What Is A W

A W-2 is a form your employer sends you at the end of every year. A W-2 says how much money you earned during the year. Your W-2 also says how much money was taken out of your paycheck for taxes during the year. You use your W-2 when you file your taxes with the Internal Revenue Service and some states.

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

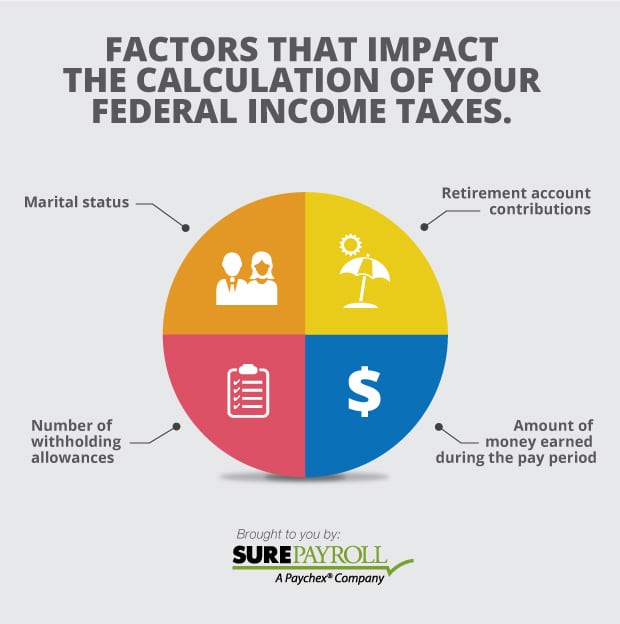

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Federal Unemployment Tax Act

The federal government doesn’t pay unemployment benefits but does help states pay them to employees who’ve been involuntarily terminated from their jobs. To fund this assistance to the states, there’s FUTA, which is a tax created by the Federal Unemployment Tax Act. The tax applies only to the first $7,000 of wages of each employee. The basic FUTA rate is 6%, but employers can receive a credit for state unemployment tax of up to 5.4%, bringing the net federal rate down to 0.6%, or a maximum FUTA payment of $42 per employee.

However, the credit is reduced if a state borrows from the federal government to cover its unemployment benefits liability and hasn’t repaid the funds. Then such state becomes a “credit reduction state” and the credit reduction means the employer pays more FUTA than usual.

You May Like: When Do I Have To File Taxes 2021

Apply For Unemployment Benefits

After an unexpected job loss, you’ll want to apply for unemployment benefits as soon as possible. These payments can provide financial relief until you secure a new job. Unemployment benefits vary from state to state, but you’ll generally have to meet the following criteria to be eligible:

- You’re unemployed through no fault of your own. Lack of available work counts .

- You meet certain work and wage requirements. Each state has its own minimum requirements. To be eligible, you must have worked for a certain amount of time or earned a minimum amount of income.

- You meet any additional requirements set by your state. You can use this search tool sponsored by the U.S. Department of Labor to review your state’s requirements.

If you’ve checked off all these boxes, you can apply for unemployment benefits in your state. You’ll provide basic information about yourself and your former employer when filing a claim. If approved, you should receive your first benefit check within two to three weeks. Benefits typically last up to 26 weeks, but some states offer more or less than that. The amount you receive will depend on your previous weekly earnings and your state’s maximum benefit. Massachusetts provided up to $823 per week in 2022, for example, while Alabama offered just $275.

Bom The Best Of Michelle Singletary On Personal Finance

If you have a personal finance question for Washington Post columnist Michelle Singletary, please call 1-855-ASK-POST .

Recession-proof your life: The tsunami of economic news in 2022 is leading consumers, investors and would-be homeowners alike to ask whether a recession is inevitable. Whether a recession comes, there are practical steps you can take to help shield yourself from a worst-case scenario.

Also Check: Ny State Tax Payment Online

Should Parents Include A Dependent Childs Income On Their Tax Return

You may avoid the hassle and expense of filing a tax return for your dependent child by adding the childs income to your tax return. You can claim a childs income on your tax return if the child qualifies as your dependent. To be eligible as a dependent, the minor must live with you for more than half the year, receive more than half of their financial support from you, and be under age 19 for the tax year or 24 if they are a full-time student. Additionally, the dependent childs gross 2022 income must be under $11,500.

Even if you can claim a dependent childs income on your tax return, if their income pushes you into a higher tax bracket, you may want to consider filing a separate tax return for the minor.

Five Minutes Or Youre Out

When Vincent Carson, 26, began his search for a new apartment, he spent his days constantly refreshing apartments.com, KSL classifieds and Facebook marketplace.

I actually was pushed out of Austin because I couldnt afford it, Carson said. I thought that Salt Lake would be cheaper and it was not, he laughed.

He lucked out when he finally spotted a listing for under $1,000 in the 9th and 9th district.

When he messaged the landlord on Facebook marketplace, the listing had only been posted for about five minutes.

They said, Carson recalled, ” We already have other people looking. Come right now. And I put my name down like that day.

The price and location are right, but there are some weird things, Carson said, that make his living situation less than ideal.

For instance, there are monthly building and apartment inspections.

It just feels weird that Im an adult and it feels like a freshman dorm, Carson said. Plus his lease, Carson said, allows for a pet with a monthly deposit. But every time he has broached the subject of getting a cat, hes been told no.

Renters like Carson dont have a lot of other options, or ability to push back in a competitive market.

My issue with moving, Carson explained, is I just think Ill end up in a worse place.

Vincent Carson, 26, moved to Salt Lake City after getting priced out of Austin, Texas.

Don’t Miss: Income Tax Rates In South Carolina

What’s The Deadline If I File For An Extension

Taxpayers requesting an extension will have until Oct. 16, 2023, to file their 2022 tax return.

Fiiling an extension doesn’t push back your payment deadline, though. You still need to submit anything you owe on time to avoid late penalties. An extension just gives you more time to complete your return.

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

In technical terms, this is called going from gross pay to net pay.

If youre trying to figure out a specific step, feel free to skip to the one youre looking for:

- Step 1: Figure out gross pay

- Step 2: Calculate employee tax withholdings

Recommended Reading: Husband And Wife Llc Tax Filing

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2021, the IRS recommends that you check your withholding amounts again. Do so in early 2022, before filing your federal tax return, to ensure the right amount is being withheld.

Recommended Reading: What Is Car Sales Tax In California

How To File Your Taxes With Turbotax

The IRS offers several options for married taxpayers. The most common is married filing jointly, allowing couples to pool their incomes and claim certain tax benefits.

To file taxes jointly with TurboTax, simply select the Married Filing Jointly option when prompted during the tax-preparation process. You and your spouse will then need to enter your individual information, such as your Social Security numbers, incomes, and deductions.

One advantage of filing your tax return jointly is that you may be able to lower your overall tax rate by combining your incomes and claiming certain deductions.

For example, if one spouse has a higher income than the other, they may be able to claim a larger portion of the mortgage interest deduction.

When Filing Married Jointly Who Is The Primary Taxpayer

If you and your spouse file your taxes jointly, the IRS will consider both of your incomes when determining your tax bracket.

However, the primary taxpayer is typically the spouse who earns the most income. This means that most of your joint tax bracket will be based on the primary taxpayers income.

The benefits are that you can take advantage of certain tax deductions and credits you would not be eligible for if you filed separately. You may also end up paying less in taxes overall by filing jointly.

Read Also: Federal Tax Return Due Dates Chart 2022

Do Minors Have To Report Unearned Income

Unearned income includes investments, social security benefits, unemployment compensation, trust distributions, and capital gains. If a dependent minor had more than $1,150 in unearned income in 2022, they would have to pay taxes.

Although its not likely a minor will be earning a lot from investments or social security benefits, if they buy collectibles and sell them for profit, theyll then have to pay taxes on those profits if they earn more than $1,150 in profit from the sales.

How Do I Compare Fees To Cash My Paycheck

You can cash your paycheck at a business to get money in your hands. You might cash your paycheck at:

- a bank or credit union

- some convenience stores, grocery stores, or other stores

- check-cashing stores

Cashing a paycheck at your bank or credit union is usually free. Sometimes, the bank named on the check might cash a paycheck if you do not have an account.

Businesses charge different fees for cashing a check. Call, visit, or go online to find out what a business charges. Check-cashing stores sometimes charge high fees.

Don’t Miss: How To Check If Your Taxes Were Filed

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

How To Calculate Withholding And Deductions From Employee Paychecks

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Are you considering doing your own payroll processing? Calculating withholding and deductions for employee paychecks isn’t difficult if you follow the steps detailed here.

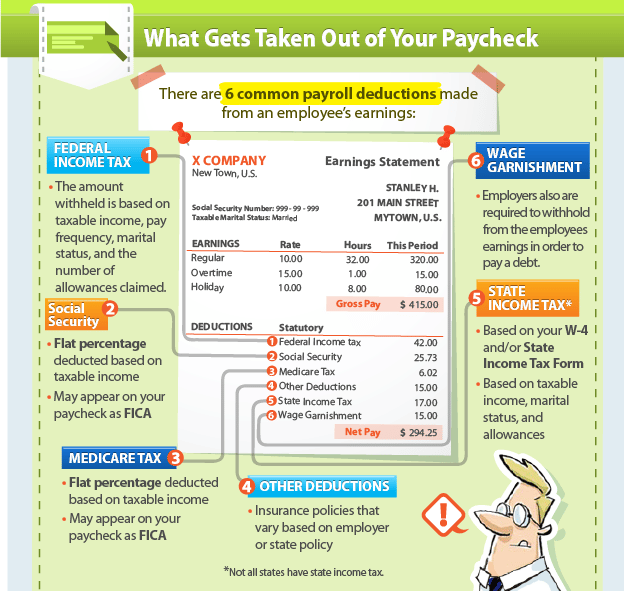

Your goal in this process is to get from the gross pay amount to net pay . After you have calculated gross pay for the pay period, you must then deduct or withhold amounts for federal income tax withholding, FICA tax, state and local income tax, and other deductions.

Read Also: What Is California Tax Percentage

How Do The Brackets Work

There are seven tax brackets for married couples filing jointly in the United States, and your income will determine which bracket you fall into. The higher your income, the higher your tax bracket or marginal tax rate will be.

What Was Updated In The Federal W4 In 2020

In 2020, the IRS updated the Federal W4 form that eliminated withholding allowances. The redesigned Form W4 makes it easier for your withholding to match your tax liability. Hereâs how to answer the new questions:

- Step 2: check the box if you have more than one job or you and your spouse both have jobs. This will increase withholding.

- Step 3: enter an amount for dependents.The old W4 used to ask for the number of dependents. The new W4 asks for a dollar amount. Hereâs how to calculate it: If your total income will be $200k or less multiply the number of children under 17 by $2,000 and other dependents by $500. Add up the total.

- Step 4a: extra income from outside of your job, such as dividends or interest, that usually don’t have withholding taken out of them. By entering it here you will withhold for this extra income so you don’t owe tax later when filing your tax return.

- Step 4b: any additional withholding you want taken out. Any other estimated tax to withhold can be entered here. The more is withheld, the bigger your refund may be and youâll avoid owing penalties.

If your W4 on file is in the old format , toggle “Use new Form W-4” to change the questions back to the previous form. Employees are currently not required to update it. However if you do need to update it for any reason, you must now use the new Form W-4.

