Is A Tax Id Number Public Information

Related. Your employer identification number , or FEIN, allows you to do business and report financial information to the Internal Revenue Service. However, an EIN number is a public record, making your company vulnerable to people who care less about your business.

What Is An Itin Used For

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Do I Need A Tax Id Number

A tax ID number isnt necessarily a requirement for all businesses , but it is impossible to accomplish certain things unless you have one. While not every business needs to get a tax ID number, most will want to. Here are the main reasons why you should consider obtaining a tax ID number for your business:

- To file taxes separately from your personal taxes: Depending on your business entity, you may be required to obtain a tax ID number so that the business can file taxes separately from your personal tax return. All partnerships, corporations and LLCs that elect to be taxed as a corporation must obtain one to file their taxes.

- When you want to hire employees: If you plan on hiring someone to work in your business, then you have to have your business tax ID number in order to do so.

- When you create a Keogh plan: Any tax-deferred pension plan, typically created for a self-employed individual, will need to obtain a tax ID number to open the plan.

- You may need one just for being in a certain industry: If your business is required to pay certain taxes beyond income tax, then you may be required to have a business tax ID number. An example would be a trucking company that is required to pay excise taxes.

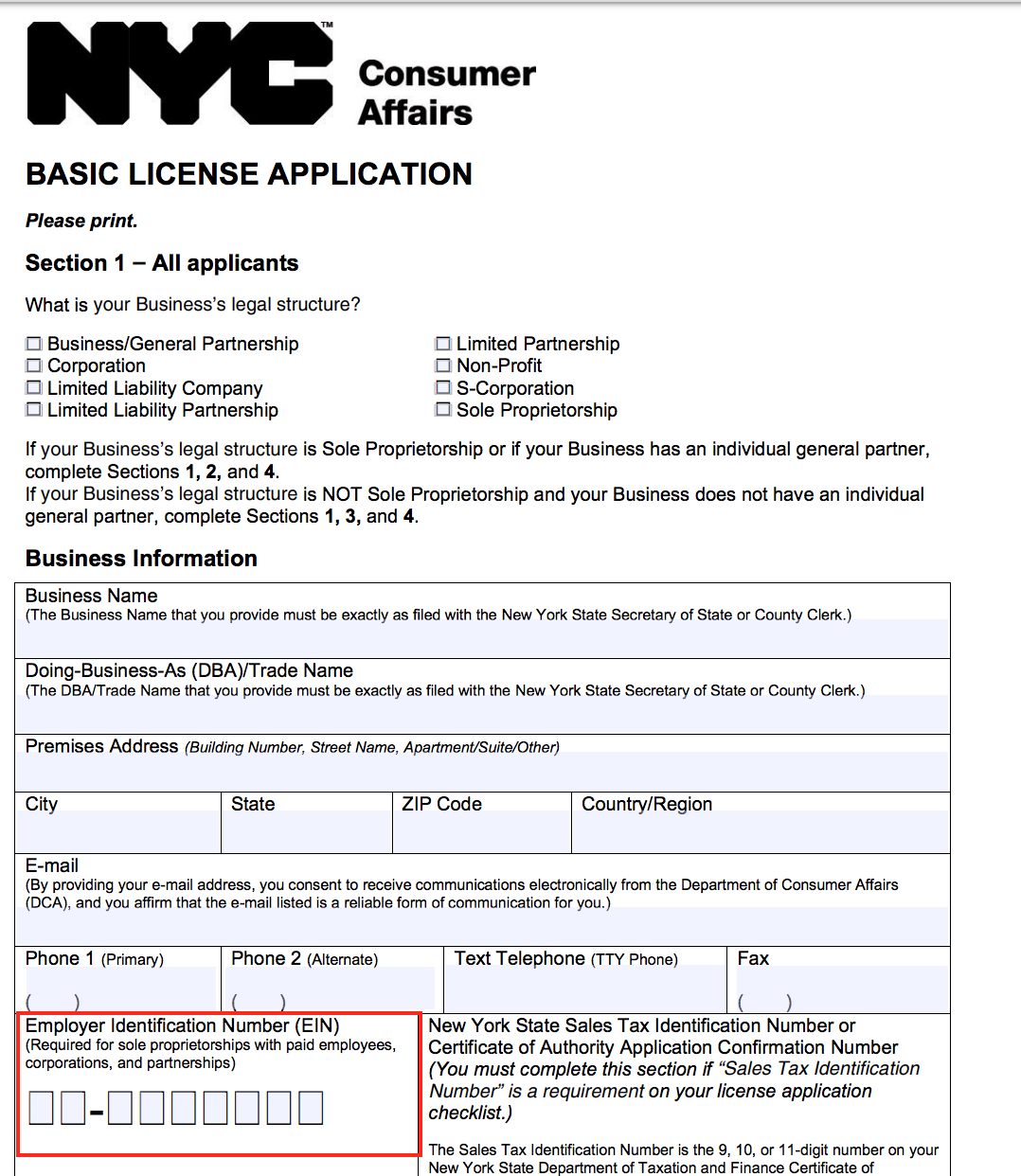

Additionally, some financial institutions may not allow you to open a business bank account without one, and there may be some types of business licenses where one is required, but this is not always the case.

Recommended Reading: Who Does Taxes For Free

How Do I Know If I Need A Tin

You need a TIN if you are authorized to work in the United States or if you plan to file taxes with the IRS. You’ll also need a TIN if you want to take advantage of benefits or services offered by the government. If you run a business or other organization, you’ll also need a TIN to run your day-to-day operations and to report your taxes.

Foreign Persons And Irs Employer Identification Numbers

Foreign entities that are not individuals and that are required to have a federal Employer Identification Number in order to claim an exemption from withholding because of a tax treaty , need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only””For Tax Treaty Purposes Only””Required under Reg. 1.1441-1″”897 Election”

To expedite the issuance of an EIN for a foreign entity, please call . This is not a toll-free call.

Recommended Reading: When Are Llc Taxes Due

Your Companys Ein And Business Identity Theft Issues

Its easy for someone to get your business EIN, and they might be able to use it to steal your business identity. The IRS recognizes that a companys EIN may be the target of hackers and identity thieves. It suggests some ways to be watchful for identity theft related to taxes. Your business may have been hacked if:

- You receive tax notices about fictitious employees

- Your business tax return is accepted, but you havent file for that year yet

- You receive bills for a line of credit or a credit card that you dont have

The best way to check for business identity theft is to get a copy of your business credit report. Check it in detail for unexplained creditors and inaccurate or out-of-date information.

Itin Requests To Pay Withholding On Forms 8288 And 8288

If a transferee does not have a TIN, and an amount withheld under section 1445 is due to the IRS, complete Form 8288, 8288-A and mail the forms along with the payment to Internal Revenue Service, Ogden Submission Processing Campus, PO Box 409101, Ogden UT 84409, by the 20th day from the date of the sale.

In a separate package, mail a completed Form W-7 with supporting documentation and a photocopy of Form 8288 and 8288-A to Internal Revenue Service, Austin Submission Processing Campus, ITIN Operation, PO Box 149342, Austin TX 78714-9342. Make sure you select reason h and write Exception 4 on right side of reason line h. The Austin IRS campus will fax Form 8288/8288-A to the Ogden campus.

The Ogden Submission Processing Campus will not date stamp or mail out Form 8288-A, Copy B to the foreign transferor, if the transferors TIN is missing. Instead, Ogden IRS will mail letter 3794 SC/CG to the transferor with instructions to apply for an ITIN. Once the transferor receives the ITIN number they are to write it on the letter 3794 SC/CG and mail it back to the Ogden IRS office. The Ogden IRS office will document the ITIN number on Form 8288-A Copy B, date stamp Copy B mailed on it, and mail it out to the transferor.

You May Like: How Much Taxes Deducted From Paycheck Nc

Where To Find Your Tax Id

If you already have a tax ID, you can find it here:

- Your employer and your tax advisor know your tax ID.

If you lost your tax ID, there are 2 ways to get it back:

- Go to the nearest Finanzamt, and ask for it. They will tell you your tax ID1, 2. You dont need an appointment.

- Fill this form, and the Finanzamt will send you a letter with your tax ID. It takes up to 4 weeks1. They will send it to the address you registered, not anywhere else.

How To Cancel An Ein

If you apply for an EIN and realize you dont need it or close your business, you can close your business account with the IRS.

How you close your account depends on whether youve ever used the EIN to file tax returns or not.

If you never used the EIN, send a letter to the IRS that includes the complete legal name of your business, your EIN, business address, and the reason you need to close your account. Send your letter to Internal Revenue Service, Cincinnati, OH 45999. You may want to send the letter certified return receipt so you have confirmation that the IRS received it.

If youve filed an income tax return using the EIN, you need to file a final return before the IRS can close your account. Business tax returns, including Form 1065, Form 1120-S, and Form 1120, include a checkbox to mark the return as final. You need to file a final return even if you didnt have any revenues or expenses during your last year in business.

Once the IRS assigns an EIN, it will never assign it to another business entity, even after closing your business account. It remains the permanent federal identification number for that business, and you can reopen your account and reuse the EIN for that same business later if needed.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Don’t Miss: T Mobile Taxes And Fees

Get An Ein For Small Business Disaster Loans

- Your business will need an EIN to apply for Small Business Administration loans, including disaster loans for businesses affected by the public health crisis and economic downturn, as well as the 2021 winter storms.

- The Economic Injury Disaster Loanprogram is an SBA disaster loan program for businesses with fewer than 500 employees, including sole proprietors, independent contractors, and self-employed persons. Check with your local lender to see whether they participate in this program.

How To Find An Ein For A Business

The nature of your business may require that you regularly look up EINs of other companies, or you may want to look up another business’s EIN to validate their information.

If the company is publicly traded and registered with the Securities and Exchange Commission , you can use the SEC’s EDGAR system to look up such a company’s EIN for free. You can do an EIN lookup for nonprofit organizations on Guidestar.

If a company is not registered with the SEC, it will be more difficult since theres no central EIN database for these companies. Here are a few strategies you can use:

- Contact the company’s accountant or financing office and ask for the EIN, though they dont have to provide it.

- Search for the company on the secretary of states website or seek out other local or federal filings that may be online.

- Hire a service or use a paid database to do the EIN search.

Also Check: Travel Trailer Tax Deduction 2021

Does Your Business Need An Ein

Since the IRS uses EINs to identify which business tax returns taxpayers must submit, most self-employed folks and small business owners will need an Employer ID Number at some point . But youâre legally required to get an EIN if you answer yes to any of the following questions:

-

Does your business have any employees?

-

Does your business operate as a C corporation, S corporation, limited liability company , or partnership?

-

Do you file employment or excise tax returns?

-

Do you withhold taxes on income, other than wages, paid to a non-resident?

According to the IRS, sole proprietorships donât require an EINâthey can just use their Social Security number . If youâre a sole proprietor that wants to do any of the above , though, youâll still need an EIN.

Even if youâre not legally required to have an EIN, we recommend getting one anyway. EINs are also required to open business bank accounts and credit cards, apply for business licenses, and secure some types of financing.

How To Find Another Company’s Ein

Usually, small business owners need to locate their own company’s tax ID number, but businesses sometimes need to look up another company’s EIN. For example, you can use an EIN to verify a new supplier or client’s information. Also, in industries like insurance, you might need other companies’ EINs during your daily course of business.

Use one of the following options to find another business’s federal tax ID number:

You May Like: What Age Do You Start Paying Tax

Read The Disclaimer And Click Proceed

Take note of whats written on the disclaimer. It says that the app can only assist individual taxpayers as of this time. Also, the app can only provide assistance during weekdays, Monday to Friday, from 8 AM to 5 PM. Any queries sent during weekend or holidays will be processed on the next business/working day.

How To Find Ein Numbers: What You Need To Know

The first thing to ask when trying to locate EIN numbers is whether or not the business in question even has an EIN. To determine this, youâll need to know whether the business meets certain standards that require them to get an EIN.

According to the IRS, these standards are that a business:

- Farmersâ cooperatives

- Plan administrators

A sole proprietorship that doesnât meet the above standards may still choose to get an EIN in order to interact with other businesses or set up business accounts.

Read Also: Small Business Income Tax Calculator

Does My Business Need To Reapply For A New Ein

Sometimes, your business may need to reapply for a new EIN. The IRS requires you to reapply for one rather than amending your business’s existing EIN. According to the IRS, here are the most common reasons:

- You change the structure of your business, like incorporating or turning your sole proprietorship into a partnership.

- You purchase or inherit an existing business.

- You created a trust with funds from an estate.

- You are subject to a bankruptcy proceeding.

If your circumstances require you to reapply for an EIN, the application process is the same as if youre applying for one for the first time.

Apply For Your Tax Id Number Online

Do you need your Tax ID Number fast? Applying for your Tax ID Number online is the best option. When you apply online through a third-party tax ID service, you can get your Tax ID Number in an hour. The tax ID service will collect and verify your information and give you a Tax ID Number that can then be used immediately on official forms and documents.

Also Check: Sales And Use Tax Exemption Certificate

How To Find An Ein Number

One of the most important numbers for a business owner to know besides their social security number is their businessâ employer identification number .

But unlike social security numbers, EINs arenât something that most people can recall off the top of their heads. This is sometimes a problem because EINs are required on a variety of different business documents from tax returns to bank account applications.

In this guide, weâll go over how to find business EIN numbers both for your own business and for other companies in case you ever need to locate a taxpayer identification number..

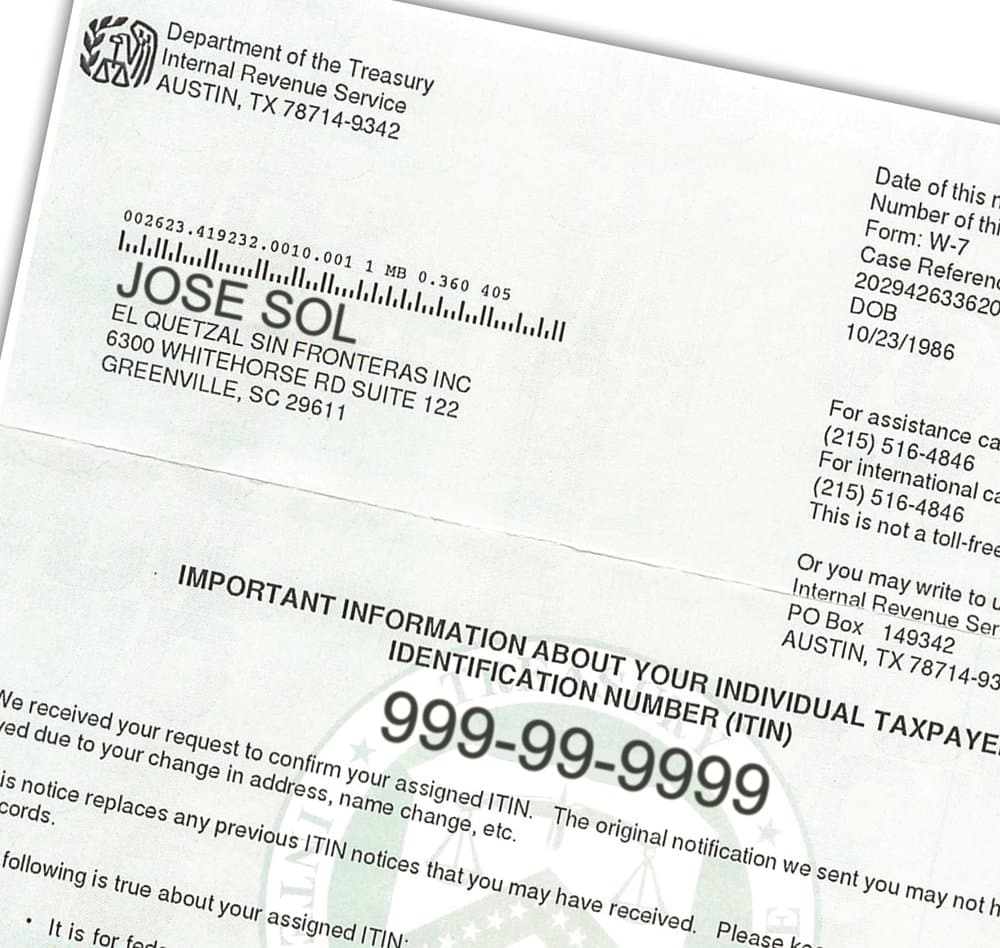

Individual Taxpayer Identification Number

The IRS issues the Individual Taxpayer Identification Number to certain nonresident and resident aliens, their spouses, and their dependents when ineligible for SSNs. Arranged in the same format as an SSN , the ITIN begins with a 9. To get an individual tax id number, the applicant must complete Form W-7 and submit documents supporting his or her resident status. Certain agenciesincluding colleges, banks, and accounting firmsoften help applicants obtain their ITIN.

Recommended Reading: Do 16 Year Olds Have To File Taxes

No Authorization Needed Access Directly From Irs Website

The search for an employer identification number of your company or another company may require certain authorizations but that is not the case when it comes to charitable companies. You can directly access the online IRS application to find your EIN number. The online database search can be conducted using specific parameters like the company name, state, and city of operations.

What Is A Tin

A federal tax ID number is an identifying number the Social Security Administration or IRS assigns to individuals and businesses. TINs are generally nine-digit numbers that help identify an individual or company.

Social Security numbers are the most common type of taxpayer identification number. SSNs are also the only TIN that the SSA issues. But, the IRS also assigns TINs. And if you have a business, chances are you may need an IRS-issued TIN at one point or another.

Most businesses also need a state tax ID number for reporting state taxes . Your state issues state tax ID.

You must include your TIN on your small business tax returns, statements, and other tax-related documents.

You May Like: How To Apply For An Extension On Taxes

How Do I Recover A Lost Ein

Companies will keep the same EIN so long as their firm is open unless they reorganize and apply for a new number. You can recover a misplaced or lost EIN by looking up the number on your computer-generated IRS notice associated with the ID number assignment.

If you are unable to use that original paperwork, contact your bank or credit union. These institutions keep your company’s EIN on file with the rest of your account information.

If these options are unavailable, you can contact the IRS Business and Specialty Tax Line. You’ll need to provide personal information in order to confirm your identity before the department will provide the EIN.

If you need help understanding how to find a state tax ID number for a company, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Preparer Taxpayer Identification Number

Paid tax preparers must apply for and receive a PTIN to include on returns. If you prepare or assist in preparing federal tax returns for compensation, you need a PTIN. There is a fee to renew the PTIN.

Unlike other federal TINs, the PTIN is an eight-digit number preceded by the letter P.

Application

You can apply for a PTIN online or by filing Form W-12, IRS Paid Preparer Tax Identification Number Application.

Also Check: What Does It Mean To Write Off Taxes