Understanding Your First Paycheck

You get your first job out of college. You can finally breathe a sigh of relief you have post-grad plans! You can confidently answer that nerve-racking question: What are you doing after graduation?

But as soon as you accept that job offer, the train leaves the station pretty quickly! A whole lot of big financial decisions come at you fast like getting an apartment, paying your bills and setting up a budget to make sure your math checks out.

One of the most shocking things is when you get that first paycheck and how small it really is! You knew some taxes would be taken out but most of us are unprepared for how much really comes out.

“A lot of times when people accept their new job offer, they think, ‘Oh my goodness,’ like $40,000 a year is like winning the lottery when you’ve gone from making like $4,000 a year over the summer, you know?” said Sophia Bera, a financial advisor at Gen Y Planning. “And so I think what people don’t realize is, then how little that actually translates to in their net pay.”

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

Georgia Median Household Income

| 2011 | $46,007 |

If you file in Georgia as a single person, you will get taxed 1% of your taxable income under $750. If you earn more than that, then youll be taxed 2% on income between $750 and $2,250. The marginal rate rises to 3% on income between $2,250 and $3,750 4% on income between $3,750 and $5,250 5% on income up to $7,000 and, finally, 5.75% on all income above $7,000.

For married couples who file jointly, the tax rates are the same, but the income brackets are higher, at 1% on your first $1,000 and at 5.75% if your combined income is over $10,000.

Read Also: How To File Unemployment Taxes

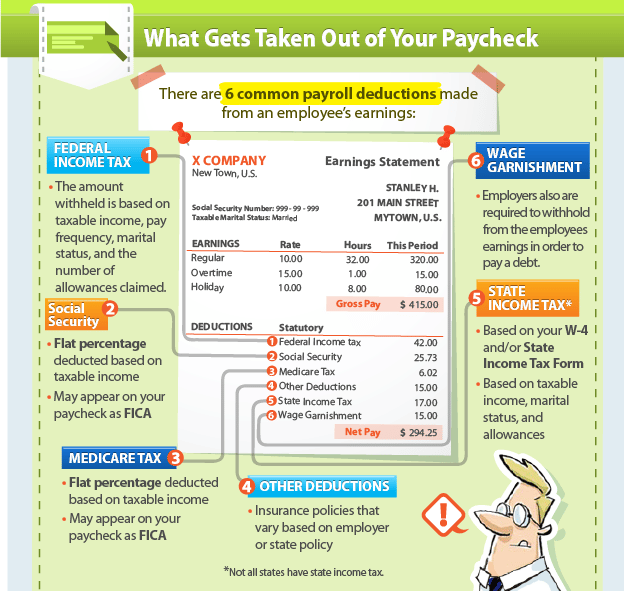

Understanding The Tax Deductions On Your Pay Stub

Your pay stub summarizes employment earningsEarnings For companies, its the money they make and share with their shareholders. For investors, its the money they make from their investments.+ read full definition and other amounts deducted for income taxIncome tax A charge you pay based on your total income from all sources. The Canadian government and your province set the rate.+ read full definition, EI and CPP.

Depending on how you get paid, your pay stub may be a paper slip or a digital record. Your pay stub will either be attached to your cheque or to a direct depositDirect deposit A way to have money from your pay, investments or the government put into your account without a cheque. Example: You can ask the Canada Revenue Agency to deposit your tax refund directly into your bank account rather than mailing you a cheque.+ read full definition statement. It will show the difference between the amount of money you earn, and the amount of money you actually take home.

A pay stub will include:

Pennsylvania Median Household Income

| 2010 | $49,288 |

Pennsylvania levies a flat state income tax rate of 3.07%. Therefore, your income level and filing status will not affect the income tax rate you pay at the state level. Pennsylvania is one of just eight states that has a flat income tax rate, and of those states, it has the lowest rate. Just like federal income taxes, your employer will withhold money to cover this state income tax. Pennsylvania also levies local income taxes in more than 2,500 municipalities. And of Pennsylvanias 500 school districts, 472 of them levy a local income tax.

The table below lists the local income tax rates in some of the state’s biggest cities.

Read Also: Annual Income After Taxes Calculator

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

Read Also: What Do You Need To Do Your Taxes

A Warning For Freelancers

One really important thing to note is if you accept a freelance job, you have to ask if your employer is taking taxes out of your paycheck or not.

If they are, the above calculations are a fairly good gauge of your take-home pay, though you probably won’t have deductions for a 401 or health-care benefits.

