Capital Gains Tax Rates For The State Of California

Capital gains taxes may vary from 1% or as high as 13%. The amount you are taxed may depend on the source of the gains, and where you are on the California State income tax bracket. It will be helpful to get the advice of a tax professional with experience with capital gains if you arent sure how to report them.

Remember, tax laws are subject to change and may change more frequently than you realize. Its best to consult the current years state income tax guidance for best results.

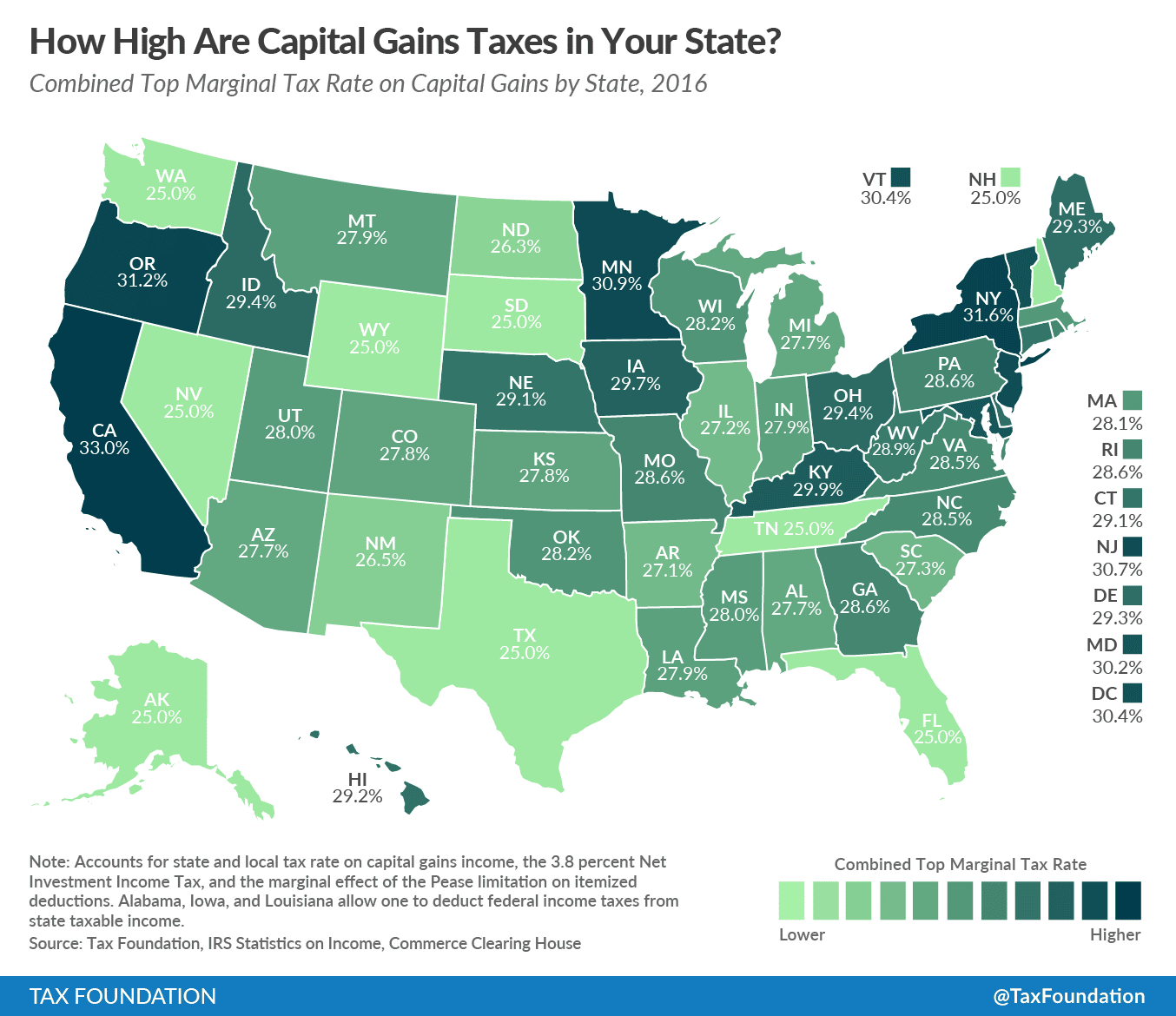

States With The Highest Capital Gains Tax Rates

The states with the highest capital gains tax are as follows:

California

California taxes capital gains as ordinary income. The highest rate reaches 13.3%

Hawaii

Hawaii taxes capital gains at a lower rate than ordinary income. The highest rate reaches 7.25%.

