The Tax Identification Number

Germany is following the example of many of its neighbors in the European Union and modernizing its tax system. By introducing the tax identification number , the Federal Ministry of Finance and the federal government want to simplify the taxation procedure and have already reduced bureaucracy.

The IdNo will replace the tax number for income tax in the long term. It will be permanently valid and will not change, for example, after a move, a change of name due to marriage or a change in marital status. The IdNo is an 11-digit number that contains no information about you or the tax office responsible for your tax matters.

Save The Document With Your Ein

Once you complete all sections of the application, the system will generate a new EIN that you can begin using immediately. An official IRS document will load onto your computer, which confirms that your application was successful and provides your EIN. Its a good idea to save a copy on your computer and to print one for your records in case you forget the EIN.

Does Your Business Need A Tax Id

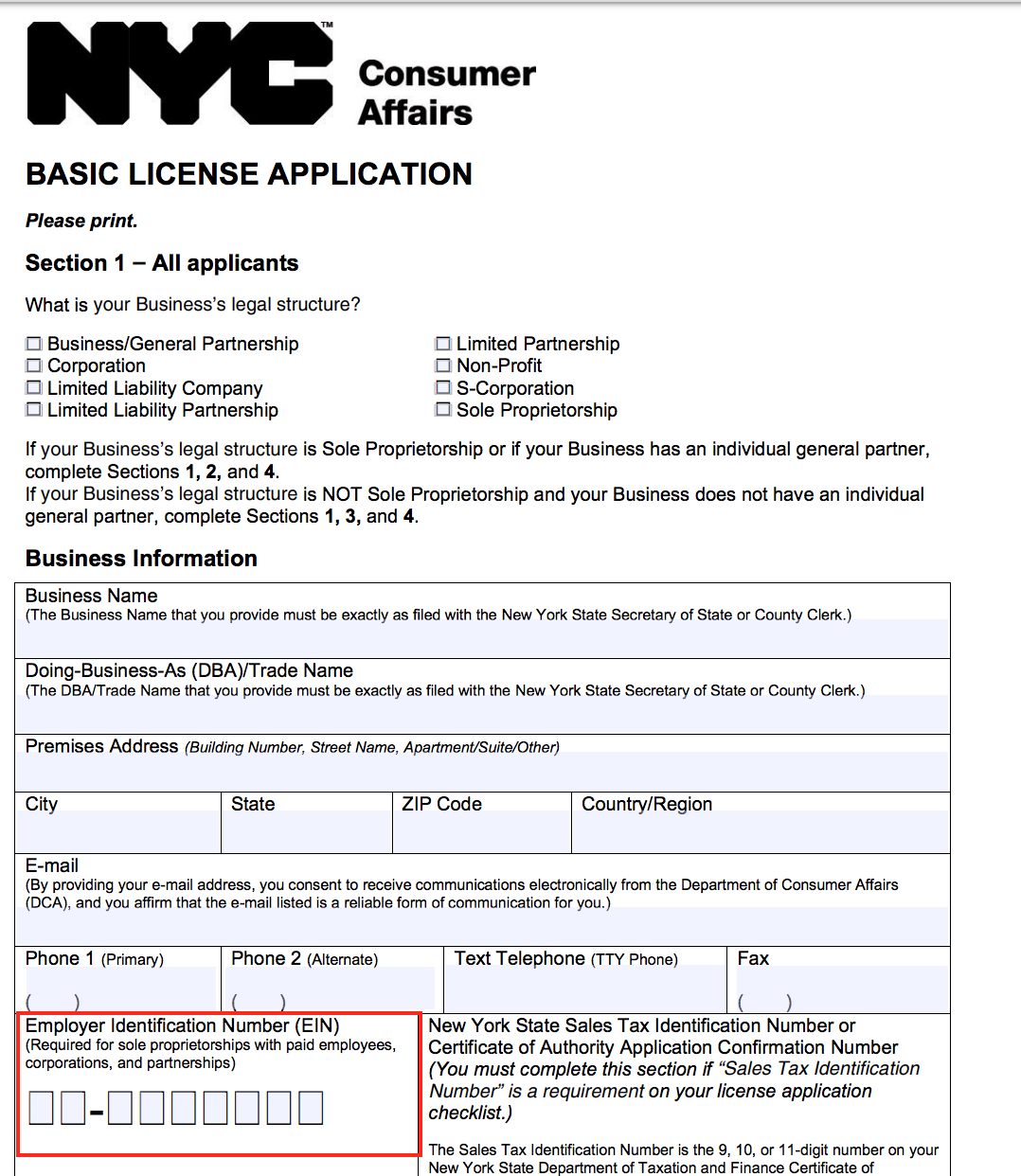

EINs are required for most types of business entities, including a partnership tax id and a tax id for corporations, and for any business owner that has employees and needs to establish a payroll.

Federal tax IDs, including EINs, are furnished by the Internal Revenue Service and are unique to the legal entities they identify. The IRS will use this number to identify and track any tax responsibilities the legal entity may have.

In addition to identifying your business tax obligations, EINs are necessary for other business objectives, including opening accounts and applying for credit in the name of the company some states may require businesses to obtain an EIN for various permits or licenses depending on the type of business you establish and its intended business activities.

There are actually three types of federal tax IDs, and each has its own purpose and is intended for particular people and companies. The bottom line is that these IDs are meant to be identification that a business uses for all business and tax matters. Read on to get a rundown of all of them.

You May Like: How Is Property Tax Paid

How Businesses Use Tax Id Numbers

An Employer Identification Number is essential for an LLC or a corporation. You should acquire this number when you first apply for LLC formation. Sole proprietorships may also apply for tax id numbers.

These codes appear on several important financial documents:

- Income tax filing for business entities

- Payroll distribution tracking for employees

- Business credit files and credit applications

It is possible to open more than one credit file by requesting multiple Tax ID numbers. To cut down on abuse, the IRS limits distribution of EINs to one per day for each applicant.

Making Changes To Your Employer Identification Number

Keep in mind that just because you have an EIN, donât assume itâs written in stoneâthere are occasions when you may need to change your EIN. There are other cases where your EIN may remain the same, but you will still need to notify the IRS of changes to your business.

If you have an EIN, you need to get in touch with the IRS in the event that:

- you change your business name*

- you change your business address*

- your business changes ownership

- your business management team changes

- your business changes entity types*

* In these circumstances your EIN doesnât change, but the IRS still needs to be notified

If youâre unsure whether you need to notify the IRS of a change, check out their page on EIN changes.

Don’t Miss: Where’s My Tax Refund Pa

What Is The Individual Taxpayer Identification Number

Individual Taxpayer Identification Numbers are personal identifiers for non-US residents . The ITIN is a tax processing number used by the IRS to aliens who may or may not have the right to work in the US, such as aliens on temporary visas and non-resident aliens. Often people who arent US citizens need this identification number to open a US bank account.

How To Get A Tax Identification Number

The IRS offers information on how to apply for different Tax Identification Numbers.

- Social Security number: Complete Form SS-5, Application for a Social Security Card PDF, and submit proof of your identity, age, and U.S. citizenship or lawful alien status, the IRS says.

- Employer Identification Number: There are a number of ways to apply for an EIN, including online, fax, mail and telephone.

- Individual Taxpayer Identification Number: Complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. You must submit documentation of your nonresident or resident alien with the Form W-7. You can mail the material, take it to an IRS walk-in office or submit it through an Acceptance Agent authorized by the IRS.

- Adoption Tax Identification Number: Complete Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions.

- Preparer Tax Identification Number: Tax preparers can apply for a PTIN through the IRS sign-up system. You can also complete Form W-12, IRS Paid Preparer Tax Identification Number Application. However, the IRS notes that the paper application takes four to six weeks to process.

Also Check: Boat Loan Calculator With Tax

Foreign Persons And Irs Employer Identification Numbers

Foreign entities that are not individuals and that are required to have a federal Employer Identification Number in order to claim an exemption from withholding because of a tax treaty , need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only””For Tax Treaty Purposes Only””Required under Reg. 1.1441-1″”897 Election”

To expedite the issuance of an EIN for a foreign entity, please call . This is not a toll-free call.

Individual Taxpayer Id Number

An ITIN is for people who aren’t eligible to receive a Social Security Number or Employer ID Number. An employer can accept an ITIN from an individual for tax purposes .

The IRS issues ITINs to people who need a tax identification number to process tax returns and payments.

Who might need an ITIN:

- A non-resident alien who is filing a U.S. tax return and not eligible for an SSN

- A U.S. resident alien filing a U.S. tax return and not eligible for an SSN

- A dependent or spouse of a U.S. citizen/resident alien

- A dependent or spouse of a non-resident alien visa holder

ITINs are fortax-reporting purposes only the number cannot be used for identification purposes. The IRS emphasizes that the ITIN is NOT used:

- To authorize someone to work in the U.S.

- To make someone eligible for Social Security benefits, or

- To qualify a dependent for an Earned Income Tax Credit .

Don’t Miss: Minimum Income To File Taxes

Federal Tax Id Number Versus Ein

In short, a federal tax ID is the same as an EIN. As is often the case in business, though, youll hear several acronyms that all reflect the same concept. These acronyms can be confusing, but here is a clear breakdown of what each refers to and how they differ.

- The federal tax ID number is also known as the TIN.

- Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity.

- An EIN may also be called a FEIN .

Q9 What Is Placement Documentation

A9. Placement documentation is the signed documentation placing the child in your care for legal adoption. In general, one of the following documents will satisfy this requirement:

- A placement agreement entered into between you and a public or private adoption agency.

- A document signed by a hospital official authorizing the release of a newborn child to you for legal adoption.

- A court order or other court document ordering or approving the placement of a child with you for legal adoption.

- An affidavit signed by an attorney, a government official, etc., placing the child with you pursuant to the states’ legal adoption laws.