If your employer doesn’t take taxes out, then you’ll need to manage those payments yourself. Typically, that means making quarterly estimated tax payments. You’ll also pay both the employee and employer portions of the taxes for Social Security and Medicare. Advisors recommend setting aside about one-third of your gross 1099 income in a separate account to pay your taxes. If it’s separate, it will be ready when your tax bill comes due.

Since your take-home pay is actually less than your gross pay, Bera said she recommends negotiating your salary even if it’s your first job out of college.

“A lot of times people are afraid to negotiate. And I think: It’s worth the ask, right?” Bera said. “It’s worth asking, ‘Hey, here are some things that I bring to the table.'”

You would be surprised. Most hiring managers go in prepared to negotiate and don’t give you their highest offer. So, if you ask for more money, and make the case for why you deserve it, you just might get it!

And, it’s important to make sure you’re enrolled in direct deposit, so your paychecks are automatically transferred to your bank account.

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky, and the penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

If youâd rather not deal with the stress, we highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time to handling pesky withholding calculations and payroll taxes. Whenever you need to check your records, youâll have automatically generated pay stubs to review with all the essential information.

Read Also: Penalty For Missing Tax Deadline

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

What Percentage Of My Paycheck Is Withheld For Federal Tax

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether theyre single or married, or the head of a household.

Also Check: What Percent Of Your Check Goes To Taxes

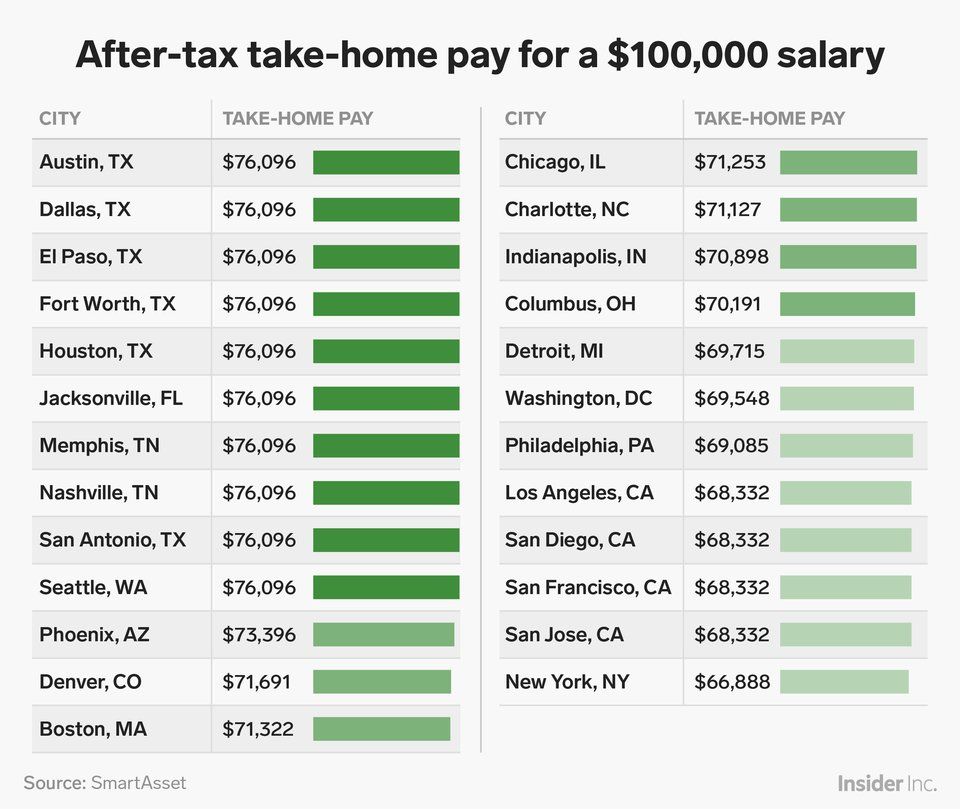

How Much In Taxes Is Taken Out Of Your Paycheck

Where does the money go, and what is it used for?

If you’re making money, chances are you’ll have to pay taxes on it. In fact, Uncle Sam takes a decent-sized chunk of your paycheck before it even hits your bank account. Before you sign a lease or nail down your budget, youll need to figure out your “take-home pay,” or the amount of your hard-earned money that will actually end up in your pocket.

In this article, well answer two questions: How much can you expect to pay in taxes, and just what is that tax money used for?

Understanding The Us Tax Withholding System

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Income taxes weren’t always withheld from people’s paychecks. In fact, income tax withholding is a relatively recent development. Before 1943, taxes were only withheld in spurts when the government needed to raise extra revenue. This article explains how we arrived at the current system that takes income taxes out of your paycheck and how this withholding process works.

