How Do I Get My State Tax Transcripts

Online To read, print, or download your transcript online, youll need to register at IRS.gov. To sign-up, create an account with a username and a password. By mail To get a transcript delivered by postal mail, submit your request online. The IRS will send your transcript within 10 days of receiving your request.

What Is A Tax Transcript

What is a tax transcript, and how can you obtain one? IRS tax transcripts are summary documents of your tax return information, and theyre often used as proof of income when applying for loans. You may also use a tax transcript when determining the amount of estimated taxes that you might owe in the future. If youre completing financial aid documents, such as the FAFSA, you will likely need to request a tax transcript if you dont have a copy of your return already.

Is The Tax Return Transcript The Same As The Tax Return

The tax return is a form filed with the IRS that is used to determine an individuals tax liability. The tax return transcript is a document tax filers can request from the IRS that includes the information submitted on the tax return.

Why is my tax transcript not available?

If you didnt pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call 800-908-9946.

Also Check: Can I Use Bank Statements As Receipts For Taxes

Request A Business Tax Transcript

As mentioned earlier, the most common use for tax transcripts is to provide income verification to a lending institution thats considering you for a loan. In 2019, the IRS ceased mailing tax transcripts to third parties, except participants of the Income Verification Express Service program. Therefore, the easiest means for an individual to acquire a tax transcript is simply to request it directly from the IRS.

To get a business tax transcript, go to the IRS website, where you can request a transcript by mail or online. Whereas in previous years, individuals couldnt get an electronic copy of a tax transcript from the IRS without using a third-party service, the online request form now allows taxpayers to access their transcripts quickly and easily.

Irs Tax Transcript: How Can You Get A Tax Transcript Online Immediately

We explain the process that you need to follow

- Fourth Stimulus Check 2022.How to receive this $1,400 payment

There are hundreds of thousands – if not millions – of people in the United States currently sorting their taxes, but sometimes you might need a copy of your filed tax return from the IRS, which can lead to some making a request for a tax transcript.

The benefit to this is that is can be helpful to you when you prepare future tax returns, and you will need it if you are made to fix something from a prior year tax return.

Some of the examples in which you might need a tax transcript are when you apply for a loan to buy a property or if you are starting a new business.

Don’t Miss: Can I Still File My 2017 Taxes Electronically In 2021

Can I Get A Copy Of My Original Tax Return

A tax transcript isnt a photocopy of the original return. Instead, a transcript displays a certain amount of information, processed and transcribed.

If you want to access a photocopy of your tax return, you will need to submit Form 4506, which can be found on the IRS website.

This will need to be mailed to the IRS, and there is an associated fee. Expect a processing time of up to 75 days.

Record Of Account Transcript

How Are Bonuses Taxed?

Financial planning and Investment advisory services offered through Diversified, LLC. Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC. Headquartered at 80 State Street, Albany, NY 12207. Purshe Kaplan Sterling Investments and Diversified, LLC are not affiliated companies.

Diversified, LLC does not provide tax advice and should not be relied upon for purposes of filing taxes, estimating tax liabilities or avoiding any tax or penalty imposed by law. The information provided by Diversified, LLC should not be a substitute for consulting a qualified tax advisor, accountant, or other professional concerning the application of tax law or an individual tax situation.

Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell securities in the United States or in any other jurisdiction.

You May Like: Tax Short Term Capital Gains

What Is An Irs Tax Transcript And How Do I Request One

OVERVIEW

Learn which situations may require an IRS tax transcript, along with how to request your tax transcript, and how to interpret it when it arrives.

Do you need information from a tax return you filed three years ago because you’re making a major purchase and the lender wants to see your tax history? Maybe you need to provide your adjusted gross income from the past three years to demonstrate your financial picture but can’t find your tax return paperwork.

If you find yourself in a similar situation, you don’t need to panic. You can simply find this information by downloading your IRS tax transcript online or requesting a copy in the mail. This form provides most of the information you submit on your Form 1040, and you can access it for free.

How To Get A Tax Transcript Online

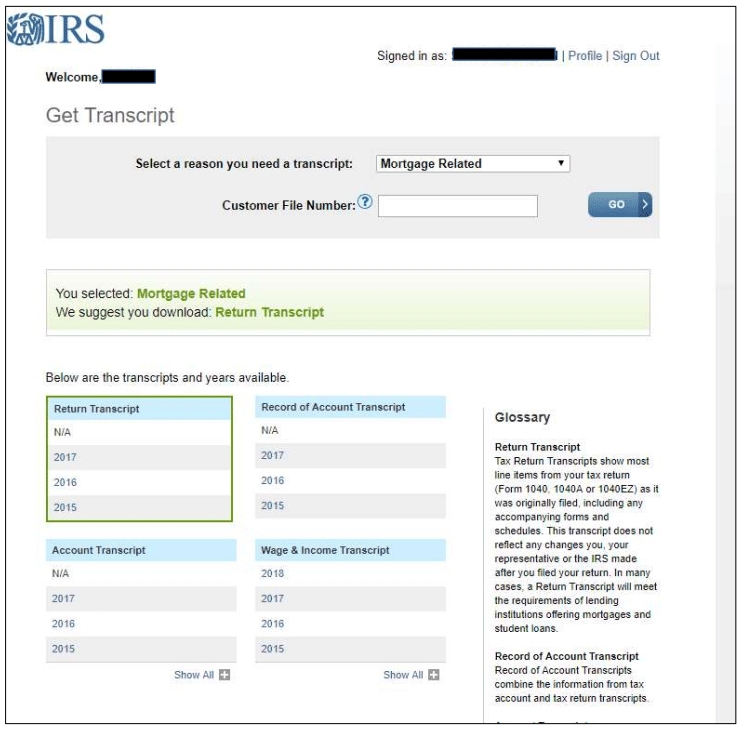

You are able to immediately access your free transcript online, as you can do this by going to IRS.gov and using the Get Transcript tool.

Alternatively, if you would rather get your tax transcript using another method, you are able to get it by phone, by mail or by fax within five to 10 days from the point at which the IRS receives your request.

Should you need a copy of your filed and processed tax return, there is a $50 fee for each tax year. In order to receive this, you will need to fill in the Form 4506, Request for Copy of Tax Return.

You May Like: Amended Tax Return Deadline 2020

How Do I Get My Tax Transcript

An IRS Tax Return Transcript can be obtained: ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

How do you request tax transcripts from IRS?

- There are several ways to request your tax return transcript the IRS does not charge to provide a return transcript to you. Request from the IRS Website: Available at www.irs.gov, Get My Tax Record. You will have a choice of Get Transcript Online or Get Transcript by Mail.

You May Like: Is Hazard Insurance Tax Deductible

Paper Request Form Irs Form 4506t

ONLY the Tax Return Transcript can be obtained using the 4506T-EZ. If you require other IRS documents, as well, and you need or choose to use a paper request form, use the IRS Form 4506-T, instead, as all of the IRS documents may be ordered together on that one form.

NOTE: If any information does not match IRS records, the IRS will notify the tax filer that it was not able to provide the transcript.

Also Check: How Much Can You Earn Before You Owe Taxes

You May Like: Are Municipal Bonds Tax Free

Can I Get An Irs Transcript Online

To request either transcript online, go to www.IRS.gov and look for our new online tool, Order a Transcript. To order by phone, call 800-908-9946 and follow the prompts in the recorded message. Complete Form 4506, Request for Copy of Tax Return, and mail it to the IRS address listed on the form for your area.

Why Might You Need A Transcript

If you keep meticulous records and have all of your tax information neatly organized, you might not ever need a tax transcript. You’ll have your full 1040 to pull exactly what you need.

In the event you may have misplaced your documentation or it isn’t complete, you may need to pull your transcript to provide an official record of your tax information.

One common instance where you might need a tax transcript is when you apply for a mortgage and the lender wants to see a record of your tax history. Mortgage lenders commonly require at least two years of tax information to substantiate your income and typically want to receive it directly from the IRS rather than from the borrower.

You may also need a tax transcript when you apply for financial aid from a college or university through FAFSA. As another common example, you might need to have your tax transcript when you apply for federal health care programs like Medicaid.

Also Check: How Much Do You Have To Make To Claim Taxes

Can I Download My Irs Transcript Online

You may register to use Get Transcript Online to view, print, or download all transcript types listed below. If youre unable to register or you prefer not to use Get Transcript Online, you may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call 800-908-9946.

Receiving The Transcript By Mail

Recommended Reading: How To Check If Your Taxes Were Filed

You May Like: Tax Credits For Electric Vehicles

Do Transcripts Need To Be Sent By Deadline

If you dont need to submit your application immediately and one of your colleges requires Courses & Grades, you should wait until you can complete Courses & Grades before submitting. If you arent able to get your transcript before you need to submit your application to a required college for a deadline, thats okay.

Q6 My Transcript Information Doesn’t Appear To Be Correct What Should I Do

In some cases, we may have changed the reported figures on the original return you filed due to input errors or incomplete or missing information. If we changed the figures on your return during processing, a tax return transcript will show your original figures, labeled “per return,” and the corrected figures labeled “per computer.” It won’t show amendments or adjustments made to the account after the original return has posted. If you filed an amended return or we adjusted your account after it was processed, request a record of account transcript. If the transcript obtained doesn’t appear to be correct or contains unfamiliar information due to possible identity theft, call us at .

Read Also: What Is The Maximum Tax Refund You Can Get

Q4 Can I Use Get Transcript If I’m A Victim Of Identity Theft

Yes, you can still access Get Transcript Online or by Mail. If we’re unable to process your request due to identity theft, you’ll receive an online message, or a letter if using the Mail option, that provides specific instructions to request a transcript. You may also want to visit our Identity Protection page for more information.

How Do I Get My Actual Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

Read Also: How Much Will I Get Paid After Taxes

How Do I Get A Tax Transcript

A tax filer may also obtain a tax return transcript by electronically submitting a transcript request by going to the IRS website www.irs.gov, select Get Your Tax Record, then select the Get Transcript by Mail option. You can also submit a paper Form, 4506T-EZ or 4506-T, or by calling 1-800-908-9946.

How Much Does It Cost To Get A Tax Return Transcript

The IRS does not charge a fee for transcripts, which are available for the current tax year as well as the past three tax years. A tax return transcript shows most line items from your tax return as it was originally filed, including any accompanying forms and schedules.

Read Also: When Are Tax Returns Sent Out

How Do I Read My Tax Transcript Refund

Look for words on the transcript that are the same, or similar to, the words on the blank return. For example, if you’re looking for the amount you entered on Line 4, this amount is your adjusted gross income. On your transcript, it will be listed as “adjusted gross income” under “adjustments to income.”

Tax Professionals Can Now Order More Transcripts From The Irs

IR-2021-226, November 16, 2021

WASHINGTON The Internal Revenue Service today announced that, effective Nov. 15, 2021, tax professionals are able to order up to 30 Transcript Delivery System transcripts per client through the Practitioner Priority Service® line. This is an increase from the previous 10 transcripts per client limit.

“Increasing the number of transcripts a caller can receive addresses the concerns the IRS has received from PPS callers. This is another example of addressing concerns from our partners and stakeholders,” said Ken Corbin, the Wage and Investment Commissioner and the IRS Taxpayer Experience Officer.

Through PPS, tax professionals can order a variety of transcripts. Practitioners can receive transcripts for up to five clients per call. There’s no change to the number of clients.

Transcripts available under this newly-expanded limit include the:

- Tax Return Transcript,

Also Check: Out Of State Sales Tax

Are There Other Ways To Get Tax Records

If youre looking for your tax records and you used tax software, your tax software provider may have them on file depending on which provider you used and what program you purchased. If you used a tax preparer, he or she may still have your tax returns on file as well.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

|

Can I Get A Copy Of My Taxes Online

Order Online. The fastest way to get a Tax Return or Account transcript is through the Get Transcript tool available on IRS.gov. Although the IRS temporarily stopped the online viewing and printing of transcripts, Get Transcript still allows you to order your transcript online and receive it by mail.

You May Like: Can You Write Off Property Tax

How Can I Get My Tax Transcripts Without A Credit Card

If your previous year tax returns are not available, you can use the IRS Get Transcript tool. Try the online option first. If you are unable to obtain the transcript online, you can have one sent to the address the IRS has on record for you. You can find IRS Get Transcript here.

How To Complete Any Form Tax Return Transcript Online:

PDF editor permits you to help make changes to your Form Tax Return Transcript from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

IR-2021-226, November 16, 2021

WASHINGTON The Internal Revenue Service today announced that, effective Nov. 15, 2021, tax professionals are able to order up to 30 Transcript Delivery System transcripts per client through the Practitioner Priority Service® line. This is an increase from the previous 10 transcripts per client limit.

Through PPS, tax professionals can order a variety of transcripts. Practitioners can receive transcripts for up to five clients per call. Theres no change to the number of clients.

Also Check: Do You Have To Pay Taxes On Life Insurance