Recommended Reading: What Is The Current Tax Year

Take Care Of Deductions

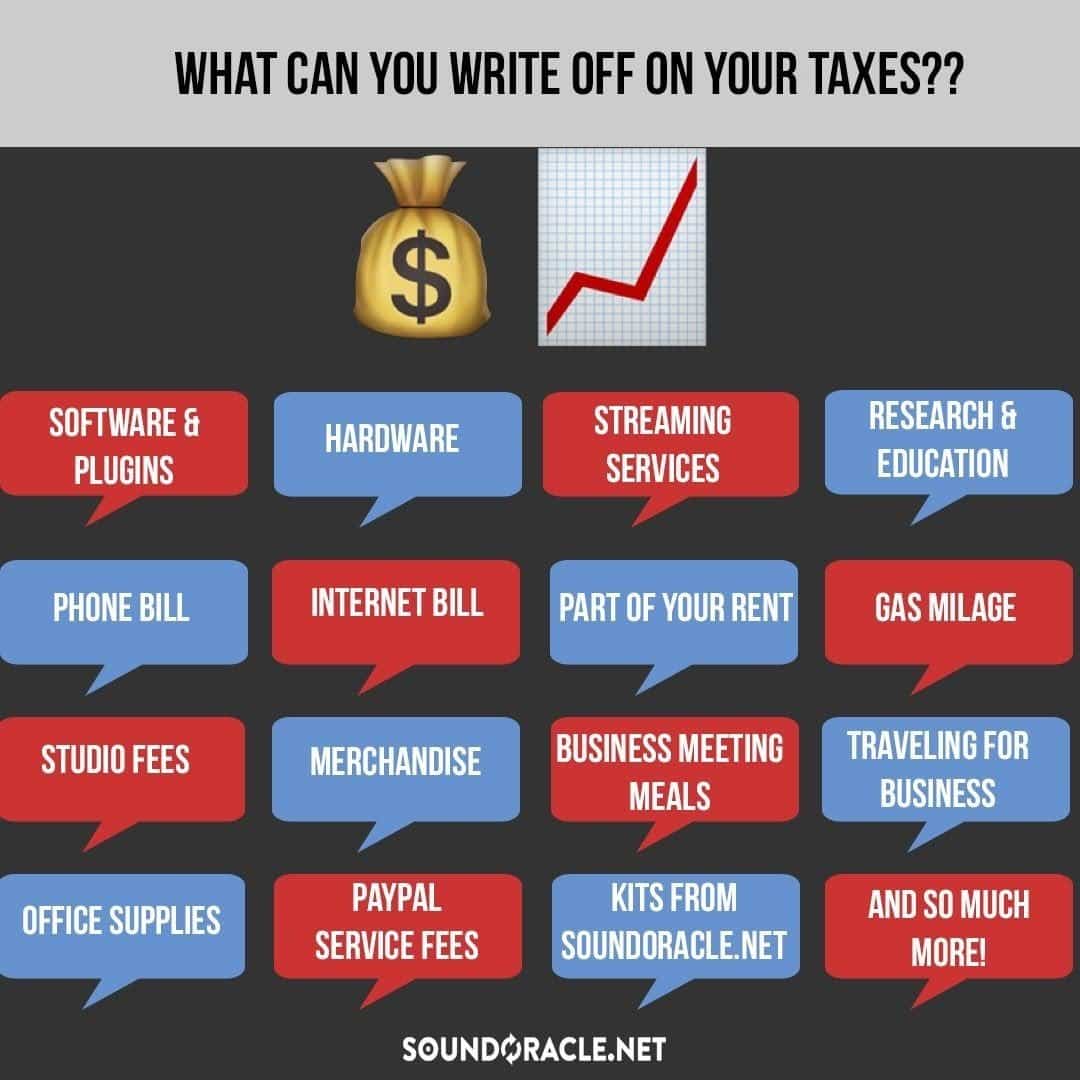

In addition to withholding for payroll taxes, calculating your employees paycheck also means taking out any applicable deductions.

There are voluntary pre and post-tax deductions like health insurance premiums, 401 plans, or health savings account contributions. Some employees also have involuntary deductions that may need to be considered for items like child support or wage garnishments .

Be careful here, because pre-tax deductions like 401 are taken out of gross income in Step 1, which means that the tax withholding calculation in Step 2 will be lower. Post-tax deductions are taken out after Step 2. Pre-tax deductions will save the employee more taxes.

Don’t Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

The United States has a “pay as you go” federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If you’re an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, you’ll be better off if you don’t have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way you’ll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Recommended Reading: How Long To Do Taxes On Turbotax