Does California Offer A Tax Credit For Electric Cars

California does its tax credits for electric vehicles a little differently. They offer rebates rather than tax credits.

You may receive up to $1,500 for electric vehicles and plug-in vehicles. The exact amount will depend on the size of the battery.

If youre living in the state of California, you should check with your local government about electric car incentives. Depending on your location within California, you could get extra cash, access to more road privileges, or some other kinds of incentives.

What Electric Cars Are There To Look Forward To

The future of cars is electric and there are plenty of new vehicles to be on the lookout for.

More and more manufacturers are producing electric cars as part of their yearly lineup of vehicles, like Volvo and the new Volkswagen ID. Some of the most exciting electric cars are not yet available, but include the electric Hummer and the Tesla Cybertruck.

There are many manufacturers that build electric cars in addition to their more well-known combustion engine counterparts, including models like the BMW i3, Kia Niro EV, and Hyundai Ioniq.

What Is A Written Binding Contract

In general, a written contract is binding if it is enforceable under State law and does not limit damages to a specified amount . While the enforceability of a contract under State law is a facts-and-circumstances determination to be made under relevant State law, if a customer has made a significant non-refundable deposit or down payment, it is an indication of a binding contract. For tax purposes in general, a contract provision that limits damages to an amount equal to at least 5 percent of the total contract price is not treated as limiting damages to a specified amount. For example, if a customer has made a non-refundable deposit or down payment of 5 percent of the total contract price, it is an indication of a binding contract. A contract is binding even if subject to a condition, as long as the condition is not within the control of either party. A contract will continue to be binding if the parties make insubstantial changes in its terms and conditions.

Read Also: Nj State Income Tax Rate

What Are The Tax Benefits Of An Electric Car

The tax benefits for electric cars are more than just tax credits. The transportation section of the bill does more than just increase the tax credit available to many plug-in vehicle buyers. It would repeal the current vehicle sales cap, which has denied Tesla and General Motors eligibility and is about to deprive Nissan of it as well.

Currently, as mentioned earlier, once an automaker has sold 200,000 qualified vehicles in the United States, its EVs and plug-in hybrids are no longer eligible. The new measure would extend eligibility until the year in which 50 percent of all new vehicles sold in the United States were qualified EVs or plug-in hybrids. It is expected that this will take a decade or more. Then there would be a three-year transition period.

After the sales cap was reached, the full rebate would still be available in the first year, a 75% credit would be available in the second year, and a 50% credit would apply in the third year, with no tax credit availability after that.

The EV rebate proposal is estimated to cost $31.6 billion over the next ten years by the Congressional Budget Office. That is only a small portion of the total cost of the Clean Energy Plan, which is estimated to be $259 billion. The biggest news for EV buyers may not be the increased tax credits, but rather that the measure converts the credit into a refund for eligible vehicles purchased by Jan. 1, 2022.

How Federal Electric Vehicle Tax Credits Work

When you buy an electric or plug-in hybrid vehicle, you may qualify for a federal tax credit that reduces your income tax liability. While that doesnt translate into direct savings off the purchase price, you may get some delayed gratification after April 15. Leases do not qualify, however, since the manufacturer receives the tax credit. The dealer will sometimes pass on the savings by reducing your monthly payment.

So how much is the federal tax credit worth? Eligible vehicles such as EVs can qualify for up to $7,500. The exact amount varies depending on the vehicles battery capacity, but electric vehicles have historically qualified for the full amount. Plug-in hybrids tend to qualify for tax credits, corresponding to their reduced all-electric range.

You should know that federal tax credits are allocated to 200,000 vehicles for each manufacturer annually. This amount refers to the total number of vehicles sold across the automakers entire lineup, not the number of individual models. After 200,000 vehicles have been sold, the credit drops to 50 percent of the original amount over the next six months. Then its reduced further, to 25 percent, for another six months, and finally it is phased out completely.

Read Also: Tax Burden By State 2022

Is There A Tax Credit For Plug

Duke Energy is not affiliated with the manufacturers or vendors, does not expressly or implicitly warrant the performance of the products and is not liable for any damage caused by these products or for any damage caused by the malfunction of these products. Any non-Duke Energy logo or trademark is owned by its respective manufacturer or its assignee. Duke Energy, 400 South Tryon Street, Charlotte, NC 28202.