Iowa

Taxes capital gains as income and the rate reaches 8.53%.

Maine

Taxes capital gains as income. The rate reaches 7.15% at maximum.

Minnesota

Taxes capital gains as income and the rate reaches a maximum of 9.85%.

New Jersey

New Jersey taxes capital gains as income and the rate reaches 10.75%.

New York

New York taxes capital gains as income and the rate reaches 8.82%.

Oregon

Oregon taxes capital gains as income and the rate reaches 9.9%.

Vermont

Vermont taxes short-term capital gains as income, as well as long-term capital gains that a taxpayer holds for up to three years. They are allowed to deduct up to 40% of capital gains on long-term assets held over three years. The capital gains tax rate reaches 8.75%.

Wisconsin

Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% . The capital gains tax rate reaches 7.65%.

What Is The Capital Gains Rate For Retirement Accounts

One of the many benefits of IRAs and other retirement accounts is that you can defer paying taxes on capital gains. Whether you generate a short-term or long-term gain in your IRA, you dont have to pay any tax until you take money out of the account.

The negative side is that all contributions and earnings you withdraw from a taxable IRA or other taxable retirement accounts, even profits from long-term capital gains, are typically taxed as ordinary income. So, while retirement accounts offer tax deferral, they do not benefit from lower long-term capital gains rates.

You May Like: California Used Car Sales Tax

Using A 1031 Exchange For Investment Properties

In your journey as an investor, you may find yourself owning property as an investment or property that produces income. However, you will need to pay taxes on your profit when you want to sell your property. A 1031 Exchange is a great way to lessen your tax obligations.

A 1031 Exchange allows you to exchange your property for another “like-kind” property. For example, if the property is held for income or investment in the United States, it can be considered like-kind. Using the 1031 exchange enables you to defer paying taxes on the sale. Some requirements need to be met to use a 1031 Exchange, so this is another occasion when professional advice is a good idea.

Only three kinds of property are eligible for a 1031 Exchange. You have to purchase a new property â you can’t put in a property you already own.

You will need to understand the concept of “like-kind” to do a successful 1031 Exchange. “Like-kind” does not refer to the quality or grade of the property but rather its nature or character. The IRS regulations say that “all real property is like-kind to all real property.” So, suppose you’re selling property for which you possess a fee title. In that case, you can consider any other real property as a replacement.

You will need to find a qualified intermediary to act as your exchange facilitator in order to do a 1031 Exchange. Check with trusted attorneys, CPAs, or escrow experts for their recommendations.

Property Held for Income â Delaware Statutory Trust

How The California Capital Gains Tax Works

The capital gains tax in California is applied to the profit you make from selling certain assets, like stocks, bonds, and real estate. The rate could vary because it is taxed as regular income. To calculate your capital gains taxes in California, you’ll need to know your marginal tax bracket.

The California capital gains tax is imposed on the sale or exchange of capital assets located in California. The tax is calculated using the following formula:

Capital Gain = Sale Price of Asset –

For example, let’s say you bought a house in Los Angeles for $500,000 and sold it later for $700,000. Your capital gain would be $200,000 . If you had selling expenses of $20,000 , your capital gain would be reduced to $180,000. And if your adjusted basis was $250,000 , your capital gain would be further reduced to $130,000.

Recommended Reading: Is It Better To File Taxes Jointly

The Capital Gains Tax In California

Capital gains tax charges you on the difference between the amount you paid for the asset and the amount for which you sold the asset. This tax may apply to a number of different types of investment, such as stocks and bonds, or to assets such as boats, cars and real estate. The amount you earned between the time you bought the property and the time you sold it is your capital gain.

The IRS charges you a tax on your capital gains, as does the state of California through the Franchise Tax Board, also known as the FTB. The exemption is $250,000 for single taxpayers. Married taxpayers have a double exemption for a $500,000 exemption. This means that if you bought a home for $300,000 and sold it for $900,000, you d have a capital gain of $600,000. But if youre married, your exemption is $500,000 of that amount, so youd have a capital gain of $100,000 that youd need to pay taxes on.

There are a few things that could disqualify you from the capital gains exemption. For example, if the house was not your primary residence. If this is an investment property or a second home, you will not qualify for a tax exemption on capital gains.

Other things that might disqualify you from the exemption:

Read Also: Aarp Foundation Tax-aide Site Locator

Change Of Residency To California

If you are a California resident who sold property located outside California on the installment basis while a nonresident, your installment proceeds while a California resident are now taxable by California.

Example 4

On July 1, 2009, while a nonresident of California, you sold a Texas rental property in an installment sale. On May 15, 2010, you became a California resident and on August 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

Your capital gain income and interest income received on August 1, 2010, are taxable by California because you were a California resident when you received the proceeds.

Example 5

On September 1, 2008, while a nonresident of California, you sold stock in an installment sale. On June 1, 2010, you became a California resident and on October 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

Your capital gain income and interest income received on October 1, 2010, are taxable by California because you were a California resident when you received the proceeds.

Don’t Miss: How Much Is Capital Gains Tax On Crypto

What Are Rule Exceptions

The above-stated rates and calculator can be applied to most assets, however, there are a few exceptions to the rule. Collectible Assets such as coins, metals, and fine art are taxed at 28% as their long-term capital gains tax rate. The short-term capital gains tax rate is determined using the income tax rate.

Capital Gains Tax Breaks Dont Drive State Economic Growth

Proponents of capital gains tax breaks often argue that they spur economic growth by encouraging investment. But historically, there is no obvious connection between tax rates on capital gains and economic growth at the national level, tax policy expert Leonard Burman notes. There is even less reason to expect a state tax break on capital gains to boost a states economy. The companies, bonds, and other assets generating capital gains for a states residents could be located anywhere in the country or the world, so any possible economic benefit wouldnt necessarily go to the state giving the tax break.

Moreover, capital gains taxes generate revenue to support three major building blocks of thriving communities: K-12 and higher education, health care, and transportation. And, by increasing the share of state revenues paid by the wealthy, they allow states to keep taxes lower on people with moderate incomes, who spend a larger share of their incomes to boost local economies.

Don’t Miss: Travis County Tax Office – Main

How Much Is Capital Gains Tax In California

Regardless of the year, the California capital gains tax rate of 2022 is based on the type of asset that made profitable gains that need to be assessed.

If it was a short-term holding such as a stock or a real estate flip, you may be taxed as high as 15% on the profits of the sale.

In contrast, a long-term holding real estate property may be taxed even higher, but the higher rate in the State of California will be offset by lower rates with the Federal Tax Code.

What this means is that for the investor, depending on the asset, the tax code encourages long-term capital gains with various deductions, exclusions, and how the tax rate is calculated, such as income for California or based on income tax brackets for federal taxes.

What Is The Capital Gains Tax And How Big A Bite Does It Take

- Copy Link URLCopied!

Dear Liz: We own stocks with enormous capital gains as in, six figures or more. The tax would be a lot. Any advice on how to limit the tax bite? Our income consists of Social Security and a teachers pension.

Answer: Capital gains taxes may be less of a problem than you fear. If your taxable income as a married couple is less than $83,350 in 2022, your federal tax rate on long-term capital gains is zero. If your taxable income is between $83,350 and $517,200, your federal capital gains tax rate is 15%.

In addition, you may owe state taxes. California, for example, doesnt have a capital gains tax rate and instead taxes capital gains at the same rate as ordinary income.

Capital gains arent included when determining your taxable income, by the way, but they are included in your adjusted gross income, which can affect other aspects of your finances. A big capital gain could determine whether you can qualify for certain tax breaks, for example, and could inflate your Medicare premiums. Thats why its important to get good tax advice before selling stocks with big gains.

You May Like: Annual Income After Taxes Calculator

How To Lower Your Capital Gain Taxes

Based on Internal Revenue Service rules, a home you’ve lived in for at least two of the last five years is considered a primary residence. Therefore, profit from the sale of your primary residence is exempt from capital gains taxes.

But if your new home has a significant increase in value after only a year, and you sell it, you will need to pay capital gains tax. When you’ve owned your home for at least two years, meeting the primary residence rules, you may still need to pay taxes on any profits if they exceed thresholds set by the IRS.

You can exclude up to $250,000 of the profit if you’re single. If you’re part of a married couple filing a joint return, you could exclude up to $500,000 of the gain. This type of exemption is only allowed once every two years.

You can add your cost basis and costs of any improvements that you made to the home to the $250,000 if single or $500,000 if married filing jointly.

Do You Need A Real Estate Agency To Help Sell Your Home

Sexton Group Real Estate Property Management in Berkeley, California is a boutique real estate company specializing in residential sales as well as property management services for properties throughout the San Francisco Bay Area. We have 2 offices to serve you, one in the heart of Berkeley and the other in the heart of Lafayette, California. The Sexton Group encompasses the essence of Berkeleys charm and Lafayettes family-oriented vibe all with a relaxed, down-to-earth nature. We are an amazing group of agents whose wealth of experience spans more than 25 years in the industry. Looking to sell a home in Contra Costa or Alameda County? Contact us today for your free consultation!

Read Also: Are Lawyer Fees Tax Deductible

Sale Of Your Principle Residence

We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years.

In addition, you may only have one home at a time. It may be any of the following:

During the 5 years before you sell your home, you must have at least:

- 2 years of ownership and

- 2 years of use as a primary residence

Ownership and use can occur at different times.

J Net Operating Losses

For taxable years beginning on or after January 1, 2002, the net operating loss carryover computation for the California taxable income of a nonresident or part-year resident is no longer limited by the amount of NOL from all sources. Only your California sourced income and losses are considered in determining if you have a California NOL.

Read Also: Ny State Tax Payment Online

Crypto Capital Gain Taxes

Cryptocurrency is taxed in a similar way that stocks or property is taxed. This means that, depending on how long you hold the cryptocurrency for, the capital gains from cryptocurrency transactions are classified as either short-term capital gains or long-term capital gains. If you hold your cryptocurrency coins for a period of less than one year, then the capital gains realized from the transaction will be considered short-term. On the other hand, if you hold it for more than a year, you will realize long-term capital gains, which are taxed differently. Depending on your level of income and your tax filing status, the tax rate on short-term capital gains varies from 10% to 37%, the same rates as ordinary income is taxed at. Meanwhile, the tax rate on long term capital gains can either be 0%, 15% or 20%.

What constitutes a taxable event?

You will need to report the capital gains realized from a transaction involving cryptocurrency every time that the transaction constitutes a taxable event. There are 3 scenarios for this:

Imagine that you used $921 to purchase one bitcoin in January 2017. Now, you sell that bitcoin getting $57,284 in return. This is a taxable event, and you are required to pay taxes on the long-term capital gains that you realized. The capital gains will be equal to $57,284 – $921 = $56,363.

How To Calculate California Capital Gains Taxrate& Cost Basis

In general, you can use a straightforward calculation to figure your capital gains tax in California by calculating your gross tax rate.

Use this easy formula to calculate your California capital gains taxes:

Capital Gain = Sale Price of Asset

To calculate your capital gains tax for California, you will need to subtract the cost basis from the sale price. This is your profit. You will then multiply your profit by the capital gains tax rates.

For example, lets say you sell a stock for $100,000 that you bought for $40,000. Your profit is $60,000. For round numbers lets say that your California capital gain tax rate is 10%. Therefore, your tax would be $6,000 .

Don’t Miss: How Much Tax Is Taken From My Check

New York Capital Gain Taxes

The state of New York treats all capital gains as income. That is the capital gain you make on selling your investment will be treated as income and taxed at the same rates. Similar to California, New York makes no distinction between long-term and short-term capital gains. No matter when you choose to sell your investment, your capital gain will be taxed at the following rates by the state government:

New York Capital Gain Tax Rates

| Tax Rate |

|---|

How Can I Save Capital Gains Tax On The Sale Of My House

Exemptions from your Gains that Save Tax Section 54F

Recommended Reading: Montgomery County Texas Tax Office

Don’t Miss: Do I Have To Pay Taxes On Inherited Money

Ways To Boost State Revenues From Capital Gains

The remaining 41 states and the District of Columbia, which currently tax capital gains at the same rate as ordinary income, should resist cutting these taxes and instead raise them to generate revenue they can invest in broadly shared prosperity. They have several options:

Raise the capital gains income tax rate. States could simply levy a higher rate on capital gains income than on income from wages, salaries, and other sources, or raise the rate just on short-term capital gains.

Eliminate stepped-up basis. Under current state and federal law, people who inherit assets such as stocks, bonds, or real estate pay no taxes on any appreciation of those assets that occurred before they inherited them. As a result, a large share of capital gains is never taxed.

For example, consider a taxpayer who bought 100 shares of stock for $10 each and held them until their death, when the value had risen to $50 per share. They left them to their daughter, who sold them a number of years later, after the value had risen to $55 per share. Under current law, the daughters taxable capital gains would reflect the $5-per-share increase that occurred while she owned the stock, not the $45-per-share increase that occurred since their mother bought it.

| TABLE 1 |

|---|

Massachusetts General Laws Chapter 29, Section 5G, .

Institute on Taxation and Economic Policy estimate, November 2018.