Total Tax Burden: 574%

Before 2016, Tennessee taxed income from investments, including most interest and dividends but not wages. Legislation passed in 2016 included a plan to lower taxes on unearned income by 1% per year until the tax was eliminated at the start of 2021. To make up for the shortfall, Tennessee levies high sales taxes and the highest beer tax of any state in the union at $1.29 per gallon.

With full implementation of the new legislation, Tennessee expects to attract retirees who depend heavily on investment income. The states total tax burden is 5.74%, the second-lowest in the nation. In the affordability category, Tennessee ranks 17th overall, and on the U.S. News& World Report Best States to Live In list, it ranks 29th.

In 2019, at $9,868 per pupil, Tennessee ranked just above Texas in terms of education spending in the southern U.S. It also did a better job of fairly distributing its school funding than the Lone Star State did, earning the Equality State a C in 2015.

At $7,372 per capita, Tennessee ranked 39th in terms of healthcare spending in 2014. The state hasnt received an official letter grade for its infrastructure yet, although the ASCE did note that 4.4% of its bridges are structurally deficient and 276 of its dams have a high hazard potential.

What States Do Not Tax Pension

The following states are exempt from income taxes on pension income:

What states have no tax on pension income?

- The states that dont tax any income include Alaska, Florida, Nevada, South Dakota and Texas. Washington and Wyoming also lack an income tax. Alabama, Hawaii and Illinois exempt certain qualified private pensions, claims About.com.

Total Tax Burden: 684%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshires Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027. The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.

Even so, New Hampshires total tax burden is just 6.84%, according to WalletHub, ranking the state fifth in the nation. The state ranks fourth on the U.S. News & World Report list of Best States to Live In and 38th in the nation for affordability.

Although New Hampshire spent more on education than any other state on this list at $17,462 per pupil in 2019, its outlay was among the lowest in the northeastern region of the U.S. Additionally, in 2015 it earned a grade of D from the Education Law Center for its school funding distribution.

New Hampshire received a marginally better grade of C- for its infrastructure in 2017. At $9,589 per capita in 2014, its healthcare spending is the ninth highest in the nation.

Don’t Miss: Travis County Tax Office – Main

Why Choose Pennsylvania For Your Retirement

Pennsylvania can be a great place to start your retirement living journey with Cornwall, PA being the best suburb in PA to retire in! Just ask the retirees who are already living there. A few of the positive features to those who call Pennsylvania home include:

Retirement Information Ira Topics Pension Exclusions Social Security Benefits

Q. Im planning to move to Delaware within the next year. I am retired. I am receiving a pension and also withdrawing income from a 401K. My spouse receives social security. What personal income taxes will I be required to pay as a resident of Delaware? I also would like information on real estate property taxes.

A. As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, persons 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income . Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans , such as IRA, 401 , and Keough plans, and government deferred compensation plans . The combined total of pension and eligible retirement income may not exceed $12,500 per person age 60 or over. If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income.

Also, Delaware has a graduated tax rate ranging from 2.2% to 5.55% for income under $60,000, and 6.60% for income of $60,000 or over.

For information regarding property taxes you may contact the Property Tax office for the county you plan to live in.

You May Like: How Much Is Tax At Walmart

All The States That Don’t Tax Retirement Income

States vary widely in the way they tax retirement income so location is an important consideration in financially planning for retirement. Some states dont levy income states on any sort of retirement income, while others tax IRA and 401 distributions, pension payouts and even social security payments like ordinary income. Income taxes are just part of the story, however, as some states with low or no income taxes have high property, sales and other taxes. Consider working with a financial advisor when you are planning for retirement to make sure you avoid any unnecessary taxes.

Retirement Income Tax Basics

Most retirement income can be subject to federal income taxes. That includes Social Security benefits, pension payments and distributions from IRA and 401 plans. Exceptions include distributions from Roth IRA and Roth 401 plans. Federal income taxes on Roth contributions are paid before the contributions are made. These contributions as well as any investment gains can be withdrawn free of federal income taxes after five years if you have reached age 59 1/2.

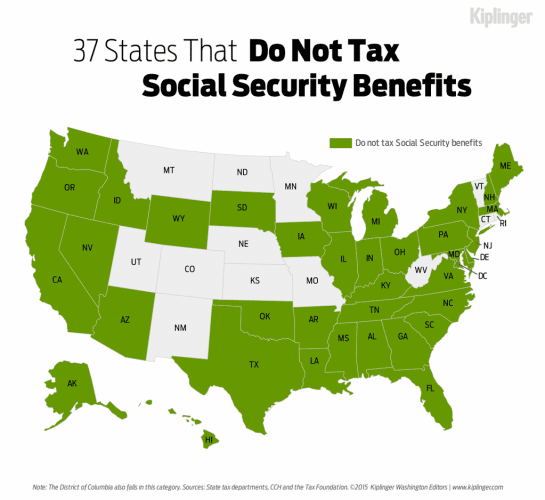

The situation is more complex when it comes to how states will tax your income. Many states have no income tax at all, so all retirement income, as well as other income, is state tax-free. Most states specifically exclude Social Security benefits from taxation. Some others also exempt retirement account distributions and pensions. Most have a mix of approaches to taxing retirement income.

Bottom Line

Does The State Tax Pensions

Many states tax income from pensions and 401 plans, but 12 states do not. These states are Alaska, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington and Wyoming.

Most of these states dont have state income tax at all, with the exception of Illinois, Mississippi, and Pennsylvania. Alabama and Hawaii tax 401 plans and IRAs, but not pension plans.

Also Check: File Income Tax Return India

Taxes And Retirement Living In Pennsylvania

When looking for the right state to begin your retirement, you want to consider taxes. Youll need to ask yourself what type of income is taxed in PA so that you can stretch your retirement income as far as it will go. The tax benefits of Pennsylvania alone make it the best place for retirees.

If youve asked yourself the question, is retirement income taxable in PA?, then the answer is no! Pennsylvania does not tax its residents retirement income. It is one of only two states, and the only state on the East Coast, that considers pension income completely tax exempt.

The Keystone State also has the lowest flat tax rate in the country at just 3.07 percent. It is impossible to escape federal income taxes, but when you retire, you might lower your tax obligation by moving to a state like Pennsylvania where the flat tax rate is low and pension income is tax exempt.

Retirement income typically consists of pooling income from several different sources:

When you are a resident of Pennsylvania, your retirement income is tax exempt. Pennsylvania is one of the most generous states in the country for retirees income. They are also helpful when it comes to other taxes.

How Many Types Of Pension Do We Have

There are 2 main types of pension plans: defined benefit and defined contribution .

What are the 3 main types of pensions?

There are three main types of pensions. State pensions , occupational pensions and private / personal pensions .

How do I know what type of pension I have?

If you know you have a retirement pension but are unsure what type of retirement plan this is, your best bet is to contact your pension provider. They will be able to provide you with all the details of your program, including its type, the fees you pay and what your pension looks like.

Read Also: How Old Do You Have To Be To File Taxes

What Are Qualified Distributions

A subtraction is allowed on the Michigan return for qualifying distributions from retirement plans. Retirement plans include private and public employer plans, and individual plans such as IRA’s. To be considered a qualified distribution for the subtraction, several requirements must be met. For employer plans, an employee must have retired under the provisions of the plan, the pension benefits must be paid from a retirement trust fund, and the payment must be made to either the employee or a surviving spouse.

For qualifying distributions, there may be a limitation on the amount of the exemption that can be claimed.

Property Taxes In Pennsylvania

When you reach retirement age, your house may be paid off. Your living expenses would be reduced to property maintenance and taxes. In some states, retirees are quick to downsize to lower their tax burden. In other states with high taxes, property taxes on a single-family home can represent a large part of the retirement budget.

Many homeowners hold their property taxes in escrow, which means they pay toward them each month with their mortgage payment. When the mortgage is paid off, and the taxes are collected twice a year, the amount can be shocking. Many communities across the country are struggling with budget shortfalls and are raising taxes to try to close the gap.

In Pennsylvania, if you are over 65, you may be eligible for a rebate on your housing costs, whether you own or rent your home. For seniors who own their home and do not exceed $35,000 in annual household income, the average property tax rebate is $650. With supplemental rebates, that amount can increase. Income calculations to determine eligibility exclude 50 percent of income that comes from social security and Railroad Retirement benefits.

Property taxes for seniors in Pennsylvania are calculated in their favor. Even renters are eligible for a housing rebate if their income is under $15,000. The same exemptions apply in determining the total amount of income.

At a retirement community such as Cornwall Manor, residents do not pay property taxes.

Recommended Reading: Tax Id Numbers For Businesses

Why Do States Charge A State Tax

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.

Recipients Born Before 1:

For 2021 you may subtract all qualifying retirement and pension benefits received from public sources, and may subtract private retirement and pension benefits up to $54,404 if single or married filing separately or up to $108,808 if married filing jointly. Private subtraction limits must be reduced by public benefits subtracted. Withholding will only be necessary on taxable pension payments that exceed the pension limits stated above for recipient born before 1946.

- Complete Form 4884, Michigan Pension Schedule.

- Military pensions, Michigan National Guard pensions and Railroad Retirement benefits are entered on Schedule 1, line 11. These continue to be exempt from tax. They must be reported on Schedule W Table 2, even if no Michigan tax was withheld.

- Social Security benefits included in your adjusted gross income are entered on Schedule 1, line 14 and are exempt from tax.

- Public pensions can include benefits received from the federal civil service, State of Michigan public retirement systems and political subdivisions of Michigan.

- Rollovers not included in the Federal Adjusted Gross Income will not be taxed in Michigan.

- Subtraction for dividends, interest, and capital gains is limited to $12,127 for single filers and $24,254 for joint filers, less any subtractions for retirement benefits including US military, Michigan National Guard, and railroad retirement benefits.

Don’t Miss: Massachusetts State Income Tax 2021

State Local Sales And Use Taxes

State income taxes arent the only taxes that can affect your income in retirement. State sales and local sales and use taxes can also take a bite out of your retirement finances. All states and the District of Columbia impose these taxes except Alaska, Delaware, Montana, New Hampshire and Oregon.

The highest state sales taxes are in California , Indiana, Mississippi, Rhode Island and Tennessee . On the flip side, the lowest state sales taxes are in Colorado , Alabama, Georgia, Hawaii, Louisiana, New York, South Dakota and Wyoming . Local sales and use taxes, meanwhile, are assessed by cities, counties and special taxing jurisdictions. These vary widely all across the country.

Do Americans Working Abroad Pay Social Security Tax

Living abroad and taxes you have to pay no matter where you live or work. Yes, thats true if you are a US Citizen or Green Card holder, you will have to pay Social Security whether or not you live in the US.

What taxes do US citizens pay when working abroad? Yes, if you are an American living abroad as a US Citizen, you must file a US Federal Tax Return and pay US taxes on your worldwide income no matter where you live at the time. In other words, you are subject to the same income tax laws as people living in the United States.

Also Check: California Llc First Year Tax Exemption

Anime With Baby Main Character

Connecticut: Increased the exemption on income from the state teachers’ retirement system from 25% to 50%. The exemption increase will take place starting in January 2021. Indiana: The state is phasing in a military retirement income deduction over four years. This change started rolling out in 2019.

The most common instances of retirement and pension benefits from employment that is not covered by Social Security are police and firefighter retirees, some federal retirees covered under the Civil Service Retirement System and hired prior to 1984, and a small number of other state and local government retirees. Kentucky law excludes up to $31,110 in pension income from state tax . … If you elect to withhold, TRS will withhold federal taxes on the taxable portion of your annuity as calculated using IRS guidelines. For other disbursements, such as a.

Most pensions are funded with pretax income, and that means the full amount of your pension income would be taxable when you receive the funds. … that do not tax pension income at all. Here they are: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming. wequassett resort sold. hinds county courthouse.

peter parker x reader pregnant angst

The roughly 26 million federal and state government employees are covered by a tax-funded, wage- and ination-indexed, dened benet pension program Under the EEE tax regime, an exemption from tax is provided for amounts drawn at retirement , in.

Can You Take 25% Of Your Pension Tax

You can take money from your pension pot as and when you need it until it runs out. Its up to you how much you take and when you take it. Each time you take a lump sum of money, 25% is tax-free. The rest is added to your other income and is taxable.

You May Like: How To Add Sales Tax On Square

Which States Do Not Tax Your 401k When You Retire

Alaska, Alabama, Hawaii, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington, and Wyoming do not tax 401 plans when you retire.

SoFis Insights tool offers users the ability to connect both in-house accounts and external accounts using Plaid, Incs service. When you use the service to connect an account, you authorize SoFi to obtain account information from any external accounts as set forth in SoFis Terms of Use. SoFi assumes no responsibility for the timeliness, accuracy, deletion, non-delivery or failure to store any user data, loss of user data, communications, or personalization settings. You shall confirm the accuracy of Plaid data through sources independent of SoFi. The credit score provided to you is a Vantage Score® based on TransUnion data.Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.SORL0522041

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT