Is All Equipment And Personal Property Sold With An Exempt Boiler Or Furnace Also Exempt

No. Equipment that directly contributes to the operation of the system is exempt. Fuel storage and conveyance equipment that can be attached to a system are exempt as part of the system, as well as connected control devices. Buffer tanks are exempt if they are required for an advanced wood boiler system to operate. Electrical wiring and components used to connect a boiler, storage tank, and a control device are also exempt. However, fuel, heat distribution equipment , cleaning supplies, shelving, lattices, and similar items are not exempted as part of the system.

Equipment purchased for repairs is exempt if it would also be exempt when purchased for an initial installation. Supplies used to install or repair a system are not exempt .

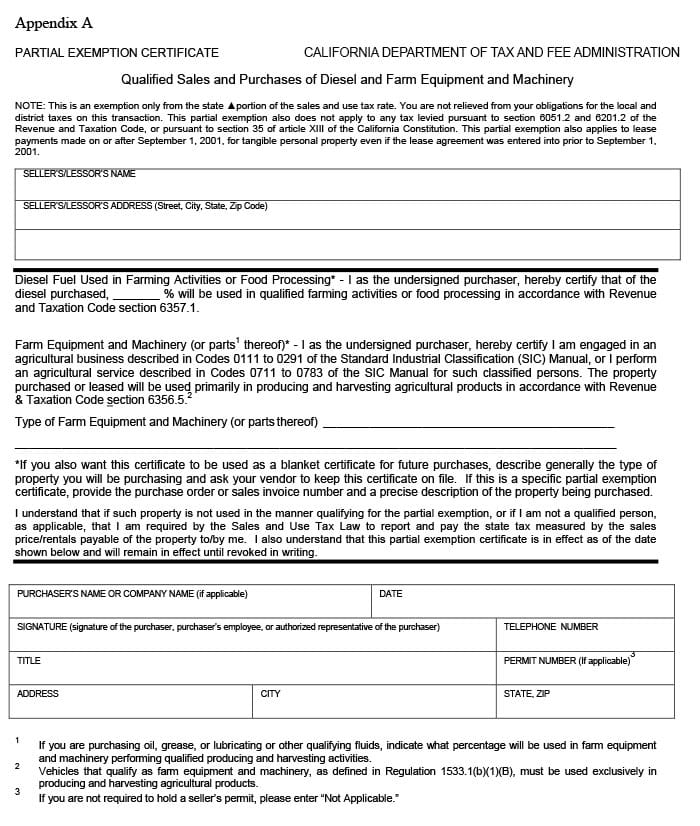

How To Use A Sales Tax Exemption Certificate

If youre a business owner, you can use a sales tax exemption certificate to purchase goods and services for your business without paying sales tax. To do this, present the certificate to the seller at the time of purchase.

The seller will then be able to sell you the goods or services without charging sales tax. Youll need to make sure that you keep track of your exemption certificates and renew them before they expire, as expired exemption certificates cannot be used to claim a sales tax refund.

Sales & Use Tax Exemptions By State

- Present completed VT Resale and Exempt Organization Certificate of Exemption .

- Sales tax exemption applies to hotel occupancy.

- Some cities have local taxes.

- Exempt from meals/lodging tax with prior approval

- Exempt from sales tax

- Submit completed CERT-119 to seller of tangible personal property or taxable services with IRS determination letter . Keep copy for six years.

- Complete CERT-112 , obtain signature of University officer, and submit with IRS determination letter to CT Dept of Revenue Services for approval 3 weeks in advance for meals/lodging exemption. Present approved CERT-112 to retailer of meals or lodging. Keep copy of certificate and substantiating information six years.

Exemption applies to hotel occupancy, tangible personal property purchased or rented, and services purchased.

Sales tax exemption applies to lodging accommodations.

Tax exemption identification number: E9952-6824-04

No exemption from Illinois Hotel Operators Occupation Tax

Therefore, when a public school from Vermont makes purchases in Iowa the school would be subject to paying Iowa sales tax.

Not exempt from Kansas Transient Guest Tax

Purchase exemption number OA173254, effective 01/09/2002.

Not exempt from KY u-drive-it tax on rental of motor vehicle.

Not exempt from Maine Meals and Lodging Tax.

Not exempt from Maryland Lodging Tax.

Don’t Miss: Sales Tax Exempt Form Ny

What Happens If A Seller Didnt Obtain A Properly Completed Exemption Certificate And Cant Locate The Customer To Obtain A New One Because They Are No Longer In Business

In most audit situations a non-taxable sale not supported by a properly completed exemption certificate will be disallowed and sales tax will be assessed against the seller, even though sales tax, in general, is a consumer tax. To make matters worse, since most non-taxable sales are reviewed using a test period audit method the sales tax due on each disallowed sale will be projected throughout the entire audit period. A missing or incomplete exemption certificate can create unnecessary exposure on an audit due to the mathematical compounding of the error rate:

- Say the auditor tests a total of $525,000 worth of non-taxable sales for a one month period. Of that amount, the auditor disallows $12,000 worth of the non-taxable sales in the test period due to lack of properly completed exemption certificates. Assuming an 8% sales tax rate and 36 months in the audit period, the auditor will project additional sales tax due of $34,560 as the result of only $960 of additional tax found due in the test period.

What Is A Sales Tax Exemption Certificate

A sales tax exemption certificate is an official document that allows businesses and consumers to purchase goods and services without paying sales tax. State governments typically issue exemption certificates, and they can be used for a variety of purposes, including business-to-business transactions, resale transactions, and certain types of charitable donations.

Exemption certificates can also be used to claim a sales tax refund. Sales tax exemption certificates can provide significant savings for businesses and consumers alike. Many companies use exemption certificate management software to help streamline applying for and using exemption certificates.

Also Check: How Much Is Tax At Walmart

How To Make Sure Youre Getting The Best Deals On Big Ticket Items By Taking Advantage Of Tax Exemptions

If youre looking to save money on oversized ticket items, you can take advantage of sales tax exemptions. Exemption certificates can be used to purchase items without paying sales tax, which can lead to significant savings on large purchases.

When shopping for exempt items, ask the seller if they offer a sales tax exemption certificate. Many businesses are happy to provide this service, and it can help you save a lot of money on your next big purchase.

When An Exemption Certificate Is Needed

A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. This includes most tangible personal property and some services. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made, but preferably at the time of the sale.

Example: You purchase cleaning supplies, which are taxable, from a distributor. However, if you intend to resell the cleaning supplies to your customers , you may purchase the supplies without paying sales tax.

Since the sale of cleaning supplies is normally subject to sales tax, the distributor needs some record to show why it didnt collect sales tax from you. Otherwise, the distributor could be held liable for the tax. Therefore, if you give a properly completed exemption certificate to the distributor within 90 days of your purchase, you are certifying that you intend to resell the items you purchased.

If you intend to use the supplies yourself, you cannot use a resale exemption certificate, and the distributor must collect sales tax from you.

Certain sales are always exempt from tax. This means a purchaser does not need an exemption certificate to make purchases of these items or services. For a list of items and services that may be purchased tax-free without an exemption certificate, see Publication 750, A Guide to Sales Tax in New York State.

Recommended Reading: Out Of State Sales Tax

What Is Meant By A Properly Completed Certificate

In most states a properly completed exemption certificate means the certificate is completed in its entirety by the purchaser, i.e. every line required to be completed is completed by the purchaser issuing the certificate. Most states require that the properly completed certificate be obtained within 90 days of the date of sale and that a seller accept the certificate in good faith. Accepting a certificate in good faith means that the seller has no reason to believe that what the purchaser has indicated on the certificate is not true.

Do States Differ In Their Treatment Of Sales Made To Exempt Organizations And Governmental Agencies

Yes, states differ in their treatment of sales made to exempt organizations status for income tax purposes) and governmental agencies. A general rule of thumb is that purchases by the Federal government are exempt in every state, but documentation requirements vary. Some states tax state and local government purchases including MN, SC, WA, CA, AZ and HI. States that do exempt state and local governmental agencies generally require the purchases must be for the exclusive use of the exempt entity and the exempt entity must be the payer of record.

Most clients think all sales made to not-for-profit 501 organizations are automatically exempt. This could be a costly presumption. In order for a not-for-profit to be exempt the organization must apply for, and be granted, exempt sales and use tax status in the state in which they conduct business. Dont be fooled by the organizations exempt sounding name, ensure you obtain a properly completed exemption certificate if tax is not charged or you may be subject to penalties for not collecting sales tax.

You May Like: Which States Do Not Tax Pension

The Gdvs Makes No Guarantees Regarding The Awarding Of Tax Exemptions

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. The actual filing of documents is the veterans responsibility.

To obtain verification letters of disability compensation from the Department of Veterans Affairs, please call 1-800-827-1000 and request a Summary of Benefits letter.

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office. The GDVS can only verify the status of a veterans or surviving spouses eligibility.

Abatement of Income Taxes for Combat Deaths

Georgia law provides that service personnel who die as a result of wounds, disease, or injury incurred while serving in a combat zone as a member of the U.S. armed forces are exempt from all Georgia income taxes for the taxable year of death. Additionally, such taxes shall not apply for any prior taxable year ending on or after the first day served in the combat zone.

Ad Valorem Tax on VehiclesThis exemption applies to either the annual property tax or the title tax, whichever is applicable.

The exemption is granted on ONLY one vehicle the veteran owns and upon which the free Disabled Veteran license plate is attached. Veterans who qualify for the Purple Heart or Medal of Honor specialty license plates are also exempt.

Extension of Filing Deadline for Combat Deployment

What Type Of Boiler Or Furnace Is Exempt As An Advanced Wood Boiler

A boiler or furnace is exempt if it is:

Also Check: Does The Post Office Have Tax Forms

Teleproduction Or Other Postproduction Service Equipment

A partial exemption from the sales and use tax became available under section 6378 for the sale, storage, use or other consumption of machinery, equipment including component parts to a qualified person used primarily in teleproduction or other postproduction services. The exemption also includes property sold or purchased by a qualified person primarily to maintain, repair, measure, or test any property used in teleproduction or postproduction services. The partial exemption may also apply to rental receipts paid by a qualified person for teleproduction or postproduction equipment and machinery.

The partial exemption applies only to the state sales and use tax portion. The exemption does not apply to any local, city, county or district taxes. Sales and purchases of teleproduction or other postproduction services including property used to maintain, repair, measure or test any such property will continue to be subject to the remaining portion of the sales and use tax rate consisting of the local, city, county and any applicable district taxes.

A retailer will be relieved from the liability for the sales and use tax subject to the partial exemption if they take a partial exemption certificate timely and in good faith, from purchasers stating the property will be used in a qualified manner as provided under section 6378. The partial exemption certificate should be retained for a period of not less than four years.

See also:

Examples Of When You Might Need To Present A Sales Tax Exemption Certificate

There are many situations where you might need to present a sales tax exemption certificate. For example, if you run a business that sells taxable goods or services, youll need to present an exemption certificate when making purchases for your business.

Additionally, if youre planning on making a large purchase , you may be able to use an exemption certificate to avoid paying sales tax on the investment.

You May Like: How Much Foreign Income Is Tax Free In Usa

What A Seller Needs To Know

As long as the purchaser gives you the appropriate certificate, properly completed, within 90 days of the date of the purchase, you do not have to charge the purchaser sales tax.

You must accept the certificate in good faith, which simply means that you had no prior knowledge that the certificate was false or fraudulent.

You must exercise ordinary care when accepting a certificate. You could be held liable for the sales tax you didnt collect if you knew that the purchase was not for an exempt purpose, or you knew that the certificate was false or fraudulent.

You have the right to refuse to accept an exemption certificate, even if it is correct and properly completed. However, if you refuse a certificate, you must charge the purchaser sales tax.

You must attach the exemption certificate to the record of the purchase or have some other method of associating the exemption certificate with a particular sale. You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. For more information, see Tax Bulletin Record-keeping Requirements for Sales Tax Vendors .

How To Use An Exemption Certificate

As a purchaser, you must use the correct exemption certificate, and complete it properly before giving it to the seller. The exemption certificate must include all the following:

- the date it was prepared

- the purchasers name and address

- the sellers name and address

- the identification number on the purchasers Certificate of Authority

- the purchasers signature, or an authorized representatives signature and

- any other information required by that particular certificate.

You must give the exemption certificate to the seller within 90 days after the date of the purchase. Otherwise, both you and the seller could be held liable for the sales tax.

Sellers have the right to refuse your exemption certificate, even if it is correct and properly completed. A seller that refuses your certificate must charge you sales tax. You may apply for a refund of the sales tax using Form AU-11, Application for Credit or Refund of Sales or Use Tax. For more information, see Tax Bulletins How to Apply for a Refund of Sales and Use Tax and Sales Tax Credits .

For a list of general sales tax exemption certificates, see the chart at the end of this bulletin. Other certificates are listed in Tax Bulletin Quick Reference Guide for Taxable and Exempt Property and Services .

Also Check: How To File Taxes Without W2 Or Paystub

Exemption For Forestry And Wood Products Machinery Equipment And Repair Parts

In 2017, purchases of specific types of machinery used in timber cutting, timber removal, and the processing of timber or other solid wood products, as well as repair parts, became exempt from the Vermont Sales and Use Tax. In 2019, purchases of specific accessories used on these machines also became exempt. Some purchases require a completed exemption certificate. Learn more about the exemption for forestry and wood products machinery, repair parts, and accessories, and print an exemption certificate.

Who May Use Exemption Certificates

You may use an exemption certificate if, as a purchaser:

- you intend to resell the property or service

- you intend to use the property or service for a purpose that is exempt from sales tax or

- you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities.

In some cases, you must also have a valid Certificate of Authority to use an exemption certificate . Note that many exemption certificates are very specific about what type of purchaser may use the certificate see the certificates instructions for details.

Most sellers must have a valid Certificate of Authority in order to accept an exemption certificate. A properly completed exemption certificate accepted in good faith protects the seller from liability for the sales tax not collected from the purchaser.

Exemption certificates of other states or countries are not valid to claim exemption from New York State and local sales and use tax.

Also Check: Amend My 2020 Tax Return

Exemption For Agricultural Machinery And Equipment

Agricultural machinery and equipment is exempt from sales and use tax if it is used predominately in the production of agricultural or horticultural commodities for sale. Predominately means 75 percent of the time it is in use. Learn more about the exemption for agricultural machinery and equipment.

Diplomatic Sales Tax Exemption Cards

The Departments Office of Foreign Missions issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic Relations , Vienna Convention on Consular Relations , and other treaties to provide relief from certain taxes.

The cards provide point-of-sale exemption from sales tax and other similarly imposed taxes throughout the United States. At the time of payment when making a purchase, the cardholder must present the card to the vendor in person. The vendor may verify the cards validity online or by calling OFM during business hours. The vendor should retain a copy of the front and back of the card for accounting and reporting purposes.

Types of Sales Tax Exemption Cards

Mission Tax Exemption Cards

Diplomatic tax exemption cards that are labeled as Mission Tax Exemption Official Purchases Only are used by foreign missions to obtain exemption from sales and other similarly imposed taxes on purchases in the United States that are necessary for the missions operations and functions. All purchases must be paid for with a check, credit card, or wire transfer transaction in the name of the foreign mission.

Personal Tax Exemption Cards

Other personnel may also be eligible to apply for a card if they qualify based on a treaty other than the VCDR or VCCR.

Don’t Miss: Bexar County Tax Assessor Collector San Antonio Tx