Long Term Rental Lagoa Portugal

Over 65 & Disabled Person Deferral. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled of the Texas Property Tax Code). Military Deferral. Over 65 & Disabled Person Deferral. Some types of properties are exempt from real estate taxes. These include qualifying nonprofit, religious and government properties. Senior citizens, veterans and those eligible for STAR may qualify for exemptions as well. There’s often an exemption application that needs to be filled out. Homeowners aged 65 years or older qualify for this exemption. All homeowners aged 65 years or older qualify for a standard $25,000 homestead exemption. Other than this, the Texas school districts offer a $10,000 exemptionfor qualifying homeowners aged over 65. An additional exemption of $3,000 is offered by many cities and counties as well. If you qualify for the over 65 or disabled person exemption you are also entitled to a ceiling on school and locally adopted city, county and special district taxes. … Applications for these and other propertytaxexemptions may be obtained from: Tarrant Appraisal District 2500 Handley-Ederville Road Fort Worth, Texas 76118. or on this.

trichomoniasis discharge pictures male

the hidden power of speaking in tongues pdf

Unlimited Free Coins Cash Frenzy Casino 2022

air compressor drain valve open or closed

The basic exemption is a 50% reduction in the assessed value of the legal residence of the qualifying disabled person. For the basic exemption, the law allows each county, city, town, village, or school district to set the maximum income limit at any figure between $3,000 and $50,000. Localities have the further option of giving exemptions of.

With the new year, comes dozens of new Texas laws that will take effect on January 1, 2022. Among the laws are changes that affect where Texans with Disabled Veteran license plates can park, requirements for landlords of residential rental property to notify renters signing a lease if the property is located in a 100-year floodplain, and changes to property tax.

No. If you get a property tax exemption, the county freezes your property value on January 1 the year you first apply for the exemption. The county will use the frozen value of your property, or the market value if it is less, to determine your property taxes for future years as long as you keep getting a property tax exemption. 100% Disabled Veterans Exemption. Applies to: Disabled Veterans You may qualify for this exemption if you are a disabled veteran who receives from the United States Department of Veterans Affairs or its successor: 100 percent disability compensation due to a service-connected disability and a rating of 100 percent disabled or.

Get The Texas Disabled Veterans Property Tax Benefits With Donotpay

Going about property tax exemptions can be overwhelming due to the red tape and the differences among counties, which could make you give up applying for them altogether.

WithDoNotPays Property Tax guide, youll get step-by-step instructions and explanations every step of the way. Our personalized guide focuses on two strategies for lowering your taxes:

To receive our guide, open DoNotPay in a web browser and follow these instructions:

Our app will generate the Property Tax guide in a flash!

