Do States With No Income Tax Outperform Other States

Four of the top 10 states with the strongest economic outlook do not charge an income tax, according to 2021 rankings from the American Legislative Exchange Council, a think tank focused on free markets and limited government.

Part of that might be because theyre attracting more workers. States that dont have an income tax gained a net inflow of 285,000 new residents leaving from the 41 states that did charge an income tax, according to 2018 figures from the IRS, the most recent for which data is available.

An analysis from the Tax Foundation using Commerce Department data shows that states without an income levy grew at twice the national rate over the past decade, while gross state product grew 56 percent faster in those locations over the same period.

They tend to be outshining some of their peers that do have income taxes, says Katherine Loughead, senior policy analyst at the Tax Foundation who focuses on state tax policy.

Others, however, point out that missing income tax revenue might come with a cost particularly when it comes to infrastructure and education spending. South Dakota and Wyoming, for example, spent the least on education of all states, according to a 2021 analysis from the Census Bureau.

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

Us Income Tax Rates By State

We have summarized the US income tax rates for all 50 states showing what the respective rate is in each state. In addition to this, you can discover more details on the specific income tax you are required to pay in the state you live in. See the table at the bottom of this page.

The US income tax rates by state for 2021 vary depending on where you live.

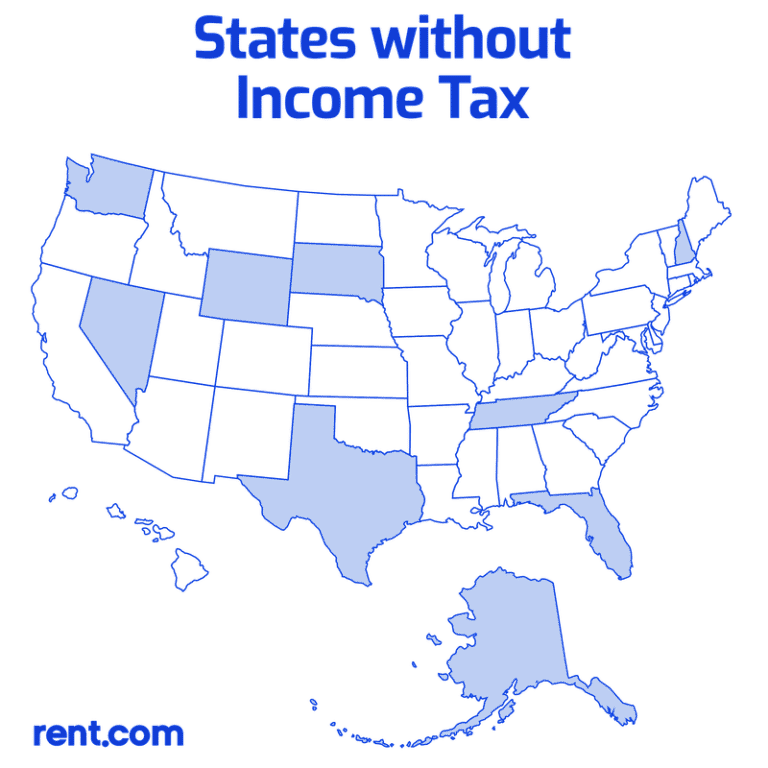

Here is a list of nine states in the US that have no income tax:

In addition to the above, New Hampshire taxes interest and dividends at a rate of 5%. To see more information on how many states have no income tax, we have created a page specifically on this.

Read Also: How Can I Get My Tax Transcript Online Immediately

States With No Income Tax

The table below illustrates the differences among states with no income tax. The first two columns show the states total tax burden as a percentage of personal income followed by the rank that the state holds among all 50 states.

The third column shows the states affordability ranking, which combines both the cost of housing and cost of living, and the last column includes the states rank on the U.S. News& World Report Best States to Live In list.

These figures are as of the most recent reports: 2021 for overall tax burden, 2020 and 2019 for affordability, and 2021 for Best States to Live In.

| Comparison of States With No Income Tax | |

|---|---|

| No-Tax State | |

| 44 | 1 |

These States Have No Income Tax

There are seven U.S. states with no income tax, while another two states have no income tax on wages but do tax interest and dividends — an important consideration for retirees. The grass isn’t always greener on the other side of the state line, though. These states still need money for government services, and they raise it through other means, namely sales taxes, property taxes, and other fees. Depending on your situation and your willingness to move, with some planning you could start paying less in taxes and keeping more of your income. Read on to find out more.

States with no income tax:

States with nearly no income tax:

Let’s examine each of the states with no income tax using each state’s data on tax revenue as well as the Tax Foundation’s most recent data, which is for 2011. The Tax Foundation has been collecting data on taxes since 1937, and its data takes into consideration a per-capita average of both state and local taxes.

1. Alaska

If saving money is your only concern, Alaska is the best place for you. Of course, with its distance from the rest of the country and harsh winters, America’s northernmost state is not for everyone. According to the Tax Foundation, the average state and local tax paid per capita was $3,319 — the 18th-lowest amount out of all 50 states. Senior citizens get an added incentive to live in Alaska, as the state exempts them from the first $150,00 of assessed value for property taxes.

2. Florida

3. Nevada

4. South Dakota

5. Texas

Also Check: Free Amended Tax Return 2020

States With No Income Tax 2022

States in the United States receive federal assistance for some programs, but each state is still responsible for raising its revenues to pay for education, transportation, health care, and other programs. How is this money raised? It is typically raised through taxes. Most states tax the wages of its residents with a state income tax. However, some states do not have a state income tax, although residents do have to pay federal taxes. While living in a state with no taxes sounds great, its important to note that these states still have to raise revenue. This means that taxes in other areas such as sales tax or property tax are much higher for residents.

In the United States, there are currently seven states that do not have a state income tax. These states are Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. Some states, such as Washington, have never had a personal income tax. Other states, such as Alaska, have repealed laws in recent years that require citizens to pay state income taxes. In some states, other types of taxes are used to replace the individual income tax. In Florida, for example, residents have to pay sales taxes, higher property taxes, and corporate income taxes.

Paying Taxes Is A Part Of Life For Most Americans And While Everyone Is Subject To The Same Irs Tax Laws When They File Their Federal Tax Return Annually They Dont Necessarily Pay The Same State Income Taxes

Why? Where you live and work affects the state tax laws that apply to you. Some states dont have any income tax at all and you may be tempted to relocate to one thinking the move will reduce your overall tax obligation.

While the thought of living in a state where income taxes arent taken from your paycheck may be appealing to those who live in states where their income is taxed, theres usually a give and take. States may need to make up for a lack of income tax revenue in other ways. For example, some states have higher sales tax rates or rely on money from tourism to help fund budgets. Others have local taxes levied by municipalities or counties.

Before you consider a move to a state with no personal income tax, its important to know all the details and how they could impact you.

Keep in mind, just because you live in a state that doesnt have an income tax doesnt necessarily mean you wont file a state income tax return. If you live in one state and work in another, you may have to file an income tax return in the state where you earn your paycheck. Likewise, if you moved during the tax year and previously worked in a different state, youll likely need to file with that state. Its important to check each states tax laws to find out the details.

Don’t Miss: How Much Do You Have To Make To Claim Taxes

Other Taxes In These States

Before you plant a “For Sale” sign on your lawn and begin packing your bags to move to one of these tax-free states, keep in mind that they still have to raise revenue to function. That means they have to get their money from somewhere.

States without an income tax often make up for the lack of these revenues by raising various other taxes, including property taxes, sales taxes, and fuel taxes. These can add up so that you’re paying more in overall taxation than you might have in a state that does tax your income at a reasonable rate.

New Hampshire and New Jersey have some of the highest average property taxes per capita in the nation, although New Hampshire doesn’t have a sales tax. Tennessee has one of the highest sales tax rates in the U.S. Washington will get you at the gas pump with a combined federal and state gas tax of nearly $0.68 per gallon.

States in the Northeast and along the West Coast also have higher-than-average costs of living that should also be taken into account.

Us State Income Tax Rates

The general approach to US state income tax rates is done in three different ways.

- Residents and those working in a specific state either do not pay any income tax at all

- They pay a flat rate of income tax, including on interest and dividends, and this income tax rate does not change based on the level of earnings

- Or, the state you live in imposes a progressive tax. This means that people with higher taxable incomes pay higher state income tax rates, and those with lower incomes pay less tax.

Most people live and work in the same state for the entire year. This is your state of residence and determines the rate of income tax you pay. You may have a job that requires travel to other states, but this does not typically affect the rate of tax you pay on your income, it is the state you live in that determines this.

However, if you lived in one state for part of the year and moved to another state, you may owe state income tax to two different states at two different rates. Similarly, if you work in one state and own income-generating property in another state, you may be liable to pay income tax in more than one state, which may require more than one tax return.

Recommended Reading: Look Up State Tax Id Number

The Effect On Your Federal Tax Return

It used to be that you could claim a tax deduction for state income taxes you paid if you itemized on your federal return. The Tax Cuts and Jobs Act capped this deduction at $10,000 when it went into effect in 2018, and this $10,000 limit includes certain property taxes as well.

The property taxes you can deduct are the taxes you pay for property such as a boat or car charged annually.

Energy And Climate Change

The Inflation Reduction Act is the largest piece of federal legislation ever to address climate change. It will invest $369 billion in provisions relating to energy security and climate change. The summary provided by Senate Democrats identifies primary goals as driving down consumer energy costs, increasing energy security, and reducing greenhouse gas emissions.

The bill aims to decrease residential energy costs by focusing on improvements to home energy efficiency. Measures include $9 billion in home energy rebate programs that focus on improving access to energy efficient technologies, and 10 years of consumer tax credits for the use of heat pumps, rooftop solar, and high-efficiency electric heating, ventilation, air conditioning and water heating. The bill extends the $7,500 tax credit for the purchase of new electric vehicles while also providing a $4,000 tax credit toward the purchase of used electric vehicles, in an effort to increase low- and middle-income access to this technology. This is projected to lead to an average of $500 in savings on energy spending for every family that receives the maximal benefit of these incentives. The bill includes a 30% tax credit and different types of rebates for homeowners who will increase the energy efficiency of their house. In some cases, all upgrade expenses will be returned.

Also Check: File State And Federal Taxes For Free

Why Do Some States Not Have An Income Tax

State income tax is set at the state level, not the federal level, so it’s entirely up to state lawmakers. Their reasons for not having income taxes could be driven by their ideals for tax policy, as an incentive to attract new residents, or an increase in revenue from another source.

State income tax in Alaska was repealed after an oil boom in the 1970s. The overwhelming majority of the state’s revenue comes from oil industry activity. Alaska decided that it could receive most of the revenue it needed from the oil industry, so the state no longer requires taxes on residents’ incomes.

States With No Income Tax: Final Thoughts

While eliminating an income tax might sound like it saves you money, the policy is a little trickier than it sounds. States still need money, so getting rid of an income tax typically means that they impose higher taxes in other areas. The only exception is states that generate revenue from natural resources, like Alaska with its petroleum.

Whether living in a state with no income tax will save you money varies by individual. Typically, people who have a high income will benefit, as well as those who dont rely on public education, drive very much, own a lot of property, or spend much money overall. Youll have to take a look at your income, lifestyle, and spending habits to determine whether moving would be financially beneficial for you.

Because of the U.S.s unique mix of state and federal laws, you should always look into tax laws when youre considering moving. If youre envisioning relocating to another part of the country, then consider the new states tax laws and how theyll affect your personal finances.

Don’t Miss: How Long Does Your Tax Return Take

Tennessee And New Hampshire Income Tax

Tennessee gradually reduced its “Hall tax” on interest and dividend income. The state’s 6% Hall tax rate was reduced by 1% increments each year until the tax was eliminated on January 1, 2021.

Alaska, Tennessee, and New Hampshire are the only states to ever take legislative steps to eliminate an existing income tax.

New Hampshire assesses a 5% tax on interest and dividend income beyond $2,400. Interest and dividend income aren’t taxed for married couples filing joint returns until that amount exceeds $4,800. An additional $1,200 exemption is available for certain taxpayers who are disabled, blind, or over the age of 65.

The tax on interest and dividends is being phased out over a five-year period. As a result, new Hampshire will officially have no income tax by 2026.

Do Foreigners Have To Pay Taxes

Whether you live in the United States or another country, regardless of where you earn income, your worldwide earnings are subject to U.S. income tax. Certain exclusions and/or foreign income tax credits may be available to you. If you want to find out more information about the United States Tax Guide, visit Publication 54.

Even if you bring in foreign income, you must include it on your tax return. Your citizenship status determines how much taxes you pay in the United States. You may be able to claim an exemption if your income falls below a certain level. This type of income must be kept in a detailed record. If you earn money abroad or from foreign sources, you must report this to the IRS. You can reduce your U.S. tax liability by claiming exclusions and tax credits. In 2022, you can file an exemption of up to $112,000 for foreign income earned in the United States.

Recommended Reading: Free Tax Filing H& r Block

You Dont Own Much Property

If you dont own a lot of property, then you wont get hit too hard with the often high property taxes in income tax-free states. If you do own a lot of property, then living in one of the nine states discussed above probably wouldnt work in your favor.

If you own a lot of land or houses, then you may end up getting hit with high property taxes.

Property Taxes For Foreigners

A property tax is a tax levied on the ownership of land or buildings. The tax is paid by the property owner, not the tenant. Foreigners who own or lease property in the United States are required to pay property taxes. If you are not a United States citizen or resident, you are considered a foreign national under tax law.

Don’t Miss: How Much Will I Get Paid After Taxes

You Dont Rely On Public Services

States without income taxes may offer reduced or lower quality public services, like transportation, health care, or public education. If you dont have kids or are sending your kids to private school, then this might not affect you.

Washington, by the way, is an exception with its strong public school system, but it has some of the highest sales and gas taxes in the country. If you drive a lot in Washington, then you might end up paying a lot in gas tax and highway and bridge tolls.

If youre sending kids to public school, be careful about the quality of the education system in an income tax-free state.