Who Can Claim The Car & Mileage Tax Deduction

Fortunately, the driver tax deduction is not limited to Uber, Doordash or rideshare drivers. If you work primarily from a home office, the occasional supply run, client meeting or business trip also counts. The IRS considers your business driving mileage to be deductible from your taxable income. You don’t have to drive year-round, either. If you happen to drive for office work only during the summer, you can write off car expenses during those months.

You can’t deduct the cost of commuting as a business expense. The IRS does not consider “commuting miles” as a business expense, so moving to and fro from your home and your workplace does not count. However, running a business errand is considered a valid expense.

Pen And Paper Vs Mileage Tracker App & Web Dashboard

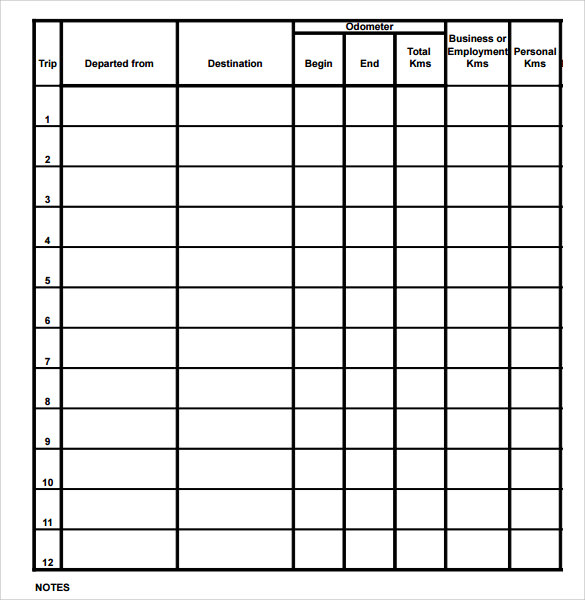

There are several ways to keep track of your business miles: You can create a mileage log on paper, on Google / Excel Sheet, a printable Mileage Log Template or you can use a Mileage Tracker App on your phone sometimes accompanied by a Web Dashboard.

However, backtracking your business miles to reconstruct your mileage log on paper, especially retrospectively can be extremely difficult. There are countless fixed data and circumstances you have to keep in mind and put into your mileage log very precisely. It is a cheap solution, but at the end of the day, you will certainly ask yourself: Is it worth it?

Even mileage trackers with GPS technology are inexact sometimes because they can only track real-time driving, they cannot be used for reconstructing or creating logs retrospectively.

How To Calculate Standard Mileage Rate

The standard mileage rate is one tax deduction method you can use. If you use this method, you can claim a standard amount per mile driven.

The standard mileage rate is easier to use than the actual expense method. Rather than determining each of your actual costs, you use the IRS standard mileage deduction rate.

Calculating mileage for taxes using the standard method is a three-step process:

Determine if you can use the standard mileage rate

Not all business owners can use the standard mileage method. First, you must own or lease the car you put business miles on.

If you own the car and want to use the standard mileage rate, you must choose this method during the first year you put business miles on it. You can opt for the actual expense method later.

If you lease the car and select the standard mileage rate, you must use this method during the entire lease period.

According to the IRS, you cannot use the standard mileage rate if you do any of the following:

- Operate five or more cars at the same time

- Claim a depreciation deduction for the car using any method other than straight-line

- Claim the Section 179 deduction on the car

- Claim the special depreciation allowance on the car

- Claim actual expenses after 1997 for a car you lease

- Are a rural mail carrier who received a qualified reimbursement

Know the mileage deduction rate

You May Like: How To Apply For An Extension On Taxes

Types Of Mileage Reimbursement: Fixed Vs Variable Rates

How much to reimburse for mileage varies depending on whether your car is driven at a fixed or variable rate.

A fixed rate allows a motorist to calculate their mileage based on the miles they drive. A “variable rate” calculates mileage based on factors such as fuel efficiency, driving time, and vehicle location, but it has a lower reimbursement amount than a fixed rate allowance.

A fixed rate is more common, with the Internal Revenue Service allowing a taxpayer to deduct either actual vehicle expense or a specified rate based on the IRS standard mileage rate.

Why Is Employee Mileage Reimbursement Important

Under certain state in USA , it is a legal requirements mandates employers to reimburse their employees for all business related travel & tour expenses using their personal vehicle. Under Federal Law as well , because not reimbursing the mileage expenditure , many employers may face lawsuits and associated penalties for not paying the minimum wage, government encourage them to reimburse expense that an employee incurred for . There are multiple ways to reimburse your employees for using their personal vehicles, and they all use the IRS standard mileage rate as a basis for payment. Before diving deep into the different reimbursement methods, heres everything you need to know about the IRS standard mileage rate.

Don’t Miss: What States Do Not Have Sales Taxes

Choose A Method: Standard Or Actual

The IRS allows freelancers, gig workers like Uber or Lyft rideshare drivers, and the self-employed to deduct their business mileage in one of two ways. Thereâs the standard mileage rate method, and the actual expenses method.

Let’s dive into tracking your mileage vs taking your actual expenses.

How Commuting Miles Work With A Home Office

Now you’re probably thinking, “What if my place of work is a home office?”

If we followed the IRS rules in this instance, then your commute from the bed to the laptop would be your first trip to work. And then, your first trip of the day â to McDonald’s for the 20-nugget combo â would count as a business trip, right?

Wrong â even if Ronald McDonald himself is one of your clients. If you’re a home-based independent contractor, then applying the rules as they are to you would be unfair to people who work out of separate business offices. After all, they don’t get a mileage reimbursement when they leave home.

That’s why, if your primary place of work is your home office, your first and last trips of the day count as commuting mileage. So if you want to get some business mileage out of a trip from home, go to a temporary work location first â like a client meeting site. Then you can go grab some nuggets with Szechuan sauce.

Don’t Miss: Is Credit Card Interest Tax Deductible

Can I Take A Mileage Deduction If I Get A Mileage Reimbursement

No. The new tax laws removed deductions for unreimbursed business expenses like mileage.

Are mileage reimbursements taxable?

While there is no standard mileage reimbursement program across the country, it is a common practice in many industries to compensate employees for traveling from home to work.

The Internal Revenue Service states: “Under current law, a taxpayer generally will not be required to include in income any reimbursements or payments by an employer to an employee for qualifying expenses incurred in the course of employment, unless the reimbursements or payments are excludable from gross income under another provision of the Code, such as section 122. If the reimbursements or payments qualify as a working condition fringe benefit, they are excludable from income and the employer can deduct them as a business expense.”

How To Log Mileage For Taxes In 8 Easy Steps

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If driving is an essential part of your job, you may be qualified to deduct the costs on your federal income tax return. So if you’re a financial planner on the go who visits clients across the city, you can deduct the mileage that you accumulate while you’re driving on the job. You can also use the deduction for medical purposes, if you’re an active member of the military, or while working with charitable organizations.

The rules are set by the Internal Revenue Service , which adjusts the deductible mileage rate for inflation each year. So if you qualify, get ready to document your travels as supporting evidence in the event your taxes are audited.

We’ve listed eight easy steps in this article that you can follow if you want to claim this tax deduction.

Recommended Reading: Texas Property Tax Increase 2021

What’s The Best Way To Track Business Mileage

Many people arenât sure of the best way to track business mileage. Business owners often find it difficult to account for the miles driven for their business and car owners who use their car for work often may not be able to document their mileage accurately due to lack of time, leaving thousands of dollars on the table.

The best way to track business mileage is to always keep a record of your driving in some way. However, this should be done in a way that is easy to maintain, so that it is not a hassle. It is also important to understand what type of mileage tracking you would like to use. In general terms, there are three types:

1) Computerized 2) Manual 3) Paper

The best option is to document your mileage via an app like MileIQ. When you add the MileIQ appto your phone, you can automatically track your mileage wherever you go. The app runs seamlessly in the background, making it easy and efficient to use. Plus, with a one-swipe verification, you can easily classify your drives from the app dashboard. This app creates accurate reports you can rely on for all your mileage tracking needs.

The Actual Expenses Method

As the name suggests, the actual expenses method requires you to add up all the money actually spent in the operation of your vehicle. You then multiply this figure by the percentage of the vehicles business use.

- For example, if half the miles you drive are for business and half are for personal use, you will multiply your total vehicle expenses by 50% to arrive at the business portion .

Some of the costs you can include in your actual expenses are:

- New tire purchases

- Title, licensing, and registration fees

- Vehicle depreciation

TurboTax Tip: Compute your mileage deduction using each method and then choose the method that yields that larger deduction.

You May Like: Why Am I Paying Medicare Tax

Types Of Transportation That Qualify For Self

There’s no upper limit to how many miles you can claim a deduction for as long as you drive them for business. There are a few more things to consider though, and we’ve compiled a brief list.

Types of transportation that are considered business:

- Driving between two different places of work

- Driving from your home to a temporary place of work

- Meeting clients and going on customer visits

- Running business-related errands

Types of transportation that are NOT considered business:

- Commuting from your home to your permanent place of work

- Carrying tools does not make a commute a business trip

- Displaying advertising on a car does not make driving it a business trip

For cases in which you have no place of work, where your home qualifies as your place of work, carpooling, and more, check out the IRS’s own publication on transportation.

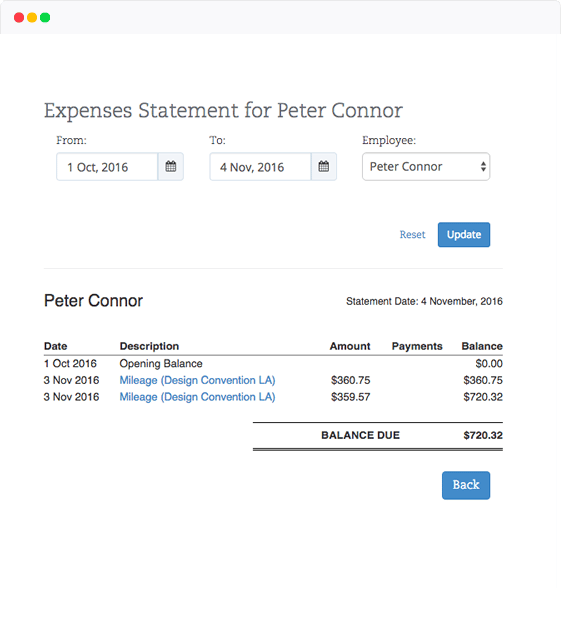

How Do Companies Calculate Mileage Reimbursements

Companies typically use a car allowance or per-mile reimbursement. An allowance is a set fee per month for employees. The reimbursement involves paying an agreed-upon fee per mile. For mileage reimbursements, many businesses still rely on manual mileage logs. That means employees write down their mileage, input it in spreadsheet forms, then include that information during their monthly expense report. This process is ripe for mileage inflation and inefficiencies. Modern companies are leaning toward solutions like MileIQ for Teams. This service app automatically tracks and logs employee mileage, while also providing seamless reporting.

Read Also: What Is The Federal Tax On Gasoline

Calculating Your Reimbursement When Using Your Vehicle For Both Business And Personal Use

If you use your vehicle for both business and personal use, it will be important to differentiate the mileage accumulated. This makes it easier to know what to claim for depreciation and other costs related to operating your vehicle.

Lets say that youve driven your car 300 miles for personal reasons within a given period. Within that same time frame, lets say you also drove a total of 100 miles for business purposes using the same vehicle. In this example, you have driven for 400 total miles.

What Qualifies As Business Mileage

First things first. âCommutingâ doesn’t qualify as business miles.

Say you have an office, shop, or other location where you normally conduct your business. In that case, driving from your home to that location is considered commuting and isn’t deductible. It’s no different than if you were a W-2 worker and commuted to an office each day.

Some freelancers have tried to think of workarounds to turn those commuting miles into actual business miles â say, by making business calls while driving.

Unfortunately, that won’t cut it with the IRS. In their eyes, the commuting rule is black and white.â

However, if your office is in your home, then any miles you drive to visit clients or customers does count as business mileage.

Hereâs a cheatsheet to help you figure out whether your miles count:

You May Like: Small Business Income Tax Calculator

Determine Your Method Of Calculation

You can choose between two methods of accounting for the mileage deduction amount. The first is the standard mileage deduction, which requires you to track how much you drive during the tax year. If you’re not inclined to do that, you may want to claim deductions for vehicle expenses during the course of running qualified activities.

The standard mileage deduction requires only that you maintain a log of qualifying mileage driven. The deduction for the 2022 tax year is:

- For business: 58.5 cents per mile, up 2.5 cents from 2021

- For medical or moving for qualified active-duty Armed Forces members: 18 cents per mile, up two cents from 2021

- For charitable organization services: 14 cents per mile, which remains the same for 2021

The deduction for vehicle expenses requires that you retain all receipts and other relevant documentation relating to the costs of driving.

If you choose to take the deduction for vehicle expenses, you can factor in depreciation, lease payments, registration expenses, oil and gas, repairs, tires, tolls, parking, insurance, and any other costs that are directly related to your vehicle. Remember, you can only claim these expenses if you qualify.

What Is Mileage Reimbursement

Mileage reimbursement is a tax deduction offered to employees who use their own vehicles for work-related travel. If you are reimbursed for mileage, you can reduce the amount of income taxes you owe on your salary.

Reimbursement for company mileage is an often misunderstood tax deduction. Whether you are a business owner or just a regular employee, you can deduct your expenses by using your own vehicle for work-related travel.

Recommended Reading: Your Tax Return Is Still Being Processed 2022

Records You Need To Keep For Self

In order to claim mileage deductions for self-employed, you must keep adequate and timely records of your mileage as proof. You must also keep all records and receipts for at least 3 years from the date you file your tax return. Read below to find out the records you need to keep according to the mileage deduction method you choose.

If You Use The Standard Mileage Rate Method

You must keep a timely log of your business mileage. The log should contain details of each business trip, including the date, mileage, destination and purpose of the trip. You should also log your total mileage for the year.

Keep in mind that if you use a vehicle for both business and personal use, you must record all mileage in order to work out the business use of the vehicle.

Also Check: Pay Federal Estimated Tax Online

How To Track Your Miles

If you drive a lot and decide that the standard mileage method is best for you, you’ll have to track how many business miles you drive every year.

This is most commonly done with a mileage tracking app, or by keeping a mileage log and consulting your car’s odometer.

Combine this with Keeper to track any other deductible expenses, like tolls, parking fees, and car washes. Then you’ll be prepared to take the biggest possible tax deduction on your business miles.

Robby Nelson, CPA

When not hanging out with his high profile friends like Gandhi or Batman, Robby enjoys spending time with his wife and children. He can sneeze with his eyes open, has won two lifetime achievement awards, and has visited every country three of which haven’t been discovered yet. He is also a Certified Public Accountant and assists clients with a wide variety of accounting and tax issues.

Find write-offs.

Where Can I Find The Official Irs Standard Mileage Rate For 2022

Notice 2021-02 PDF, should be referred. It contains the optional 2021 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate plan.

For the the year 2022click IRS standard mileage rateExcerpt is below .

Beginning on January 1, 2022, the standard mileage rates for the use of a car will be:

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021,

18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and

14 cents per mile driven in service of charitable organizations the rate is set by statute and remains unchanged from 2021.

Also Check: How Much Is Bonus Tax

Who Can Claim The Irs Standard Mileage Rate

You may not use the standard mileage rate if you.

Operate your business as a corporation and claim the vehicle as a corporate expense

Use the vehicle for hire, as in the case of a taxicab

Use five or more vehicles at the same time in your business

Claim a depreciation deduction on the vehicle using any method other than straight line

Claim section 179 expensing on any part of the vehicle, or

Claim actual expenses on a leased vehicle.

Example. Alternating Five Vehicles