How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Tax On Rebates & Dealer Incentives

The state of Texas does not tax rebates and dealer incentives. In other words, be sure to subtract the incentive amount from the car price before calculating the sales tax amount.

As an example, lets say you want to purchase a new truck for $50,000 and the dealer provides a $3,000 rebate. You do not have to pay a sales tax on the $3,000 rebate. Therefore, the taxable amount is $47,000.

Local Authorities Set Taxes

In the Lone Star State, local government entities are responsible for determining your property tax, not the state. Your local property taxes help pay the salaries of firefighters and police, finance public schools, libraries, playgrounds, roads, and streets and pay for emergency medical services.

Though you may like seeing your tax dollars at work in your community, local government property taxes can be poorly administered, regressive, and vary by geographical region and property type. You may end up paying higher rates than you would for a similar home in the next neighborhood over just by virtue of your specific local governments priorities.

Texas cannot regulate or intervene in property taxation, even to increase funding for public education. It is up to local authorities to determine how much of your taxpayer money goes toward each service, and you may end up paying for services you dont use or dont believe are necessary.

Additionally, since the local government relies on property taxes as a source of revenue, Texans face stiff penalties for failing to pay these taxes on time.

You May Like: How To Check If Your Taxes Were Filed

What Factors Determine The Cost Of Tax Title And License

The cost of tax, title, and license differs from place to place. It depends on whether the car is new or used, and the amount of the vehicle. Thus, we will be looking at Texas and how much it will cost for tax title and license. The amount of money you have to pay for tax title and license depends on several factors. Sales tax, for example, is determined by the cost of purchasing the vehicle. It is also influenced by the tax rate that may be obtainable in the county you live.

A title fee is only paid once. The sales tax, registration fee, and other local fees are paid annually. The cost paid is determined by the purchase price of the vehicle, fuel efficiency, weight the vehicle can carry, age, etc.

How Much Taxpayers Will Benefit

How much, if any, of the adoption tax credit a parent will receive depends on their federal income tax liability in 2022 . In one year, taxpayers can use as much of the credit as the full amount of their federal income tax liability, which is the amount on line 11 of the Form 1040 less certain other credits . Even those who normally get a refund may still have tax liability and could get a larger refund with the adoption tax credit. Taxpayers have six years to use the credit.

People who do not have federal income tax liability will not benefit this year. We encourage them to claim the credit and carry it forward to future years since the credit may become refundable again in the future.

Don’t Miss: Irs Address To Mail Tax Returns

What Personal Property Is Taxed In Texas

The property tax in Texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. Property that’s not directly responsible is exempt. It doesn’t count as being used to make income if you drive your car to and from work.

More Power For Taxpayers

Local governments in Texas rely heavily on property tax revenue to pay for salaries of police officers and firefighters, as well as for government services including roads, libraries and public schools.

Unlike most other states, Texas does not have a state income tax, and property tax bills are among the highest in the nation.

Each year, appraisal districts assess home values and then notify homeowners of how much their houses are worth. Later, local governments decide how much money they will need to provide public services. They then set a property tax rate that will allow them to collect the amount of revenue needed. Some governments have access to additional sources of revenue for example, school districts receive state and federal funds, and some counties receive sales taxes.

According to the comptrollers office, property tax collections have risen more than 20% since 2017.

Historically, where theres been a big increase in the total assessed value, some taxing jurisdictions have just left their property tax rates the same as the year before, said Charles Gilliland, an economist at the Texas Real Estate Research Center. That results in huge increases in Texas homeowners property taxes.

A pair of bills in 2019 tried to address this. House Bill 3, a school finance bill, included about $5.1 billion devoted to lowering Texans property tax bills.

You May Like: Haven T Received Tax Return

Getting Your Will In Order

Since there is no state inheritance tax in Texas and beneficiaries can receive their inheritance without this extra burden of taxation, you may think that you do not need a willthink again!

All wills go through probate. However, if you die without a will in Texas your estate goes through probate without your assets having clear intentions with regard to your wishes. This often results in a lengthy process that could be avoided. The Texas Probate Code then decides who inherits your property, and a tax may be levied against your estate.

For these reasons and many more, its important to start estate planning early.

Before you begin planning your estate, ask yourself thisam I committed to my financial legacy? Writing your will earlier rather than later is the key to a tidy estate and will improve your loved ones well being even after you pass away. You should also avoid cookie-cutter online DIY will documents that are spell more trouble than help.

To have peace of mind, set up a complimentary consultation with Leslie Thomas of Thomas-Walters, PLLC. She can provide you with guidance on the Texas estate tax, inheritance laws, and the best plan for your situation.

If you would like more information about estate planning and how to minimize taxes, dont hesitate to get in touch with our office for a consultation. We would be happy to answer any questions you may have.

Powerball Winnings After Taxes: How Much The Winner Could Actually Take Home In Texas

Monday night’s Powerball jackpot has increased to an estimated $800 million dollars, according to the Texas Lottery.

That’s the fifth largest U.S. lottery prize of all time, but if you beat the odds and match all six numbers, it doesn’t all go right to your bank account.

Winners can choose to have their prize money paid out in 30 payments over 29 years, or in a lump sum.

If there is a single winner of the $800 million jackpot, those who pick the cash option will receive an estimated $383.7 million.

Then there are the taxes. The IRS immediately takes 24% of all lottery winnings over $5,000, dropping the total to approximately $291,612,000 for a winner choosing the lump sum.

The winner will also likely owe more when they file their 2022 federal income taxes.

Texas is one of 10 states that does not tax lottery winnings at the state level.

The next drawing will be held on Saturday, Oct. 29, at 10:12 p.m. CST.

Read Also: When Is An Estate Tax Return Required

Who Can File A Texas Franchise Tax Report

After starting a business in Texas, any authorized person may sign the Texas Franchise Tax Report. An authorized person is someone your business permits to act on its behalf. This could be someone within the business , or someone outside of the business that you hire to file your report. When you hire Northwest Registered Agent for business renewal service, well submit the Texas Franchise Tax for you!

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas’ taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

You May Like: Taxes On 2 Million Dollars Income

How Having No Income Tax Impacts Your Earnings

If you live in a state that doesnt levy personal income taxes, it means that your state government does not require you to pay taxes from your wages, pension, retirement plan plan or IRA), or Social Security income.

Example: An individual with a yearly salary of $80,000 living in a state imposing a tax rate of 5.25% for their income bracket must pay a yearly income tax rate of $4,200, reducing their yearly earnings to $75,800 .

Who Pays Texas Income Tax

Most states impose a tax on your earnings if you live or work within the state that is similar to that imposed by the federal government. States that have income taxes often base them on a percentage of your income that can either vary based on your income level or be imposed at a flat rate. Texas is one of a select group of states that dont impose an income tax on individuals, but it does levy taxes on business income.

Also Check: Corporate Tax Rate In India

Employer Payroll Tax Withholding

All employers are required to withhold federal taxes from their employees wages. Youll withhold 7.65 percent of their taxable wages, and your employees will also be responsible for 7.65 percent, adding up to the current federal tax rate of 15.3 percent. Speak to your accountant for more information.

Texas Property Taxes By County

You can choose any county from our list of Texas counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the Texas property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In Texas By County

Don’t Miss: Amend My 2020 Tax Return

Reason Number Three These Taxes Are Set At A Local Government Level

The State of Texas doesnt determine what your property tax bill will be, as this is set by your local authorities. While this is a good thing in some ways as it keeps the power to change taxes local to your own community, it does mean that the state government cant act to regulate or influence this taxation. The most they can do is pass a bill that tightens regulations on tax hikes, pass a law that allows residents of Texas to vote on tax increases in their local community, or increase state funding for public education . For these changes to occur, they would have to be passed by the state legislature, which hasnt happened at this point. In fact, state funding for public education has dropped in recent years from 45% to 38%.

How Much Are Taxes In Texas

Property taxes in Texas are calculated based on the county you live in. The average property tax rate in Texas is 1.80%. This is currently the seventh-highest rate in the United States. Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year.

Read Also: What Is Tax Filing Deadline

Texas Sales Tax Rates By City

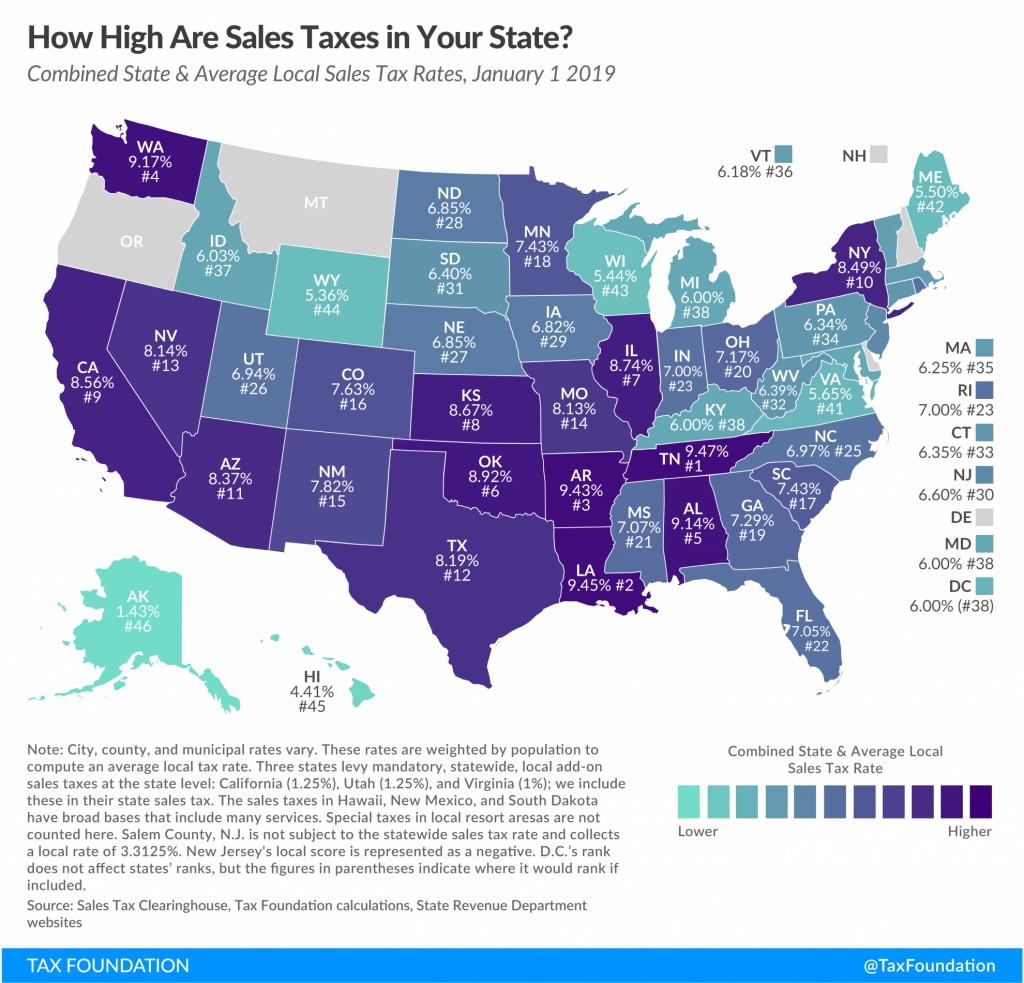

The state sales tax rate in Texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%.

Texas has recent rate changes .

Select the Texas city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Texas was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Complete The Franchise Tax Questionnaire

Mailing Address:

- Youll see the option to change your LLCs mailing address.

- The mailing address is the address where the Comptroller will send you notices and correspondence.

- Initially, the Comptroller uses the address of your Texas Registered Agent .

- If you would like your tax mail sent to a different address , you can update your mailing address. Note: this just changes your address with the Comptroller, not the Secretary of State. And this address doesnt have to be an address from your Certificate of Formation. Furthermore, the address can be in any state or in any country.

Also Check: How Do I Get My Tax Transcripts

Now Write Your Employees Paychecks

Youve figured out all your payroll needs, so now you can make your small business stand out in the big state of Texas. Get your signature ready because after youve calculated your employees net pay by implementing all deductions, its time to write those checks.

All you have to worry about is paying your employees on time and setting aside any taxes your company is responsible for .

You need to fill out Forms 940 and 941 , but if you prefer ongoing fulfillment, payment can be made via the EFTPS payment system. Find further information on the IRS here.

Inheritance Tax Laws In Texas

Inheritance tax, also called the estate tax or death tax, is levied at both the federal level and state level and applies to any assets transferred to someone other than the deceaseds spouse at the time of death.

In some states, individual inheritors are charged a state inheritance tax on top of federal inheritance taxes. But Texas does not have a state tax for inheritance.

Read Also: Johnson County Property Tax Search

How To Calculate Total Revenue For A Texas Llc

Total Revenue comes from your LLCs federal income tax return. While there are more details and exceptions, the information below is a simplified approach, extracted from the Texas Tax Code: Section 171.1011.

The information below is subject to change. Again, we recommend calculating Total Revenue with an accountant in Texas.

Note: Calculating an LLCs Total Revenue for Combined Reporting and Tiered Partnerships are different. These are discussed below in the FAQ section.

What Is A Texas Franchise Tax

The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entitys Existence in Texas, if needed to terminate the entity with the Secretary of State.

Also Check: How To File Va State Tax Extension

Don’t Miss: Irs Track My Tax Return

How Is The Texas Franchise Tax Calculated

The Texas franchise tax calculation is based on margin, which can be calculated using one of the following methods:

- Total revenue times 70%

- Total revenue minus $1M

- EZ Computation* Total revenue times apportionment factor, then apportioned total revenue times tax rate of 0.331%. Only businesses with an annualized total revenue of $20M or less qualify for EZ Computation

Donât Miss: How To Pay Sales Tax For Small Business

Early Successes In Asking Voters For More Money

Some counties and school districts have successfully gone beyond the revenue growth limit with an election. Last year, Lubbock County voters approved a property tax hike to fund salary increases for sheriffs deputies.

This year, Lubbock County approved the maximum tax rate it could set without triggering an election.

If you keep jumping everybodys taxes by 8% every year, thats a problem, said Lubbock County Commissioner Jason Corley. Corley voted against this years proposed tax rate, saying he wanted to keep tax rates even lower.

Still, counties have had to get creative when it comes to figuring out how to provide the same level of service to their constituents amid price increases and labor shortages, he said.

People are saying, I cant hire a plumber, Corley said. Well, I cant hire a lawyer in the DAs office either.

Lubbock has found cost savings in employee benefits by relying on private contractors. The West Texas county also saved on utility costs by having certain court hearings virtually instead of in air-conditioned courthouses.

Several school districts, including Fort Bend Independent School District and Katy ISD, have decided to hold property tax rate elections in November to bring in more revenue.

Other school districts have adopted budgets that include millions of dollars in deficits. Lufkin ISDs board of trustees last month adopted a $4.3 million deficit for its new budget.

Don’t Miss: How To Find 2020 Tax Return