- @Sign up for Email

How Do You Receive Ev Tax Credits

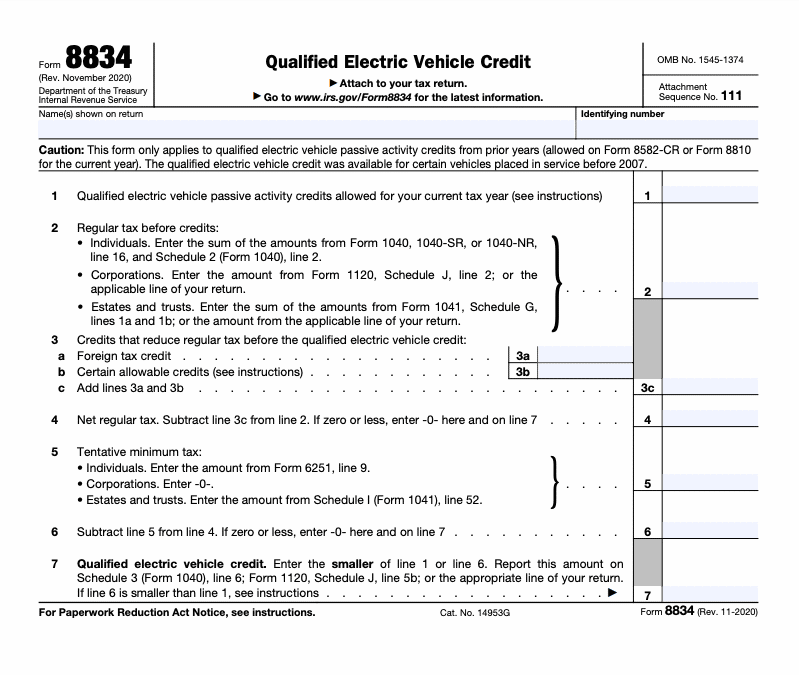

The process is fairly simple. After purchasing a qualifying vehicle, you fill out form 8936 along with your tax return. It is important to note that the EV tax credits are nonrefundable. This means the credits can only be applied to the taxes you owe in a given year. If you received more in credits than you owe in taxes, you will not receive the difference. The credits do not roll over, either.

You cannot qualify for EV tax credits if you lease an eligible vehicle. This is because the manufacturer still technically owns the vehicle. Nonetheless, manufacturers can qualify for and receive the entirety of an eligible vehicle it leases out. In the pre-IRA days, it was not uncommon for manufacturers to factor this into the lease, allowing lessees of eligible vehicles to indirectly benefit from the EV tax credit. We expect this practice to continue.

Beginning in 2024, buyers of vehicles eligible for the federal EV tax credit will be able to transfer the credits to the dealer itself in order to reduce the vehicle’s sale price. In the past, buyers paid full price for the vehicle and only enjoyed the benefits of the EV tax credit after submitting their taxes.

Read Also: State Income Tax In Kentucky

The Best Electric Cars

Thinking of going electric? Its the perfect time to make the switch. Weve rounded up some of the best electric vehicles qualifying for tax credits and rebates when purchased new. If youre just starting your EV adventure, there are more cars also available as electric vehicles than you might think.

Today, electric vehicles go further than ever as technology continues to improve. Automakers are also hard at work developing all-new electric vehicles and paving the way for EV SUVs and trucks. From the flagship Ford Mustang Mach-E to the Hummer EV, its safe to say that your options are quickly expanding every year.

For a deeper dive into the world of electric vehicles, be sure to check out our EV buying guide. When youre ready to buy, you can use TrueCar to shop and get an upfront, personalized offer from a certified dealer. Until then, keep an eye out for the latest electric vehicle news and updates from the TrueCar blog.

Inflation Reduction Act Benefits: Electric Vehicle Tax Incentives For Consumers And Us Automakers

The Inflation Reduction Act is the most significant climate legislation in United States history. Energy Innovation Policy and Technology LLC® modeling finds the IRAs $370 billion in climate and clean energy investments could cut U.S. greenhouse gas emissions up to 43% below 2005 levels by 2030.

Combined with state action and forthcoming federal regulations, the IRA puts the United States within reach of its Paris Agreement commitment to cut emissions 50% to 52% by 2030. The IRA will strengthen the U.S. economy by creating up to 1.3 million new jobs and avoid nearly 4,500 premature deaths annually by reducing air pollution, both in 2030.

In this series, Energy Innovation® analysts showcase the IRAs benefits in the power, buildings, and transportation sectors of the U.S. economy. This article details IRA investments in the transportation sector.

Emissions reductions under provisions in the Inflation Reduction Act. Users are free to copy, … distribute, transform, and build upon the material under the CC BY License as long as they credit Energy Innovation for the original.

