How To Check Your Refund Status

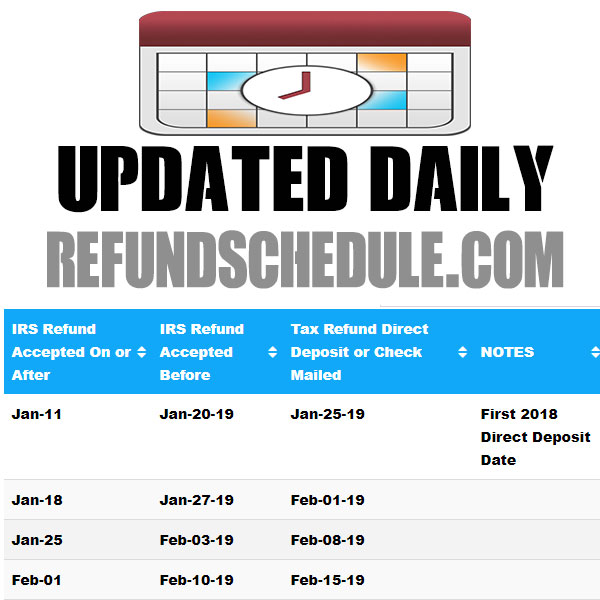

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for previous years tax returns or amended returns.

Recommended Reading: Morgan Stanley Tax Documents 2021

File South Carolina Income Taxes

South Carolina income taxes are collected based on a six-tier bracket with the first $2880 of earned income remaining untaxed. The top rate is 7%, which is applied on incomes exceeding $14,401. At these rates, Palmetto State ranks 12th highest among all states that collect state taxes on individual incomes.

Residents who file federal tax returns will need to file SC tax returns. Part year residents, referring to those who may have moved during the tax year, may elect to file as full-time residents using Form SC 1040. Use SC 1040-TC to receive tax credits for taxes paid to other states.

Nonresidents should attach Schedule NR to the Form 1040. Nonresident SC tax filers should include anyone who derived income from the lease or rental of properties located in South Carolina.

State tax returns, using Form SC 1040, are prepared after federal tax returns are filed. Additional forms and schedules will depend on the tax filer’s status. The deadline for filing the forms and paying the tax due is April 15 although an automatic extension can be obtained by submitting Form SC 4868 to extend the due date for the returns to October 15. For those who have already obtained a tax extension for filing their federal returns, a copy of the federal extension attached to the South Carolina tax returns when submitted will suffice. Any taxes due will be deemed late after the original deadline and may be subject to penalties.

Wheres My Refund South Carolina

To check the status of your South Carolina state refund online, go to .

You will be prompted to enter your Social Security number or ITIN and your exact refund amount, then click Search.

If your refund status hasnt changed in more than 6 weeks or your refund status tells you to contact the SCDOR, then you should call , Option 2.

If you e-filed your South Carolina state return and received a confirmation from your tax preparation software, the SCDOR has received your return. You can expect your refund to move through the review process within six to eight weeks from the date you filed.

Status changes are posted nightly on the SCDOR website. Please note, if you filed your state tax return by paper, it may take more time for your refund status to update.

Read Also: Are Municipal Bonds Tax Free

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Don’t Miss: Can You Write Off Property Tax

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Check Your 2014 South Carolina State Refund Status Wheres My South Carolina State Refund

You will need your social security number, numbers in your mailing address, your zip code, and your 2014 tax refund amount claimed on your 2014 South Carolina tax return. Wheres My South Carolina State Refund?

- 540 2EZ, line 23

- 540NR Short or Long Form, line 103

| South Carolina State Tax Refund Status Information |

You May Like: Tax Short Term Capital Gains

South Carolina Taxable Income

South Carolina has a simplified income tax structure that follows the federal income tax laws. South Carolina accepts the adjustments, exemptions, and deductions allowed on the federal tax return with few modifications. The federal taxable income is the starting point in determining a taxpayers state income tax liability. Individual income tax rates range from 0 percent to a top rate of 7 percent on taxable income. Tax brackets are adjusted annually for inflation.

Wheres My State Tax Refund West Virginia

Check on your state tax return by visiting the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

Read Also: Tax Credits For Electric Vehicles

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times.

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their returns after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Recommended Reading: How Much Will I Get Paid After Taxes

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Don’t Miss: Where Is My California Tax Refund

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, your refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns is available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

How Will You Receive Your Rebate

For most taxpayers, the SCDOR will issue rebates in much the same way we issued refunds this year.

- If you received a refund by direct deposit, the SCDOR will use the same bank account to issue your rebate by direct deposit.

- If your bank account has changed since receiving your 2021 direct deposit refund, notify us by November 1. Download and complete the SC5000 and email it to . You will receive your rebate as a paper check.

- Paper checks will be issued if:

- You received your 2021 refund by debit card or paper check.

- You had a balance due and did not receive a refund.

- You received your 2021 refund using a tax preparers account.

Don’t Miss: How To Amend Tax Return Turbotax

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your zip code.

If you e-filed, you can generally start to see a status four days after the Oklahoma Tax Commission receives your return. Paper filings will take longer and you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

Wheres My State Tax Refund Nebraska

Its possible to check your tax refund status by visiting the revenue departments Refund Information page. On that page, you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

Don’t Miss: How Much Is Tax At Walmart

South Carolina Gov Mcmaster Signs Tax Cut Bill That Includes Refund Checks

South Carolina Gov, Henry McMaster releases his budget proposal along with Lt. Gov. Pamela Evette on Monday, Jan. 10, 2022, in Columbia, S.C.

South Carolina taxpayers will be receiving income tax refund checks by the end of the year after Gov. Henry McMaster signed a bill to approve both refunds this year and an income tax rate cut for the future.

The legislation will result in income tax refund checks being sent in late November or December for those who paid taxes this year. It will be a full refund for those who paid $800 or less, which includes 33% of taxpayers.

Any South Carolina taxpayer who paid $100 in taxes will receive the $100 rebate and that rebate will grow along with tax liability up to a cap of $800 per tax filing. Those who did not pay income taxes will not receive a rebate.

The states top income tax rate will now drop from 7% to 6.5% for the 2022 tax year, for income taxes paid in 2023. The bill also would lower that top rate by 0.1 percentage points each year, starting in 2023, until it reaches 6%.

Ultimately, the legislation will reduce the state from its current six income tax brackets to three of 6%, 3% and 0%. The bill will result in a $600 million impact in the first year and ultimately a $1 billion impact.

The bill also includes a 33% cut in manufacturing property taxes from 9% to 6% starting this tax year in what will amount to $100 million in savings statewide for manufacturers.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Recommended Reading: How Much Foreign Income Is Tax Free In Usa

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real-time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Also Check: Out Of State Sales Tax

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page, you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Don’t Miss: California Sales Tax By Zip Code