The Tax Benefits Of Marriage:

- Gift taxes and estate planningSpouses can give unlimited gifts of cash or other property to one another free of gift taxes. This provision has important implications for estate planning purposes, so be sure to review any estate plan you may have previously had once you get married.

- Larger deduction for charitable contributionsDonating cash can mean getting a deduction, helping you lower your taxable income. For your 2021 taxes, a new rule related to the CARES Act allows an above-the-line deduction of $300 for gifts of cash to charity. However, those who are married filing jointly can double that amount and deduct $600.

As you become familiar with the different processes of tax filing when youre married, be aware of how your tax situation could change in the future. Changes in your combined income, qualifications for additional tax credits, or an increase in debt will influence your tax filing. If you were ever to separate, choosing to file taxes separately will avoid any liability relating to your soon-to-be-exs finances.

There isnt one right answer for every married couple when it comes to your taxes. How you choose to file together depends on your personal circumstances and many variables surrounding income, debt, expenses, and liabilities. The best course of action is usually to file jointly as a married couple and claim as many credits as you can, but if you think you could save money by filing separately, consult with a tax professional.

Example: Capital Gains And The Tax Implications Of Getting Married

Capital gains tax is tax at your marginal tax rate that applies when you sell an asset like property or shares. However, your main residence or family home is exempt from this tax. This means that if you sell your home for $200,000 profit, none of that contributes to your taxable income.

However, this exemption only applies to a main residence. And a couple, like an individual, can only have one main residence so they can only claim the CGT exemption for one home . Alternatively, the couple can choose to apportion the CGT between the two properties.

If you still have questions about the tax implications of getting married or what you need to include on your tax return, just ask! Our expert team of accountants can quickly determine your obligations and help ensure you get your return right.

Should I File Separately If My Husband Owes Taxes

A: No. If your spouse incurred tax debt from a previous income tax filing before you were married, you are not liable. … Your spouse cannot receive money back from the IRS until they pay the agency what they owe. If your spouse owes back taxes when you tie the knot, file separately until they repay the debt.

Recommended Reading: How To Read Tax Return

What Are The Disadvantages Of Being Married

Disadvantages of Getting Married

- You limit your level of freedom.

- No other partners allowed.

- You might get trapped in an unhappy marriage.

- Dependence on your partner.

- Bad for one party in case of divorce.

- Divorce may lead to financial obligations.

- Attraction may suffer significantly over time.

- Divorce rates are quite high.

Which Filing Status Will Save You Income Taxes

As a result of the Tax Cuts and Jobs Act, the tax rates in effect during 2018 through 2025 for married taxpayers filing separate returns are exactly half those for marrieds who file joint returns. Nevertheless, most married people save on taxes by filing jointly, particularly where one spouse earns most or all of the income. This is because filing jointly shifts the high earner’s income into a lower tax bracket. If spouses earn about the same income, there should be little or no difference in their tax rates whether they file jointly or separately. The only way to know for sure if you’ll pay more or less taxes by filing separately or jointly is to figure your taxes both ways. This isn’t hard to do if you use tax preparation software.

You May Like: Taxes On 2 Million Dollars Income

When To File Jointly

As mentioned before, it is usually a better idea to file jointly as a married couple. The IRS encourages married couples to file their tax returns jointly by extending special tax deductions and credits. In short, you and your spouse should file a joint tax return unless you have a specific reason not to.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Pay Taxes Quarterly

Who Benefits More Marriage

According to Quartz.com, are more likely than single men with equal education to be among the top 1% of earners because of the benefit of women’s unpaid labor. Although men have traditionally viewed marriage or settling down, studies have shown that men reap awesome financial benefits from marriage.

Tax Tip: Filing Jointly Is Not Always Best

- Publish date: Feb 8, 2011 9:00 AM EST

Depending on your situation, filing separately may allow you to use certain exclusions and claim credits not available to those filing jointly.

NEW YORK – Generally speaking, it is better for a married couple to file a joint return than to file separately, as separate filings will usually result in the same or greater combined tax liability. But in some cases it may pay to file separate returns.

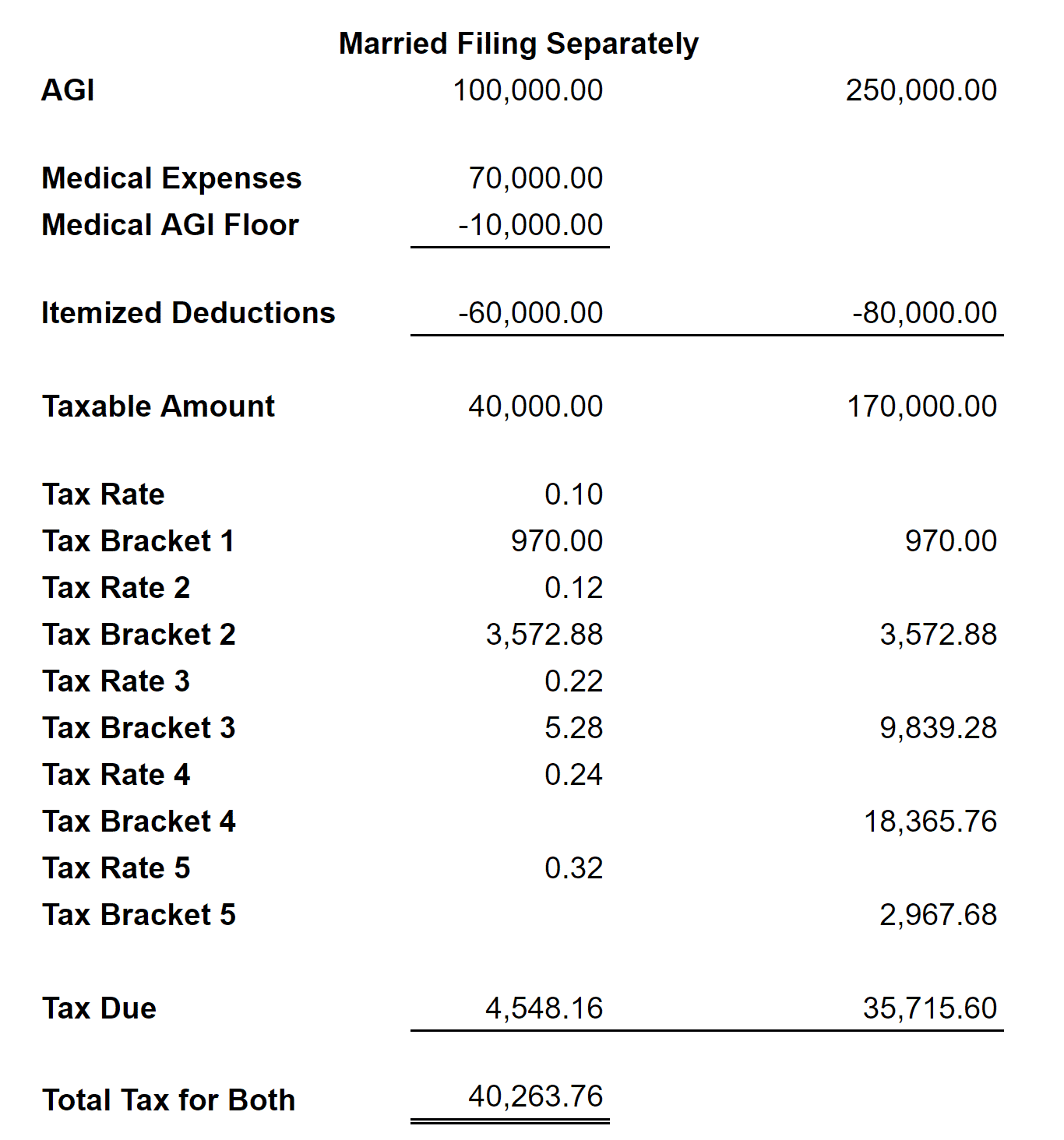

Because of the 7.5% of Adjusted Gross Income exclusion for medical expenses and 2% exclusion for miscellaneous deductions, if one spouse has excessive deductions in either of these categories then applying the percent exclusions to a lower separate AGI could result in less combined tax. If you have children, filing separate returns could also possibly increase your Child Tax Credit.

It’s not only federal rules that can make filing separately advantageous, either. You must consider the state tax consequences when determining how to file as well, as in most cases you must use the same filing status on your resident state income tax return that you use on your federal return. Filing separately may cost $150 more in federal income tax, but in some cases it could save you twice that in state income tax.

To make your tax preparer happy and ensure you get the best tax deal possible, check out MainStreet’s roundup of theessential documents to bring your tax preparer.

Read Also: How Much Do You Have To Make To Claim Taxes

Which Is Better For Your Financial Situation: Filing Taxes Jointly Or Separately

So youve tied the knot. Congrats! Getting married comes with a lot of firsts, which can be exciting and challenging. For one, this is likely the first time youve had the option to file taxes jointly but you can also choose to file as married filing separately.

Here are some considerations to help you decide , plus tips if you decide to file your taxes jointly.

Should You File Your Taxes Jointly?

If youre dealing with any of the following situations, it may make sense to file separately until these wild cards are resolved and youve made all your financial decisions together as a couple for a full year:

When to File Jointly

It makes sense for most couples to file taxes jointly because the tax rate is usually lower and you can claim higher standard deductions. You are also eligible for several tax breaks that you cant claim when filing separately, including:

- Tuition and fees deduction

- Tax-free exclusion of U.S. bond interest

- Tax-free exclusion of Social Security benefits

- Child and dependent care credit

- Earned income credit

- American opportunity or lifetime learning education credits

Tips for Filing Taxes Jointly

If you decide to file taxes jointly, ask these questions before you get to your tax preparers office to make the process go smoother:

Get more help filing your taxes at the .

Content Type: Article

When Should Married Couples File Taxes Separately

- Tax liabilitiesThere are some scenarios where it may make more sense to file separately. One is if you have a specific reason to keep your tax liabilities independent. For a variety of reasons, divorcing or separated couples may not be willing to file their taxes jointly. Filing separately may also be appropriate if one spouse suspects the other of tax evasion. If this is the case, the innocent spouse should file separately to avoid potential tax liability due to the behavior of the other spouse. When you file jointly, you and your spouse are both responsible for all the information you report, so be certain that all details are completely accurate for both of you.

- Another reason is if one of you has a lot of itemized deductions that dont apply to the other person. For example, if you have out-of-pocket medical expenses that exceeds 7.5% of your adjusted gross income. If you file jointly and double your income, it will be a lot harder to write off those expenses.

- Owing on your taxesIf you choose to file separately because you or your spouse will owe money on your tax return, the IRS will not apply your refund to your spouses balance. That could be a way for you to get a refund. Your spouse may owe more, though.

Recommended Reading: 1 Year Tax Return Mortgage

Is It Worth Getting Married For Tax Purposes

For many people, the main tax benefit of filing as a married couple is ease: They get to file a joint tax return, and sometimes, take more deductions. Minimizing any potential negative tax implications of marriage requires advance planning ideally, before you and your betrothed walk down the aisle and say I do.

A Spouse Is On An Income

Another reason to consider filing separately is if one spouse uses an income-driven repayment plan for federal student loans. When you file jointly, your combined income is recognized as the borrower’s income, since the AGI listed on your annual tax return is the figure used to represent income. A higher combined AGI could significantly drive up monthly payments for the individual borrower.

Don’t Miss: How To Report Tax Fraud To The Irs

Is There A Tax Break For Getting Married

A married couple can get greater charitable contribution deductions. … Also for 2020, you can deduct up to $300 per tax return of qualified cash contributions if you take the standard deduction. For 2021, this amount is up to $600 per tax return for those filing married filing jointly and $300 for other filing statuses.

File Separately For High Expenses

If you and your spouse have very different incomes and very different expenses, it might be worth filing separately.

For instance, say one spouse makes $40,000 and spent $5,000 on medical care. The other spouse earned $70,000 and spent just $1,000 on health care. Their combined expenses come out to $6,000 on $110,000 of combined income a combination of medical and income numbers that’s too small to deduct on their tax return.

If this couple files separately, however, the first spouse will have spent 12.5% of their individual income on medical expenses, and will be able to deduct it.

The same applies if one of you is in an income-based loan repayment program. Filing separately may mean lower monthly payments, Betterment notes, because the lender won’t consider both partners’ income in the calculation.

Read Also: How To Find 2020 Tax Return

Qualifying Widow Status When One Spouse Is Deceased

The tax code allows you to file a joint return with your spouse for the tax year in which they die. Then you might be able to file as a qualifying widow for two more years going forward, or perhaps as head of household. Otherwise, you’d then have to file as a single taxpayer.

A qualifying widow can’t remarry during the two years during which this filing status is available, and they must have a child or stepchild who they can claim as a dependent and who lived with them through the entire tax year. Foster children don’t count.

Electronic Filing Signature Authorization

There are three methods for taxpayers to sign their tax returns when electronically filing them each allows the use of Personal Identification Numbers to sign the return. The spouses must sign and date the Declaration of Taxpayer to authorize the origination of the electronic submission of the return to the IRS before transmitting it. New e-signature guidance allows taxpayers to e-sign Form 8879 from their home computer.

Form 8879 is also the declaration document and signature authorization used for an e-filed return when an electronic return originator enters or generates the taxpayers PIN on the e-filed individual income tax return. The ERO, who is a paid tax return preparer, must have the spouses execute Form 8879 before the return is electronically submitted and then must sign the ERO declaration on Form 8879. The ERO retains the Form 8879 and does not submit it to the IRS.

Spouses who prepare their own returns using software must use the self-select PIN method. This allows taxpayers to select five digits to enter as an electronic signature. The prior year adjusted gross income or prior year self-select PIN, as well as the taxpayers date of birth, is needed for the IRS to authenticate the taxpayer. For joint returns, both spouses must create PINs.

Recommended Reading: Can I Still File My 2017 Taxes Electronically In 2021

Talk To A Tax Attorney

Need a lawyer? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What Are The Pros And Cons Of Filing Taxes Jointly

The Pros and Cons of Filing a Joint Tax Return

- You’ll be legally responsible for your spouse’s misdeeds. …

- You might not be able to take advantage of deductions for medical costs. …

- Student loan interest deduction eligibility. …

- More tax credits and deductions. …

- More from Personal Finance Cheat Sheet:

Don’t Miss: How Is Property Tax Paid

How To File Taxes Together

The steps to file jointly are similar to those required to file as single.

Youll need to notify the IRS if youve changed addresses. Youll also need to update your information with the Social Security Administration office if you took your spouses last name. The name associated with your Social Security number needs to match the name on your taxes or you risk the IRS holding your tax refund until the issue is resolved.

Youll also need to:

-

Gather tax documents for both you and your spouse. This includes W2s, 1099s, medical and childcare expenses, mortgage interest statements, and investment income statements.

-

If you can write off more than the standard deduction, you should itemize your tax return. Keep in mind that youll need receipts or other documentation to back up your itemized claims for deductions and credits.

-

Choose a filing method. You can hire a tax professional or use tax software to file your tax return. You also have the option to mail in a paper return.

-

File your taxes. Your tax return is due by April 15, but you can file your taxes early to avoid extra stress and give yourself a safety net if you need more time to track down missing information, like expense receipts.

-

Start preparing for next year. Organize your paperwork so its easy to locate in the future. Depending on whether you receive a tax refund or a tax bill, you may consider adjusting your tax withholdings to better match your new financial situation.

But What If One Partner Earns Significantly More Than The Other

Heres where it gets interesting. In some relationships where one partner earns more than the other, it makes sense to purchase the property in only the lower earning spouses name.

Thats because the total tax you have to pay on the rental income is calculated against your taxable income. The higher the taxable income, the higher the tax payable. So, by investing in the name of the lower-earning spouse, the taxable income and tax payable on any rental income earned is lower than if you split it 50/50.

However, when investing there are more factors to consider than just the taxable income of you and your spouse. We recommend your tax agent gives you detailed tax advice before you decide to ensure you make the right financial choice for your circumstances.

Don’t Miss: Out Of State Sales Tax