Paypal Venmo And Other Third

If you’ve been self-employed or freelancing for a few years, you likely already know that you’re required to report your freelance earnings to the IRS. This year, your earnings will be even easier for the IRS to access, since third-party payment apps are now reporting your payment activity to the IRS.

While you’ll still need to report your earnings like usual, the difference is, the IRS will be able to verify the amounts you report against the transactions the payment apps provide. So, if you’re off by $100, the IRS will know.

This new regulation could help freelancers. Platforms like PayPal, Venmo, Cash App, Zelle and others will be providing users with 1099-K forms, which can make reporting your income a little easier.

And don’t worry — the money you gifted to your kids is safe from taxes. Only earnings sent through these third-party apps are subject to taxation.

No matter how you were paid, if you had any self-employment income in 2022, Steber recommends working with a tax professional to make sure you take advantage of every eligible tax break. “Self-employed people have some of the most complex tax returns, and quite frankly, some of those lucrative tax benefits in the tax code to watch out for,” he said.

When Your Child Should File

Your child should file a federal income tax return even though it isnt required for the reasons above, if:

- Incomes taxes were withheld from earnings

- They qualify for the earned income credit

- They owe recapture taxes

- They want to open an IRA

- You want your child to gain the educational experience of filing taxes.

In the first two cases, the main reason for filing would be to obtain a refund if one is due. The others are income dependent or based on taking advantage of an opportunity to begin saving for retirement or to begin learning about personal finance.

You May Like: Buying Tax Liens California

Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019, Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

Recommended Reading: When Will I Get My Tax Return

Why You Havent Received The Full Amount Of Your Child Tax Credit

You need to file your 2021 tax return to get all of the Child Tax Credit for which you are eligible.

Filing a tax return is how you can tell the government about your family and the number of qualifying children you are claiming. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS estimated you would be able to properly claim on your 2021 tax return.

Any remaining Child Tax Credit benefits will be paid when eligible parents and guardians file their tax returns for 2021 and claim the Child Tax Credit.

To get free assistance filing for the Child Tax Credit, go here.

If you had any life events such as an income change or the birth of a child during 2021, this may have an impact on the remaining amount of Child Tax Credit that you can properly claim.

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

You May Like: Va State Tax Refund Status

You Can Get More When You File

When filing your taxes, you will get the full amount of Child Tax Credit, even if you received less in monthly payments last year than you may have been eligible for.

You will be able claim the full amount of any remaining Child Tax Credit benefits you are eligible for against any 2021 tax liability you owe and receive any leftover amount as a refund payment.

Any amount of monthly Child Tax Credit payments received last year will reduce the amount of remaining Child Tax Credit benefit you are eligible for when tax filing.

The Child Tax Credit Does Not Affect Your Other Federal Benefits

Having received monthly Child Tax Credit payments in 2021, and any refund you receive as a result of claiming the Child Tax Credit, is not considered income for any family. Therefore, it will not change the amount you receive in other Federal benefits. These Federal benefits include unemployment insurance, Medicaid, SNAP , SSI, SSDI, TANF, WIC, Section 8, or Public Housing.

Recommended Reading: What Is Real Estate Tax

Requirements For Llcs Treated As Sole Proprietorships

LLCs taxed as sole proprietorships dont have to file an annual federal business tax return in years of no business activity. Only single-member LLCs — LLCs with one owner — can be taxed as sole proprietorships.

Single-member LLCs are pass-through entities that report business activity on the owners personal return. Unlike C corporations, pass-through entities arent subject to a uniform small business tax rate. Pass-through businesses are taxed at their owners individual tax rates.

Your single-member LLC files Form 1040 Schedule C to detail business revenue, deductions, and credits to the IRS. Since LLCs taxed as sole proprietorships dont file a separate business tax return, theyre called disregarded entities, which are inseparable from their owners for tax purposes.

You dont have to file Schedule C for your single-member LLC when your company brings in less than $400 for the year. I still recommend attaching Schedule C whenever there is any business activity, though, even if its less than the required amount.

Temporary Charitable Donation Deductions Have Ended

Fewer filers may be able to claim charitable donation tax breaks for this tax year. The expanded charitable cash contribution benefits that were offered in 2020 and 2021 have ended. The temporary suspension of the 60% AGI limit in 2020 and 2021 is now back, limiting the amount you can claim in charitable contributions.

Also Check: Tax Credit For Electric Vehicle

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

The Tax Filing Threshold

The tax filing threshold is the amount of money you need to earn before you are legally required to file an income tax return with the IRS. While this information may be subject to change, at time of writing for most taxpayers the IRS sets this threshold at the standard deduction.

This means that if your total income is less than the standard deduction for your filing status that year, you likely do not have to file a tax return with the IRS. You can literally skip tax season altogether. For taxpayers filing their 2021 taxes this threshold is $12,550 for single filers and $25,100 for a married couple.

This is the case for most taxpayers. However, as with all things tax, there are several exceptions to this rule that can change an individuals filing threshold. The most common are:

- If you are over 65: The filing threshold increases. You do not have to file taxes if you earned less than $14,250 for single filers and $27,800 for married couples.

- If you are self-employed: There is almost no filing threshold. You must file taxes if you earned more than $400 combined. This is because you will owe payroll taxes.

The tax filing threshold applies to all taxable income that you receive over the course of the year. Even if additional deductions and credits would reduce your income you must file taxes if your total earnings exceed the threshold.

Recommended Reading: Home Depot Tax Exempt Registration

What Counts As Taxable Income

All these thresholds and limits are based on earned and/or unearned income. Earned income typically comes from salaries, wages, or self-employment. Unearned income derives from things like interest and investment gains. But some common types of income fall outside these parameters, so gross income rules apply. Gross income is your earned and unearned income added together. Unemployment compensation is considered taxable income, as well.

If you received an Economic Impact Payment in 2021, affectionately known as a stimulus payment or stimulus check, is not taxable income. It doesnt contribute to your earned or unearned income thresholds.

Social Security benefits are only taxable if your gross income, tax-exempt interest, and half of your benefits combined exceed $25,000 if youre single or $32,000 if youre married and filing a joint return, as of 2021. Married taxpayers who file separate returns may have to pay taxes on that income, as well. You also must report and pay taxes on all your benefits if you lived with your spouse at any time during the tax year.

Filing Taxes For A Small Business With No Income: What You Should Know

Are there any benefits to filing taxes for a small business with no income? It depends. You should be aware of these specific tax situations.

Various business situations may lead you to report no income for an entire tax year. You may have formed your LLC before opening your business. You may have stopped all business activities at your corporation, but you haven’t officially filed your Articles of Dissolution yet. Whatever the reason, there are certain questions you must answer to determine if you need to file a business tax return.

You May Like: Arizona Charitable Tax Credit List 2021

File A 2020 Tax Return If Youre Missing Stimulus Payments And Think Youre Eligible For More Money

I know many people have questions about tax law changes related to the American Rescue Plan Act of 2021. I urge you to start with IRS.gov Coronavirus Tax Relief to find the most updated information when its available. If youre looking for general information, the best place to start is IRS.gov. It will save you time because our employees wont be able to provide much more information if you call.

Economic Impact Payments, also known as stimulus payments, are different from most other tax benefits. Thats because people can get them even if they have little or no income, and even if they dont usually file a tax return. This is true as long as you are not being claimed as a dependent by someone else and you have a Social Security number. When it comes to missing stimulus payments, its critical that you file a 2020 tax return even if you dont usually file to provide information the IRS needs to send the payments for you, your eligible spouse and eligible dependents.For anyone who missed out on the first two rounds of payments, its not too late. If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, you can get that missing money if youre eligible for it, but you need to act. All first and second Economic Impact Payments have been sent out by IRS. If your 2019 tax return has not been processed yet, the IRS wont send you the first or second payment when it is.

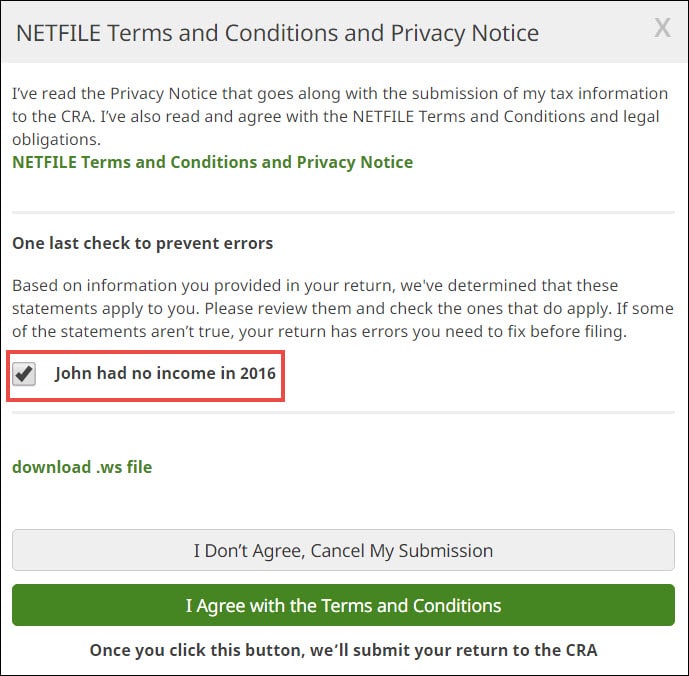

How Do I Add $1 Of Interest Income

If you file a tax return without any taxable income, the IRS will reject it. To get around this rejection, the IRS suggests people report $1 of interest income on their tax return. To accomplish this within the program, please follow the steps listed below.

- Select Federal from the navigation bar

- Select Income from the same navigation bar

- Select 099-INT, DIV, OID from the Income page

- Choose Did you earn any interest or dividend income from a bank, brokerage firm or some other financial institution?

- Select Interest Income, Form 1099-INT, , then press continue

- Enter your name in the box titled “Payer’s Name” and $1 inside the box labeled Interest Income

- Press continue at the bottom of the page to save your entries to your tax return

Also Check: Tax Credits For Electric Cars

Income Tax Brackets For This Year Were Raised

For 2022, income tax brackets were also raised to account for inflation. Your income bracket refers to how much tax you owe based on your adjusted gross income, which is the money you make before taxes are taken out, excluding itemized exemptions and tax deductions.

While the changes were slight, if you were at the bottom of a higher tax bracket in 2021, you may have bumped down to a lower rate for your 2022 tax return.

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Don’t Miss: How To Check On Status Of Tax Refund

How Can I Get My Tax Return For 5 Years

To use this tool, you must create an account on the IRS website and verify your identity to access it. Once you have done this, you will have access to the transcription system. The wage and income statement shows what has been reported to the tax authorities over the years and is generally available over the past five years.

Can You File Taxes With No Income

If you havent made any income or very minimal income amounts within the year, you might not have to file any of the related tax forms and paperwork.

Now before you jump for joy at evading one of the most confusing and stressful parts of the year, its important to keep in mind that just because you might not have to doesnt mean you shouldnt.

There can be a lot of benefits from still completing all the forms which we will go over throughout this article. Filing a tax return with zero income is completely legal and many people do still file regardless of their minimal income.

Contents

Don’t Miss: Are Funeral Expenses Tax Deductable

Do I Need To File A Tax Return

You may not have to file a federal income tax return if your income is below a certain amount. But, you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. Find out if you have to file a tax return.

You Must File Tax Form 8843 By June 15 2022

All international students, scholars and their dependents present in the U.S. under F-1, F-2, J-1, or J-2 nonimmigrant status who are nonresidents for tax purposes must file Form 8843 “Statement for Exempt Individuals and Individuals with a Medical Condition” even if they received NO income in 2021.

Download the Form 8843 Guide below for detailed instructions. This guide has been created to assist you in completing and subitting the Form 8843. It is a simplified version of the IRS instructions found on pp. 3-4 of the Form 8843. The IRS also has additional guidance on completing Form 8843 here.

What if I forgot to file my Form 8843 in a previous year?

Complying with U.S. tax law is part of maintaining your immigration status. You should file the previous year’s Form 8843 as soon as possible.

Don’t Miss: Percent Of Taxes Taken Out Of Paycheck