Learn What Tax Deductibles Youre Eligible For

Limited Liability Companies can benefit from a variety of incentives and tax deductions that allow owners to save money. These are some of the most common tax deductions among LLCs:

- Donations to charity. LLCs can deduct donations made to charitable organizations, up to 10 percent of their income.

- Home Office. If your LLC operates from your own home, you can deduct utilities, your telephone bill, mortgage interest, real estate taxes, and rent, among other costs, as long as you meet certain conditions. For example, the home office should be used regularly and exclusively for business purposes, as well as to store inventory or products. The amount of the deduction depends on the percentage of space in the house used by the LLC.

- Mileage. This type of business can deduct the cost of the mileage covered for business purposes. The mileage does not include commuting from home to the workplace.

- Education. An LLC can deduct expenses on the education of its employees. These costs may include tuition, equipment, supplies, and books. These expenses can not exceed $5,250.

- Ordinary and necessary expenses. They are expenses related to the business. The list is long, but most common expenses are the following: transportation, consulting services, accounting, attorneys fees, office supplies, repairs, financial services, payroll, travel, and entertainment, among others.

Get here a complete list with the most common tax deductibles for small businesses.

What Is The Penalty For Filing Llc Taxes Late

LLCs taxed as partnerships that file Form 1065 after the return filing deadline are charged $210 per partner for each month or part of a month that the return was late, including any extension periods. The maximum length of penalties is 12 months.

For example, if the partnership has 3 partners and the return is filed 4 months late, the penalty would be $2,520.

How Llc’s Pay State Income Tax

Each state has a different way of classifying LLCs for state income tax purposes. After you have figured out your LLC’s tax status, you can go to your state’s department of revenue to find out how your state might be taxed.

You will need to look at two factors:

- What is the tax based on? Most states use the federal income tax liability as a basis, but states modify that basis for their state tax.

- How does the LLC’s tax classification affect the state income tax?

Some states call their income tax a franchise tax. Other states may charge LLCs a gross receipts tax rather than an income tax.

Also Check: How To Add Sales Tax On Square

Estimate Your Federal Self

In most cases, LLC owners are subject to paying federal self-employment taxes, which cover your FICA and Medicare contributions.

If you plan on drawing a salary from your LLC , youll have to pay self-employment taxes on this income.

However, owners who are not active in the LLC those who have merely invested money but dont provide services or make management decisions for the LLC may be exempt from paying self-employment taxes on their share of the profits.

2021, the social security tax rate is 6.2% for wages with a maximum wage of $142,800. Federal Unemployment tax is paid directly by the employer and uses only the employers funds .

These rates vary depending on how much the employee makes. Not all employers are subject to FUTA. Please consult with a tax professional or payroll provider for additional information.

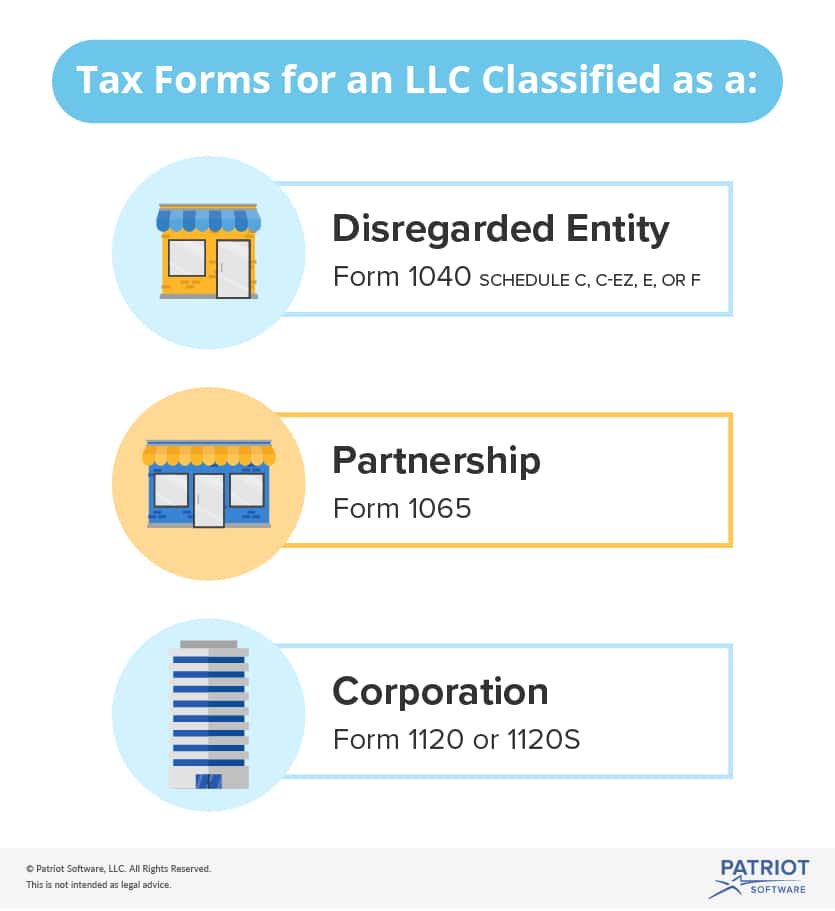

How Is A Limited Liability Company Taxed

For tax purposes, by default, an LLC with one member is disregarded as an entity. Or, in other words, is treated as a sole proprietorship. By default, LLCs with more than one member are treated as partnerships and taxed under Subchapter K of the Internal Revenue Code.

However, an LLC can elect to be treated as an association taxable as a corporation by filing Form 8832, Entity Classification Election. If so, the LLC will be taxed under Subchapter C of the Code. And, once it has elected to be taxed as a corporation, an LLC can file a Form 2553, Election by a Small Business Corporation, to elect tax treatment as an S corporation.

You May Like: When Is Tax Returns Due

Be Aware Of The Deadlines For Filing Taxes As An Llc

LLCs must pay their taxes quarterly. The deadline to file taxes depends on the tax classification of the business:

- One single-member LLCs. They must submit Schedule C before April 15th.

- Partnerships. They must submit Form 1065 and Schedule K-1 for each member before March 15th.

- S Corporations. March 15th.

Llcs Classified As S Corporations

LLCs that are designated as S corporations must file an informational return by March 15. An S corporation LLC is a pass-through entity, similar to a disregarded entity or partnership, and doesnt pay its own taxes.

You can get money from your LLC S corporation as both an employee and owner. As an employee, youll get paid via payroll . Youll get a W-2 for this portion of your income.

LLC S corporations also have to pass their profits on to shareholders each year via distributions. As an owner, youll receive a K-1 for your portion of the profits. Unlike with a partnership, you dont have to pay self-employment tax on the distributions, but youll still have to include them on your personal tax return and pay income tax on the money.

Also Check: Look Up State Tax Id Number

Do Llc Members Pay Self

LLC members are not employees so no contributions to the Social Security and Medicare systems are withheld from their paychecks. Instead, most LLC members are required to pay these taxes — called “self-employment taxes” when paid by a business owner — directly to the IRS.

The current rule is that any owner who works in or helps manage the business must pay this tax on his or her distributive share . However, owners who are not active in the LLC — that is, those who have merely invested money but don’t provide services or make management decisions for the LLC — may be exempt from paying self-employment taxes on their share of profits. The regulations in this area are a bit complicated, but if you actively manage or work in your LLC, you can expect to pay self-employment tax on all LLC profits allocated to you.

Each member who is subject to the self-employment tax reports the amount due on Schedule SE, which must be submitted annually with his or her tax return. LLC owners pay twice as much self-employment tax as regular employees, because regular employees’ contributions to the self-employment tax are matched by their employers. However, LLC members also get to deduct half of the total amount from their taxable income, which saves a few tax dollars.

As of 2022, the self-employment tax rate for business owners is 15.3%, which consists of the following:

Llc Taxes In Texas: Everything You Need To Know

LLC taxes in Texas are, like most of the rest of the laws governing business in the state, very favorable to companies that do business there. 3 min read

LLC taxes in Texas are, like most of the rest of the laws governing business in the state, very favorable to companies that do business there. LLCs, or limited liability companies, are legal entities that are filed at the state level with special protections when it comes to liability. This leads to significant differences between LLCs founded in Texas and in any other state. Depending on the kind of business you are starting, Texas may just be the perfect place.

Read Also: How To File An Extension Taxes

Quarterly Payroll Taxes For Employers

If you employ one or more people in your business, you should file Form 941, Employers Quarterly Federal Tax Return. Then deposit your taxes on the following dates:

- for first quarter

- for third quarter

- for fourth quarter of the previous calendar year

The IRS gives you an additional 10 calendar days to file your return if you deposit all your taxes before they are due.

How Can I Lower My Llc Taxes

As a member of an LLC, you can lower your taxes in two ways.

First, you can increase your expenses and claim more tax deductions to lower the amount of profit that will flow through to your individual tax return. Or you can try an alternative tax planning strategy elect S-Corporation status and pay payroll taxes on distributed income.

Recommended Reading: Annual Income After Taxes Calculator

How To File Llc Taxes

If your business is organized as an LLC, it may be taxed as a sole proprietorship, a partnership, or a corporation, and you may be responsible for self-employment taxes in addition to federal and state income tax.

From a tax standpoint, limited liability companies are like hermit crabs. With no tax classification of their own, they inhabit the tax homes of other types of businesses, and they can choose and change the way they are taxed.

This tax flexibility is one of the things that make LLCs so appealing for small business owners. But if youre just starting out, the LLC tax filing process can seem confusing.

LLCs can choose to be taxed like sole proprietorships, partnerships or corporations. Its important to understand the differences between them because the way your business is taxed can affect both your total tax bill and your obligation to pay self-employment tax.

Llc Tax Requirements For Filing As An Llc Corporation

Once you have made a corporate tax election, you will treat your business as a separate taxpayer. The business itself will need to report all income and expenses on Form 1120. If you do not file, for instance, you and the other associated owners will not be personally liable. The major downside to this option is that the LLC will be subject to “double taxation.”

Understanding your LLC tax filing requirements is imperative when it comes to long-term success. If you do not properly file your taxes, this could lead to issues with your “Certificate of Good Standing” and future ability to operate as a business. Practice due diligence and ask the right questions.

If you need help with LLC tax filing requirements, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Don’t Miss: Credit Karma Tax Return 2020

Do Llcs Pay State Taxes

Most states tax LLC profits the same way the IRS does: The LLC members pay taxes to the state on their personal returns, while the LLC itself does not pay a state tax.

Additional taxes in some states. A few states, however, do charge the LLC a tax based on the amount of income the LLC makes, in addition to the income tax its owners pay. For instance, California levies a tax on LLCs that make more than $250,000 per year the tax ranges from about $900 to $11,000.

Annual fees in some states. In addition, some states impose an annual LLC fee that is not income-related. This may be called a “franchise tax,” an “annual registration fee” or a “renewal fee.” In most states, the fee is about $100, but California exacts a hefty $800 “minimum franchise tax” per year from LLCs .

Before forming an LLC, find out whether your state charges a separate LLC tax or fee. For more information, check the website of your state’s secretary of state, department of corporations, or department of revenue or tax. For more state-specific information on LLCs, see our 50-State Guide to Forming an LLC.

Can I File My Llc Taxes Separately

Since an LLC is a business, can you file taxes separately from your personal tax return? The answer is yes and no. It really depends on your LLC tax structure. If youre a single-member LLC, a partnership, or an S corporation, these are all pass-through entities. That means any profits and losses flow through to your tax return.

But if youre being taxed as a partnership or an S corporation, you need to send in separate returns and include the income and losses of the LLC on your 1040 individual tax return.

If you elect to be taxed as a C corporation, you will complete your tax return separatelyincome and losses from the business dont flow through to your individual income tax return.

Read Also: How To Get Old Tax Returns

Llcs Owned By One Person

If an LLC is owned by only one person, the IRS treats the business entity as a sole proprietorship. The LLC does not pay taxes or file a return. Instead, the owner of the LLC must report all of the profits and losses of the LLC on Schedule C and file it with their 1040 tax return. You will also probably have to pay income tax on any money that you leave in your business bank account for future business spending.

Filing Taxes As A C Corporation

If the members of an LLC believe it can lower its tax bill by being taxed as a corporation, they can file Form 8832 with the IRS and opt to be taxed as a C corporation.

Changing your tax status to a C corporation means that the IRS treats your business as a separate taxpayer. Instead of letting the LLCâs corporate income and expenses flow through to their personal tax returns, the LLC owners are taxed separately from the company, and the LLC files its own separate corporate tax return.

LLC owners use the corporate tax return, also known as Form 1120, to report the corporationâs income, gains, losses, deductions, and credits to calculate its tax liability. Like Schedule C, youâll need all of your companyâs important financial information and statements on hand before filling it out.

Also Check: Is Hazard Insurance Tax Deductible

When Are Taxes Due

The due dates and intervals for payments are usually routine from year to year but they are affected by weekends and legally observed holidays. For example, Emancipation Day in the District of Columbia is April 16. When it falls on a Saturday, it is observed on April 15, which pushes the April 15 federal tax due date to April 18.

There are also exceptions for state-observed holidays and emergency orders. State holidays adjust the due dates only for specific states while emergency orders may extend the time for the whole country or specific areas that are affected by weather events or other emergencies that could cause postal delays. This allows residents more time to recover and collect their financial records.

Read Also: How To File Federal Tax Return

Tax Deadlines For Sole Proprietorships

LLCs taxed as sole proprietorships need to file Form 1040 , the deadline to file taxes is May 17. Form 1040 should be filed with Schedule C, and it serves to pay federal income tax that covers all income, losses, and annual expenses of a single-member LLC.

The LLC itself is not doesnt file any business tax because it is not a separate legal entity.

Read Also: What Do You Need To Do Your Taxes

Tax Deadlines For Small Businesses In The Uk

While the UK tax year runs April to April, the deadlines for filing small business taxes differ for limited companies. Below are HMRCs guidelines for small businesses that operate as a limited company:

- First years tax return: 21 months after the date it registered with Companies House

- Subsequent tax returns: 9 months after the companys financial year ends

- Corporation tax filing: 12 months after the accounting period ends

- Corporation tax payments: 9 months and one day after the accounting period ends

If your annual turnover surpasses £85,000, you may also have to pay Value Added Tax each quarter of your accounting period. Deadlines to file and pay a VAT return are one month and seven days after the quarter ends. If your quarter ends on March 31, for example, your VAT deadline would be May 7.

Company directors and self-employed people in the UK are also required to pay both income tax and national insurance. This is calculated and filed through a self-assessment tax return:

- Self-assessment filing deadline: October 31 for paper tax returns January 31 for online tax returns.

- Income tax payments: January 31 in the year following the tax return.

- Payment on account: July 31 in the year following the tax return. This acts as a contribution for your tax payments the following year.

Minimum Annual Franchise Taxes

Many states have a minimal or progressive franchise or privilege tax charged on all companies doing business in the state.

States collecting minimal annual franchise taxes from LLCs include:

- Alabama, Arkansas, California, Connecticut, Delaware, Washington DC, North Caroline, Rhode Island, Tennessee, Texas, and Washington.

Also Check: Department Of Tax Debt And Financial Settlement Services