Does An Eligible Employer Identify The Average Number Of Full

Yes. All entities are considered a single employer for purposes of determining the employer’s average number of employees if: they are aggregated as a controlled group of corporations under section 52 of the Internal Revenue Code are partnerships, trusts or sole proprietorships under common control under section 52 of the Code or are entities that are aggregated under section 414 or of the Code.

Example: Employers O and P each have 75 full-time employees, respectively. Employers O and P are corporations that have each issued a single class of common stock, and a single individual owns more than 80 percent of the common stock of both Employer O and Employer P. Employers O and P are therefore treated as a single Eligible Employer with more than 100 full-time employees for purposes of the Employee Retention Credit. Accordingly, each is eligible for the Employee Retention Credit only for wages paid to an employee that is not providing services due to either a full or partial suspension of operations by governmental order, or a significant decline in gross receipts.

How Do I Get A Cash Refund From The Erc

The ERC is a federal payroll tax credit for payroll tax periods in 2020 & 2021. In most cases tax credits reduce the total amount of taxes owed. In the case of ERC not only does it reduce your taxes owed, but if your taxes owed are reduced to zero you are entitled to compensation above and beyond your original tax liability.

If your business has previously filed 2020 and 2021 payroll taxes, you can retroactively claim the ERC to reduce your tax debt and where applicable receive a surplus credit, which can result in a cash refund.

This Page Is Not Current

Find current guidance on the Employee Retention Credit for qualified wages paid during these dates:

- After December 31, 2020 and before July 1, 2021 Notice 2021-23PDF, Notice 2021-49PDF and Revenue Procedure 2021-33PDF

- After June 30, 2021 and before October 1, 2021 Notice 2021-49PDF and Revenue Procedure 2021-33PDF

- After September 30, 2021 and before January 1, 2022 Notice 2021-49PDF and Notice 2021-65PDF

These FAQs do not reflect the changes made by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 , enacted December 27, 2020, the American Rescue Plan Act of 2021 , enacted March 11, 2021, or the Infrastructure Investment and Jobs Act , enacted November 15, 2021. The Relief Act amended and extended the employee retention credit under section 2301 of the CARES Act for the first and second calendar quarters of 2021. The ARP Act modified and extended the employee retention credit for the third and fourth quarters of 2021. The Infrastructure Act terminated the employee retention credit for wages paid in the fourth quarter of 2021 for employers that are not recovery startup businesses.

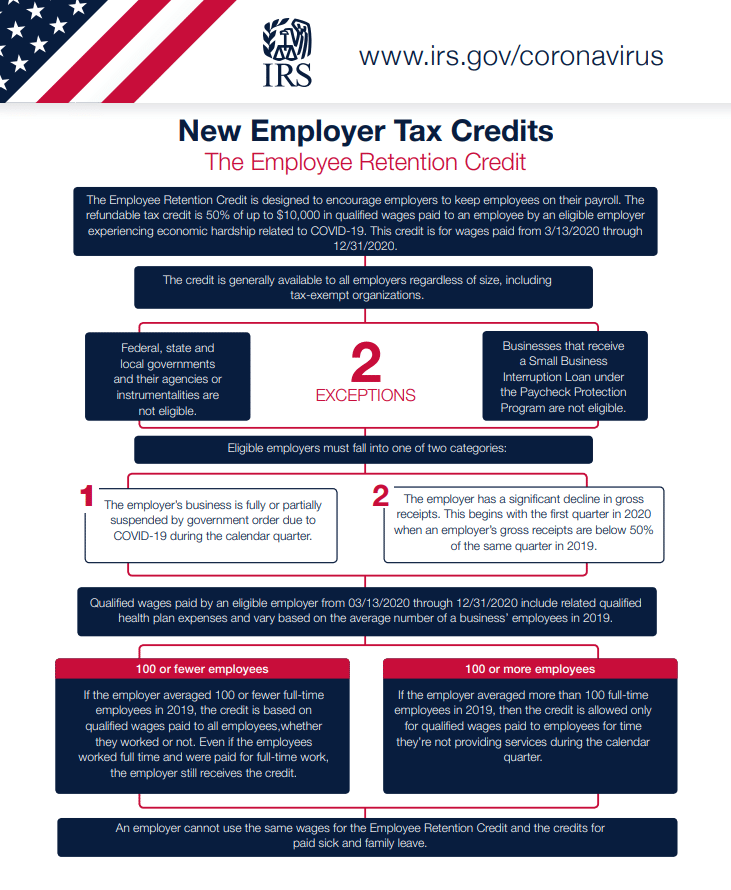

The Employee Retention Credit under the CARES Act encourages businesses to keep employees on their payroll. The refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19.

Read Also: Johnson County Property Tax Search

How Does An Employer That Started A Business In 2019 Determine Whether It Had A Significant Decline In Gross Receipts For Purposes Of The Employee Retention Credit

An employer that started a business in the first quarter of 2019 should use the gross receipts for the applicable quarter of 2019 for comparison to the gross receipts for the same quarter in 2020 to determine whether it experienced a significant decline in gross receipts in any quarter of 2020.

An employer that started a business in the second quarter of 2019 should use that quarter as the base period to determine whether it experienced a significant decline in gross receipts for the first two quarters in 2020 and should use the third and fourth quarters of 2019 for comparison to the third and fourth quarters of 2020, respectively, to determine whether it experienced a significant decline in gross receipts for those quarters.

An employer that started a business in the third quarter of 2019 should use that quarter as the base period to determine whether it experienced a significant decline in gross receipts for the first three quarters in 2020 and should use the fourth quarter of 2019 for comparison to the fourth quarter of 2020 to determine whether it experienced a significant decline in gross receipts for that quarter.

An employer that started a business in the fourth quarter of 2019 should use that quarter as the base period to determine whether it had a significant decline in gross receipts for any quarter in 2020.

How Does An Employer That Acquires A Trade Or Business During The 2020 Calendar Year Determine If The Employer Had A Significant Decline In Gross Receipts

For purposes of the Employee Retention Credit, to determine whether an employer has a significant decline in gross receipts, an employer that acquires a trade or business during 2020 is required to include the gross receipts from the acquired business in its gross receipts computation for each calendar quarter that it owns and operates the acquired business. Solely for purposes of the Employee Retention Credit, when an employer compares its gross receipts for a 2020 calendar quarter when it owns an acquired business to its gross receipts for the same calendar quarter in 2019, the employer may, to the extent the information is available, include the gross receipts of the acquired business in its gross receipts for the 2019 calendar quarter. Under this safe harbor approach, the employer may include these gross receipts regardless of the fact that the employer did not own the acquired business during that 2019 calendar quarter.

Also Check: What Is The Tax Rate On 401k Withdrawals

Can Freelancers Receive Erc

Unfortunately, self-employed freelancers and the owners of LLCs are not eligible employees for receiving an ERTC. If your company is structured as an S-Corp or C-Corp, you may count as eligible if you are on the payroll and provide significant work for the business.

See If You Qualify For The ERC

Lendios easy-to-use ERC application is designed to simplify the process at every step.

If An Amount An Eligible Employer Pays To An Employee Is Exempt From Social Security And Medicare Taxes Can The Eligible Employer Still Claim The Employee Retention Credit On The Amount Paid To That Employee

No. The Employee Retention Credit is allowed on qualified wages paid to employees an amount must constitute wages within the meaning of section 3121 of the Internal Revenue Code in order to fall within the definition of qualified wages.

Example 1: A church in State X employs an ordained minister the minister is a common law employee of the church. The governor of State X issues an executive order limiting gatherings of more than 10 people. As a result, the church suspends Sunday worship services, but continues to pay the minister’s salary and parsonage allowance. The minister’s salary and parsonage allowance do not constitute wages within the meaning of section 3121 of the Code and therefore are not qualified wages for purposes of the Employee Retention Credit.

Example 2: A group of licensed real estate agents at Real Estate Brokerage Firm Y receive substantially all their payments for services directly related to home sales and perform services under a written contract providing that they will not be treated as employees for federal tax purposes. Therefore, the licensed real estate agents at Real Estate Brokerage Firm Y are treated as statutory nonemployees under the Code. Amounts paid to the licensed real estate agents at Real Estate Brokerage Firm Y do not constitute wages within the meaning of section 3121 of the Code and therefore are not qualified wages for purposes of the Employee Retention Credit.

Read Also: Property Tax Help For Low-income Homeowners

Government Order Fully Closes Your Business

If a federal, state or municipal government order fully closed your business due to Covid-19, wages you paid employees during the closure probably count for employee retention credits for 2020 and for the first three quarters of 2021.

Example: A government order banned patrons from visiting your firm from April 15, 2020 through November 15, 2020. Wages paid for the last half of the second quarter, all the wages paid during the third quarter, and wages paid for the first half of the fourth quarter potentially count for employee retention credit purposes.

Can I Get Both The Erc And Ppp Loan

Yes. While an employer may not include wages funded by a PPP loan in the ERC calculation, PPP funds only apply to eight to ten weeks of wage expenses. The ERC eligibility periods are longer. PPP loans can also fund non-wage expenses.

For ERC purposes, it is most important to develop work papers that allocate the PPP funding across the entire 24 week Covered Period.

PPP funding may be allocated to wages that would not generate any ERC .

Also Check: How Is Property Tax Paid

Six Misconceptions About Employee Retention Credit Eligibility

The initial confusion surrounding eligibility for the employee retention credit in the CARES Act was exacerbated by subsequent legislative changes. Navigating those intricacies is necessary to determine eligibility and calculate an accurate ERC, says Ashley Hogsette of Synergi Partners.

In March 2020, Congress passedthe Coronavirus Aid, Relief, and Economic Security Acts employee retention credit in just 12 days with no contemporary legislative history. The IRS has not and will not issue formal regulatory guidance, leaving some gray areas and many unanswered questions for taxpayers. The initial confusion surrounding eligibility for the employee retention credit was further exacerbated by subsequent legislative changes to the CARES Act, resulting in an eligibility matrix for employers to navigate with little guidance.

Understanding the details of the legislation is challengingit can be complex, ambiguous, and almost contradictory. Navigating and interpreting these intricacies is necessary to determine eligibility and calculate an accurate ERC. As you read the highlights of the legislative updates since March 2020 below, it is easy to see why there are so many misconceptions.

Consolidated Appropriations Act 2021

Recommended Reading: Irs Free Tax Filing 2022

How Is The Maximum Amount Of The Employee Retention Credit Available To Eligible Employers Determined

The Employee Retention Credit equals 50 percent of the qualified wages that an Eligible Employer pays in a calendar quarter. The maximum amount of qualified wages taken into account with respect to each employee for all calendar quarters is $10,000, so that the maximum credit for qualified wages paid to any employee is $5,000.

For more information and examples, see Determining the Maximum Amount of an Eligible Employer’s Employee Retention Credit.

Amount Of The Credit For 2020

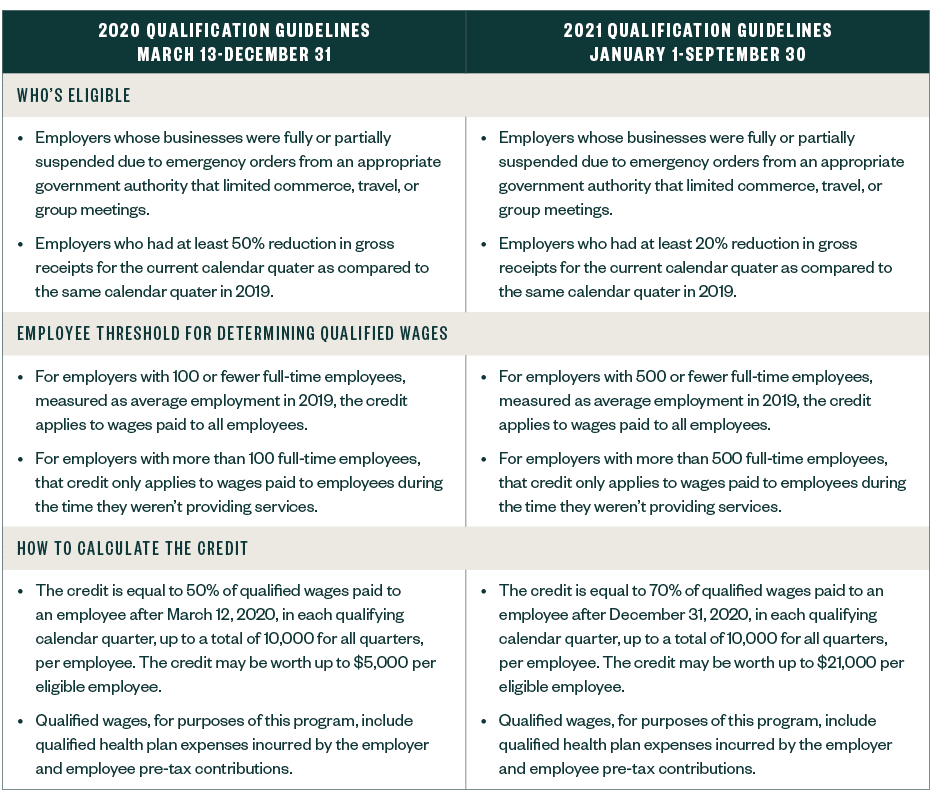

For 2020, the credit was equal to 50% of up to $10,000 in qualified wages per employee for all eligible calendar quarters beginning March 13, 2020, and ending Dec. 31, 2020, up to $10,000 per eligible employee annually.

A qualifying period began in any quarter where receipts were less than 50% of receipts in the same quarter in 2019. It ended at the beginning of the first calendar quarter after the first quarter in which gross receipts were greater than 80% of gross receipts for that quarter in 2019.

The credit was applied to your portion of the employees Social Security taxes and was fully refundable. This means that the credit served as an overpayment and would be refunded to you after subtracting your share of those taxes.

You May Like: When Is The Last Day To Turn In Taxes

Can My Cpa File For My Erc

It is important to remember that you must meet certain deadlines in order to claim the credit and receive the associated benefits. The deadline for 2020 was extended to July 15th 2021, but you should take steps now to ensure that you have all the information and documentation required to qualify before this deadline passes.

If your accountant or CPA is not an ERC specialist, they are likely to take weeks wading through the complicated eligibility criteria and filing process. Meanwhile, during those weeks, other business owners are successfully filing for their credits. There is a limited amount of funds available dont let a filing delay cost you from receiving your credit!

Mistakes To Avoid With The Ertc

The ERTC is a complicated credit. Its something the IRS has never done in previous years and has been modified several times since it was created. This is the perfect storm for errors. You need to avoid these common mistakes if you want to get the most benefit from this valuable credit.

- Assuming a PPP loan disqualifies you. The original rules stated you couldnt get this credit if you had a PPP loan. This changed in 2021.

- Only looking at revenue. You can qualify based on a decline in revenue, but you can also qualify if you had to shut down or change operations due to COVID-19.

- Not including healthcare expenses. Wages, as well as the employer portion of health insurance expenses, can be used to calculate this credit.

- Missing the deadline. You can amend a tax return for an almost indefinite amount of time, but if you want a refund, you only have three years.

- Applying for the final quarter of 2021. You can only claim the credit for this quarter if your business is a recovery start-up business.

The biggest mistake you can make is not applying, since you may qualify even if you think you dont. Gather your quarterly profit and loss statements for 2019, 2020, and 2021. Get together notes about business closures or operational changes during COVID-19. Find your payroll reports. The numbers from this paperwork are all you need to work through the pre-qualification steps.

Recommended Reading: Travel Trailer Tax Deduction 2021

How To Calculate Employee Retention Credit

The credit is equal to 50% of the qualifying wages paid to eligible employees, up to $10,000 of wages per employee per quarter. To calculate the employee retention credit, first determine the number of eligible employees and the total amount of qualifying wages paid to those employees during the relevant quarter.

Qualifying wages are capped at $10,000 per employee for all quarters, so if an employee was paid more than $10,000 in qualifying wages during a quarter, only $5,000 of those wages will be counted towards the credit.

Once you have determined the total amount of qualifying wages paid, multiply that number by 50% to calculate the employee retention credit. For example, if an employer has 10 eligible employees and pays each employee $10,000 in qualifying wages during a quarter, the employer would be entitled to a credit of $50,000 .

If you have any questions about how to calculate your employee retention credit, please consult with a qualified tax professional.

What Makes The Employee Retention Credit Fully Refundable

The credit is fully refundable because the Eligible Employer may get a refund if the amount of the credit is more than certain federal employment taxes the Eligible Employer owes. That is, if for any calendar quarter the amount of the credit the Eligible Employer is entitled to exceeds the employers share of the social security tax on all wages paid to all employees, then the excess is treated as an overpayment and refunded to the employer under sections 6402 and 6413 of the Internal Revenue Code . Consistent with its treatment as an overpayment, the excess will be applied to offset any remaining tax liability on the employment tax return and the amount of any remaining excess will be reflected as an overpayment on the return. Like other overpayments of federal taxes, the overpayment will be subject to offset under section 6402 of the Code prior to being refunded to the employer.

For more information on the reduction in deposits for the credit and deferral of payment and deposit of the employers share of social security taxes due before January 1, 2021 under section 2302 of the CARES Act, see Deferral of employment tax deposits and payments through December 31, 2020.

For more information on the claiming the refundable Employee Retention Credit, see How to Claim the Employee Retention Credit.

Read Also: How Long Receive Tax Refund

Amount Of The Credit For 2021

For 2021, the credit was equal to 70% of up to $10,000 in qualified wages per employee for each eligible calendar quarter beginning Jan. 1, 2021, and ending Sep. 30, 2021. This works out to a maximum credit of $21,000 per employee .

The credit was applied to your portion of the employees Social Security taxes and was fully refundable. This means that the credit would serve as an overpayment and be refunded to you after subtracting your share of those taxes.

How Do The Credits Work

The American Rescue Plan Act stipulates that the nonrefundable pieces of the employee retention tax credit will be claimed against Medicare taxes instead of against Social Security taxes as they were in 2020. However, this change will only apply to wages paid after June 30, 2021 and will not change the total credit amount.

If the credit exceeds the employers total liability of the portion of Social Security or Medicare, depending on whether before June 30, 2021 or after in any calendar quarter, the excess is refunded to the employer.

At the end of the quarter, the amounts of these credits will be reconciled on the employers Form 941.

Recommended Reading: How To Pay My Tax Online