You May Like: Do I Need Letter 6475 To File Taxes

Understanding Your 401 Retirement Plan

You wouldn’t expect to have to think about retirement from the minute you get your first full-time job but you do! A lot of companies will ask you to enroll in your 401 plan, where you contribute to your retirement account.

A 401 is a company-sponsored retirement savings plan where employees can contribute portions of their income, and their employers may match those contributions.

And as for making informed choices on which investments to choose, Bera, Boneparth and McKenna all recommended looking into your employer’s 401 plan, online portals and even working with financial advisors when making the decision to start investing into a 401.

It may not be fun for you to learn about investing but this is your money and your future so it’s critically important that you put in the effort to understand how much money you have, where it’s going and how much it’s growing .

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

When using the Wage Bracket Method, there are two possible calculations: one for employees with a Form W-4 from 2019 or earlier, the other for employees with a Form W-4 from 2020 or later.

Employees with a Form W-4 from 2019 or earlier:

In IRS Publication 15-T, find the worksheet marked âWage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier.â

Check Form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Enter the employeeâs total taxable wages for the payroll period on line 1a. This includes any earnings an employee pays taxes on, including salaries and cash tips.

Use the amount on line 1a to look up the Tentative Withholding Amount. Find the table that corresponds to your payroll period and the marital status of the employee

Find the wage amount on the left side of the table. Once youâve identified the row, use the number of allowances the employee has reported on Form W-4 to locate the corresponding column. The cell where these two meet will give you the tentative withholding amount for this employee.

Take the tentative withholding amount from this table and input it on line 1b.

On line 2a, enter any additional amount to be withheld as reported on Form W-4

Add lines 1b and 2a to find the amount to withhold from the employeeâs wages and record it in line 2b.

Employees with a Form W-4 from 2020 or later:

Also Check: What Is Self Employment Tax

Estimating Your Taxes In More Complex Situations

If your tax scenario is more complex, you will have to provide information on dependents, your spouses earnings, income from other jobs, and any tax credits and deductions you plan to claim.

The IRS recommends using its online Tax Withholding Estimator to make sure the right amount is being withheld from your pay. IRS Publication 15-T, meanwhile, is used by employers to figure out how much federal income tax to withhold from employees paychecks.

You can also use Form W-4 to request additional money be withheld from each paycheck, which you should do if you expect to owe more in taxes than your employer would normally withhold.

You might ask your employer to withhold an additional sum if you earn self-employment income on the side and want to avoid making separate estimated tax payments for that income. You can also use Form W-4 to prevent your employer from withholding any money at all from your paycheck, but only if you are legally exempt from withholding because you had no tax liability for the previous year and you also expect to have no tax liability for the current year.

Recommended Reading: How Much Tax Do You Pay On Doordash

Missouri Median Household Income

| $8,704+ | 5.40% |

Missouri’s top income tax rate is set to drop to 5.10% over the course of the next few years. This will happen if the state’s revenue meets a certain growth rate or level, resulting in a “triggered” tax cut.

A financial advisor in Missouri can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Recommended Reading: What Is Tax Filing Deadline

If You Dont Have Employees

If you run a small business without any employees, youâll still have to remit payroll taxesâfor yourself. This is called self-employment tax and is effectively Medicare plus Social Security for yourself . Learn more in our guide to self-employment taxes.

Payroll taxes when you do have employees gets a little trickier.

Payroll Hourly Paycheck Calculator

This calculator uses the withholding schedules, rules and rates from IRS Publication 15.

APL Federal Credit Union

© 2018 APL Federal Credit Union. .All rights reserved. 800.367.5796 · 11050 Johns Hopkins Rd. · Laurel, MD 20723

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Don’t Miss: How Much In Taxes Do I Owe

What Is My Filing Status

The filing status you use largely depends on the answer to one question: Were you considered married on the last day of the year? If yes, you are considered married for tax filing that year. If not, you are considered not married.

Some particular circumstances under which married persons may be viewed as not married. For example, someone may qualify for Head of Household status even if they are not legally separated or divorced.

Types of filing statuses include:

What Is A Federal Income Tax Withholding

Federal income tax is imposed by the United States Internal Revenue Services on all earnings of U.S. individuals and businesses. It is a standard tax withheld on all forms of income when you operate a business or work for a company in all fifty states of the U.S. The income taxes withheld are the source for all development programs of the government.

Recommended Reading: I Only Got Half Of My Tax Refund 2021