Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Copies Of Old Returns

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Recommended Reading: What Is The Tax Rate On 401k Withdrawals

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

Find Out If Your State Still Owes You A Tax Rebate Or Stimulus Check

South Carolina is mailing out refunds through the end of the year, and California won’t finish until January 2023.

Many states are still issuing tax refunds and stimulus checks as residents cope with ongoing inflation. Massachusetts only began returning $3 billion in surplus tax revenue in November. The Massachusetts payments, equal to about 14% of an individual’s 2021 state tax liability, are expected to continue to be issued at least through about Dec 15.

South Carolina will continue issuing for up to $800 through the end of the year, and residents of California, Colorado, Massachusetts and Hawaii are also still receiving their payments

Your state could be sending out a rebate or stimulus check, too. See if you qualify and how much you could be owed. For more ontax credits, see if you qualify for additional stimulus or child tax credit money.

Don’t Miss: Are Taxes Taken Out Of Social Security

Our Streamlined Procedures Deal

The IRS amnesty program, known officially as the Streamlined Foreign Offshore Procedures was established 2012 to encourage U.S. citizens/green card holders living abroad to come into full compliance on their delinquent or incomplete U.S. tax return and FBARs.

-

Individual must have been physically outside the United States for at least 330 days during any of the most recent three years.

-

The failure to file tax returns and FBARs was not due to willful conduct.

-

The IRS has not initiated an examination of taxpayer’s returns for any taxable year.

-

Complete the Certification by U.S. Person Residing Outside of the U.S in which you certify that your failure to file resulted from non-willful conduct.

-

Complete and submit the most recent 3 years of delinquent U.S. tax returns.

-

Complete and submit the most recent 6 years of delinquent FBARs.

We at CPAs for Expats have helped many citizens to take advantage of the Streamlined Procedures Amnesty Program. We provide personalized support to enable you to gather and prepare the necessary documents and then we do rest!

Our Streamlined Amnesty program package includes filing all the required documents:

-

3 years of tax returns

-

6 years of FBARs and

-

Streamline Certification Form

for a flat fee of $1,249

Ways To Get Transcripts

You may register to use Get Transcript Onlineto view, print, or download all transcript types listed below.

If you’re unable to register, or you prefer not to use Get Transcript Online, you may order a tax return transcriptand/or a tax account transcript through Get Transcript by Mailor by calling . Please allow 5 to 10 calendar days for delivery.

You may also request any transcript type listed below by submitting Form 4506-T, Request for Transcript of Tax Return.

Don’t Miss: Last Day To Sell Stock For Tax-loss 2021

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Also Check: Property Taxes In Texas Vs California

Get A Free Copy Of A Prior Year Return

Print your completed tax returns for free! If you prepared a tax return from 2015-2021 using FreeTaxUSA, here’s how to print a copy of your return:

- Returning users:

- Step 2) Click on Prior Years at the top of the screen

- Step 3) Choose the year in the Prior Year Returns section

- Step 4) View or download the return you want to print

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Recommended Reading: Irs Track My Tax Return

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Im Not A Us Citizen But I Pay Taxes Can I Get A Third Stimulus Check

Under the , non-US citizens, including those who pay taxes, werent eligible to receive the $600 payment, unlike with the first round of checks. Under the CARES Act of March 2020, all US citizens and non-US citizens with a Social Security number who live and work in America were eligible to receive stimulus payments. That included people the IRS refers to as resident aliens, green card holders and workers using visas such as H-1B and H-2A.

If your citizenship status has changed since you first got a Social Security number, you may have to update the IRS records to get your check. US citizens living abroad were also eligible for a first payment.

For the third payment, the new law includes checks for mixed-status citizenship families families with members with different immigration statuses who were left out of the first two checks.

What counts as income? That depends on your personal circumstances.

Recommended Reading: Maryland Tax Changes For 2021

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

What To Do If You Missed The Deadline To Claim Your Money

If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, donât worry. You can still claim that money when you file your taxes in 2023 â you just wonât receive it this year.

The final cutoff day for claiming the money will be on Tax Day in 2025, but we recommend filing as soon as possible.

You May Like: How To Check If You Received 3rd Stimulus Check

Also Check: What State Has Lowest Property Taxes

Did You Get A Refund And The Amount Was Less Than You Expected Or When You Checked The Status Of Your Refund The Automated System Indicated The Irs Had Not Received Your Tax Return

You may want to request a transcript of your tax account to see what happened. The IRS may have changed an amount on your tax return during processing, but for some reason you didnt get a notice, or maybe your tax return wasnt received by the IRS. A transcript of your account will have information about the receipt and processing of your return

Copies Of Tax Returns

A copy of your tax return is exactly that a duplicate of the return you mailed or e-filed with the IRS. For a fee, the IRS can provide up to six years back, plus the current years tax return, if youve already filed yours. Youll need to fill out and mail Form 4506 to the IRS to request a copy of a tax return.

You might need a copy of your old tax return, rather than a tax transcript, if more-detailed information from prior tax returns is required or if older tax information is needed.

You May Like: What Is Federal Excise Tax

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Q1 How Do I Get A Transcript Online

Upon successful registration, we give you the option to “continue” and use Get Transcript Online. We’ll ask you the reason you need a transcript to help you determine which type may be best for you. Get Transcript Online provides access to all transcript types and available years for you to view, print, or download from your browser.

You may log in with your username and password any time after you’ve registered by clicking on the Get Transcript Online button.

You May Like: Sales Tax In North Dakota

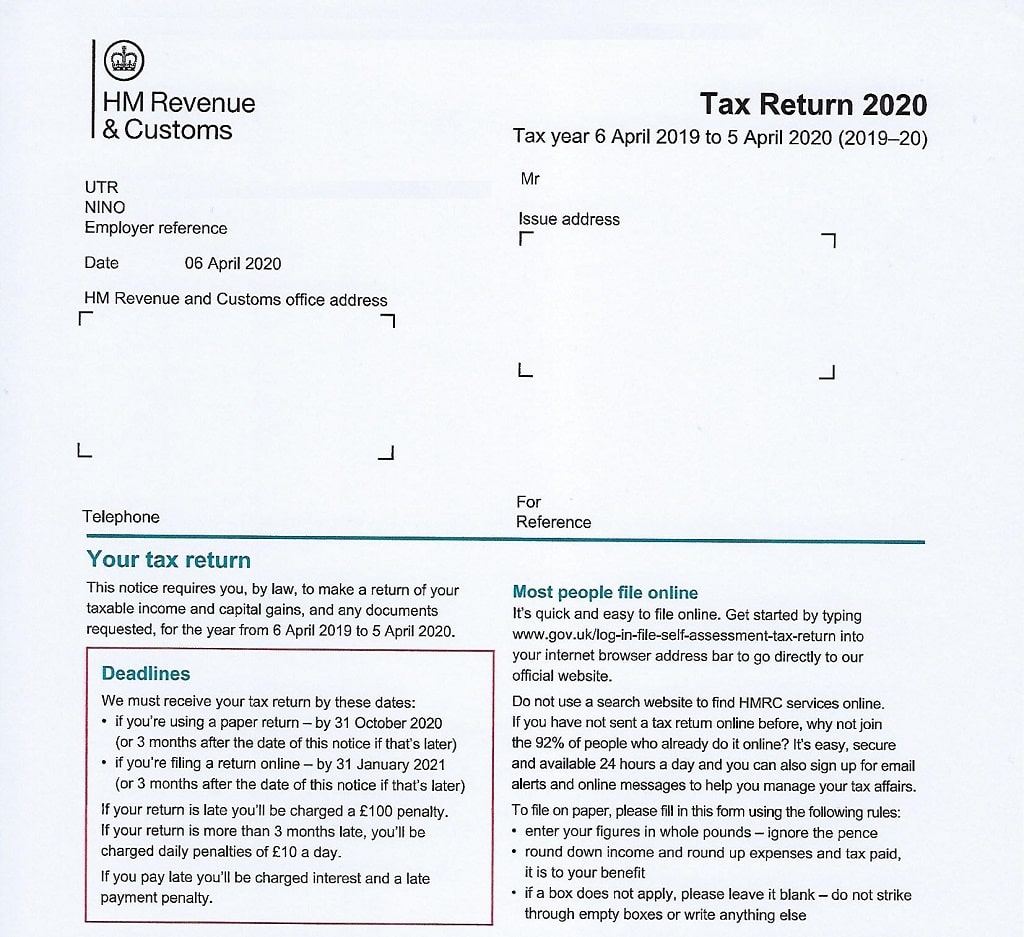

If You Need To Change Your Return

You can make a change to your tax return 72 hours after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2023 for the 2020 to 2021 tax year

- 31 January 2024 for the 2021 to 2022 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

You May Like: How Much Is Stock Taxed

You May Mail A Paper Return

Directions to print forms:

1. Click on the folders below to find forms and instructions. You can also search for a file. If you click on a folder and run a search, it will only search that folder.

2. Click a form to print it.

Note: Your browser may ask you to allow pop-ups from this website. Allow the pop-ups and double-click the form again. For the best user experience on this website, you should update your browser .

Mac Users: Safari may block pop ups on default. You can go to your Safari menu, preferences and then security to allow pop-ups.

You can also find printed forms:

- At your local District Office. See the CONTACT US link at the top of this page.

- At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or

- You can call 1-866-285-2996 to order forms to be mailed.

Browse or Search Forms

While People With Income Under A Certain Amount Aren’t Required To File A Tax Return Because They Won’t Owe Any Tax If You Qualify For Certain Tax Credits Or Already Paid Some Federal Income Tax The Irs Might Owe You A Refund That You Can Only Get By Filing A Return

Get to know the IRS, its people and the issues that affect taxpayers

As the Deputy Commissioner of Wage & Investment, its important to me that my organization ensures that everyone can claim the tax credits theyre eligible for, whether its a tax refund, a stimulus payment or federal withholding credits.

Before I talk about 2020 tax returns, I do want to mention that IRS employees are hard at work to process some of last years returns that we werent able to get to because of the many office closures during the pandemic. Its important that you file your 2020 tax return even if your 2019 tax return hasnt been processed yet. We will still process your 2019 return even if youve already gotten your 2020 tax refund.

Don’t Miss: 2021 Dependent Care Tax Credit