Hawaii State Unemployment Insurance

As an employer in Hawaii, you have to pay unemployment insurance to the state. The 2022 tax rates range from 0.2% to 5.8% on the first $500 in wages paid to each employee in a calendar year.

If youre a new employer , you pay a flat rate of 3%.

In addition, you are responsible for paying whats called the Employment and Training Assessment Rate, which is 0.01%.

For the complete SUI tax rate schedule, head on over to the official State of Hawaii unemployment insurance website.

Nexus Regulations In Hawaii

Businesses are not obligated to pay the GET unless they have established a physical or economic nexus, a significant business presence, in Hawaii. For out-of-state sellers, GET payments are only due on a particular purchase if delivery is made in Hawaii and the seller has a nexus there. A business is considered to have a nexus if they:

- Have property in the state

- Provide services in the state

- Acquire a presence in the state for any period of time

- Are incorporated in the state

- Have a local phone number in the state

- Store goods in the state

Voluntarily registering to pay the GET may also create a nexus condition for a business depending on the specific circumstances of their situation.

Economic nexus is established in Hawaii if a business does $100,000 or 200 or more transactions with people in Hawaii. This applies to gross sales for individual businesses and marketplace sales for facilitators.

Passing Along Hawaii Ge Tax To Your Customers

Hawaii allows most businesses to pass along the General Excise Tax to customers, but there are a few things you need to know about the subject.

Warning:

This is not tax or legal advice and it might not apply to your situation. While it may be OK to pass along GE Tax according to GE Tax law, there could be other laws preventing it. For example, if you are in a lease or other contract, it might not be appropriate to add GE Tax to your arrangement.

Every tax situation is different and you may need more forms that are presented here. This is an introductory guide only, and we recommend having your tax forms filed by a professional. Information presented on this page may be outdated. Please read all Hawaii State-provided form instructions carefully.

Tax Services Oahu | Hawaii General Excise Tax Services

Don’t Miss: What Do You Need To Do Your Taxes

Due Dates For Hawaii Tax Returns

The tax returns of Hawaii are due by day 20 in the 4th month after the tax year closes. For businesses that file according to the traditional calendar year, returns are due by April 20. Businesses that can’t file on that date can acquire an automatic extension of state tax. In Hawaii, an extension grants a filer six extra months to file their return, which means their new due date becomes October 20 .

Sales And Property Taxes In Hawaii

Sales Taxes Like many states, Hawaii has multiple Sales tax rates. One at the state level and another at the local level. The state rate is 4.00% and the average local rate is 0.44% which is a low sales tax compared to most of the country. Sales tax bases define what is taxable and nontaxable. Most states apply the sales taxes to only final retail sales. However, Hawaiis sales tax has a broad tax base that additionally includes many business-to-business services. .

Property Taxes the average property tax rate for residential property in the state of Hawaii is 0.31%, making it the lowest state in the union as far as Property Tax as a Percent of a taxpayers primary residence.

Don’t Miss: How To Calculate The Sales Tax

Other Taxes And Duties

Depending on your industry, your LLC may be liable for certain other taxes and duties. For example, if you sell gasoline, you may need to pay a tax on any fuel you sell. Likewise, if you import or export goods, you may need to pay certain duties.Speak to your accountant about any other taxes or duties you may need to withhold or pay.

Payroll Taxes In Hawaii

Payroll taxes are paid by business on the behalf of their employees to fund unemployment insurance. It consists of multiple factors, such as taxable wage base and UI tax rate. Below is an outline of important factors regarding State Payroll Taxes in Hawaii

- Wage Base Hawaiis wage base of $48,100

- New Employers UI Contribution Tax is 2.40% for all new employers.

- Education & Training Tax E& T tax rate is 0.10% for all employers

- UI Rates range from 0.00% to 5.60%

- Temp Disability Insurance Benefits Hawaii pays TDI for employees who have worked for an employer over 14 weeks. The employer may elect to deduct up to 0.50% from the employees pay to fund the TDI.

Don’t Miss: Penalty For Filing Taxes Late If I Owe Nothing

Other Hawaii Tax Facts

Hawaii taxpayers can file electronically, as well as check the status of their refunds via the Department of Taxations e-filing services.

Make sure you have a minister officiating your wedding if the state determines your ceremony is a nonreligious tourist wedding, youll have to pay the states 4% excise tax.

For more information, go to the Department of Taxations website.

To download tax forms on this site, you will need to install a free copy of Adobe Acrobat Reader. Click here for instructions.

Related Links:

Adjusting Prices Above The Ge Tax Rat

To bridge the gap between what a business collects from their customers and what is payed to the state, businesses are allowed to add 4.1666% to each sale on Maui , or 4.712% to each sale on Oahu, Kauai, and the big island.

This way when a small business collects extra revenue from their customers to cover the GE Tax, they now collect a very close amount to how much they pay to the State of Hawaii.

Note that if you are a commissioned agent you cannot pass the tax along to your customers. There are other exceptions as well. Its often prudent to seek the advice of a tax professional to make sure you are in compliance.

Read Also: When Is An Estate Tax Return Required

State Tax Changes For 2021

Tax laws can change at any time as legislation is passed or repealed. The below came into effect for tax year 2021.

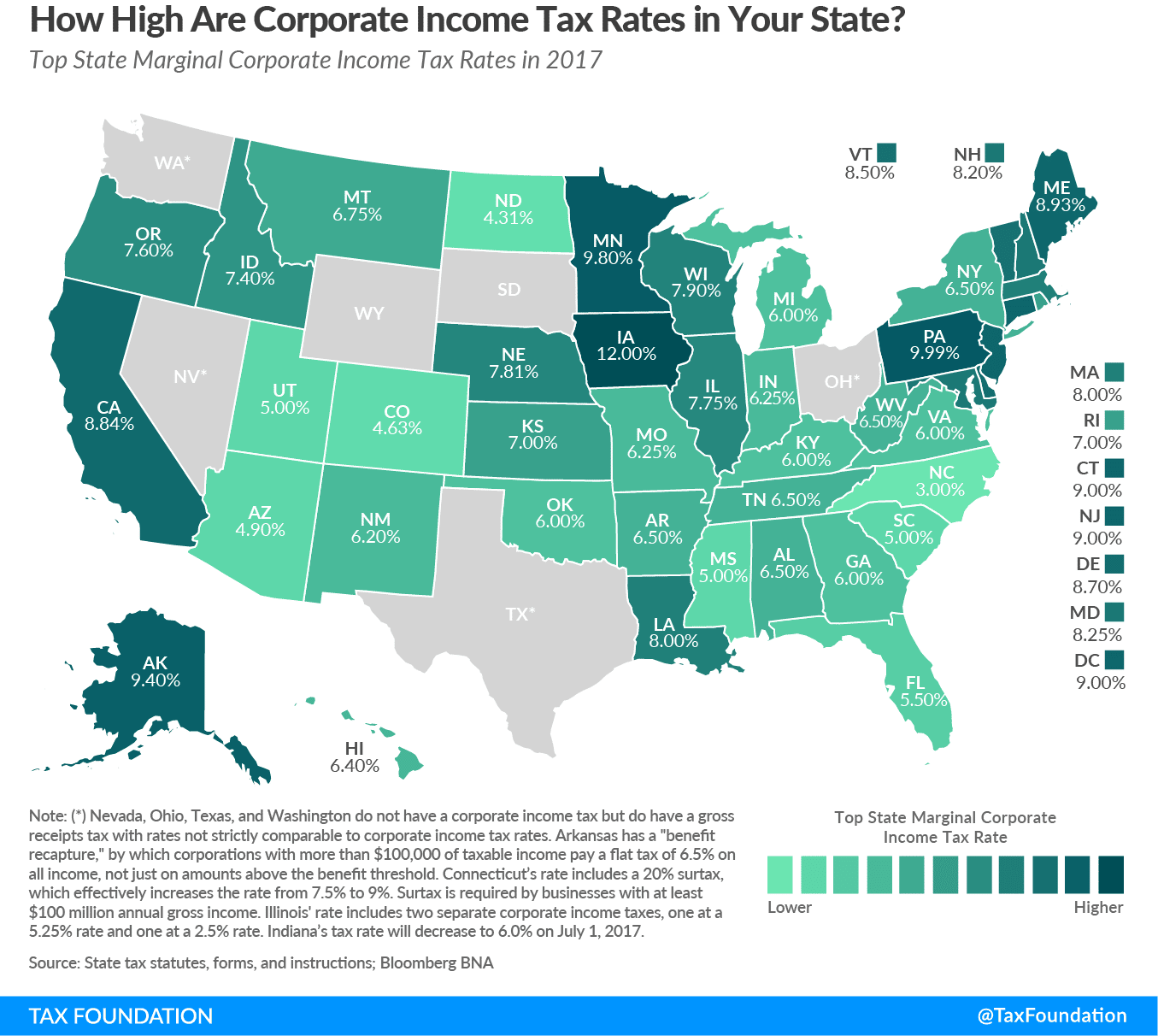

- Arizona:An individual income tax surcharge of 3.5% was put in effect for taxpayers with marginal income above $250,000 or $500,000 .

- Arkansas:Top rate dropped from 6.6% to 5.9%.

- Colorado:A permanent reduction of Colorados flat individual and corporate income tax rates changed it from 4.63% to 4.55%.

- Tennessee:The Hall Tax was completely phased out.

- New Mexico: The top marginal individual income tax rate was permanently increased from 4.9% to 5.9% with the addition of a new bracket.

- New York: In April 2021, New York’s highest tax rate changed with the passage of the 20212022 budget. The previous 8.82% rate was increased to three graduated rates of 9.65%, 10.3%, and 10.9%. All these rates apply to incomes over $2 million, with the highest rate of 10.90% applying to incomes over $25 million. In 2028, these rates are scheduled to revert to the pre-2021 rate.

How Your Hawaii Paycheck Works

Hawaii employers are responsible for withholding FICA taxes – 1.45% of your earnings for Medicare taxes and 6.2% for Social Security. Your employer will then match these amounts, so the total contributions are double what you get paid. Any earnings that exceed $200,000, are subject to an additional 0.9% in Medicare taxes, which your employer does not match. If you are self-employed you must pay the total 2.9% in Medicare taxes and 12.4% in Social Security yourself. Fortunately, there is a deduction available to help self-employed people recoup some of that money.

In addition to FICA taxes, federal income taxes are withheld from each of your paychecks and sent to the IRS. This money goes toward your annual income taxes. How much your employer withholds in federal income taxes depends on the information you provide on your W-4 form. You need to fill out a new W-4 every time you start a new job.

There are a few changes that the IRS made to the W-4 in recent years. Instead of asking you to list total allowances, the new W-4 uses a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income and jobs. Filers also have to enter annual dollar amounts for things like income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. These updates will primarily affect those adjusting their withholdings or switching jobs.

Recommended Reading: What Is Real Estate Tax

Personal And Real Property Taxes

Personal property, such as cars or boats, is not subject to property tax.

Real property, land and improvements are taxed with assessments at 100% fair market value. Tax rates are per $1,000 net assessed value.

Property taxes are administered by the counties of Honolulu, Hawaii, Maui and Kauai.

Exemptions are allowed for owner-occupied homes, with multiple exemptions based on age. Specific exemption amounts may vary by county. Check the website links above for jurisdiction details.

Where Do You Pay Income Tax For Out

You should always expect to file income taxes in the state where you live. If you cross state lines for your job, you may or may not have to file taxes in another state, too. Some states have agreements that allow workers to only file taxes where they live, regardless of where they work. Check with a tax professional to learn how state laws may apply to your situation.

Read Also: How Does Tax Write Off Work

How Do Hawaii Tax Brackets Work

Technically, you don’t have just one “tax bracket” – you pay all of the Hawaii marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your Hawaii tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the Hawaii tax brackets using this model:

| For earnings between $0.00 and $2,400.00, you’ll pay 1.4% |

| For earnings between $2,400.00 and $4,800.00, you’ll pay 3.2%plus $33.60 |

| For earnings between $4,800.00 and $9,600.00, you’ll pay 5.5%plus $110.40 |

| For earnings between $9,600.00 and $14,400.00, you’ll pay 6.4%plus $374.40 |

| For earnings between $14,400.00 and $19,200.00, you’ll pay 6.8%plus $681.60 |

| For earnings between $19,200.00 and $24,000.00, you’ll pay 7.2%plus $1,008.00 |

| For earnings between $24,000.00 and $36,000.00, you’ll pay 7.6%plus $1,353.60 |

| For earnings between $36,000.00 and $48,000.00, you’ll pay 7.9%plus $2,265.60 |

| For earnings between $48,000.00 and $150,000.00, you’ll pay 8.25%plus $3,213.60 |

| For earnings between $150,000.00 and $175,000.00, you’ll pay 9%plus $11,628.60 |

| For earnings between $175,000.00 and $200,000.00, you’ll pay 10%plus $13,878.60 |

| For earnings over $200,000.00, you’ll pay 11% plus $16,378.60 |

More Hawaii Payroll Tax Resources:

As if that wasnt enough, here are some helpful links that can if you would like to learn more about Hawaii payroll taxes:

Department of Taxation 222-3229 | Register Your Business | Withholding Tax

Department of Labor and Industrial Relations 586-8915 | Unemployment Insurance Express | Employer Website

LET’S DO THIS

Don’t Miss: California Llc First Year Tax Exemption

The Hawaii Income Tax

Hawaii collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Like the Federal Income Tax, Hawaii’s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Hawaii’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Hawaii’s %. You can learn more about how the Hawaii income tax compares to other states’ income taxes by visiting our map of income taxes by state.

Hawaii effectively doubles bracket widths for married couples filing jointly. Other states with this policy include AL, AZ, CT, ID, KS, LA, ME, NE, and OR.

There are -931 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

Hawaii Sales Tax Software

Whether your company is based in Hawaii or you simply do regular business there, you will need to keep track of all of your sales transactions that are subject to the GET in order to remain compliant and to keep your account in good standing with the state. This can be a challenge, particularly if you do business in multiple states, as the specific requirements for establishing nexus and determining what is and isnt taxable can vary a great deal from one state to another.

TaxTools can significantly ease that burden, however, thanks to the impressive array of features it provides to help you manage your GET tax payments and record-keeping. This suite of software can provide up-to-date reports complete with location information for all of your sales, and it makes filing your returns as easy as possible as well. It also integrates smoothly with all ecommerce platforms, so no matter how you reach your customers, TaxTools can help you keep your business running smoothly.

If youre ready to learn more about how TaxTools can streamline your tax tracking and reporting processes, both in Hawaii and elsewhere, for a free trial today.

Don’t Miss: How To File Back Taxes Without Records

How Do Tax Brackets Work

Say you’re a single person with $50,000 of taxable income. Using the charts above, you would be in the 22% federal tax bracket and the 8.25% Hawaii state tax bracket. In this example, you are referencing your marginal tax rate. Marginal tax rates refer to the highest tax bracket your income falls into.

However, because we have a progressive tax system, this doesn’t mean that all of your income is taxed at 22% at the federal level and 8.25% at the state level. When you move into a higher tax bracket, only the income that falls into that higher bracket is taxed at a higher rate.

Returning to the example above, if you have taxable income of $50,000, on your federal return you’ll pay a 10% tax rate on the first $9,950 of income, 12% tax rate on the next $30,575 of income, and 22% tax rate on the last $9,475 of income. This is your effective tax rate

To look at it another way, let’s do the math:

10% x $9,950 = $995

22% x $9,475 = $2,084.50

Total taxes you owe = $6,748.50

While your marginal tax rate is 22%, your effective tax rate is roughly 14% .

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: Free Tax Filing H& r Block

How Does The Federal Estate Tax Work

In theory, the federal state tax is pretty easy to understand. But the details can be very confusing and challenging when put into practice.

When a person passes away, the executor must summarize all of the decedents assets. An evaluation must be completed on farms, real estate and other collectibles. Stocks, bonds and investment accounts will typically have fair value custodian statements.

Once assets are determined, the executor should summarize all the liabilities of the person who passed away. This would include mortgages, credit cards, medical bills, and any other estate liabilities.

The estate can then be reduced for miscellaneous costs to administer the estate, legal and accounting fees, and funeral related costs.

While less than half of 1% of Americans will be assessed and estate tax, the rate is as high as 40%. So even if your assets are well below the exemption level, they may increase overtime and you may find that you have a significant estate tax problem.

How You Can Affect Your Hawaii Paycheck

Hawaii Free Press” alt=”To What Extent Does Your State Rely on Property Taxes? > Hawaii Free Press”>

Hawaii Free Press” alt=”To What Extent Does Your State Rely on Property Taxes? > Hawaii Free Press”> If you consistently find yourself paying a lot in taxes come April, you can ask your employer to withhold a dollar amount from each of your paychecks to right-size your withholding. If you are paying a lot in taxes, you may also want to consider upping your contribution to retirement accounts like a 401 where your money can grow tax-free. Not only will you be saving more for retirement, but since this money comes out of your paycheck before taxes are withheld, you can actually lower your taxable income and, if youre lucky, decrease how much you owe in taxes.

Conversely, if you tend to get a huge tax refund, you may want to adjust your withholding in the other direction. Some may consider a big tax refund a good thing, but others might argue you could have used that money to do other things throughout the year. Its worth decreasing your dollar withholdings on your W-4 form if you pay too much in taxes throughout the year.

Also Check: Free H& r Block Tax