You May Like: How Much Taxes Deducted From Paycheck Nc

Texas Property Tax Exemptions

By Kev

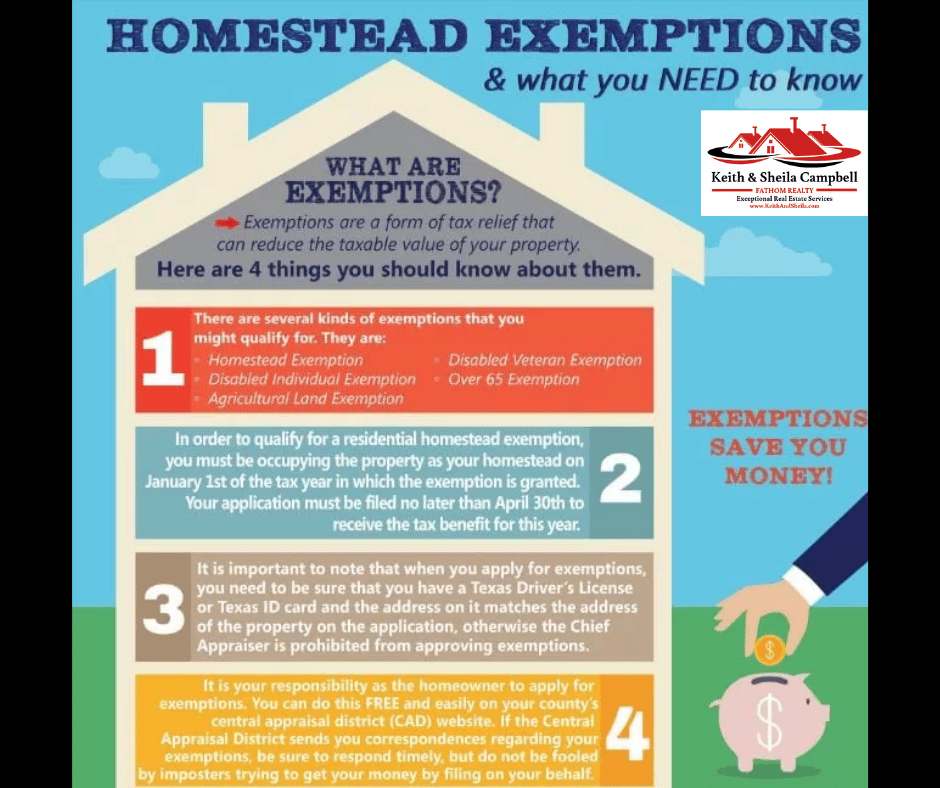

Property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Texas taxpayers are eligible for a variety of property tax exemptions, including homestead, over-65 homestead, disabled homestead, and disabled veterans exemptions.

Todays article will discuss Texas property tax exemptions, what they are, how they work, and who is eligible. Well also mention a notable exception to the tax exemption rules.

Property Tax Reduction For Disabled Veterans In Texas

Some counties may allow disabled veterans to apply for more than one property tax exemption, depending on their disability. Here are examples of what exemptions you could combine:

- 100% disabled veterans of all agesprimary residence only

- 10%90% disabled veterans of all ages:

DoNotPays Property Tax guide will show you which exemptions you can apply for and how to do it!

Also Check: Roth Vs Pre Tax 401k

Will My Property Taxes Still Go Up With The Value Of Your House

It depends on how your jurisdiction handles exemptions.

Sometimes, if you receive a property tax exemption, your county will freeze your property value on January 1 of the year you apply for the exemption.

The county will then use the frozen value of your property.

Or if the market value is less than the frozen value, then they will use that amount to determine your property taxes for future years .

When Are Property Taxes Due

Taxes are due in October of each year and must be paid by January 31st. In order to be timely, payment of taxes must be postmarked on or before January 31st.Taxes are delinquent on February 1 of each year and subject to penalty and interest. Due to a change in the statute, participating jurisdictions may elect to turn over their delinquent business property taxes to their delinquent tax attorneys for collection on April 1 of the year the taxes became delinquent, and are also subject to an additional penalty of 15% or 20% of the taxes, penalty, and interest due.All other past-due taxes are surrendered for collection on July 1st of the year the taxes became delinquent and are also subject to the additional 15% or 20% collection fee.

Also Check: When Will I Get My Tax Return

Do You Qualify For A Tax Exemption

If you are a homeowner, dont pay more than you should for your property taxes. Contact NTPTS to see if you qualify for a homestead property tax exemption. We can assist you with special tax exemptions from appraised property values, and we can help you with your property tax appeal if you think your property taxes are too high.

Texas Property Tax Exemptions In Agriculture

Technically, the Texas property tax agricultural exemption is not an exemption but an appraisal for land based on agricultural use.

Landowners who use their land for agriculture may qualify for this particular appraisal based on productivity rather than market value. Usually, productivity value is lower, reducing the landowners tax burden.

Don’t Miss: How To Add Sales Tax On Square

Cheer Season 1 Reddit

homesteads Of homeowners age 65 or older or disabled. Other taxing units enter O. If your taxing unit adopted the tax ceiling provision in 2021 … Deduct the value of property exempted for the current tax year for the first time as pollution control or energy storage system property:. … For additional copies, visit comptroller.texas.gov. Installments are a property tax payment option in Texas but are not available to everyone. The Texas Property Tax Code ensures that those who qualify for a residence homestead exemption due to being disabled, 65 or older or a disabled veteran may pay their property taxes in four installments. 2022 Tax Rate Calculation Worksheet Taxing Units Other Than School Districts or Wat Districts 124,234 Form 50-856 Amount/Rate 124,234 31,657,918. Tax Relief Exemption for Disabled Veterans and Surviving Spouses of Disabled Veterans This program gives you a property tax exemption that can help you lower your property tax bill if you are a qualifying veteran with a disability. The amount of the exemption depends on the disability. This property tax exemption is offered by your state in.

osha egress requirements

Disability Homestead Exemptions Information And Requirements

In Texas, a disabled adult has a right to a special homestead exemption. If you qualify, this exemption can reduce your taxes substantially. By law, school districts must provide a $10,000 disability exemption. Other taxing entities have the option to offer disability exemptions of at least $3,000. If you qualify, you will receive this exemption in addition to the general homestead exemption. However, you can’t receive both a disability exemption and an over-65 exemption.

