Individuals Living Abroad Or Traveling Outside The United States

If youre living or traveling outside the U.S. or Puerto Rico on May 1, you have until to file your return. You must still pay any tax you expect to owe by the May 1 due date.

Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Personal Tax Changes And Tax Filing Deadline

The tax filing deadline in Canada in 2022 is on May 2, 2022.

2021 was another extraordinary year. Unlike previous years where you probably only focused on getting your T4 slip and that was it, your 2021 tax return filing may look a bit different.

Canadians who received COVID-19 financial benefits are required to report the income on their tax return.

For example, you must report income received from the Canada Recovery Benefit , Canada Recovery Sickness Benefit , and Canada Recovery Caregiving Benefit . Recipients of these benefits will get a T4A slip from CRA.

The tax was withheld at source for these three benefits, however, depending on how much you earn from other sources, you may still owe taxes or receive a refund.

For the 2022 tax year, the following updates are applicable:

RRSP Contribution Limit: The RRSP annual limit for 2022 is increasing to $29,210 from the previous limit of $27,830 in 2021. You can still make RRSP contributions for the 2021 tax year during the RRSP season that ends on March 1, 2022.

Basic Personal Amount: The federal basic personal amount in 2022 is up to $14,398 if your income is $155,625 or less. A clawback of the personal amount applies to higher taxable incomes and is $12,719 if you earn $221,708 or more.

TFSA Contribution Limit: The annual TFSA limit for 2022 is unchanged at $6,000. If you have been eligible to contribute to a TFSA since it was implemented in 2009, your total contribution room is now $81,500 .

- Up to $50,197: 15%

What If You Miss A Deadline

You’ll probably be hit with a financial penalty, such as an extra interest charge, if you don’t submit a tax return and make any payment that is due by its appropriate deadline. There are two main penalties you may face:

- Failure-to-file penalty:This penalty for 1040 returns is 5% of the tax due per month as of tax year 2021, up to a cap of 25% overall, with additional fees piling up after 60 days.

- Failure-to-paypenalty: This penalty is 0.5% for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

If both are penalties are applied, the failure-to-file penalty will be reduced by the failure-to-pay penalty amount for that month. If you are on a payment plan, the failure-to-pay penalty is reduced to 0.25% per month during that payment plan schedule. If you don’t pay the taxes you owe within 10 days of receiving a notice from the IRS that says the agency intends to levy, then the failure-to-pay penalty is 1% per month.

Generally, interest accrues on any unpaid tax from the due date of the return until the date of payment in full. To avoid fees and required payments, the IRS recommends you should file your return as soon as possible if you miss a deadline.

You May Like: Morgan Stanley Tax Documents 2021

This Is The New Tax Filing Deadline For 2020 Returns

The Internal Revenue Service announced Wednesday that it is pushing back the filing deadline for 2020 returns from April 15 to May 17, 2021.

The move is intended to give tax filers more time to get their returns in order after a year that wreaked havoc on many people’s finances. accelerated after President Joe Biden signed the American Rescue Plan into law four weeks after the IRS started collecting tax returns.

According to IRS data, 35 million people had already filed their taxes in the first eight days of the tax filing season, well before the bill was signed. But the ARP includes multiple provisions that could impact a filer’s return this year, including a third stimulus payment and a tax break on the first $10,2000 in unemployment insurance.

Now, the IRS is working on guidance for how those early filers can take advantage of the tax breaks in the bill.

The IRS already delayed the start of tax season to Feb. 12 so that it had time to disburse the second stimulus payments earlier this year. It also extended the tax deadline to June 15 for people in Texas after the state was hit with severe winter storms earlier this year.

The move also gives the agency more time to disburse stimulus payments and process tax returns from this year and a backlog from last year.

To see the status of your federal refund, use the IRS’s Where’s My Refund? tool. Those who e-file will likely get their refunds more quickly than those who file via a paper return.

When Is The Deadline To File Taxes For Missing Stimulus Checks

So its been a while since Ive used the stimulus word I used that word a lot throughout most of 2020 and into 2021 as well as I was tracking the first three stimulus payments on my YouTube channel.

And then I stopped creating stimulus content because it was clear that there was not going to be a fourth stimulus payment, at least not at the federal level.

But I decided to create another piece of stimulus content here in the fall of 2022 because some people have been reaching out to my tax company, Choice Tax Relief, about filing their taxes to get their missed stimulus payments.

Also Check: New York Sales Tax Rate

Prior Information Re 2019 Tax Returns

COVID-19 Update March 18, 2020: The 2019 tax deadline is extended to June 1. Tax balances and instalments may be deferred tillSeptember 1st without interest or penalties. These measures were alsoannounced by the Quebecgovernment. If you are expecting a refund, or have income-testedbenefits such as Canada Child Benefit or GST Credit, it may be best to not delayyour filing.

Updates May22/25,2020: CRA confirmed that as long as the tax return is filed bySeptember 1, there will be no late filing penalty. This includes taxreturns filed for self-employed with a June 15th due date.

UpdateJuly 27, 2020: The payment due date is extended from September1, 2020 to September 30, 2020 for current year individual, corporate, and trusttax returns, including instalment payments. Penalties and interest willnot be charged if payments are made by the extended deadline of September30th. This includes the late-filing penalty as long as the return is filedby September 30th.

The also indicates that interest is being waived onexisting tax debts related to individual, corporate and trust income tax returnsfrom April 1, 2020 to September 30, 2020, and for GST/HST returns from April 1,2020 to June 30, 2020.

Important: However, if 2019 individual tax returns are not received and assessed by early September 2020, estimated benefits and/or credits will stop in October 2020 and individuals may have to repay the amounts that were issued as of July 2020.

See:

Filing 2019 taxes through the COVID-19 crisisand

Tax Filing Deadlines For Final Tax Returns

If you are the legal representative of a deceased person, you are in charge of ensuring their final tax return is submitted to the CRA. If the individual died between Jan. 1 and Oct. 31 of the tax year, their return is due April 30, but if they died between Nov. 1 and Dec. 31, their return is due six months after the date of their death.

Again, if the deceased person or their spouse or common-law partner is self-employed, the CRA extends the due date to June 15, but it still begins assessing interest as of April 30.

Recommended Reading: What Form Do You Need To File Taxes

What Are The Penalties For A Late Tax

The government wants every penny it is owed and wants it in good time. As such, there are penalties for filing a late tax return if you have an unpaid tax balance.

If you are getting a refund or your tax balance is zero, there are no penalties for sending in your return after the deadline date.

The penalties for filing your income tax and benefit return late when you owe the Canada Revenue Agency are as follows:

The Deadlines Are In 2024 And 2025

So what are the actual deadlines to file your 2020 and/or 2021 tax return to claim your missing stimulus payments?

Well, the actual deadline to file a return and get a refund for that year is generally three years from the original due date of the return, not including extensions. Theres an exception if youve made a payment of tax for that tax year within the past two years, but that exception likely doesnt apply to most folks out there who only need to file to claim their missing stimulus.

So because the original due date of the 2020 Form 1040 was May 17, 2021 because the IRS pushed out tax day by a month you have until three years from that date so May 17, 2024 to file your 2020 tax return to claim your refund attributable to the Recovery Rebate Credit for your missing first and/or second stimulus amount.

And because the original due date of the 2021 Form 1040 was April 18, 2022, you have three years from that date so April 18, 2025 to file your 2021 tax return to claim your refund attributable to the Recovery Rebate Credit for your missing third stimulus amount.

So the deadline to file for the stimulus checks is May 17, 2024, for the first and second stimulus checks and April 18, 2025, for the third stimulus check.

Recommended Reading: Work At Home Tax Credit

What If You Cant Pay Your Taxes

Even if you cannot pay your taxes for one reason or another, file your return anyway, and immediately apply for a payment plan. The IRS will generally let you pay over time, as long as you make arrangements to do so.

You can also go to IRS Direct Pay and have tax payments withdrawn directly from your bank account if you owe money and don’t want to send a check to the IRS via snail mail. This could save you time and money in the long run.

Tax Tips For Canadians

To help you navigate tax season, weve rounded up our 15 most popular and helpful tips, from how long to keep tax documents to what happens if you lie on your return. Youll also find advice for dealing with U.S. investments, how much money to set aside for taxes if youre self-employed, and much more, with links to our full articles on each topic. There really is something for everyone.

Read Also: Sales Tax In Nj Calculator

What If I Made A Mistake And Need To Re

It happens. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You don’t need to redo your whole return. Along with filing an amendment using Form 1040-X, youll also need to include copies of any forms and/or schedules that youre changing or didnt include with your original return.

IRS Form 1040-X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process to correct your tax return.

To avoid delays, make sure you only file Form 1040-X after youve already filed your original Form 1040. If youre filing a Form 1040-X to collect a tax credit or refund from a previous year, youll need to file within three years after the date you timely filed your original return, or within two years after the date you paid the tax, whichever is later.

Its Never Too Late To Get Help

With nearly 60 years of experience preparing and filing all sorts of Canadian taxes, H& R Block has tax solutions that will fit your needs and gives you access to the largest network of reliable Tax Experts.

Although our offices are busier in April than in January, H& R Block Tax Experts are here for you all year round whether its your first time filing, if you need to catch up on returns from previous years, or anything else tax season sends your way. We can even review up to three of your past returns looking for money that others may have missed through our Free Second Look service. By filing with H& R Block, you can be sure youll get the most out of your return, with our Maximum Refund GuaranteeTM.

Read Also: Is Hazard Insurance Tax Deductible

What Happens If You File Personal Taxes Late

Filing your taxes late when you have earned a refund or dont owe any further tax will not result in any fees or penalties. However, if you owe money and file late, the CRA charges you a penalty on the taxes owed equal to five percent plus an additional percent for each month late up to 12 months. Taxes owed to the CRA are due the day your tax return is due for individuals. If you cannot pay the full amount, the CRA will accept late payments but charges compound daily interest on all amounts due.

