In Most Cases Your Home Has An Exemption

The single biggest asset many people have is their home, and depending on the real estate market, a homeowner might realize a huge capital gain on a sale. The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax, as long as you meet all three conditions:

If you meet these conditions, you can exclude up to $250,000 of your gain if you’re filing as single, head of household, or married filing separately and $500,000 if you’re married filing jointly.

Business Income Isn’t A Capital Gain

If you operate a business that buys and sells items, your gains from such sales will be consideredand taxed asbusiness income rather than capital gains.

For example, many people buy items at antique stores and garage sales and then resell them in online auctions. Do this in a businesslike manner and with the intention of making a profit, and the IRS will view it as a business.

- The money you pay out for items is a business expense.

- The money you receive is business revenue.

- The difference between them is business income, subject to self-employment taxes.

Let a tax expert do your investment taxes for you, start to finish. With TurboTax Live Full Service Premier, our specialized tax experts are here to help with anything from stocks to crypto to rental income. Backed by our Full Service Guarantee.You can also file your own taxes with TurboTax Premier. Your investment tax situation, covered. File confidently with Americas #1 tax prep provider.

A Closer Look At Capital Gains Tax

If you’ve recently earned profit from selling an investment, you may be required to pay capital gains tax. In Canada, capital gains or losses are realized only when assets are sold and are subject to capital gains tax. In this article, we will focus solely on gains realized through the sale of securities . A good understanding of this form of taxation may help you formulate personalized tax saving strategies.

While this article offers general guidance, it is not tax or investment advice. It is always in your best interest to work with a tax or investment professional who can offer personalized support.

Recommended Reading: My Tax Return Was Accepted

Will Capital Gains Tax Rates Change For 2023

Capital gains tax rates are the same in 2023 as they were in 2022: 0%, 15%, or 20%, depending on your income. The higher your income, the higher your rate. While the tax rates remain unchanged for 2023, the income required to qualify for each bracket goes up to adjust for inflation. The maximum zero-rate taxable income amount is $89,250 for married filing jointly and surviving spouses, $59,750 for heads of household, and $44,625 for married filing separately taxpayers.

Applying Listed Personal Property Losses

You have a listed personal property loss if, in a particular year, your losses from dispositions of LPP are more than your gains from such dispositions. Applying this type of loss is different from applying other capital losses because of the following reasons:

- You can only deduct losses from the disposition of LPP from any gains you had from selling other LPP

- The LPP losses you deduct in the year cannot be more than your LPP gains from such dispositions for that year

- You cannot use this type of loss to reduce any capital gains you had from selling other types of property

If you have an LPP loss in 2021, you can use the loss to reduce gains from dispositions of LPP you had in any of the three years before 2021 or the seven years after.

For information on how to apply a prior-year LPP loss to 2021 gains from dispositions of LPP, see Listed personal property.

To carry back your 2021 LPP losses to reduce your LPP net gains from 2018, 2019, and 2020, complete Form T1A, Request for Loss Carryback, and include it with your 2021 income tax and benefit return . Do not file an amended return for the year to which you want to apply the loss.

Example

Nathan should not complete Schedule 3 for 2021. However, he should keep a record of his LPP loss in case he wants to apply the loss against LPP gains in another year.

You May Like: When Do I Have To File Taxes 2021

When Do You Pay Capital Gains Taxes

You generally owe capital gains tax for the tax year you sell an investment. For example, if you sell a stock in June 2022, youll need to report it when you file your 2022 tax return by April 2023 or October 2023 if you file an extension.

Remember: Capital gains tax isnt due until after an investment is sold.

When you sell an investment, its called a realized gain or loss. The transaction is complete and youve made your profit or taken your loss.

If you havent actually sold the capital asset, any investment profits or losses are called unrealized gains/losses.

State Taxes On Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you’re lucky enough to live somewhere with no state income tax, you won’t have to worry about capital gains taxes at the state level.

New Hampshire, for example, doesn’t tax income, but does tax dividends and interest. By comparison, states with high income tax California, New York, Oregon, Minnesota, New Jersey and Vermont) also have high taxes on capital gains too. A good capital gains calculator, like ours, takes both federal and state taxation into account.

You May Like: Are Lawyer Fees Tax Deductible

What Happens If You Don’t Pay Capital Gains Tax

If you forget to pay taxes on your trades or hope that you can skip out on capital gains taxes by flying under the radar, you good be setting yourself up for a major headache. … In rare cases, taxpayers can even be prosecuted for tax evasion, which includes a penalty of up to $250,000 and 5 years in prison.

Gift The Assets To A Family Member

Gifting your cryptocurrency to family members could be another way to reduce your crypto tax payment.

The IRS allows tax-free gifts of up to $16,000 per beneficiary per year. If the beneficiary has a low income they do not have to pay taxes on the appreciation when they transfer it. So, at the very least, you pay less tax than if you sold the cryptocurrency yourself.

Also Check: How To File 2020 Taxes

Capital Gain Calculation In Four Steps

Looking for a capital gains tax calculator? When you file with H& R Block Premium, theres a capital gains tax calculator built right in. Once youve added the information about your asset, youll see a results page that outlines your total gain or loss. Of course, you could also get help from our tax pros when you file.

How To Determine Your Payment

Complete the IRS Estimated Tax Worksheet in Form 1040-ES to calculate the size and frequency of your estimated tax payments. There are four estimated tax payment deadlines during the year. The first-, second-, third- and fourth-quarter deadlines are April 15, June 15, September 15, and January 15, respectively, unless the deadline falls on a weekend or national holiday, in which case the deadline falls on the first non-holiday weekday following the standard date.

Estimated tax payments should be made in the quarter in which you receive the capital gains. For example, if you receive all the capital gains on May 31, make your estimated tax payment on June 15. If you receive the capital gain distribution evenly throughout the year, you need to make four payments. Be sure to take into consideration your filing status and other elements such as capital losses.

In many cases, capital losses can offset the amount of capital gains, this is known as tax-loss harvesting. Be aware there are rules regarding tax-loss harvesting that can nullify their value such as the rules on wash sales of securities.

If you find yourself making estimated payments to the IRS then you may also need to make estimated tax payments to the state. Many people forget about state taxes when planning quarterly estimated tax payments. Make sure that you also know what the state will expect as well as federal.

Read Also: New Jersey Tax Refund Status

Gifts Of Ecologically Sensitive Land

If you made a gift of ecologically sensitive land to certain qualified donees , the inclusion rate of zero may apply to your capital gain. Use Form T1170, Capital Gains on Gifts of Certain Capital Property, to report the amounts.

Note A gift of ecologically sensitive land cannot be made to a private foundation after March 21, 2017.

To qualify for the capital gains inclusion rate of zero, you must meet certain conditions, and other special rules may apply.

For more information, see Pamphlet P113, Gifts and Income Tax.

Will I Owe Capital Gains Tax If I Sell My Home

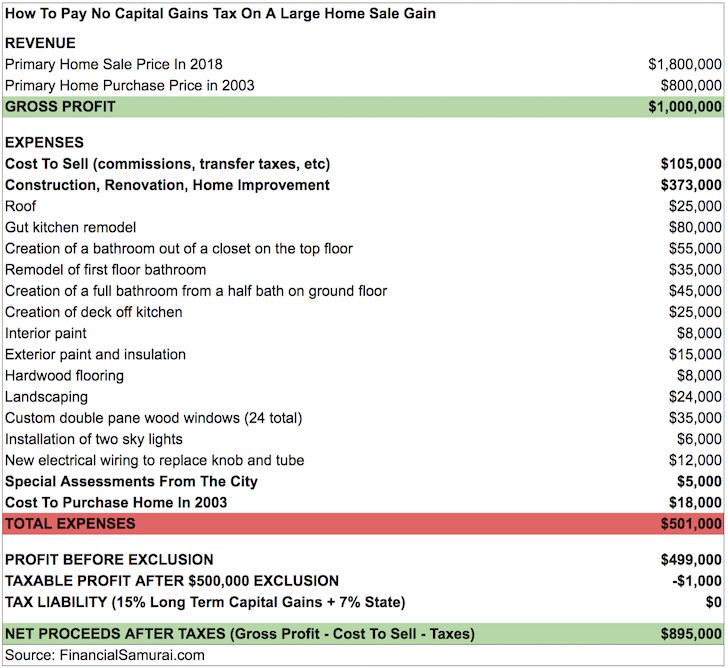

If you have less than a $250,000 gain on the sale of your home , you will not have to pay capital gains tax on the sale of your home. You must have lived in the home for at least two of the previous five years to qualify for the exemption . If your gain exceeds the exemption amount, you will have to pay capital gains tax on the excess.

Read Also: Sales Tax In Alameda County

Take Advantage Of Tax

When you invest your money through a retirement plan, such as a 401, 403, or individual retirement account , it will grow without being subject to immediate taxes. You can also buy and sell investments within your retirement account without triggering capital gains tax.

In the case of traditional retirement accounts, your gains will be taxed as ordinary income when you withdraw money, but by then, you may be in a lower tax bracket than when you were working. With Roth IRA accounts, however, the money you withdraw will be tax-freeas long as you follow the relevant rules.

For investments outside of these accounts, it might behoove investors near retirement to wait until they stop working to sell. If their retirement income is low enough, their capital gains tax bill might be reduced, or they may be able to avoid paying any capital gains tax. But if theyre already in one of the no-pay brackets, theres a key factor to keep in mind: If the capital gain is large enough, it could increase their total taxable income to a level where they would incur a tax bill on their gains.

Capital losses can offset your capital gains as well as a portion of your regular income. Any amount left over after that can be carried over to future years.

Working Out Your Capital Gain

To quickly figure out how much capital gains tax youâll pay – when selling your asset, take the selling price and subtract its original cost and associated expenses . The remaining amount is your capital gain .

If youâve made a capital gain and you’ve held an asset for greater than 12 months , you can apply the 50% discount to work out your net capital gain .

Companies and individuals pay different rates of capital gains tax. If youâre a company, youâre not entitled to any capital gains tax discount and youâll pay 30% tax on any net capital gains. If youâre an individual, the rate paid is the same as your income tax rate for that year. For SMSF, the tax rate is 15% and the discount is 33.3% .

Have confidence in your future with help from a financial adviser.

Recommended Reading: What Is Self Employment Tax

Offset Capital Gains With Capital Losses

When you sell a stock or other asset for less than what you paid for it, you experience a capital loss.

You can use capital losses to offset capital gains. If you made a big profit earlier in the year, selling stocks at a loss can reduce or even eliminate how much you owe in capital gains taxes.

This strategy is called tax loss harvesting. Many financial advisors offer this service. Its also a feature of several robo-advisors, such as Wealthfront.

If your capital losses are greater than $3,000, you can carry those losses forward indefinitely and deduct them from your capital gains in the future.

Get Your Investment Taxes Done Right

For stocks, crypto, ESPPs, rental property income and more, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: New Mexico Tax Deadline 2022

What Is The Capital Gains Tax Rate

Your capital gains tax rate will depend on your current tax bracket, the length of time youve held the asset and whether the property was your primary residence. Well look at that below.

Its also important to know the type of asset youre dealing with, because while most long-term capital gains are taxed at rates of up to 20% based on income, there are situations in which higher rates apply.

Watch Your Holding Periods

Remember that an asset must be sold more than a year to the day after it was purchased in order for the sale to qualify for treatment as a long-term capital gain. If you are selling a security that was bought about a year ago, be sure to check the actual trade date of the purchase before you sell. You might be able to avoid its treatment as a short-term capital gain by waiting for only a few days.

These timing maneuvers matter more with large trades than small ones, of course. The same applies if you are in a higher tax bracket rather than a lower one.

Also Check: North Carolina 529 Tax Deduction

What Happens If I Make A Capital Loss

Youd make a capital loss on your assets if you sold them for less than you paid for them.

If you make a capital loss, you can use it to reduce a capital gain in the same financial year.

If your capital losses are greater than your capital gains, or if you make a capital loss in a financial year in which you dont make a capital gain, you can generally carry the capital loss forward and deduct it against any capital gains you make in future years.

Understanding Capital Gains And Tax

A capital gain or loss is the difference between what you paid for an asset and what you sold it for. This takes into account any incidental costs on the purchase and sale. So, if you sell an asset for more than you paid for it, thatâs a capital gain. And if you sell it for less, that is considered a capital loss.

Capital gains tax applies to capital gains made when you dispose of any asset, except for specific exemptions .

Being organised is key when trying to quickly calculate and pay capital gains tax. And a good way to be organised is to keep up to date records by holding on to things like:

- initial sale contracts and other receipts for other expenses

- interest paid on related borrowings

- receipts for ongoing expenses

Read Also: Is Hazard Insurance Tax Deductible

How Do I Avoid The Capital Gains Tax On Real Estate

If you have owned and occupied your property for at least 2 of the last 5 years, you can avoid paying capital gains taxes on the first $250,000 for single-filers and $500,000 for married people filing jointly.

Visit the IRS website to review additional rules that may help you qualify for the capital gains tax exemption.

Realized Gains Vs Unrealized Gains

Gains that are “on paper” only are called “unrealized gains.” For example, if you bought a share for $10 and it’s now worth $12, you have an unrealized gain of $2. You won’t pay any taxes until you sell the share.

Unrealized gains could be very important if you invest in funds, however. When you buy shares of a mutual fund or ETF , you’re also “buying” any unrealized gains it hasand you’ll be subject to their eventual taxation.

Also Check: Last Day To Sell Stock For Tax-loss 2021