Ein Lookup: How To Find Your Business Tax Id Number

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

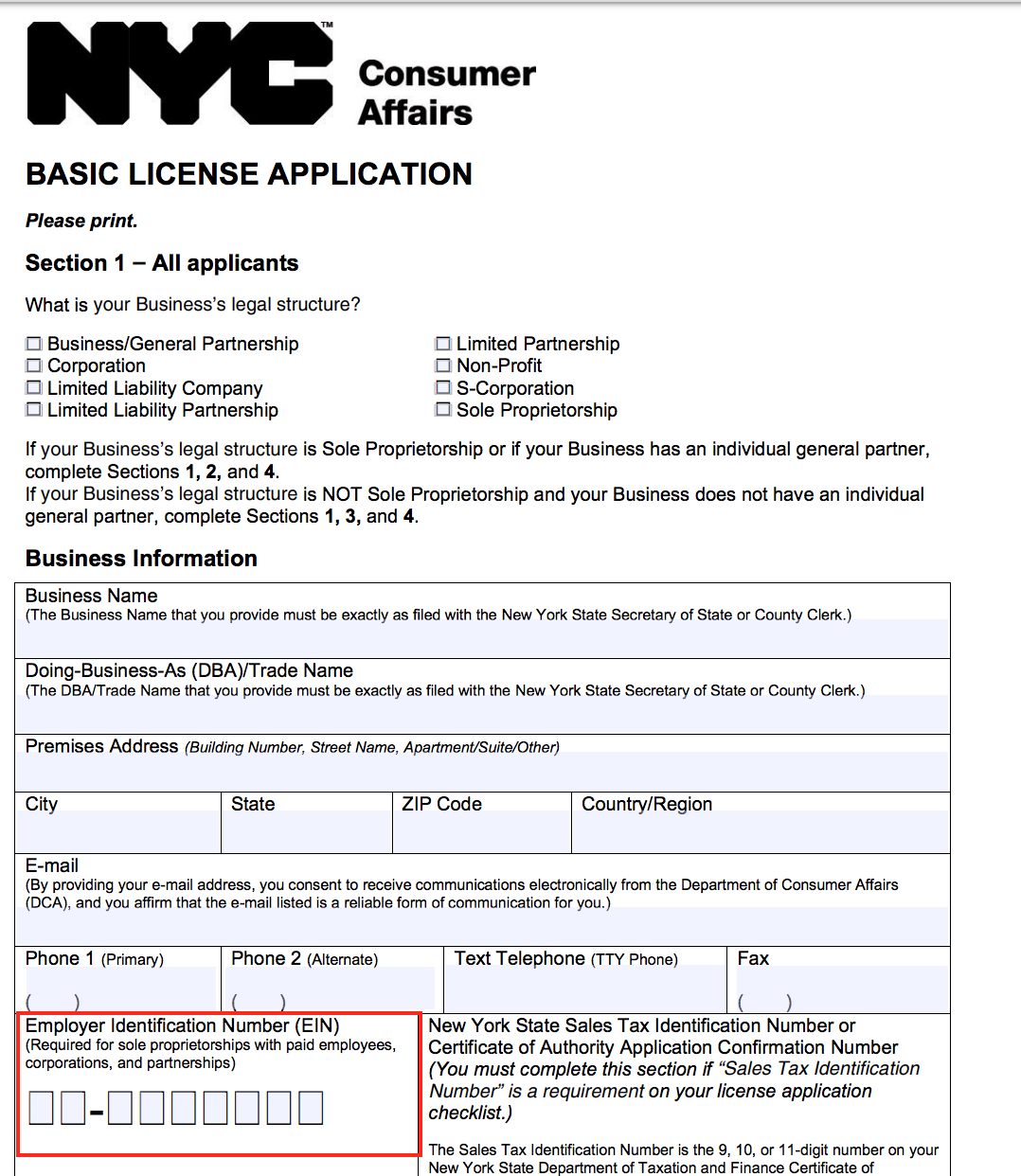

A business tax ID number, also called an employer identification number or federal tax ID, is a unique nine-digit number that identifies your business with the IRS. Owners of most types of business entities need a business tax ID number to file taxes, open a business bank account, obtain a business license, or apply for a business loan.

How Much Do You Need?

Most people know their social security number by heart, but not all business owners know their business tax ID number. Your EIN isn’t something that you use on a day-to-day basis, so keeping this number top of mind isn’t as easy as remembering your company’s phone number or address.

However, your EIN is essential for some very important business transactions, like filing business taxes and obtaining small business loans. Accuracy and speed matter in those situations. Not having your business tax ID can prevent you from getting crucial funding for your business or meeting a business tax deadline.

How to find your business tax ID number:

Check your EIN confirmation letter

Check other places your EIN could be recorded

Does My Business Need A Federal Tax Id Number

A business needs a federal tax ID number in order to apply for a business bank account or loan. Here are several other questions to help you figure out whether your business might need a federal tax ID number:

- Do you have employees?

- Do you withhold taxes on any income other than wages paid to a nonresident alien?

- Is your business a partnership or corporation?

- Is your business involved with mortgage investments?