For example, if you owe the CRA $10,000 and you file your tax return 5 months late, the CRA will apply a 10 percent penalty and your tax bill is increased to $11,000.

Tax Claims For Canadians

You likely know about claiming child care expenses, charitable donations and contributions to your registered retirement savings plan but what other deductions could you get? We list the most commonly missed tax claims. See if youre eligible for claims related to medical expenses, working from home, moving, tuition and school, investing fees, political contributions or buying your first home. And for each, we include how to make the claim, too.

Read Also: What Is Tax Filing Deadline

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

What If Im Self

As a small business owner, you may be required to file additional returns, such as those for payroll and GST/HST remittances and withholdings. Failure to meet the CRAs payroll obligations results in penalties and interest there are several types of penalties for payroll accounts. Failure to deduct can result in a penalty of 10% for the first failure, and will go up to 20% with any additional failures. Late filing or non-payment penalties start at 3% and will go up to 20%.

Don’t Miss: Penalty For Not Paying Quarterly Taxes

Returns For Which Penalty Abatement Is Not Available

The IRS notes that penalty relief for 2019 and 2020 returns is not available in some situations, such as where a fraudulent return was filed, where the penalties are part of an accepted offer in compromise or a closing agreement, or where the penalties were finally determined by a court. This relief is limited to the penalties that the notice specifically states are eligible for relief. For ineligible penalties, such as the failure-to-pay penalty, taxpayers may use existing penalty relief procedures, such as applying for relief under the reasonable cause criteria or the First Time Abate program. Visit IRS.gov/penaltyrelief for details.

Due Dates For Installment Payments

If you make installment payments throughout the year so that you can avoid a large bill at tax time, you have four due dates throughout the year. Whether you are self-employed or employed by someone else, you must submit your installment payments by March 15, June 15, September 15, and December 15 of each year.

Your taxes are done right, however you choose.

Filing on your own, with live help or handing off your taxes to an expert, with TurboTax you can be confident that your taxes are done right.

You May Like: Are Municipal Bonds Tax Free

Are Inheritance Taxes Due On The Date Of Death Or When The Inheritance Is Received

While some states do impose an inheritance tax, the federal government only imposes an estate tax. Estate taxes are imposed on the estate itself rather than on the individuals inheriting assets from the estate. Estate taxes aren’t necessarily imposed on the date of death, but they will have been assessed by the time an heir officially receives assets.

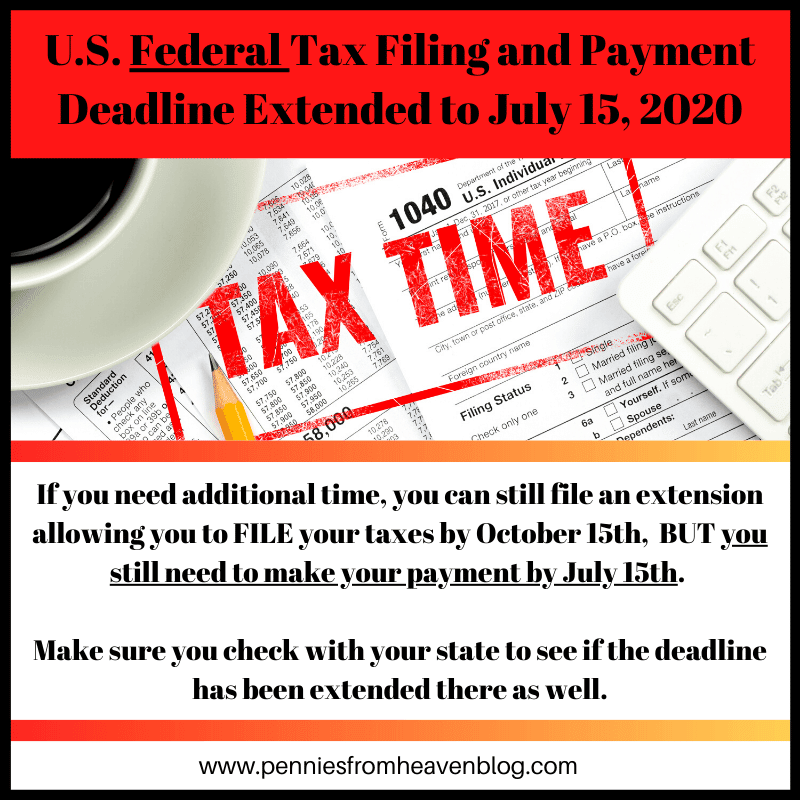

This Filing And Payment Relief Includes:

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15, 2020, are automatically extended until July 15, 2020. This relief applies to all individual returns, trusts, and corporations. This relief is automatic, taxpayers do not need to file any additional forms or call the IRS to qualify.

This relief also includes estimated tax payments for tax year 2020 that are due on April 15, 2020.

Penalties and interest will begin to accrue on any remaining unpaid balances as of July 16, 2020. You will automatically avoid interest and penalties on the taxes paid by July 15.

Individual taxpayers who need additional time to file beyond the July 15 deadline can request a filing extension by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004.

Don’t Miss: How To Find Tax Rate