Roth 401 Vs : How Are They Different

The biggest difference between a Roth 401 and a traditional 401 is how the money you put in is taxed. Taxes are already super confusing , so lets start with a simple definition, and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they go into your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

What Are The Contribution Limits In 2022

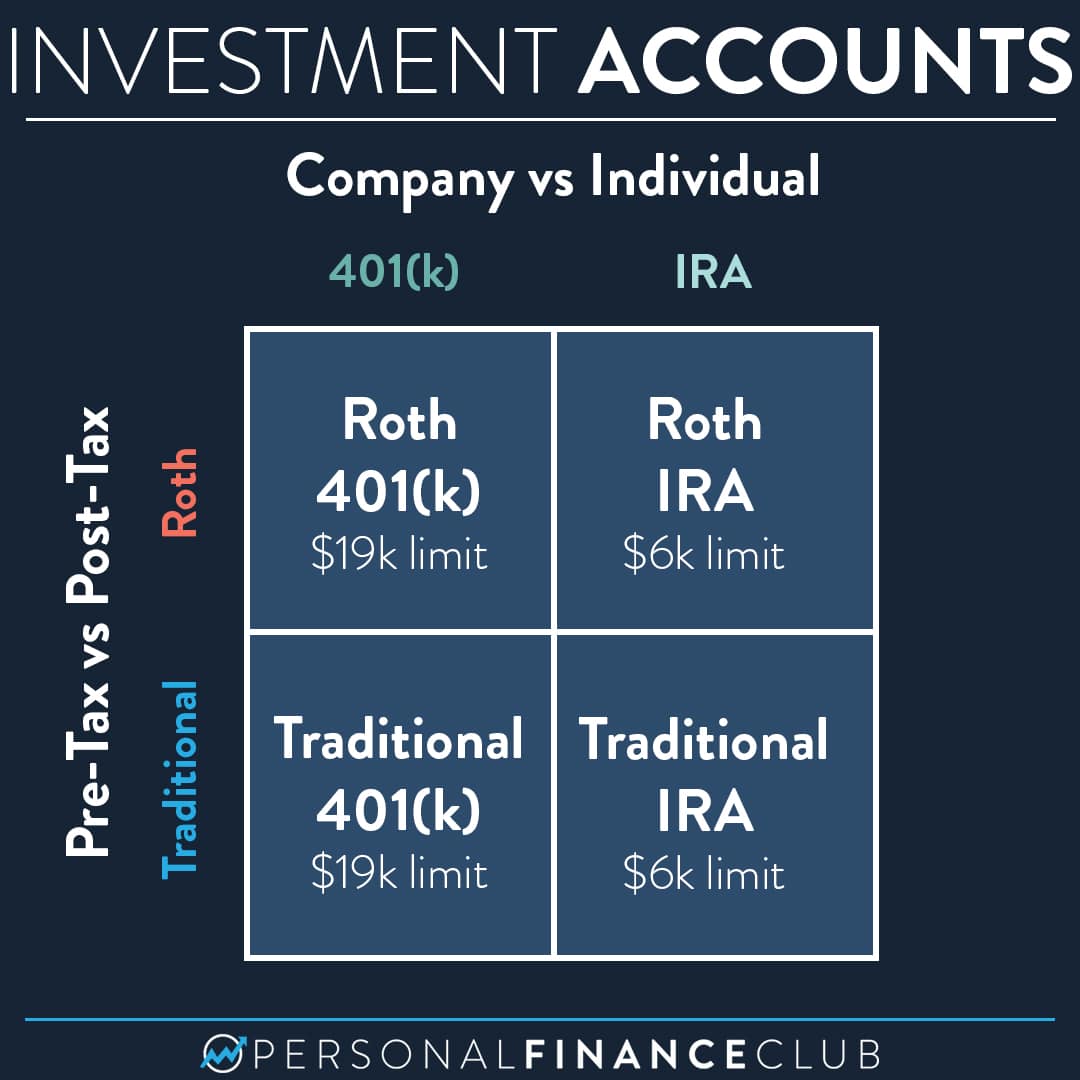

Contribution limits for Roth and traditional 401 plans are the same. You can contribute as much as $20,500 to a 401 plan in 2022, an increase of $1,000 from 2021. Those 50 and older will be able to add another $6,500 the same catch-up contribution amount as 2021 for a maximum contribution of $27,000. These limits are adjusted every year.

Your employer may contribute to your 401, too, and there is a limit to the combined amount you and your employer can contribute to 401 plans. For those age 49 and under, the limit is $61,000 in 2022, up from $58,000 in 2021. For those 50 and older, the limit is $67,500 in 2022, up from $64,500 in 2021. You cant contribute more than your earned income in any year.

Should You Consider A Roth 401

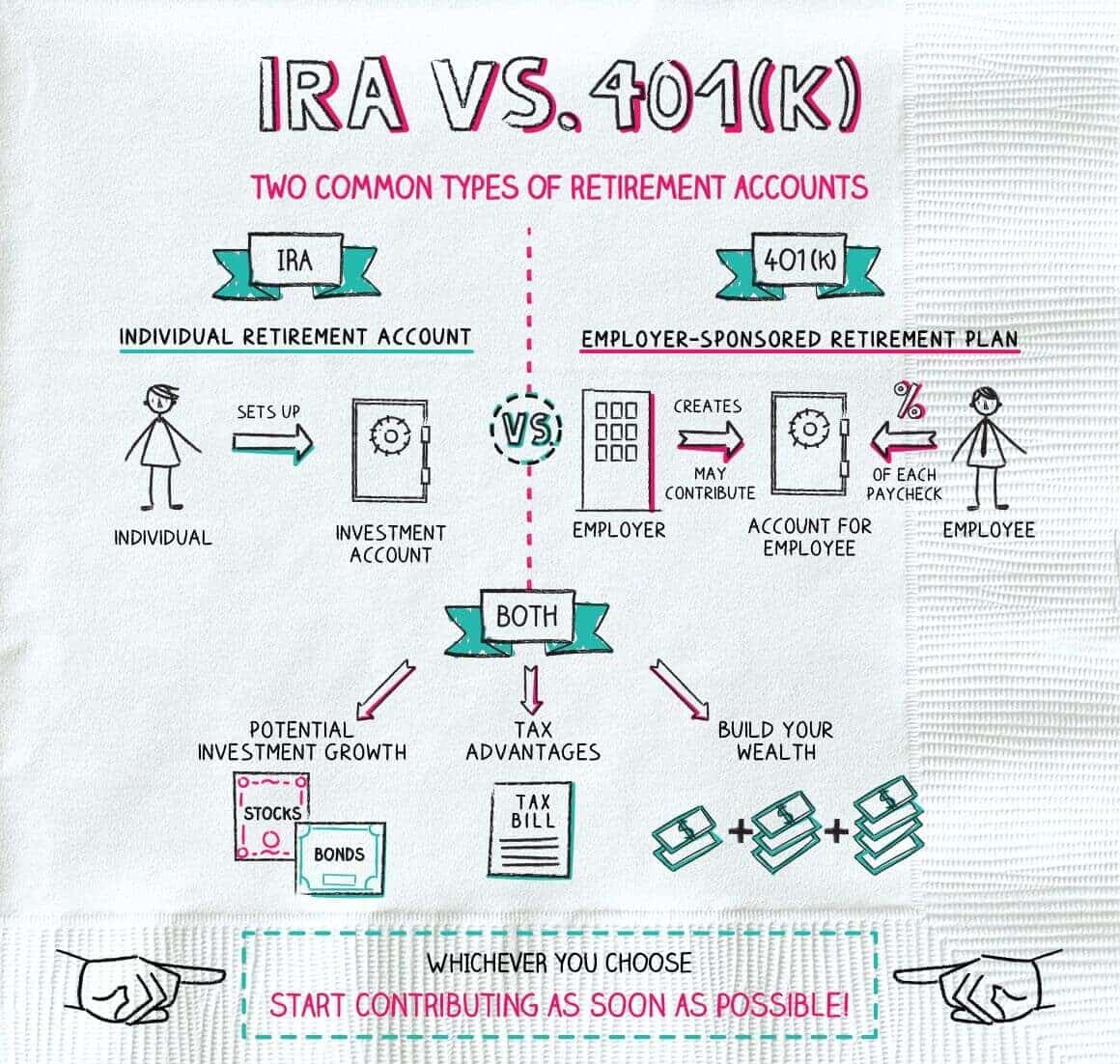

Many companies now offer employer-sponsored Roth 401 retirement accounts alongside traditional 401 plans, giving employees another way to save for retirement. What’s the difference between the two accounts? And should you consider opening a Roth 401?

Here, we’ll take a look at how Roth 401 plans stack up against their traditional counterparts and what to consider before contributing to one.

Also Check: How Much Tax Is Taken From My Check

Why Diversifying May Be The Best Bet

Just as financial advisors suggest retirement savers diversify their investments, they also preach the benefits of tax diversification especially for investors to whom the choice between a pre-tax and Roth account doesn’t seem clear.

Such investors might elect to funnel half their contributions to a Roth and half to a pre-tax account to hedge their tax bet, for example.

“I love the half and half ,” Lander said. “You’re only half wrong.”

Having two tax buckets presents financial options to retirees.

When The Roth 401 Is Better

Heres when the Roth is probably a better option:

Youre young and in a low tax bracket

I recommend making Roth contributions when someone is in a low bracket and expecting to later be in a higher tax bracket, says Mark Wilson, CFP and founder of MILE Wealth Management in Irvine, California. If you can pay taxes today at 12 percent to avoid paying taxes in the future at 25 percent, this is a good deal.

Wilson defines a low bracket as being taxed at the federal level of 12 percent or less. There are cases where Roths can make sense for folks in higher brackets as long as they are expecting even higher incomes in the future, says Wilson.

Youth is also a big advantage, allowing money to grow tax-free even longer.

The younger a person is, the more advantage a Roth can have for them, because they have a longer time for the money to grow, says Edward J. Snyder, CFP and founder of Oaktree Financial Advisors in Carmel, Indiana. The younger person is also more likely to be in a lower tax bracket than someone who is mid- to late-career.

You expect tax rates to rise

Even if you dont expect to earn more, you might expect tax rates across the country to increase, and such a rise could make the Roth 401 more attractive today.

Of course, theres always uncertainty in any projections, especially predicting the political winds.

You already have a traditional 401

RMDs can have an impact on the taxation of Social Security benefits and Medicare surcharges, says Greenman.

Read Also: How Does Sales Tax Work

Can I Contribute To Both A Roth 401 And A Traditional 401

Yes. In certain situations, you can contribute to both a Roth 401 and a traditional 401. Mostly, it depends on the options available to you. But if you have a Roth 401 with good growth stock mutual fund options, you dont need to invest in a traditional 401. The benefits of tax-free growth and tax-free withdrawals in retirement are such a great deal, we recommend you invest your entire 15% in your Roth 401.

Here’s how we look at it: Match beats Roth beats traditional. Lets break it down.

See? Easy-peasy! Keep in mind that your employer match doesnt count toward your 15% income investment. Think of this as icing on that big, delicious retirement cake.

Again, youll want to sit down with an investment professional who can walk you through these options.

The Choice Is A ‘tax Bet’

Taxes are therefore a primary consideration when choosing to save via pre-tax or Roth.

It comes down to this question: Do you expect your tax rate to be higher or lower in retirement?

If higher, it makes sense to save in a Roth account now and pay taxes at your current, lower rate. If lower, saving in a pre-tax account and deferring your tax bill generally makes more financial sense.

Consider this: If your present and future tax rates are identical, the pre-tax versus Roth choice doesn’t matter from a mathematical standpoint, said David Blanchett, head of retirement research at PGIM, an asset-management arm of Prudential Financial. You’ll end up with the same amount of after-tax retirement savings.

Of course, it’s impossible to know what your future tax rate will be lower, identical, higher due to unknowable personal circumstances and future policy adjustments.

“You’re really just making a tax bet,”Ted Jenkin, a certified financial planner and CEO of oXYGen Financial, said of the choice.

Read Also: How To Request Tax Extension

The Difference In Roth 401 And Pre

The Roth contributions, its very important that you understand theyre made with after-tax dollars. So whether its a Roth IRA that you fund on your own out of your own savings or checking account, or its a Roth 401, its made with after-tax dollars. This means that you dont get the tax break up front, but it has a whole lot of other amazing tax advantages that youre going to get later on, which Im going to discuss.

Now the pre-tax contributions, theyre going to be made before your tax is actually paid. So whether its a regular IRA, where youre going to make a contribution and take a deduction on your tax return, so the effect is, its before your taxes are paid. Or, its your pre-tax contributions into your 401 plan, those contributions are going to go in before your tax is paid.

So thats the biggest difference between Roth, which is an after-tax contribution, youve already paid your taxes. And pre-tax, and we also call pre-tax traditional contributions, thats the traditional way that 401 contributions were made. And those are made before your taxes are paid. So thats the real big difference. Theres a lot of other differences, but thats the big one that you need to be focused on today.

What Is A Traditional 401

A traditional 401 is the original version of the plan and is usually referred to simply as a 401. This type of plan allows you to make contributions with pre-tax dollars so that you dont pay taxes on money you contribute. So your tax break comes today, rather than later.

In this 401, youll also enjoy deferred taxes on your investment gains. Your money is taxed only when it comes out of the account. That means you can avoid taxes on earnings, such as capital gains and dividends, until you withdraw them from the account at retirement.

Read Also: How To File Taxes Free

Roth Vs Traditional 401 And Your Paycheck

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

The 401 is a popular workplace retirement plan, with more than 60 million active participants. Named after the section of the income tax code that created it, the 401 allows you to make regular contributions through payroll deductions to a tax-advantaged workplace retirement plan. Your company may match your contributions.

Todays workplace gives you two choices for saving with a 401 a traditional 401 and a Roth 401.

Advantages And Disadvantages Of Roth 401s

A Roth 401 may have the greatest benefit for employees currently in a low tax bracketwho expect to move into a higher one after they retire. Contributions made to a Roth 401 are taxed at the lower tax rate. Distributions are tax-free in retirement, making them the greatest single advantage. No matter how much the account grows over the years, that money is still exempt from income taxes after the account holder retires.

The downside is a little more immediate financial pain. Because contributions to a traditional 401 are not taxed immediately , the impact on your take-home pay is reduced and your tax break for the year is maximized. But theres no such deal with a Roth 401. This means that you are out-of-pocket for the deposits you make to it in the year you make them.

-

Contributions are made using after-tax dollars

-

Contributions dont reduce your taxable income

Also Check: Status Of Federal Tax Return

When Can I Take Withdrawals From A Traditional 401

You can make penalty-free withdrawals from a traditional 401 when you are age 59½ or older. Youll owe state and federal income taxes on the amount you withdraw.

In most cases, if you withdraw before age 59½, youll owe a 10 percent tax penalty on your withdrawal. And youll still owe income taxes on the total amount you withdraw. If you were 58 years old and in the 20 percent income tax bracket, youd owe $3,000 on a $10,000 withdrawal $2,000 in income taxes and $1,000 for the early withdrawal penalty.

You can, in some cases, take penalty-free withdrawals before age 59½ for unreimbursed deductible medical expenses that exceed 10 percent of your adjusted gross income, for example, or if youre permanently and totally disabled. You may also take penalty-free early distributions for health insurance and for the purchase of a first home. Youll still owe taxes on the withdrawals though.

You must start taking withdrawals by age 72, whether you need the money or not. Required minimum distributions depend on your age and the amount of money you have in tax-deferred retirement plans, including 401s.

Are You Being Realistic About Retirement Income

Many workers mistakenly assume they’ll be in the same tax bracket in retirement because they’ll require , income equal to their working years. That’s often not the case.

For example, after factoring in historic market volatility, generating $500,000/year in pre-tax income for 35 years would require a $12M starting retirement portfolio.²

Recommended Reading: Flat Tax Pros And Cons

Summary Roth 401 Or Pre

Thats all I have for you today on what is better for you? Pre-tax contributions to your 401 or after-tax Roth contributions?

Its not an easy decision. When in doubt, always go 50/50. And also remember, your employer contributions will always be taxable when you withdraw them. That should change the way you think as well, because those taxable distributions if everything is going to be taxable, that could easily put you into that 22% bracket when you are pulling money out later. So put more into the Roth now.

Just keep that in mind. 50/50 is a great place to start. If you can afford it, do the full Roth contribution and put more money in. Instead of that $320 that we talked about if you can put more money in, do it. Put more money in and do it in the Roth. Because, even though youre not saving the taxes now, you get those big benefits later.

There are also some other big benefits after you pass with how the Roth and the IRA are distributed to your beneficiaries and heirs. And again, having both types is good in that direction as well, thinking longer-term.

So, thats all I have for you today. Once again, my name is Greg Phelps with Redrock Wealth Management here in Las Vegas. The blog and podcast host and webinar host to retirewire.com. Thank you so much for your time. I hope you found this helpful. And if you have any questions, feel free to reach out through retirewire.com or redrockwealth.com.

Roth 401 Vs Traditional : Investing Pre

Which is better, a Roth or traditional 401? The main difference between a Roth 401 and … traditional 401 is the tax treatment of your contributions.

getty

Which is better, a Roth or traditional 401? The central difference between a Roth 401 and traditional 401 is the tax treatment of your contributions. Investors make traditional 401 contributions before tax while Roth savings occur after tax. Which is best for you will depend on your current/future tax situation, asset mix, and cash flows. For individuals in the upper end of the tax brackets, paying tax now on retirement savings may not make sense.

Think long-term when deciding whether a Roth 401 will be better than a traditional 401. If Roth accounts are only a small fraction of your assets at retirement, it may not be worthwhile. Further, if you’re already in a high tax bracket, it’s less likely your tax rate will get even higher when you stop working.

Read Also: File Taxes With Credit Karma

Frequently Asked Questions About Roth Contributions

When we are educating 401K plan participants on this topic, there are a few frequently asked questions that we receive:

Do all retirement plans allow Roth contributions?

ANSWER: No, Roth contributions are a voluntary contribution source that a company has to elect to offer to its employees. We are seeing a lot more plans that offer this benefit but not all plans do.

Can you contribute both Pre-Tax and Roth at the same time to the plan?

ANSWER: Yes, if your plan allows Roth contributions you are normally able to contribute both pre-tax and Roth to the plan simultaneously. However, the annual deferral limits are aggregated for purposes of all employee elective deferrals. For example, in 2021, the maximum employee deferral limits are as follows:

-

Under the age of 50: $19,500

-

Age 50+: $26,000

You can contribute all pre-tax, all Roth, or any combination of the two but those amounts are aggregated together for purposes of assessing the annual dollar limits.

Do you have to set up a separate account for your Roth contributions to the 401K?

ANSWER: No. The Roth contributions that you make out of your paycheck to the plan are just tracked as a separate source within the 401K plan. They have to do this because when it comes to withdrawing the money, they have to know how much of your account balance is pre-tax and what amount is Roth. Typically, on your statements, you will see your total balance, and then it breaks it down by money type within your account.

Roth 401 Vs Traditional 401

|

Contributions |

Contributions are made with after-tax dollars. |

Contributions are made with pretax dollars . |

|

Withdrawals |

The money you put in and its growth are not taxed . However, your employer match is subject to taxes. |

All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

|

Access |

If youve held the account for at least five years, you can start taking money out once you reach age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. |

You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

You May Like: California Llc First Year Tax Exemption

Roth Vs Traditional 401

In a traditional 401, employees make pre-tax contributions. While this reduces your taxable income now, you’ll pay regular income tax when you withdraw the money in retirement.

In a Roth 401, employees contribute after-tax dollars to a designated Roth account within the 401 plan. You receive no tax benefits from the contribution. When the money is taken out in retirement, it’s tax-free if at least five years passed since your first contribution to the Roth 401.

Investors can contribute to both a traditional 401 and a Roth 401 at the same time. However, the maximum yearly limits apply to contributions in aggregate. If you contribute to a Roth 401, any employer matching funds will still go into a pre-tax 401.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Also Check: Are Medical Insurance Premiums Tax Deductible