Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Check Your Bank Account

If you requested a direct deposit of your tax refund, the IRS will not send you a notification at the time of delivery, so your deposit may already be in your account.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more about identity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

Also Check: Georgia Payroll Tax Calculator 2021

Heres How Taxpayers Can Track The Status Of Their Refund

COVID Tax Tip 2021-39, March 30, 2021

Tracking the status of a tax refund is easy with the Where’s My Refund? tool. It’s conveniently accessible at IRS.gov or through the IRS2Go App.

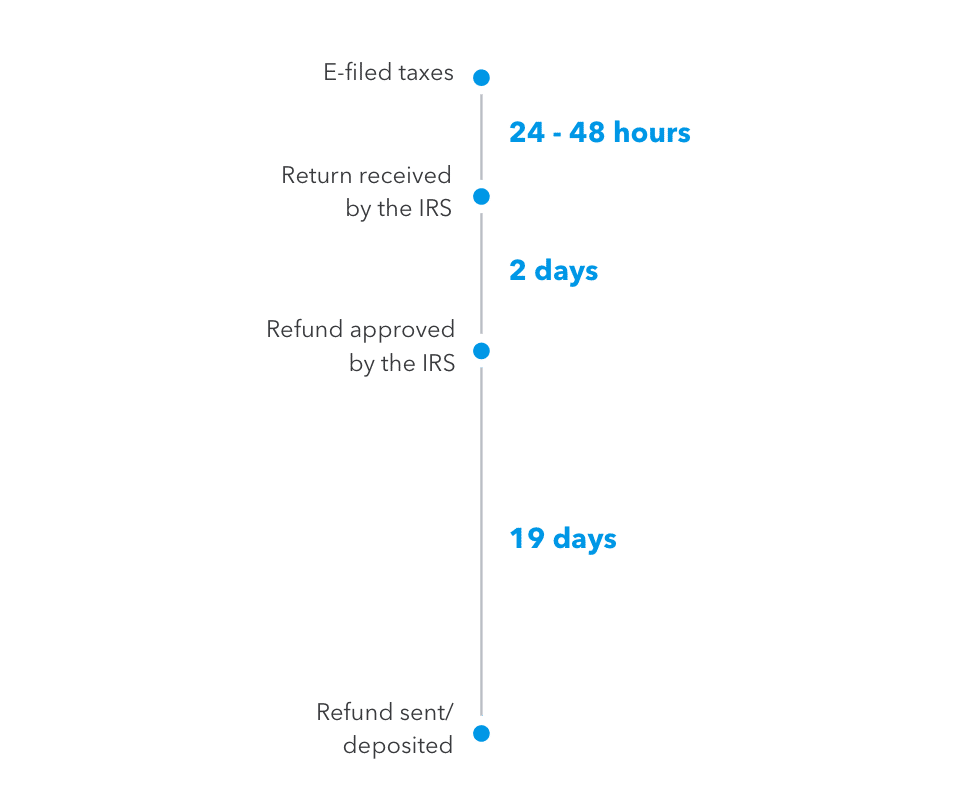

Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Follow These Tips To Get Your Refund Faster

If you file income tax returns, youre likely expecting a refund. And, if youre like most Americans, youre anxious to get that money back. After all, it is yours.

When should you expect that money to hit your bank account? Heres how to do everything you can to speed up the process and monitor your refunds progress.

You May Like: Federal Tax Married Filing Jointly

How New Jersey Processes Income Tax Refunds

Beginning in January, we process Individual Income Tax returns daily. Processing includes:

Generally, we process returns filed using computer software faster than returns filed by paper. Electronic returns typically take a minimum of 4 weeks to process.

Processing of paper tax returns typically takes a minimum of 12 weeks.

We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

In some cases, they will send a filer a letter asking for more information. In such cases, we cannot send a refund until the filer responds with the requested information.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper.

To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

Please allow additional time for processing and review of refunds.

| Sorry your browser does not support inline frames. |

Get Your Documents In Order

Because you cant complete your tax return without documents from your employer, bank, investment accounts, and other sources, its important to know when to expect them.

Other tax documents, such as K-1s from certain types of partnerships, dont have to be mailed until March 15. If youre waiting on a K-1, you may want to prepare the rest of your tax return and then add that info when it arrives. You can also estimate the amount that will be shown on the K-1, file your return, and then file an amended return later if the actual K-1 amount differs from your estimate.

You May Like: Capital Gains Tax Calculator New York

I Have Moved To Another Address Since I Filed My Return My Refund Check Could Have Been Returned To The Department As An Undeliverable Check What Do I Need To Do To Get My Check Forwarded To My New Address

In most cases, the US Postal Service does not forward refund checks. To update your address, please complete the Change of Address Form for Individuals, call the Department toll-free at 1-877-252-3052, or write to: North Carolina Department of Revenue, Attn: Customer Service, P.O. Box 1168, Raleigh, NC 27602-1168.

I Received A Form 1099

If you claimed itemized deductions on your federal return and received a state refund last year, you will receive a postcard size Form 1099-G statement. This form shows the amount of the state refund that you received last year but does not mean that you will receive an additional refund. Generally, your State income tax refund must be included in your federal income for the year in which your check was received if you deducted the State income tax paid as an itemized deduction on your federal income tax return. Please view the Frequently Asked Questions About Form 1099-G and Form 1099-INT page for additional information about Form 1099-G and Form 1099-INT.

You May Like: How Long To Do Taxes On Turbotax

How Many Years Back Can I Get A Tax Refund

Taxpayers have three years to complete their taxes and receive a refund. While those who owe taxes must pay them by the April due date, those owed a refund have three years to file, although they wont be entitled to this money after this time. The money from tax returns that are not filed within that time frame is then transferred to the U.S. Treasury.

Will Calling You Help Me Get My Refund Any Faster Or Give Me More Information

IRS representatives can research the status of your return only if:

- It’s been more than 21 days since you received your e-file acceptance notification,

- It’s been more than 6 months since you mailed your paper return, or

- The Where’s My Refund? tool says we can provide more information to you over the phone.

Also Check: When Will I Receive My Tax Refund 2022

Sign Up For Text Or Email Alerts

Many states also offer the option to sign up for text or email alerts regarding the status of your refund. This can be a great way to stay informed about your refund and to make sure it is being processed correctly. To sign up for these alerts, you will need to provide your contact information and the details of your refund, such as the type of return you filed and the exact amount of your refund. Once you have signed up, you will receive notifications when the status of your refund changes.

Signing up for text or email alerts is a convenient way to keep track of your refund. You will be able to stay up to date on the status of your refund without having to constantly check your bank account or call the tax department. Additionally, you will receive notifications right away if there is an issue with your refund.

Use The Irs Wheres My Refund Online Tool

Since 2003, the IRS has provided an online tool that lets you track the status of your refund electronically. You can access the tool, called Wheres My Refund?, as soon as 24 hours after you e-file your tax return . You can also download the IRS2Go app to track your tax refund on your mobile device.

Youll need the following information to check the status of your refund online:

- Social Security number or ITIN .

- Filing status .

- Exact amount of the refund listed on your tax return.

Once you input the required data, youll encounter one of three status settings.

The IRS updates refund status once a day, usually overnight.

Also Check: Electric Car Tax Credits California

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Where’s My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You

If you filed your tax return on time and still haven’t gotten your refund, at least it’s earning interest.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

Writer

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

If you filed your tax returnelectronically and were due a refund, you probably already received it. The IRS reported that it’s processed 97% of the more than 145 million returns it received this year and issued a few more than 96 million refunds.

As a result, delays in completing paper returns have been running from six months up to one year.

Recommended Reading: States That Don T Have Income Tax

Don’t Let Things Go Too Long

If you haven’t received your tax refund after at least 21 days of filing online or six months of mailing your paper return, go to a local IRS office or call the federal agency . Taking these steps wont necessarily fast-track your refund, according to the IRS, but you may be able to get more information about what’s holding up your refund or return.

How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Recommended Reading: The Pharisee And Tax Collector

When Every Dollar Matters It Matters Who Does Your Taxes

-

WE SEE YOU

Our Tax Pros will connect with you one-on-one, answer all your questions, and always go the extra mile to support you.

-

WE GOT YOU

We have flexible hours, locations, and filing options that cater to every hardworking tax filer.

-

GUARANTEED

Weve seen it all and will help you through it all. 40 years of experience and our guarantees back it up.

If You Choose Direct Deposit

Your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

All timing is based on IRS estimates.

Recommended Reading: Can You File Taxes On April 18

Other Factors That Could Affect The Timing Of Your Refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud.

Taxpayers who claim the earned income tax credit or the additional child tax credit may see additional delays because of special rules that require the IRS to hold their refunds until Feb. 28. You should also expect to wait longer for your refund if the IRS determines that your tax return needs further review.

Refunds for returns that have errors or that need special handling could take more than four months, according to the IRS. Tax returns that need special handling include those that have an incorrect amount for the Recovery Rebate Credit and some that claim the EITC or the ACTC. Delays also occur when the IRS suspects identity theft or fraud with any return.

Respond quickly if the IRS contacts you by mail for more information or to verify a return. A delay in responding will increase the wait time for your refund.

If you submitted an amended tax form, it may take more than 20 weeks to receive a refund due to processing delays related to the pandemic.

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Don’t Miss: Can I Still File My 2017 Taxes Electronically In 2021