Energy Innovation

Read Also: Income Tax By State Ranked

How Is The Electric Car Tax Credit Calculated

Before moving ahead with a purchase, theres still one more thing you need to consider: your personal tax situation. A tax credit is deducted from the amount of income tax that you owe, and its non-refundable.

If you only owe $1,000 in taxes in the year you claim the credit, then youll only get a $1,000 credit and you wont receive a refund for the remainder!

That means its a good idea to plan ahead and claim the credit in a year when you have a higher tax liability. For example, if youre a freelancer and your income varies, you should plan to purchase your car in a year when youve earned more money rather than less.

The Congressional Research Service found that taxpayers earning at least $100,000 claimed 78% of tax credits. The average taxpayer needs to earn at least $66,000 per year to fully benefit from the credit.

This means that middle-income earners need to do their due diligence to ensure that they get the maximum credit possible when they file their tax return.

The Biden Administration Continues To Expand Ev Adoption

President Biden first vowed to make the nations entire federal fleet all-electric. The White House has introduced two bills to expand EV adoption, one of which was signed by the President and includes funding for heavily expanded EV charging infrastructure.

Previously, there were rumors that the federal tax credit would be increased to $10,000. In President Bidens previous $174 billion investment plan for electrification, the tax credit was quickly mentioned as a reform. However, the summary remained vague about the reform only confirming that it will not only take the form of tax rebates but also point of sale rebates and it will now be for American-made EVs.

The second and larger bill sat within Bidens Build Back Better Act and subsequent increases to the federal tax credit, but it couldnt get past the Senate in late 2021. At that point, the revamped tax credit we all have sought was in limbo, possibly DOA. Until this past summer

Don’t Miss: Federal Tax Married Filing Jointly

The Federal Solar Investment Credit In 2020

The 2020 Solar Tax Credit is a 26% Federal Tax Credit for solar PV systems installed before December 31, 2020. It will decrease to 22% for systems installed in 2021. And the tax credit expires starting in 2022 for residential solar unless Congress renews it. There is no maximum amount that can be claimed.

Do Electric Vehicle Tax Credits Run Out

Yes. The government is phasing out the electric vehicle tax credits as sales increase, on the theory that the high initial cost of adding new technology to a vehicle will come down as economies of scale improve with more sales. Thats supposed to eliminate the need for subsidies. The expiration date is separate for each manufacturer and only comes after an automaker sells 200,000 qualified vehicles. Tesla hit the milestone first in July 2018. As a result, there are no federal tax credits for Tesla now.

In the last quarter of 2018, GM became the second carmaker to sell 200,000 qualified plug-in vehicles. And like Tesla, all new electric vehicles from GM no longer have the federal tax incentive.

Nissan is next in line for a credit phaseout, but Edmunds analysts say that unless sales for the Leaf pick up significantly, its unlikely Nissan will reach the threshold in 2022. All other makers are trailing far behind in plug-in car sales.

Also Check: Flat Tax Pros And Cons

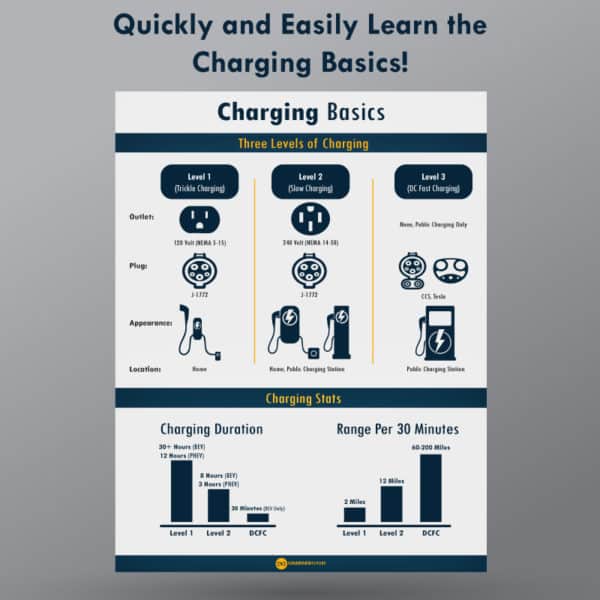

Hyundai Kona Electric Best For Charging Savings

The Kona Electric has 201 horsepower and a full-charge range of 258 miles. At-home chargers will bring the Kona Electric from 10% to 100% in just over nine hours. Using the level three chargers at any station will power the vehicle up to 80% in roughly one hour.

Digital phone keys can do everything, from locking doors to starting the car. These keys can be sent to friends or family when they need to drive the car, too. A number of driving assists are available with the Kona Electric, including safe exits on highways and sensors for when the vehicles driven in reverse, as well as lane-following, blind spot collision and driver attention warnings, which alert drivers who may be drowsy or inattentive on the road.

New buyers who have signed up for Electrify America can also get three years of free charging from the day of purchase after they enter their unique Hyundai Premium Charging code into the app. In certain qualifying states, Kona Electric drivers can drive on their own in HOV lanes. Digital displays can connect with Apple or Android devices.

- Retail price: $34,000

How Much Is The Electric Car Tax Credit

The exact amount that a car is eligible for depends on the battery capacity of the EV. The base credit is $2,500 with an additional $417 per kilowatt hour.

In practice, this means that many vehicles, including the IONIQ Electric, are eligible for the full credit, while others are eligible for a reduced amount. For example, the IONIQ PHEV is eligible for a $4,543 credit.

You can check out the full list of eligible vehicles here. Most credits are at least $4,000, while many are between $5,000 and $7,500.

Also Check: 6 Months And Still No Tax Refund 2021

What Does The Inflation Reduction Act Include For New Electric Car Tax Credits

The electric car tax credit is not new many cars have been eligible for tax credits over the last few years. However, the Inflation Reduction Act added some more details and restricted what vehicles are eligible for this tax credit and what is not.

In short, here’s what is new in the electric vehicle tax credits as of 2022:

Very Expensive Evs Are Not Eligible

The biggest change and the electric vehicle tax credit is that very expensive vehicle are no longer eligible for this benefit. According to the Inflation Reduction Act, Vehicles that allowed for the electric vehicle tax credits include low-emission trucks, vans, and SUVs with a retail manufacturer price of up to $80,000 and regular cars with a price of up to $55,000.

This price cap puts many common electric vehicles out of the qualification for electric car credits.

Therefore, you must check the list of eligible vehicles before deciding on your dream car. The last thing you want to do is to assume that you will enjoy the tax credit at the end of the year but then realize that your vehicle is not qualified. To pick up the other things to consider depending on your urine, some cars might be eligible this year but not next year.

Those who are very careful when reviewing the list will understand whether you should buy today or wait longer. New paragraph experts mentioned that if you see a vehicle listed as eligible for the EV tax credit this year, you might not want to wait for the next year because it might go out of the list.

Don’t Miss: What Is The Sales Tax

Which Evs Qualify For The Federal Tax Credit

The Department of Energy has put together a list of all EV models that qualify for incentives under the new rules. Currently, the list includes models from Audi, BMW, Chrysler, Ford, Jeep, Lincoln, Lucid, Mercedes-Benz, Nissan, Rivian, and Volvo. Right now, electric vehicles from other automakers, including Hyundai, Kia, and Toyota, are not currently on the list of cars with final assembly in North America.

The DOE will update the list as more companies report information to the government, including when they confirm the exact assembly location for specific models. Industry observers expect a significant change after January 1, 2023, when additional provisions of the IRA go into effect and vehicles from General Motors and Tesla rejoin the list.

Why 2022 Is The Year To Go Solar If You Can

Nothing lasts forever, and the federal solar tax credit is no exception. If you want to invest in solar energy for your home, 2022 is the last year to enjoy maximum benefits under the ITC.

Starting in 2023, the federal tax credit will drop to 22%. After that, unless Congress extends it again, there will be no residential tax credit on solar panels.

You May Like: Federal Small Business Tax Rate

Eligible Hydrogen Fuel Cell Cars

The whole idea of the changes in the Inflation Reduction Act regarding electric vehicle tax credit is to encourage people to use cleaner energy. Therefore, it’s not surprising that hydrogen-fueled cars are also eligible for the 7500 tax credits if they meet the manufacturer location requirement and other details.

Dont Worry About Electric Car Practicality

There was a time when the majority of electric cars were conventional models with the internal combustion engine powertrain swapped out for an electric motor and batteries. This led to all sorts of compromises in terms of interior and boot space. But today, electric cars tend to be built on purpose-designed platforms that are created either purely for electric vehicles or to accommodate various kinds of propulsion systems. The end result is that electric cars deliver boot and passenger space equivalent to petrol and diesel rivals.

With everything from superminis and small SUVs to executive saloons and luxury SUVs to choose from, there should be an electric car to meet the needs of most buyers.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance