Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

How Do Tax Returns Work

Whether you are a salaried or hourly employee, or you are a freelancer or independent contractor, you’ll file your taxes by filling out IRS Form 1040.

You’ll report your income and tax deductions on this form. Your income includes money you earn from wages, salary, tips, dividends, alimony, business income, capital gains, individual retirement account distributions, Social Security benefits and other money sources.

You can also claim deductions that lower your yearly taxable income. Allowable deductions might include payments you’ve made throughout the year to an IRA, the money you’ve paid in interest on student loans and any contributions you’ve made to a health savings plan.

When you subtract your deductions from your yearly income, you arrive at your adjusted gross income. This is your taxable income, the income on which you must pay taxes.

Many taxpayers will have to file tax returns with both the federal government and their state government. That’s because most states require their residents to pay income taxes.

As of 2021, just nine states didn’t charge income taxes. Seven of these states Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming charge no income taxes at all. New Hampshire and Tennessee don’t levy income taxes on the wages of its residents, but they do tax investment income and interest.

Some larger cities also charge taxes for working and/or residing in them. Check your citys guidelines to see if this applies before filing.

Tax On State Benefits

Your tax code can take account of taxable state benefits, so if you owe tax on them its usually taken automatically from your other income.

If the State Pension is your only income, HM Revenue and Customs will write to you if you owe Income Tax. You may need to fill in a Self Assessment tax return.

Don’t Miss: How Can I Get My Tax Transcript Online Immediately

What Is Federal Income Tax

The U.S. federal income tax is a tax levied by the Internal Revenue Service on the annual earnings of individuals, corporations, trusts, and other legal entities. Federal income taxes apply to all forms of earnings that make up a taxpayer’s taxable income, including wages, salaries, commissions, bonuses, tips, investment income, and certain types of unearned income.

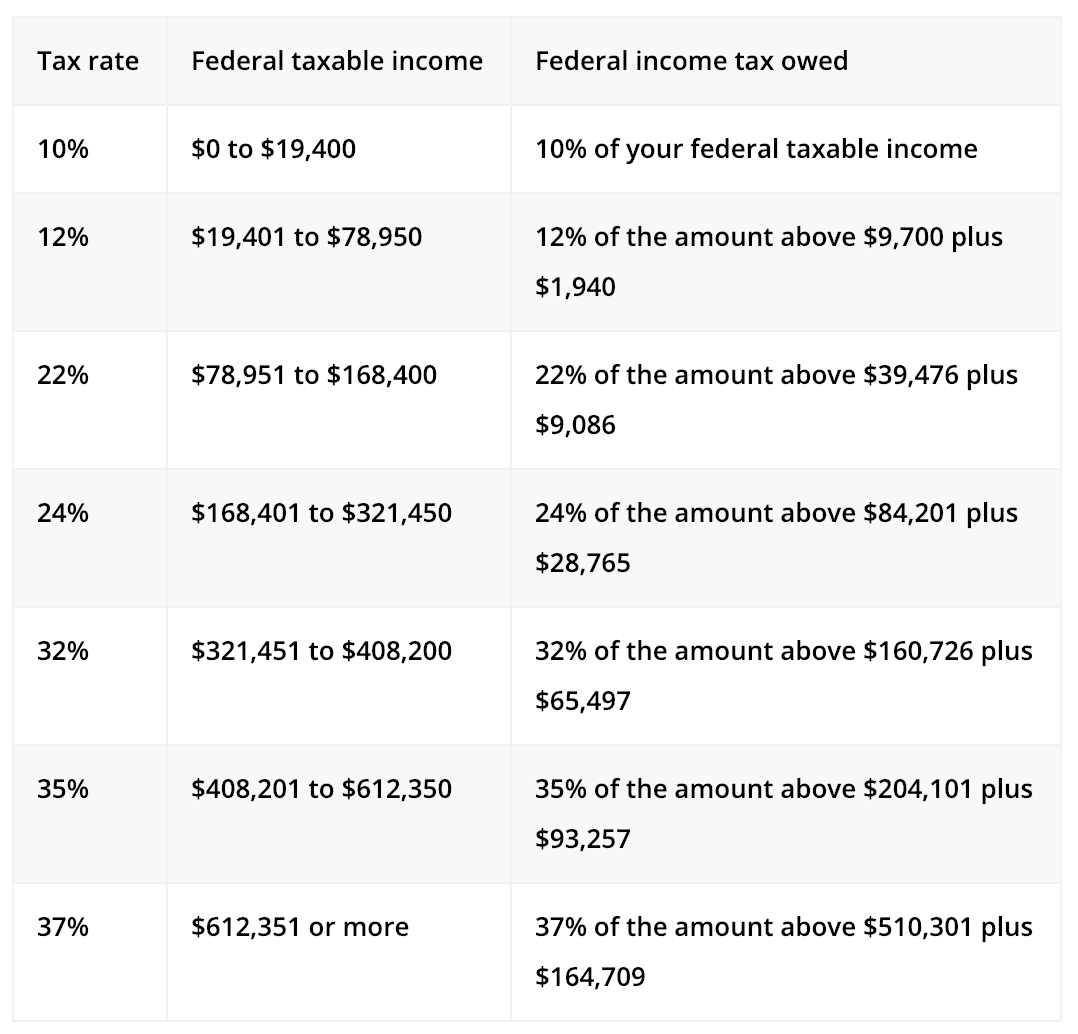

In the U.S., federal income tax rates for individuals are progressive, meaning that as taxable income increases, so does the tax rate. Federal income tax rates range from 10% to 37% and kick in at specific income thresholds. The income ranges the rates apply to are called tax brackets. Income that falls within each bracket is taxed at the corresponding rate.

The federal corporate tax rate is a flat 21% .

Do You Have An Estate Plan

We’ll show you our favorite strategies

Many people understand how charitable donations work for income tax purposes. But charitable donations work a little differently for estate tax purposes. There are three key differences.

The first difference is that the estate tax charitable deduction is allowed for a gift to a foreign charitable organization. But the income tax charitable deduction is only allowed only for donations made to U.S. charities. For this reason, many foreign charitable entities have U.S.-based affiliated organizations.

Another big difference is that the estate tax charitable donation deduction is unlimited. As such, an estate could essentially gift away its entire gross estate and not owe any estate tax. But for income tax purposes, charitable donations are limited to income .

For estate tax purposes, certain pledge payments are treated differently from the income tax requirements. Specifically, the payment of enforceable pledges is treated a little differently.

A pledge payment that is made during life can typically qualify for an income tax charitable deduction. But for estate tax purposes, payment by will of a legally enforceable pledge will qualify for an estate tax debt deduction. Still, it does not fall under the estate tax charitable deduction.

Also Check: Irs Tax Extension 2021 Form

Company And Employment Types

The UK has four main types of business structures:

- zero-hours contracts

There are also special rules if you employ family members, young people or volunteers.

As the employer, you are typically responsible for deducting and paying tax on behalf of your employees before they are paid.

To calculate how much income tax to withhold from their salary, a tax code is worked out by HMRC and it is then used by you or your accountant.

Tax codes usually start with a number and end with a letter. The most common tax code is 1250L and it means that they have a standard Personal Allowance.

Dont forget that you must set up PAYE with HMRC before the first payday so you can deduct the relevant tax and national insurance from salaries.

Tax Return Filing Status

Youll also have to determine your filing status. This is important because it helps determine how much in income tax you’ll pay. You can file as:

- Single: You’ll file as a single taxpayer if you are not married and aren’t being claimed as a dependent on someone else’s tax returns. Single taxpayers are eligible for a standard deduction of $12,550 for the 2021 tax year.

- Most people who are married file in this category. This allows them to file one joint tax return. If you file under this category, your standard deduction for the 2021 tax year is $25,100.

- Married couples can also each file their own tax returns, reporting only their personal income, deductions and credits. The standard deduction for taxpayers who file this way is $12,550 for the 2021 tax year.

Also Check: Irs How To Pay Taxes

What Is A Personal Allowance

Everyone, including students, has something called a Personal Allowance. This is the amount of money youre allowed to earn each tax year before you start paying Income Tax.

For the 2022/23 tax year, the Personal Allowance is £12,570. If you earn less than this, you usually wont have to pay any income tax.

Your Personal Allowance might be bigger if you claim Marriage Allowance or Blind Persons Allowance. Or it might be smaller if youre a high earner or if you owe tax from a previous tax year.

Check the most up-to-date Personal Allowance figures at GOV.UKOpens in a new window

Social Security And Medicare Taxes

An employer generally must withhold social security and Medicare taxes from employees’ wages and pay the employer share of these taxes.

Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year. Determine the amount of withholding for social security and Medicare taxes by multiplying each payment by the employee tax rate.

For the current year social security wage base limit and social security and Medicare tax rates refer to Publication 15, , Employer’s Tax Guide.

You May Like: Mortgage Calculator Taxes And Insurance

Which States Have No Income Tax

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not collect state income taxes. New Hampshire doesnt tax earned wages, but it does tax income earned from interest and dividends. At the end of 2023, New Hampshire will begin phasing out these taxes, and all personal income in the state will be tax free by 2027.

How Does Income Tax Work

For the Immigrant from South Africa and other countries a small overview to describe how the Dutch income tax system works

Lets start with a perspective from an employment with a monthly salary.

When earning a monthly salary, your employer withholds the P.A.Y.E from your gross salary, and pays this withholding to the Salary Tax Authorities on a monthly basis. When your employer withholds the correct amount every month according the national white table, your annual income tax return will show a zero return.If your employer withholds too little, you have to pay extra in your annual income tax return, and if withheld too much, you will receive a deductible.

The Tax Authorities collect your Gross income and pay Salary tax for the fiscal year and reflect this in your Income Tax Return, hence the calculation of your tax table.

Recommended Reading: How Much Tax Is Taken Out Of Paycheck

The Complexity Of The Us Income Tax Laws

United States tax law attempts to define a comprehensive system of measuring income in a complex economy. Many provisions defining income or granting or removing benefits require significant definition of terms. Further, many state income tax laws do not conform with federal tax law in material respects. These factors and others have resulted in substantial complexity. Even venerable legal scholars like Judge Learned Hand have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, Thomas Walter Swan, 57 Yale Law Journal No. 2, 167, 169 , Judge Hand wrote:

Complexity is a separate issue from flatness of rate structures. Also, in the United States, income tax laws are often used by legislatures as policy instruments for encouraging numerous undertakings deemed socially useful â including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, and the development of alternative energy sources and increased investment in conventional energy. Special tax provisions granted for any purpose increase complexity, irrespective of the system’s flatness or lack thereof.

Where Did The Income Tax Come From

Want someone to blame for your income tax bill this year? Look no further than Abraham Lincoln. Well, sort of.

While death and taxes might be the only things that are certain in life, it wasnt always that wayat least not as far as income taxes are concerned. Income taxes as we know them today are actually barely more than 100 years old.

In a controversial move, the first version of the personal income tax in the U.S. was signed into law by Lincoln during the Civil War as a way for the Union to pay for its war effort. Although the tax was repealed once the war was over, the debate over whether an income tax was constitutional or not raged on for decades.

All of that changed in 1913. That was the year the 16th Amendment to the U.S. Constitution was ratified, legalizing the governments right to collect a federal income tax. That same year, Congress passed legislation that made income tax a part of American life. The rest, as they say, is history.

Read Also: Where Is My California Tax Refund

Qualifying For The Credit

Many types of rental properties are LIHTC eligible, including apartment buildings, single-family dwellings, townhouses, and duplexes.

Owners or developers of projects receiving the LIHTC agree to meet an income test for tenants and a gross rent test. There are three ways to meet the income test:

The gross rent test requires that rents do not exceed 30 percent of either 50 or 60 percent of AMI, depending upon the share of tax credit rental units in the project. All LIHTC projects must comply with the income and rent tests for 15 years or credits are recaptured. In addition, an extended compliance period is generally imposed.

How Income Tax Works In Canada

Youre required to report your income to the CRA annually by filing paperwork known as a tax return. In this return, you must list all your income sources and note your eligibility for a tax deduction or tax credit.

The tax system is based on trust. Although the CRA does know about some of your income, they mostly rely on citizens to self-report their total income accurately.

