than line 96, subtract line 96 from the sum of line 110, line 112, and line 113 and enter the result on line 114. This is your total amount due. For payment options, see line 111 instructions.

Tax Law Changes/whats New

Health Care Mandate

Effective January 1, 2020, the Minimum Essential Coverage Individual Mandate requires Californians to obtain and maintain qualifying health insurance coverage. Those who choose to go without coverage could face a financial penalty unless they qualify for an exemption. For information about health coverage options and financial help, go to coveredca.com. For information about the penalty, go to ftb.ca.gov/healthmandate.

Voluntary Contributions

You may contribute to the following new fund:

- Suicide Prevention Voluntary Tax Contribution Fund

Loophole Closure and Small Business and Working Families Tax Relief Act of 2019

The Tax Cuts and Jobs Act signed into law on December 22, 2017, made changes to the IRC. California R& TC does not conform to all of the changes. In general, for taxable years beginning on or after January 1, 2019, California conforms to the following TCJA provisions:

- California Achieving a Better Life Experience Program

- Student loan discharged on account of death or disability

- Federal Deposit Insurance Corporation Premiums

- Excess employee compensation

- Excess business loss

Like-Kind Exchanges

The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. California conforms to this change under the TCJA for exchanges initiated after January 10, 2019. However, for California purposes, with regard to individuals, this limitation only applies to:

Alimony

Recommended Reading: What Is The Federal Tax On Gasoline

Whats Californias State Disability Insurance/temporary Disability Insurance

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness.

- Employee pays in CA, NJ, PR, and RI

- Employer pays in CA, HI, NJ, NY, and Puerto Rico

- Employers or employees are required to pay this tax in California, Hawaii, New Jersey, New York, Rhode Island plus Puerto Rico

For Californiaâs disability insurance tax rates today and in past years, check Californiaâs SDI section in Payroll Resources.

California State Rate For 2022

6.5% is the smallest possible tax rate 7.25%, 7.375%, 7.5%, 7.75%, 7.875%, 7.975%, 8%, 8.125%, 8.25%, 8.35%, 8.375%, 8.475%, 8.5%, 8.625%, 8.725%, 8.75%, 8.875%, 8.975%, 9%, 9.125%, 9.225%, 9.25%, 9.375%, 9.5%, 9.625%, 9.75%, 9.875%, 10%, 10.25%, 10.5% are all the other possible sales tax rates of California cities.10.75% is the highest possible tax rate

The average combined rate of every zip code in California is 8.351%

Also Check: Long Term Capital Gain Tax Calculation

Common Errors And How To Prevent Them

Help us process your tax return quickly and accurately. When we find an error, it requires us to stop to verify the information on the tax return, which slows processing. The most common errors consist of:

- Claiming the wrong amount of estimated tax payments.

- Claiming the wrong amount of standard deduction or itemized deductions.

- Claiming a dependent already claimed on another return.

- The amount of refund or payments made on an original return does not match our records when amending your tax return.

- Claiming the wrong amount of withholding by incorrectly totaling or transferring the amounts from your W-2.

- Claiming the wrong amount of real estate withholding.

- Claiming the wrong amount of SDI.

- Claiming the wrong amount of exemption credits.

To avoid errors and help process your tax return faster, use these helpful hints when preparing your tax return.