- Is your business involved with real estate conduits?

- Is your business involved with nonprofit organizations?

- Does your business handle estates, trusts or IRAs?

- Do you file a return for tobacco, employment, alcohol, firearms or excise taxes?

If the answer to any of these questions is yes, your business likely needs a tax ID. For more information visit IRS.gov

If your business is tax-exempt, you still have to apply for an EIN. However, you must make sure your business meets the tax exemption requirements before you apply for an EIN.

Upon applying for an EIN, tax-exempt businesses have three years to prove their status. You dont want to spend any of that time trying to jump through legal hoops and requirements to meet the tax-exempt regulations.

Does My Business Need To Reapply For A New Ein

Sometimes, your business may need to reapply for a new EIN. The IRS requires you to reapply for one rather than amending your business’s existing EIN. According to the IRS, here are the most common reasons:

- You change the structure of your business, like incorporating or turning your sole proprietorship into a partnership.

- You purchase or inherit an existing business.

- You created a trust with funds from an estate.

- You are subject to a bankruptcy proceeding.

If your circumstances require you to reapply for an EIN, the application process is the same as if youre applying for one for the first time.

Read Also: How To File An Extension Taxes

How To Apply For Ein Number

If you find that you are in need of an EIN, the fastest and easiest way to obtain this federal tax ID number is to apply for an EIN online. You can get a federal tax ID no matter where you are located, such as a Tennessee tax ID.

Other EIN application methods can take up to two weeks to complete. If you apply for an EIN online, youll get the results delivered to your inbox within 1-2 business days plus, you can check your EIN number online anytime you want to review your order, or in the event you lose or misplace your EIN.

If youre still wondering, Can I have more than one EIN? you should consider reviewing your personal assets and business holdings to ensure youre prepared.

Is A Fein Public

Although many entities use their FEINs to report their taxes and other financial information to the IRS and other government entities, it is public information. Corporations must share their FEINs with the other businesses they do business with. It is often needed for completing W-9 forms, providing credit references and sharing other forms of information. Sharing your FEIN sometimes creates unwanted exposure, which leads to some level of vulnerability. Just like Social Security numbers, FEINs should be used and shared discreetly to reduce the risk of identity theft and fraud.

Read Also: Montgomery County Texas Tax Office

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Applying For Your Federal Tax Id Number

The online EIN application is the fastest way to obtain an Employee Identification Number. Before the third party completes and submits the online application, the following steps must happen:

After those steps are taken, and the third party successfully completes the online application, the IRS assigns the EIN and discloses it to the third party. The taxpayer for whom the third party requested the EIN will get a computer-generated notice from the IRS to acknowledge the EIN was assigned.

Don’t Miss: Tax On Food In Virginia

Employer Tax Responsibilities Explained

Publication 15PDF provides information on employer tax responsibilities related to taxable wages, employment tax withholding and which tax returns must be filed. More complex issues are discussed in Publication 15-APDF and tax treatment of many employee benefits can be found in Publication 15. We recommend employers download these publications from IRS.gov. Copies can be requested online or by calling 1-800-TAX-FORM.

Obtain Federal Tax Id Number

Your Employer Identification Number is a nine-digit number issued by the IRS to identify your business and the type of tax returns you file. It is to be used for business purposes only. You should never use your social security number in its place.

An EIN is generally required for all businesses and it is used for all transactions and correspondence with the IRS and Social Security Administration . Download Understanding Your EIN for a complete guide to how your tax ID number works.

Also Check: Are Real Estate Taxes The Same As Property Taxes

Obtain A Tax Id Number For Your Small Business

Home » Learn » Obtain a Tax ID Number for your Small Business | EIN Number Application

Even small businesses need Employer Identification Numbers, and thats true even if the business doesnt have employees. and are one in the same: Theyre a unique number used to identify your business for the federal government and financial institutions. Heres what you need to know about getting one.

Federal Tax Id For A Business

A federal tax ID lookup is a method of searching for a business’s information using their tax identification number , or employer identification number .

Tax identification numbers are issued to businesses by the IRS depending on their structure. When a business changes its structure, it will usually be issued a new ID number. The United States federal government uses a federal tax identification number for business identification.

An EIN will possess nine numbers and is used by the IRS for administering taxes for the following entities:

- Trust or government agency

Either the grantor, owner, or trustee of an organization will be issued an EIN. The practice of one per responsible party per day applies to the issuance of EINs. To make sure tax administration is successful, the IRS is focused on only providing qualified parties with an EIN. Third-parties applying for an EIN must identify themselves as a third-party designee.

An EIN can be applied for online or by using the paper Form SS-4. An organization whose primary business address is in the United States can apply for an EIN online.

An EIN is not a replacement for a Social Security Number .

Recommended Reading: Do I Pay Taxes On Social Security

What Is A Federal Tax Id Number

Discover the steps involved in getting a federal tax ID number for your new business and how this asset helps simplify a range of financial processes, from paying employees to filing taxes. Presented by Chase for Business.

Getting a federal tax identification number is an important first step when you start your business.

According to the IRS, a federal tax ID number is used to identify a business. There are many reasons why a business may need one, including paying employees, claiming benefits and filing and paying taxes.

Heres how to figure out if you need a federal tax ID number, how to apply for one and when your business should use it.

Is Employee Identification Number Needed

In most cases, small businesses are not required to have an Employee Identification Number. If, for example, somebody is running their business as a sole proprietorship and they have no other employees, they’re most likely not going to need an EIN. If, however, the business in question has more than one employee or they have chosen to structure themselves as either a corporation or a partnership, they’re going to need to apply for an Employee Identification Number.

Some other things that might trigger the need for an Employee Identification Number might include:

- Filing a tobacco tax return

- Filing a firearms tax return

- Setting a Keogh plan up through the business in question

If you’re a business owner and you’re not sure if you need to file for an EIN, it is probably in your best interest to contact an attorney with knowledge and experience in this area to examine your specific situation and help you determine if this is something you’ll need to do. It’s not a good idea to proceed without knowing for sure whether or not you’re going to need an EIN.

Also Check: How To File Taxes Without W2 Or Paystub

What Kinds Of Businesses Need A Tax Id Number

Whether or not a business needs an EIN depends on what it does. If you pay employees at all, you need an EIN so you can withhold taxes, make appropriate tax payments and provide employees with the W2s and other forms they need at the end of the year.

According to the IRS, you also need an EIN if you:

- Choose certain types of business organization

- File certain types of tax returns

- Withhold taxes on income that you paid to non-resident aliens

- Use certain types of tax-deferred pension plans

- Partner with organizations that might require you to have an EIN

Employee Identification Number Vs Taxpayer Identification Number

A Tax Identification Number is a broad term used to describe any type of identification number. An EIN is a specific type of TIN. A TIN is a generic descriptor for an assortment of numbers that can be used on a tax form including but not limited to:

Depending on the nature of the particular taxpayer, the EIN may or may not be the TIN used by the IRS. For sole proprietors, the TIN is often their Social Security number. For corporations, partnerships, trusts, and estates, their TIN is often an EIN.

Also Check: 1 Year Tax Return Mortgage

Minnesota Taxpayer Identification Number

A business needs to obtain a Minnesota tax identification number if it is required to file information returns for income tax purposes, has employees, makes taxable sales, or owes use tax on its purchases. Most businesses need a Minnesota tax identification number. However, a sole proprietorship or single member limited liability company which does not have any of these tax obligations does not need a Minnesota tax identification number. See the Minnesota Department of Revenue Minnesota Sales and Use Tax Business Guide.

You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration, by phone at 651-282-5225 or 800-657-3605, or by filing a paper form Application for Business Registration .

To apply online, youll need your federal employer ID number , if applicable business name or if applicable, Certificate of Assumed Name business owner’s Social Security Number contact phone number and email address the North American Industry Classification Code and business begin date. You will need your federal employer ID number , if applicable the legal name or sole proprietor name and business address the business name if applicable NAICS names and social security numbers of the sole proprietor, officers, partners or representatives and address and name of a contact person. If you do not have Internet access, call 651-282-5225 or 800-657-3605 to speak to a business registration representative.

Other Key Reasons To Get An Ein

Helps Preserve Your Limited Liability

An EIN can help substantiate that you and your business are separate entities, which helps preserve limited liability should your company ever be sued.

Reduces the Potential for Identity Theft

An EIN prevents you from having to give your Social Security number to suppliers or lenders, which significantly reduces your identity theft risk.

Don’t Miss: When Are Tax Returns Sent Out

How To Find A Business Federal Id Number

Related

If you need a federal ID number for your business, you find it through the IRS website. Known as an employer identification number, EIN or tax identification number, it identifies your company to the IRS the same way your Social Security number identifies you as an individual. Once you complete the application process, the IRS assigns your EIN. Finding another business’s EIN takes slightly more work.

Filing And Tax Returns

The tax return for the deceased and their estate are separate. To meet filing requirements, you may need to file different types of tax returns.

Some or all the information you need to file income tax returns for the deceased and their estate may be in their personal records. If you need other items, we can help provide copies of:

- Income documents

- Filed tax returns

Before submitting any information request to the IRS, see request deceased person’s information.

Read Also: Sale Of Second Home Tax Treatment

Foreign Nationals: Individual Taxpayer Identification Number

For those who do not have a Social Security Number — such as nonresidents and resident aliens — they may need to apply for an individual taxpayer identification number , which is also nine digits. To apply, you’ll need to file Form W-7: IRS Application for Individual Taxpayer Identification Number. You will be asked to provide proof of your legal resident or visitor status and will have to file it through an “Acceptance Agent” authorized by the IRS.

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

Also Check: How To Report Tax Fraud To The Irs

An Intro To Tax Id Numbers For Small Businesses

Meta description: Tax ID numbers help the IRS track which people and entities have paid or owe taxes. Find out more about tax IDs and which ones you might need for your business.

If youre a United States citizen or someone who pays taxes within the United States, you have at least one tax ID number. Entrepreneurs who want to start new business adventures may need to apply for additional tax IDs to ensure they stay on the right side of tax lawsboth federal and state. Find out more about tax ID numbers below, whether you need one and how to apply for it.