The CRA recommends you file a return even if you do not earn any money. If you dont file your taxes you may miss out on free money. Some payouts you may be eligible for include:

-

Child tax benefit

-

Guaranteed income supplement

You May Like: Pa Local Earned Income Tax Instructions

How Can You Get Tax Relief

If you are a sole trader or in a partnership, tax relief allows you to make deductions for work expenses, namely what you spend to run your business.

Some types of tax relief are applied automatically, but some you must apply for, such as office and travel costs, clothing expenses, advertising or marketing, and training courses.

Remember to save every receipt for anything you plan to deduct from your taxes.

Does Social Security Count As Income

Social Security benefits are not counted as gross income. However, benefits are included in your combined income, which the IRS uses to determine if you should pay taxes on your benefits. Combined income is determined by totaling your adjusted gross income , nontaxable interest, and half of your Social Security benefits. If your combined income is between $25,000 and $34,000, you may be taxed on up to 50% of your benefits. If your combined income is more than $34,000, you may be taxed on up to 85% of your benefits.

Read Also: What Form Do You Need To File Taxes

Policy Options To Force People With Low Incomes To Pay Federal Income Tax Are Unsound

Some have implied or suggested that people who do not owe federal income tax are freeloaders who dont have a stake in the system, and that making them pay federal income taxes would improve the tax code.

Yet the vast majority of the people who owe no federal income taxes fall into one of three categories :

As Urban Institute analyst Elaine Maag has written of non-income taxpayers, most are elderly, poor, or unemployed . Whom, I wonder, should the tax man put on the block?

Another Way of Looking at Who Pays No Federal Income Tax

A separate TPC analysis categorized people who do not owe federal income tax in 2011 in a different way.* It found that of the filers who dont owe federal income tax for 2011:

* Rachel Johnson, James Nunns, Jeffrey Rohaly, Eric Toder, and Roberton Williams, Why Some Tax Units Pay No Income Tax, Urban-Brookings Tax Policy Center, July 2011 and Roberton Williams, Why Do people Pay No Federal Income Tax TPC TaxVox, July 27, 2011. For a further discussion of this TPC analysis, see Aviva Aron-Dine, Trends, Milken Institute Review, First Quarter 2012, pp. 5-11.** Roberton Williams, Why Do People Pay No Federal Income Tax?, TPC TaxVox, July 27, 2011*** The remainder of those who do not owe federal income tax, about 13 percent, dont owe federal income tax because of itemized deductions or other tax benefits.

Brief History Of Us Federal Income Taxes

As mentioned, the federal income tax was not always a part of American life. Abraham Lincoln instituted a precursor to the income tax to help fund the war effort during the Civil War. That tax was repealed in 1872, though. 1894 saw the creation of a new income tax, but the Supreme Court ruled it unconstitutional in 1895 because the tax was direct and not apportioned to the states on the basis of population.

Then, in 1909, President Taft proposed a constitutional amendment that would give the federal government the power to levy a direct income tax without spreading the tax burden across the states according to population. It took until 1913, but the 16th Amendment was ratified and the first Form 1040 was born. The Revenue Act of 1918 created a progressive income tax rate structure with rates as high as 77%. Seriously. Since the federal income tax came into being it has been a source of political controversy and groans from taxpayers.

Don’t Miss: File State And Federal Taxes For Free

How Are Income Taxes Collected

If youre like most American employees with a salary, health benefits and a 401, your employer probably sets aside some money from your paycheck for income taxes before it hits your bank account .

Remember that W-4 tax form you filled out when you first got hired? Your employer uses the information you put on that form to figure out how much to withhold from each paycheck.

So, really, youve been paying the government your fair share in taxes for most of the year.

When you fill out your tax return and file it with the IRS in the spring, youll find out if you still owe the government anything in taxes or if you overpaid and Uncle Sam owes you a tax refund.

Sounds simple enough, right? But what if youre self-employed ? Youll probably pay your income taxes through quarterly taxesor estimated taxesthat you file with the IRS every three months. If youre self-employed, youll want a tax pro who can help you throughout the year to answer all your tax questions!