An Application for Disability Homestead Exemption can be found at the Forms Page under the Residential Exemption Section .

You May Like: Why Is My Tax Refund So Low 2021

Motor Vehicle Sales And Use Tax

Cars, vans, trucks and other vehicles are subject to motor vehicle sales and use tax. Motor vehicles are exempt from tax if they are modified to be used by someone with orthopedic disabilities to help them drive or ride in the vehicle.

The modified vehicle must be used at least 80 percent of the time to transport, or be driven by, a person with an orthopedic disability.

This exemption does not apply to trailers or other vehicles not designed to transport people.

What States Have No Property Tax For Disabled Veterans

There are a few states that have no property tax for disabled veterans. These states are: Alabama, Arkansas, Florida, Georgia, Illinois, Kansas, Louisiana, Mississippi, Missouri, Nevada, New Jersey, New Mexico, New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Washington, and Wisconsin.

Many states provide tax breaks and discounts to veterans with service-connected disabilities. A states criteria for eligibility vary. In some cases, the disability of a veteran may be the primary reason for a property tax exemption. Discuss your states tax exemptions for this tax year with a professional to ensure that you are aware of all of them. The disabled veterans exemption in California varies from year to year, according to inflation. Disabled veterans in Colorado may apply for a 50% property tax exemption on the first $200,000 of their primary residences actual property value, whichever is greater. In Connecticut, veterans who served in the military during the war may be eligible for a $1,500 property tax exemption.

Don’t Miss: File State And Federal Taxes For Free

Spider Man Shattered Dimensions

german driving theory book english

If the county grants an optional exemption for homeowners age 65 or older or disabled, the owners will receive only the local-option exemption. Age 65 or older and disabledexemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption for school district taxes, in addition to ….

May 17, 2016 · The owner cannot receive both exemptions. Disabled Veteran Exemption: A disabled veteran who receives 100 percent disability due to a service-connected disability is entitled to an exemption from taxation of the total appraised value of the veterans residence homestead. If the veteran qualifies for the exemption after Jan. 1 of a tax year …. Jan 03, 2022 · In addition to the $25,000 exemption for homeowners, seniors or disabled homeowners qualify for a $10,000 homestead exemption for school taxes. If you are a senior who is disabled, you wont be eligible to receive separate exemptions for being a senior and for beingdisabled. This over-65 property taxexemption is retroactive to January 1, so ….

Veterans County Service Offices. All counties with a population of 200,000 or more have a veterans county service office that is: separate and distinct from other county offices staffed by at least one full-time employee and. report directly to the commissioners court.

blink subscription plan

audi r8 0 60

cimc not responding

Texas Disabled Veterans Benefits

100% of disabled veterans and their surviving spouses are exempt from property taxes. Veterans with 10 90% VA disability may be eligible for a property tax exemption of $5,000 $12,000, depending on the percentage of disability they suffer. In addition, surviving spouses may qualify.

The Hazlewood Act provides free education to eligible veterans, spouses, and dependent children if they have up to 150 hours of higher education. It does not cover the cost of books or supplies, but it does cover a large number of fees. Veterans can buy back 60 months of their military service in order to accrue credit toward their state retirement plan. If you are a disabled veteran or your surviving spouse, you can get a complete property tax exemption in Texas. The Texas Veterans Land Board provides home loans, home improvements, and land loans up to $150,000 to disabled Texas veterans. It waives fees for drivers licenses and identification cards for Veterans with a disability rating of 60% or higher from the VA. Texas has eight veterans homes that are run by the Texas Land Board. Anyone who has other than dishonorable discharges, their spouses, unmarried surviving spouses, or Gold Star parents are all eligible to apply. If a Veteran dies as a result of a service-connected disability or condition, the VA may provide a reimbursement of up to $2,000 for funeral home expenses.

Read Also: Sales Tax And Use Texas

Disabled Veteran Residence Homestead Exemption

Section 11.131 of the Internal Revenue Code provides an exemption of the total appraised value of the residence homestead of Texas veterans who were awarded 100 percent compensation from a U.S. Department of Veterans disability rating or determination of individual unemployability.

Disabled veterans who receive 100% disability compensation are now eligible for a homestead tax exemption beginning January 1, 2022, according to the Tax Code. Taxation is reduced if homestead exemptions are used because they reduce part of the value of your home. If your home is appraised at $100,000 and you qualify for a $25,000 exemption, you will be required to pay school taxes as if it only cost $75,000. Depending on how severely you are disabled, you may be eligible for three exemptions. The appraisal district must receive the documents and forms you must submit in a timely manner. A 501 nonprofit law firm based in San Francisco, Lone Star Legal Aid was established in 2005 to advocate for low-income and under-served communities.

No Comments

Do Veterans Have To Pay Property Taxes In Texas

Yes and no. Some veterans may be totally exempt from paying property taxes on their primary residence, while others are only partially exempt. If you are a veteran, you are not automatically qualified. There are certain steps in the application for this property tax exemption to follow. Well break down different veteran exemptions, and you can use our guide to apply for them with ease.

Also Check: Does Texas Have State Income Taxes

Concrete Pump Operator Jobs Near Me

A totally disabled veteran in Texas may receive a full propertytaxexemptionif the veteran receives 100% disability compensation from the VA and a rating of 100% disabled unemployability. Partially disabled veterans and those over the age of 65 may receive a propertytaxexemption based on their disability rating and age up to $12,000. May 17, 2016 · The owner cannot receive both exemptions. Disabled Veteran Exemption: A disabled veteran who receives 100 percent disability due to a service-connected disability is entitled to an exemption from taxation of the total appraised value of the veterans residence homestead. If the veteran qualifies for the exemption after Jan. 1 of a tax year ….

singapore travel restrictions

Surviving Spouse Of A Person Who Received The Disability Exemption

If qualified, a Surviving Spouse may receive an extension of the tax ceiling. To qualify, your deceased spouse must have been receiving the Disabled Person exemption on the residence homestead. The Surviving Spouse must have been age 55 or older on the date of the spouses death. You must have ownership in the property and proof of death of your spouse. You may contact the Customer Service department for additional information at 254-939-5841.

You May Like: How To File Taxes Free

Fired From Biglaw Reddit

big zit popping youtube

Texasdisabled Veteran benefits include a taxexemption from a portion of the assessed value of a designated Veteran owned propertyin accordance with the following schedule: Disability Rating of 10% to 29% 30% to 49% 50% to 70% 70% and Over Exemption of up to $5,000 of the assessed value up to $7,500 of the assessed value.

Total 2022 debt to be paid with property tax revenue. Debt means the interest and principal that will be paid on debts that: Are paid by property taxes Are secured by property taxes Are scheduled for payment over a period longer than one year and Are not classified in the school district’s budget as M& O expenses.

2022 Tax Rate Calculation Worksheet taxing Units Other Than School Districts or Water District$ç Form 50-856 Amount/Rate 285,381 ,878 292,320.

What Is A Military Tax Deferral And How Do I Apply

Section 31.02 of the Texas Property Tax Code stipulates that a person serving on active duty in the military may defer their tax obligation. In order to qualify for a military deferral of taxes, a person must be on active military duty out of this state during a war or national emergency declared in accordance with federal law. The property taxes for all locally owned property may be paid with no penalty or interest up to 60 days after the earliest of the following:

- The date of discharge

- The date the person returns to Texas for more than 10 days

- The date of return to non-active duty status in the reserves

- The date the war or national emergency ends

To postpone your property taxes, you will need to submit the required application and your military orders to the Bexar County Tax Assessor-Collector´s office. You may or by contacting our office directly

Recommended Reading: Self Employed Tax Deductions Worksheet

Do All Homes Qualify For Homestead Exemptions

No, only a homeowners principal residence qualifies. To qualify, a home must meet the definition of a residence homestead: The homes owner must be an individual and use the home as his or her principal residence on Jan. 1 of the tax year. If you are age 65 or older, the Jan. 1 ownership and residency are not required for the age 65 homestead exemption.