What Is Payroll Tax

Payroll tax is the tax system used by the United States to charge a certain percentage of the workers pay in other to foot some social security schemes. This tax is paid by deducting a certain amount from an employees salary. However, the employee is not the only one involved. The employer is also paying a part of the tax.

This tax is used as a support system for both Social Security and Medicare schemes. The Social Security scheme is used to provide for older people. At the same time, Medicare is an insurance scheme initiated by the federal government to alleviate health bills of both senior citizens and citizens with disabilities.

Social Security tax is deducted when you reach a certain threshold of income and is affected by the economic inflation rate. Medicare tax depends on the wages and salaries of individuals. Meanwhile, you pay the employee and the employer percentages of the tax as a self-employed person. This tax is imposed on employers and self-employed individuals in some states and cities. Some dont impose it on employees.

Some of the payroll tax benefits are the funding of the benefits for disability, health care, retirement, and survivors of the deceased workers. Social Security and Medicare schemes are known to be the second-largest revenue source for the American government.

Year To Dates And Switching Providers

Now hereâs where you need to pay extra close attention if youâre switching payroll providers. Even if youâre well versed in payroll taxes, things get a little tricky when youâre using brand-new payroll software.

To set up payroll with your new provider, you will need accurate YTD amounts for all employeesâthis includes contractors and terminated employees if you plan to have your new provider help with year-end for terminated staff as well.

For those unfamiliar, YTD amounts include all of the historical payroll transactions associated with each individual employee in a given calendar year so far. Only the current year’s information is necessary. If you are running your first payroll with a new provider in January , you can completely skip the YTDsâjust make sure you still have the data, or that your previous provider will still help you with T4s.

YTDs are also important when issuing a Record of Employment . ROEs are issued whenever an employee experiences an âinterruption of earnings,â such as when they are let go or fired. ROEs must also be issued when you move your data from one payroll system to another. YTDs help you report the correct amounts of EI contributions when issuing these ROEs.

Fica Taxes And Unemployment Taxes

Federal Insurance Contributions Act taxes fund Medicare and Social Security. Currently, the employers payroll expense is a 6.2% Social Security tax and a 1.45% Medicare tax . Each worker pays the same 7.65% tax through payroll withholdings.

The Federal Unemployment Tax Act and the State Unemployment Tax Act were passed to provide temporary income for workers who lose employment.

The current employers FUTA tax rate is 6% on the first $7,000 in gross income earned by the worker. If the wages are subject to a state unemployment tax, the employer can use a 5.4% FUTA credit, which reduces the FUTA tax to 0.6%. The total federal and state unemployment taxes will vary depending on each states unemployment program.

Read Also: How Are Social Security Taxes Calculated

Is Payroll Tax The Same As Income Tax

Income tax responsibility falls on the employee, but employers and employees pay payroll tax. Remember that income taxes are progressive, so you pay more if you earn more. But payroll taxes are regressive and require only a tiny portion of your wages. Income and payroll tax are technically different as payroll levies are relatively simple, but income taxes are complex but flexible.

While income taxes are levies imposed by the government, they depend on various factors and make the bulk of your tax return calculations. The government receives income tax, but payroll taxes go to Social Security, Medicare, and other social insurance programs. Besides, payroll tax uses a flat tax rate, while income tax uses a progressive tax rate.

Best Practices For Filing Payroll And Income Taxes

Whether you manage it yourself, have a staff member to help or outsource the task, it’s important to put enough resources into tax compliance to do it right. Errors in determining the amount owed, or delays in making payments or filing returns, could lead to fines and other financial penalties that your business can’t afford. Small-business owners can ensure that their business expenses remain manageable and their taxes are paid on time with these best practices:

JPMorgan Chase Bank, N.A. Member FDIC. ©2022 JPMorgan Chase & Co.

You May Like: How To File Taxes Free

Final Thoughts: Payroll Tax Vs Income Tax

Payroll tax and income tax are both examples of employment tax since you withhold them from employee paychecks. The payroll tax is levied by the federal government. It funds Social Security and Medicare programs, and itâs split between employee and employer. On the other hand, income tax is paid solely by the employee, but itâs still the employerâs job to withhold the amount on paychecks. Income tax funds all sorts of programs, including state and local ones.

Calculating tax withholdings can be challenging, especially for small business owners with several employees. The good news is that you can make paycheck withholdings easier by using a payroll software solution like Hourly that automatically calculates and withholds taxes like payroll and income.

What Is The Difference Between Payroll Tax And Income Tax

The main difference between income and payroll tax is who pays which and what the taxes fund. Payroll taxes are paid by employees and employers to fund Social Security, Medicare, and social insurance programs. Local income taxes are paid by employees to fund public services like transportation, education, and defense.

Recommended Reading: How To File Self Employed Taxes

Individual Income Tax Vs Payroll Tax Usage

Collecting taxes is an ideal way for governments to generate public revenue. The Internal Revenue Service enforces tax collection for the government. But how do governments use the collected individual income and payroll tax? We’ll discuss the usage of payroll taxes and individual income tax to aid your understanding.

How are income taxes used?

The government imposes income tax on individuals and businesses and collects taxes for foreign affairs and national defense programs. The United States government uses income tax to fund public services, provide goods for citizens, pay law enforcement and other governmental obligations.

Are you wondering how governments service interest on the national debt? Look no further. It is one of individual income tax usage. These taxes are beneficial for funding social programs such as human and physical development, which in turn serve local communities.

How are payroll taxes used?

Payroll taxes are money deducted from employers’ wages and salaries and remitted to the federal government. While the government receives payroll services and taxes from the Internal Revenue Service, the funds serve different purposes. The government funds Medicare, which is health insurance, federal and state Social Security, and other social insurance programs for the welfare of society. Furthermore, these taxes fund unemployment insurance and federal employees.

Payroll Tax Vs Income Tax: What’s The Difference Between Them

America has a complicated tax system, and payroll and income taxes confuse many taxpayers, especially when dealing with revenue agents. While all taxes are not the same, understanding the employment tax difference is significant for employers. But what factors come into play when you evaluate payroll tax vs income tax? Income tax comprises federal, state, and local taxes, while payroll tax includes social security and unemployment taxes.

Taxpayers use these terms interchangeably, but there are apparent differences between payroll and income taxes. We’ll discuss the difference between payroll and income taxes, employee and employer taxes, and individual income tax vs payroll tax usage. Lastly, we’ll discuss the levies considered as payroll taxes to improve your knowledge.

Recommended Reading: When Does Tax Season End 2022

What Is The Actual Difference Between Payroll And Income Taxes

Payroll tax and income tax are both employment taxes, which are withheld from employee pay stubs. The difference is in who pays them. Employers are responsible for paying half of the payroll tax, also known as FICA tax, which funds Social Security and Medicare. Employees pay the other half.

Meanwhile, employers donât pay income taxes on behalf of their employees. Employees are fully responsible for paying their own income taxes, which are taken out of their paychecks. These taxes fund a variety of things, including state and local programs.

This may be a great base knowledge on the subject, but what exactly are each of these taxes and how do you calculate them? Weâll go into all that and more in the next few sections.

Payroll Taxes Have A Larger Impact On Lower

Payroll taxes are regressive: low- and moderate-income taxpayers pay a bigger share of their incomes in payroll tax than do high-income people, on average. The bottom fifth of taxpayers paid an average of 6.1 percent of their incomes in payroll tax in 2021, according to Tax Policy Center estimates, while the top fifth paid 5.7 percent and the top 1 percent of taxpayers paid just 2.1 percent. About two-thirds of taxpayers pay more in federal payroll taxes than personal income taxes. These figures include the employer and employee shares of the payroll tax.

However, if one looks at the overall impact of Social Security and Medicare the benefits they provide as well as the taxes they collect these programs are progressive. Social Security benefits represent a higher proportion of a workers previous earnings for workers at lower earnings levels and while all Medicare beneficiaries are eligible for the same health care services, high-income beneficiaries pay more in Medicare taxes and premiums. Low-income Medicare beneficiaries are also eligible for help paying for their premiums and cost sharing. Variation in state laws and practices makes it difficult to assess the distributional effect of UI.

Recommended Reading: Irs.gov File Taxes For Free

What Is The Federal Income Tax Right Now

The following is a table listing the Federal income tax for a single individual. Federal income Taxes will change depending on whether you are married and filing jointly or not.

| RATE OF TAXATION | |

| $518,401 and above | $156,235 + 37% of the amount over $518,400 |

There is too much variance in local and states taxes to outline specifically. Check with the appropriate authorities to find out what you are expected to pay. Keep in mind that taxpayers in the most expensive states can pay three times more than the cheapest states. But also keep in mind that this is never the full story, and you can only compare your entire tax burden to another state. You have the look at the whole thing to see it clearly, and not just one or two figures.

Payroll Taxes Fund Social Security Medicare And Unemployment Insurance

The two main federal payroll taxes levied on wages are known as Federal Insurance Contributions Act taxes. Employees and employers both pay FICA taxes: employees usually have them withheld from their paychecks, while employers pay them in addition to any other taxes they owe. However, most economists agree that employees bear the cost of employer payroll taxes in the form of lower wages. The two FICA taxes are:

- the Social Security tax, also known as the Old-Age, Survivors, and Disability Insurance tax. It is levied at a rate of 12.4 percent up to a maximum amount of an employees wages . This wage cap is adjusted annually to take account of increases in average wages. In addition, certain compensation, such as employer-provided health insurance and some other fringe benefits, are not subject to the payroll tax. The revenues go toward funding Social Security, which pays benefits to retirees, persons with disabilities, and survivors of deceased workers. For options to boost Social Securitys payroll tax revenues, see Increasing Payroll Taxes Would Strengthen Social Security.

- the Medicare tax, also known as the Medicare Hospital Insurance tax. It is levied at a rate of 2.9 percent of wages unlike the Social Security tax, there is no wage cap. Married filers earnings over $250,000 are taxed at an additional 0.9 percent, for a total of 3.8 percent on this income. Revenues from the Medicare tax support the hospital insurance portion of Medicare.

Read Also: Status Of Federal Tax Return

Collect Information On Form W

Newly hired employees must complete Form W-4. Information submitted on the form tells employers how much salary to withhold from a paycheck for tax purposes. The number of allowances on the W-4, along with the gross pay, determines the tax withholdings.

The W-4 also provides guidance for employees who have multiple jobs or who have working spouses. There are extra schedules provided to calculate withholdings for these situations.

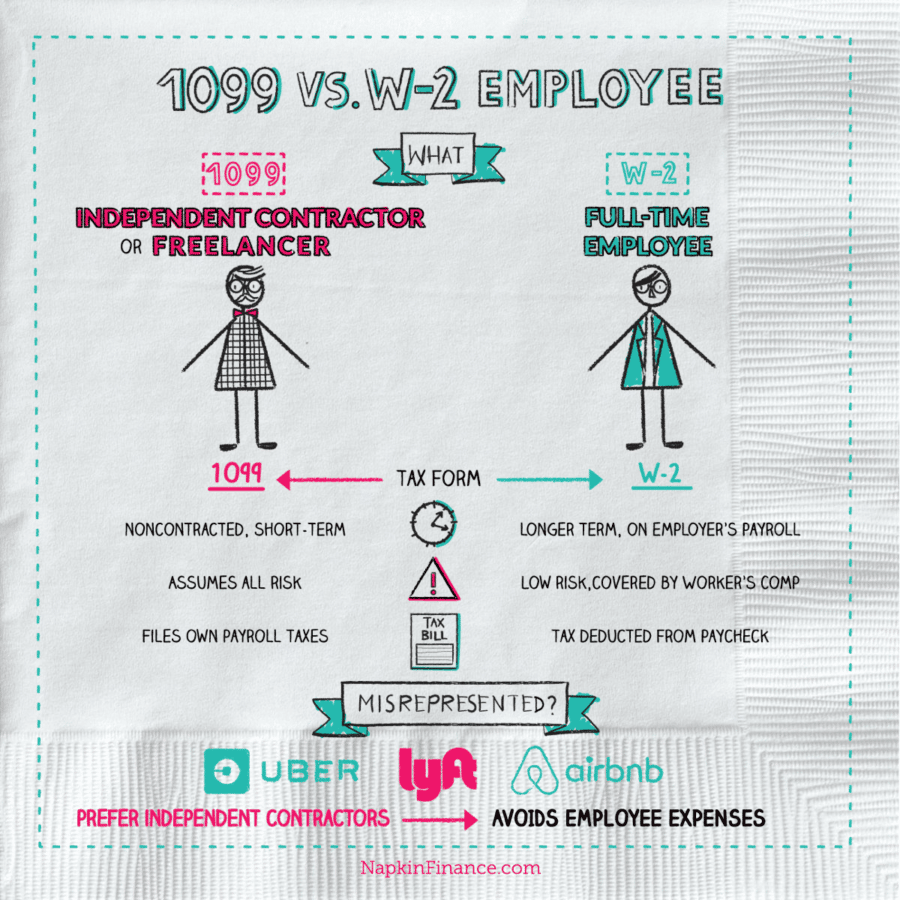

Complete Payroll Tax Forms

Payroll tax returns are complex, and the information you submit must be accurate. Make sure to submit the forms on time to avoid late filing fees. Here are the most common payroll tax forms that businesses must submit:

- Form 941: Reports federal income taxes and FICA taxes to the IRS each quarter

- Form 940: Employers annual federal unemployment tax return.

- Form W-3: Reports the total wages and tax withholdings for each employee using W-2 forms. The report is filed with the Social Security Administration annually.

- Form 1096: Reports the dollars paid to independent contractors using 1099 forms. This report is filed annually

Accounting software allows you to generate these reports automatically.

Recommended Reading: What Form Do You Need To File Taxes

What Things To Consider While Understanding The Difference Between Payroll And Income Tax

Like payroll, deducting an accurate amount of taxes is also essential for employers. Salary and tax calculation and processing include legislative rules which no one must breach. Thus understanding the difference between Payroll Tax vs Income Tax is indispensable.

The introductory note to check every time you withhold taxes is to confirm you deduct the exact amount. Withholding more amounts of taxes to compensate the contributions of the company can levy salary violations charges which no employer wants. It is a breach of the statutory laws specified above.

Assume that you are an expert in calculating taxes but do you perform that by hand? Because the manual methods may intake errors that may be out of your knowledge. Additionally, it will be time-consuming. Even though calculating manually, a separate person must be employed for the same.

Also, when considering the benefits and bonuses, the difference between payroll tax v/s income tax is essential to know. As both have different implications of the tax formulas, the employer must know when to use which taxes.

Changes To Irs Form W

Prior to the enactment in 2017 of the federal Tax Cuts and Jobs Act , most withholding allowances were based on personal exemptions, including those for the employee, spouse and any dependents. The TCJA made significant changes to tax rates, deductions, tax credits and withholding calculations, and changed the value of personal exemptions to zero.

As of January 1, 2020, IRS Form W-4 has been revised to reflect changes resulting from the TCJA where the withholding calculation is no longer tied to the number of personal exemptions claimed.

The TCJA did not impact Massachusetts laws regarding exemptions. To accurately determine the correct amount of Massachusetts withholding, employers will rely on Massachusetts Form M-4.

New employees are expected to complete both Form W-4 and Form M-4 for employers. It is not necessary for current employees to resubmit the federal Form W-4 unless they choose to adjust their withholding amounts. Employees who choose to make adjustments will submit both Form W-4 and Form M-4 to the employer.

Read Also: Is Home Insurance Tax Deductable

Determine The Periodic Gross Wages

Let us assume that you have an employee that is paid two times a month. That is equivalent to being paid 24 times in a year. Now, imagine his yearly salary is $144,000. For each pay period, he gets $6,000. Let us name him John.

Again, assume he has a month and a half gym membership for $50 and health insurance for $100. His gross wage is $6,150.

Is Payroll Tax The Same As Employment Tax

Not quite. Employment taxes are, generally speaking, all employee-related taxesincome tax, Social Security and Medicare taxes, and unemployment taxes. Payroll taxes might be defined differently depending on who you ask but, in general, they are a subset of employment taxes and include some of the taxes that appear on your paycheckSocial Security and Medicare.

Also Check: Wisconsin Sales And Use Tax

What Are Income Tax Brackets

Income tax brackets explain how much of your income can legally be taxed yearly by the Federal level. In some cases, it simply depends on how much income you earn during the tax year. The more money you make, the more taxes you pay. It applies to your income after deductions and exemptions have been made.

The percentages of income tax brackets for 2021 are as follows: 10%, 12%, 22%, 24%, 32% 35%, and 37%.