The placement documentation is sometimes referred to as “Placement Agreement” “Surrender Papers” “Temporary Placement Paperwork” “Placement Order” etc. This documentation termed differently from state to state must clearly establish that the child was placed in your home for purposes of adoption by an authorized adoption agency , and must include the following information:

- Adoptive Parent full name

Don’t Miss: Work At Home Tax Credit

Finding Your Individual Tax Id

Federal Tax Id For A Business

A federal tax ID lookup is a method of searching for a business’s information using their tax identification number , or employer identification number .

Tax identification numbers are issued to businesses by the IRS depending on their structure. When a business changes its structure, it will usually be issued a new ID number. The United States federal government uses a federal tax identification number for business identification.

An EIN will possess nine numbers and is used by the IRS for administering taxes for the following entities:

- Trust or government agency

Either the grantor, owner, or trustee of an organization will be issued an EIN. The practice of one per responsible party per day applies to the issuance of EINs. To make sure tax administration is successful, the IRS is focused on only providing qualified parties with an EIN. Third-parties applying for an EIN must identify themselves as a third-party designee.

An EIN can be applied for online or by using the paper Form SS-4. An organization whose primary business address is in the United States can apply for an EIN online.

An EIN is not a replacement for a Social Security Number .

Read Also: Irs Free Tax Filing 2022

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Itin As Tax Id Number

If you arenât eligible for an SSN, the IRS may provide you with an ITIN instead.

Typically, you can get an ITIN if youâre:

- a non-resident alien

- the dependent or spouse of a U.S. citizen or resident alien

- the dependent or spouse of a non-alien visa holder

You can only use an ITIN for tax reporting purposes. ITINs canât be used to:

- gain authorization to work in the United States

- receive social security benefits

- qualify a dependent for an Earned Income Tax Credit

How to get an ITIN

To get an ITIN, you need to submit IRS Form W-7, Application for IRS Individual Taxpayer Identification Number.

On Form W-7, you must provide:

- current name and birth name

- ID documents such as your passport, driverâs license or state-issued ID

- foreign status or immigration documents

You can submit Form W-7 in person or by mail. The IRS provides in-person locations and mailing addresses.

Using your ITIN as a tax ID number

While you can use your ITIN to file taxes for your sole proprietorship or LLC, we recommend getting an EIN. You donât need to be a U.S. citizen to get an EIN, and it can benefit you down the line as your business expands.

Also Check: Live In One State Work In Another Taxes

Applying For A Taxpayer Identification Number For A Natural Person

The taxpayer identification number is a form of personal identification that is essential for purchasing goods or services, entering into contracts, opening bank accounts, etc.

Portuguese nationals with a valid Citizens Card already have a TIN allocated to them.

If you are not in the aforementioned category, find out how to apply for a TIN.

‘How to request the NIF and the NISS for foreign citizens in Portugal’

Unexpected Payment To An Individual

A Form W8BEN or a Form 8233, Exemption From Withholding on Compensation for Independent Personal Services of a Nonresident Alien Individual, provided by a nonresident alien to get treaty benefits does not need a U.S. TIN if you, the withholding agent, meet all the following requirements.

An acceptance agent is a person who, under a written agreement with the IRS, is authorized to assist alien individuals get ITINs. For information on the application procedures for becoming an acceptance agent, see How to Become an Acceptance Agent for IRS ITIN Numbers.

Don’t Miss: How Much In Taxes Do I Owe

How To Find Another Company’s Ein

Usually, small business owners need to locate their own company’s tax ID number, but businesses sometimes need to look up another company’s EIN. For example, you can use an EIN to verify a new supplier or client’s information. Also, in industries like insurance, you might need other companies’ EINs during your daily course of business.

Use one of the following options to find another business’s federal tax ID number:

Atin Questions And Answers

The following are Questions and Answers regarding the ATIN program.

The Q& A provides information to taxpayers who need a taxpayer identification number for a child who has been placed in their home pending final adoption.

Read Also: Real Estate Excise Tax Affidavit

This One Sounds Worse Than It Really Is

Volkswagen is recalling a relatively small number of its new ID.4 electric crossovers to address an electrical issue, but not one related to its electric powertrain. This pertains to its old-fashioned 12V battery . In rear-wheel-drive models of the ID.4, VW says the 12V battery’s charging cable can rub against the steering column, potentially resulting in a short-circuit if the insulation becomes worn. If left unaddressed, it can present a fire risk. The recall covers only 1,042 examples of the EV produced for the 2022-2023 model years all-wheel drive models are not included.

“On affected vehicles , the 12V battery charging cable may contact the steering column shaft, causing the cable insulation to wear through,” VW’s recall report said. “If this happens, it may result in a short circuit. A short circuit can lead to a loss of motive power while driving which increases the risk of a crash. A short circuit in this case also increases the risk of a vehicle fire. The affected cable is a low-voltage cable therefore there is no risk of a high-voltage electric shock to occupants or servicing technicians. A risk of potential damage to the steering system cannot be ruled out.”

Because the defect is associated only with the car’s low-voltage system, which is used to power various non-traction systems on the car, there is no risk of electrocution associated with this issue. Owners should expect to be notified of the campaign by the end of February.

Related video: