What Happens When You Get Montgomery County Delinquent Property Taxes

As a resident of Montgomery County, delinquent property taxes can impact your annual statement if you fail to pay your tax bill by the deadline. At first, these tax penalty fees will begin at 7% of your total tax bill for the month of February and increase as the months go on. Whether you own a commercial or residential property, these percentages can go up 15% by June 30th. If you still havent paid by July 1st, you will also be required to pay an additional 15 to 20% collection fee.

Montgomery County Property Records Search Links

The Montgomery County Property Records Search links below open in a new window and take you to third party websites that provide access to Montgomery County public records. Editors frequently monitor and verify these resources on a routine basis.

Help others by sharing and reporting broken links.

City of Conroe City Mapshttp://www.cityofconroe.org/departments/geographic-information-system-gis-/interactive-mapsView City of Conroe interactive maps, including crime, city and water well monitoring maps.

Montgomery Central Appraisal District Websitehttp://mcad-tx.org/View Montgomery Central Appraisal District’s general information page, including contact information and news updates.

Montgomery County Assessment Rollshttps://actweb.acttax.com/act_webdev/montgomery/index.jspSearch Montgomery County property assessments by tax roll, parcel number, property owner, address, and taxable value.

Montgomery County Assessor’s Websitehttps://www.mctx.org/departments/departments_q_-_z/tax_office/index.htmlVisit the Montgomery County Assessor’s website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records.

Montgomery County Building Permitshttps://www.mctx.org/departments/departments_d_-_f/environmental_health/permitting/index.phpView Montgomery County, Texas building permit information, including filing applications, making amendments, renewals, approval status, and inspections.

Montgomery County Homestead Exemption

For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The Montgomery County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes.

Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Montgomery County property taxes or other types of other debt.

In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. To get a copy of the Montgomery County Homestead Exemption Application, call the Montgomery County Assessor’s Office and ask for details on the homestead exemption program. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space.

Recommended Reading: How Much Will I Get Paid After Taxes

Navigate Interactive Gis Map & Plat Search For Montgomery County Tx

Property GIS Maps are displayed on property detail pages in Montgomery County, TX for all registered members .

TaxNetUSA members with a Montgomery County, TX Pro subscription also have access to the Interactive GIS Map,which allows Pro members to map search results, select properties using easy drawing tools, download selected parcels as a , and print mailing labels. *

Montgomery County Property Tax Appeal

Montgomery County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Montgomery County Property Tax Assessor. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value.

As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Montgomery County Tax Assessor’s office is incorrect. To appeal the Montgomery County property tax, you must contact the Montgomery County Tax Assessor’s Office.

Are You Paying Too Much Property Tax?

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year.

We can check your property’s current assessment against similar properties in Montgomery County and tell you if you’ve been overassessed. If you have been overassessed, we can help you submit a tax appeal.

Is your Montgomery County property overassessed?

You will be provided with a property tax appeal form, on which you will provide the tax assessor’s current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate.

Has this page helped you? Let us know!

Recommended Reading: Lovetothe Rescue.org/tax-receipt

When Are Montgomery County Property Taxes Due

Once you receive your tax bill for your Montgomery County property taxes, you will need to pay it off by January 31st of the following year. This is the official deadline for when Texas property taxes are due, regardless of whether you live in Travis, Mitchell or Montgomery County. Delinquent property taxes will be issued to your account if you miss this deadline and will stay active until paid in full.

What Happens If You Dont Pay Your Montgomery County Tx Property Tax

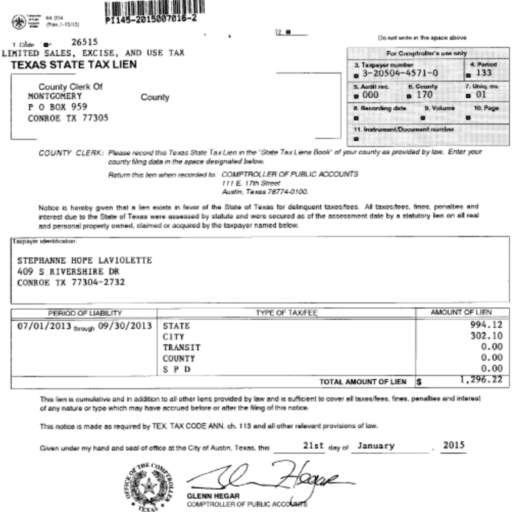

Not only will you receive a steep collection fee on top of the accrued interest from your Montgomery County delinquent property taxes, but you may receive a tax lien which allows the bank to foreclose on your property. You can prevent the foreclosure by taking care of this debt immediately, but the bank can auction off your tax deed if you ultimately default on your payment.

You May Like: Tax Loopholes For Small Business

Montgomery County Tax Office

County tax assessor-collector offices provide most vehicle title and registration services, including:

- Registration Renewals

- Vehicle Title Transfers

- Change of Address on Motor Vehicle Records

- Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates

- Disabled Parking Placards

- Copies of Registration Receipts

- Temporary Registration

Many counties allow you to renew your vehicle registration and change your address online. Some counties allow renewals at substations or subcontractors, such as participating grocery stores. Acceptable forms of payment vary by county.

Other locations may be available. Please contact your county tax office, or visit their Web site, to find the office closest to you.

This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

Please CHECK COUNTY OFFICE availability prior to planning travel.

Montgomery County Assessor’s Office Services

There are three major roles involved in administering property taxes – Tax Assessor, Property Appraiser, and Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office. For example, the Montgomery County Tax Assessor may also serve as the Montgomery County Tax Appraiser.

When contacting Montgomery County about your property taxes, make sure that you are contacting the correct office. You can call the Montgomery County Tax Assessor’s Office for assistance at 936-539-7897. Remember to have your property’s Tax ID Number or Parcel Number available when you call!

Please before you send documents or if you need to schedule a meeting.If you have general questions, you can call the Montgomery County Courthouse at 936-539-7812.

Also Check: What Can I Write Off On My Taxes

Property Tax Protection Program Benefits

- No flat fees or upfront costs. No cost ever unless your property taxes are reduced.

- All practical efforts are made every year to reduce your property taxes.

- Never miss another appeal deadline.

- Property taxes protested for you annually.

- You do not have to accept the appraisal district’s initial guesstimate of value.

- We coordinate with you regarding building size / condition to avoid excess taxes.

- Free support regarding homestead exemptions.

- Some years are good – typically 6 to 7 out of 10 will result in tax reduction for you.

- The other 3 to 4 years out of 10 we strike out. Most often due to people issues in the hearing process. Some years we get an easy appraiser at the informal some years someone who is impossible to settle with.

Modal title

Montgomery County Property Tax Rate

Contents

Because Montgomery County uses a complicated formula to determine the property tax owed on any individual property, it’s not possible to condense it to a simple tax rate, like you could with an income or sales tax.

Instead, we provide property tax information based on the statistical median of all taxable properties in Montgomery County. The median property tax amount is based on the median Montgomery County property value of $157,100. You can use these numbers as a reliable benchmark for comparing Montgomery County’s property taxes with property taxes in other areas.

Our data allows you to compare Montgomery County’s property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Montgomery County median household income.

While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Montgomery County property tax estimator tool to estimate your yearly property tax. Our property tax estimates are based on the median property tax levied on similar houses in the Montgomery County area.

Property taxes are managed on a county level by the local tax assessor’s office. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact theMontgomery County Tax Assessor .

Don’t Miss: How To Apply For An Extension On Taxes

How The System Works

The following material has been adapted from the Taxpayers Right, Remedies and Responsibilities pamphlet published by the State Comptroller of Public Accounts, and various publications issued by Montgomery Central Appraisal District.

The Basics

Property taxes are local taxes. Local officials value your property, set your tax rates, and collect your taxes. However, Texas law governs how the process work.

In Montgomery County, property taxes are based on tax rates set by the various local governments , which levy a tax, and on the value of the property. The valuation or appraisal process, which is performed by the Montgomery Central Appraisal District, serves to allocate the tax burden among property owners.

The property tax provides more tax dollars for local government services in Texas than any other source. Property taxes help pay for public schools, city streets, county roads, police, fire protection, and may other services.

The System

There are three main parts to the property tax system in Texas:

The system has four phases:

Frequently Asked Questions

Welcome To The Montgomery County Assessors Office Web Site

Montgomery County Tax Assessors Office303 South Richardson St.

Notice to Montgomery County Property Owners and Occupants.

In accordance with O.C.G.A 48-5-264.1 please be advised that the Montgomery County Appraisal Staff may be visiting your property. The purpose of the visit could be related to any of the following reasons:

The appraiser may need to take photos while visiting your property. The appraiser or data collector will have photo identification and will be driving a marked county vehicle. If you should have any questions regarding the appraisal staff visiting your property please feel free to contact the assessor’s office at 912-583-4131.

Office hours are Monday through Friday 8:30 to 4:30.

The regular meeting of the Board of Assessors will be changed to the 3rd Thursday of each month at 4:00 p.m.

The goal of the Montgomery County Assessors Office is to provide the people of Montgomery County with a web site that is easy to use. You can search our site for a wealth of information on any property in Montgomery County.

Read Also: When Are Tax Returns Sent Out

How To Save Money On Homeowners And Car Insurance In Texas

DallasJerrycar and home insurancelicensed insurance broker#1 rated insurance app45 seconds

âI usually hate all the phone calls that come with getting car insurance quotes, but with Jerry I was able to do everything over text. I went from $224 with my previous provider to $193 with Nationwide. Such a relief!â âGabby P.

Thousands of customers saved on average $887/year on their car insurance with Jerry

What Is The Montgomery County Property Tax

Proceeds from the Montgomery County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.

Unlike other taxes which are restricted to an individual, the Montgomery County Property Tax is levied directly on the property. Unpaid property tax can lead to a property tax lien, which remains attached to the property’s title and is the responsibility of the current owner of the property. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. Property tax delinquency can result in additional fees and interest, which are also attached to the property title.

In cases of extreme property tax delinquency, the Montgomery County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. Proceeds of the sale first go to pay the property’s tax lien, and additional proceeds may be remitted to the original owner.

Recommended Reading: How Much Is Inheritance Taxes

Montgomery County Property Tax Deduction

You can usually deduct 100% of your Montgomery County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. Texas may also let you deduct some or all of your Montgomery County property taxes on your Texas income tax return.

Has this page helped you? Let us know!

Montgomery County Property Tax Assessor

The Montgomery County Tax Assessor is responsible for assessing the fair market value of properties within Montgomery County and determining the property tax rate that will apply. The Tax Assessor’s office can also provide property tax history or property tax records for a property. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal.

Most county assessors’ offices are located in or near the county courthouse or the local county administration building. You can look up the Montgomery County Assessor’s contact information here .

You May Like: How Much In Taxes Do I Owe

Montgomery County Approves Proposed 2022 Tax Rate Exceeding No

3:55 PM Aug 9, 2022 CDTUpdated3:55 PM Aug 9, 2022 CDT

To fund its 2022-23 budget, Montgomery County commissioners approved a proposed property tax rate of $.3764 per $100 of taxable property, but as the rate exceeds the effective rate, a public hearing is scheduled on Aug. 26.

Law enforcement staffing, salary costsA history of lowering tax ratesCommunity Impact Newspaper

Access Montgomery County Appraisal Data

Members can search Montgomery County, TX certified property tax appraisal roll data by Owner Name, Street Address, or Property ID. TaxNetUSA members with a Montgomery County, TX Pro subscription can search appraisal data by Year Built, Square Footage, Deed Date, Value Range, Property Type, and many more advanced search criteria. All members have the ability to *.

Appraisal Data for Montgomery County is up to date as of . Custom bulk data is available. Please contact us for a quote.

Recommended Reading: Is Auto Insurance Tax Deductible

Find Montgomery County Property Records

Montgomery County Property Records are real estate documents that contain information related to real property in Montgomery County, Texas. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. They are maintained by various government offices in Montgomery County, Texas State, and at the Federal level. They are a valuable tool for the real estate industry, offering both buyers and sellers detailed information about properties, parcels and their owners.

Learn about Property Records, including:

- Where to get free Montgomery County Property Records online

- How to search for property titles and deeds

- What property information is available for Montgomery County, TX records searches

- Where to find Montgomery County Clerk, Tax Assessor & Recorder of Deeds records

Which Local Taxing Units May Tax My Property In Texas

All taxable property will pay county and school taxes. If the property is located inside a citys boundaries, you also may pay city taxes. Special taxing units-junior college, hospital district, road district and others-may also tax your property.

- Contact Information

- 109 Gladstell Conroe, Texas 77305

- Monday – Friday 8am-5pm

Recommended Reading: Irs Tax Return Amendment Status

How Are Property Taxes Handled At Closing In Montgomery County

Property taxes are routinely prepaid for an entire year of ownership. Who pays property taxes at closing when it happens during the tax year? When buying a house, at closing, homeownership switches from sellers to purchasers. At the same time, liability for the tax switches with that ownership transfer. They repay the former owners at the point ownership is transferred.

Customarily those prorated reimbursements arent direct payments made straight-through to former owners. Instead, tax repayments will be part of all other responsibilities of the buyer on final settlement.