Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Taxpayers Ordering A Transcript Should Allow Time For Delivery Here Are The Three Ways To Get Transcripts:

- Get Transcript online. People can use this tool to view, print or download a copy of all transcript types. Those who use it must authenticate their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . The number is .

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

Tax Transcript Vs Exact Copy Of Tax Return

You can obtain an exact copy of your previously filed tax return by filing Form 4506, Request for Copy of Tax Return with the IRS. You can request many types of tax returns on the Form 4506, including:

In some cases, a tax return transcript may satisfy the person or entity requesting your tax information. Most mortgage lenders are satisfied with the information provided on a tax return transcript.

A tax return transcript is a shorter printout of the information on your previously filed tax return. It lists most line items including your adjusted gross income from your original tax return as filed. It does not show any changes made in an amendment to your return. A tax return transcript is only available for the current year and previous three years.

There are several advantages to the tax return transcript. It is free, while there is a small fee for an exact copy of your tax return. The fee for an exact copy of your tax return is $43 as of 2021.

Please note, if you file a tax return jointly with your spouse, only the primary spouse listed on the tax return can request a tax return transcript via the telephone. Either spouse can request a tax return transcript via the website or complete and mail the Form 4506-T. Similarly, either spouse can complete and mail the Form 4506 to request an exact copy of the tax return.

Also Check: Capital Gains Tax Calculator New York

Benefits Of Filing Past Years Income Tax Returns

There are a number of benefits that come with filing tax returns for the previous years:

- Loans Individuals who have filed their returns for past years will find it easier to get their loans approved by banks and financial institutions. The loan process becomes faster and less complicated.

- Proof Filing past years tax returns also act as a proof of an individuals income. Tax returns are valid documents that can be submitted whenever there is a requirement to validate an individuals income.

- Investments Individuals who have filed their tax returns for past years will also find it easier to make investments or conduct stock or share trading, since financial institutions look favourably on individuals who have their returns in order.

- Refunds In case an individual has been taxed beyond what his or her taxable liability is for the previous years, that individual can claim for a refund on the excess tax that he or she has paid for the past years.

- Travel Individuals who have filed their tax returns will also find it easier to obtain visas to travel abroad. Tax returns serve as a proof of financial abidance, which is a mandatory check when it comes to applying for a visa.

Recommended Reading: Do You Claim Plasma Donation On Taxes

What Is A Transcript

Transcript is magic word with the IRS. It is their word for the electronic copy of your information at the IRS. They have tax return transcripts, and wage and income transcripts . A tax return transcript can help you get a copy of your return, or help you remember if that year you did even file a tax return. The wage and income transcript will be the data from all your income tax forms .

There are a few ways to obtain the transcripts. You can call the IRS and wait on hold for what feels like forever, and authorize them to send the information in the mail, generally takes 7-10 business days. There is a form you can fill out and mail to them, and get the information in the mail as well, the 4506-T . It is a single page form, fairly easy to fill out. Vital information at the top, tax form number is 1040 for your personal return , check the box of the type or types of transcripts you want, the years you want them for on the bottom, then sign date and mail off.

Also Check: Travel Trailer Tax Deduction 2021

Complete The Right Tax Forms

IRS forms change from year to year, so you need to make sure you use the forms for the tax year you need to file. If you use online tax software to file a return, make sure you select the correct year in the software.

If youâre filing without the help of software, you can and instructions for completing those forms at IRS.gov.

You can also work with a professional tax preparer if you donât feel comfortable filling out the forms on your own.

You May Like: Will Student Loans Take My Tax Refund 2020

Recovering Lost Income Tax Returns

If a tax preparer filed your return, you may not know that the preparer likely created an online account for you so that you could access a copy of your filed return online. If youre like most people, you find it nearly impossible to remember a username and password for an account that youve never accessed. But if you contact your tax preparer, she can walk you through the steps of retrieving your tax return information online. As an option, particularly if you do not have a computer to view your tax return or a printer to print your return, ask your tax preparer if she will make a copy for you. By law, professional tax preparers must retain copies of filed tax returns for a minimum of three years. You should not have to pay a fee to access your online account, but if your tax preparer prints a copy for you, you may have to pay a copying and/or administrative fee for this service.

Read Also: Rv Sales Tax By State

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Read Also: How To Retrieve 1040 Tax Return

Don’t Miss: Small Business Income Tax Calculator

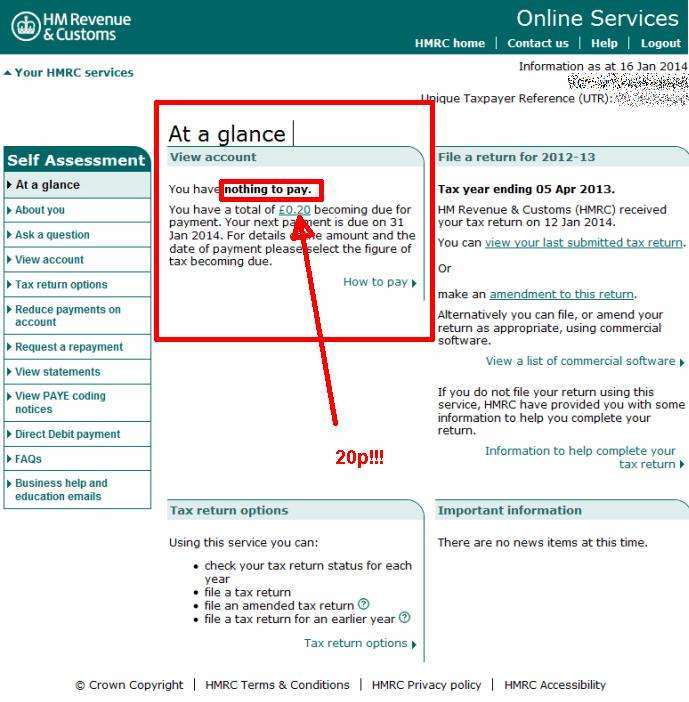

What Is A Sa302 Calculation

This is a much more detailed breakdown of your tax return. Itspecifies the tax rate youre on, the total income on which youve been chargedtax, the amount of income tax you owe, along with any Class2 and Class4 National Insurance contributions. It will also tell you about deductions,balancing payments, and any other income you may have received from othersources.

Self-employed workers can use SA302 documents to provideevidence of their income. So if youre applying for a mortgage, for example,and the bank or building society asks you to prove your income for a givenperiod, you can follow the steps above to access your SA302 documents.

If you didnt submit your tax return online, or if yourestruggling to locate certain older paper documents, then you can try contactingHMRC. Youll need your Unique Taxpayer Reference number to hand, aswell as your National Insurance Number. You should also ensure that all of yourpersonal details are up to date in your personal tax account, sothat HMRC can properly identify you with their screening questions.

You May Like: Does Doordash Take Taxes Out

How To Obtain Old Tax Documents

Do you need old tax documents from the IRS? Here’s the difference between a tax return transcript and an exact copy of your tax return. Learn which one is right for your situation and what steps you need to take to obtain them from the IRS.

Certain situations may require you to have access to your previously filed tax returns. The most common is during a loan application process when your lender requests prior years’ tax information to verify your stated income. You may also need old tax information to amend a prior-year tax return, compare it to your current year tax return, or defend yourself in the case of an Internal Revenue Service audit.

While you should save a copy of your business tax returns for a minimum of seven years, if a situation arises and you need to access an old tax document you do not have in your possession, what should you do?

Read Also: Tax Loopholes For Small Business

How Do I Obtain Past Tax Returns

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How far back can you get old tax returns?

six yearsYou can only get a tax transcript going back three tax years. If you need something older than that, youll have to order a copy of your actual filed tax return. You can get one for the current tax year and as far back as six years. To do so, you must complete and mail in IRS Form 4506, Request for Copy of Tax Return.

Security Changes For 2018

The IRS is trying to reassure taxpayers that theyre taking steps to secure their information and that its safe to e-file. They notify you if they receive duplicate filings under your Social Security number. Theyve also published Form 14039 for you to use if your e-filing is rejected because someone already filed a return with your Social Security number on it. A fillable version of this form is available on their website. After youve filled it out, you have to print it and attach it to your paper return. When the IRS receives the paper return, theyll do an investigation to identify which return is fraudulent and they will process the legitimate one. Yes, this takes a long time.

Also Check: Penalty For Filing Taxes Late If I Owe Nothing

When Will I Receive My Tax Documents In The Mail

Wells Fargo generally mails original tax documents no later than January 31, or by the IRS deadline of February 15 for brokerage accounts. Depending on the postal service delivery, you can usually expect to receive your tax documents by the third week of February or by the end of February for brokerage accounts. If you dont receive your tax documents by then, please call us at 1-800-TO-WELLS or 1-866-281-7436 for brokerage customers.

You May Like: Do You Have To Report Roth Ira On Taxes

Why Does My Form 1099 Include Interest From Multiple Accounts

If your deposit accounts have the same primary Taxpayer Identification Number and 5-digit ZIP code , we will report the interest collectively on a combined Form 1099.

If youd like to receive separate Form 1099 documents in the future, you can call us at 1-800-TO-WELLS to make your request. For business accounts, call 1-800-225-5935.

Recommended Reading: What Do You Need To Do Your Taxes

Do I Owe Us Taxes As An American Abroad

A common concern amongst expats is whether or not they owe any US tax. This is normal because the US is one of only two countries that tax their citizens no matter where they are in the world.

The good news is, expats will most likely not be double-taxed and owe US taxes. This is due to benefits like the Foreign Tax Credit and Foreign Earned Income Exclusion:

Getting Your Transcript Electronically

You can also get your transcript electronically same day. It requires having a login on IRS.GOV please be sure you are on the .gov website. On the IRS homepage, top right corner there is a search option. If you type the single word transcript the first few results are exactly what you need. Click on Get Transcript . There will be displayed similar info to what I have included here, but on the left side is the option to get your transcript online. When logged in, it is very clear to see what year and what transcript you want, and it displays immediately . Word of caution however, while there is a forgot my password option the steps required to verify who you are will be very extensive so please do not forget your IRS login information.

It is possible for a tax office to request the transcripts for you and get the electronically but our experience is that the process takes weeks, sometimes longer. The taxpayer always has the most power, and you will get the quickest results with the IRS.

Read Also: Does Texas Have State Income Taxes

How To Get Copies Of Old Tax Returns

To view copies of your old tax returns, follow these steps:

And thats it! You should now be able to view your tax yearoverviews for every year youve previously submitted a tax return.

How To Get A Transcript Of An Old Tax Return

Accessing a Transcript of Old Tax Returns Determine which type of transcript you need. Register online with the IRS. Request a transcript of your old tax returns online. View the transcript online or receive it by mail.

How can I get a copy of my tax return?

Taxpayers can complete and mail Form 4506 to request a copy of a tax return and mail the request to the appropriate IRS office listed on the form. If taxpayers need information to verify payments within the last 18 months or a tax amount owed, they can view their tax account. Subscribe to IRS Tax Tips

Read Also: Tax On Food In Virginia

Request Online With Masstaxconnect

This request requires that you log into MassTaxConnect.Please note:

- If you are not already a registered MassTaxConnect user, you will need to create a MassTaxConnect username and password by visiting MassTaxConnect and selecting Create My Username.

- Your request for a copy of a previously filed personal income tax return may take several days to process.

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Don’t Miss: Sales Tax In North Dakota