Understanding Inheritance And Tax

When asking how much can you inherit without paying taxes, its comforting to know that the IRS does not consider an inheritance of any amount as income. This means you dont need to include it on your regular tax return or pay any income taxes on the money or assets.

States also give you a free pass when it comes to income tax while a handful of states require you to file an inheritance tax return, you wont need to include an inheritance on your state income tax return. Rest assured that, regardless of the size of your inheritance, you may owe other types of tax, but you wont owe any income tax.

Ten Facts You Should Know About The Federal Estate Tax

The federal estate tax is a tax on property transferred from deceased persons to their heirs. Only the wealthiest estates pay the tax because it is levied only on the portion of an estates value that exceeds a specified exemption level $5.49 million per person in 2017.The estate tax limits the large tax breaks that extremely wealthy households get on their wealth as it grows, which can otherwise go untaxed. The estate tax thus limits, to a modest degree, the large tax breaks that extremely wealthy households get on their wealth as it grows, which can otherwise go untaxed.

The estate tax has been an important source of federal revenue for a century, yet a number of misconceptions continue to surround it. This report briefly describes ten facts about the federal estate tax.

How Can I Avoid Paying Taxes On Inherited Property

Steps to take to avoid paying capital gains tax

You May Like: Oklahoma Tag Title And Tax Calculator

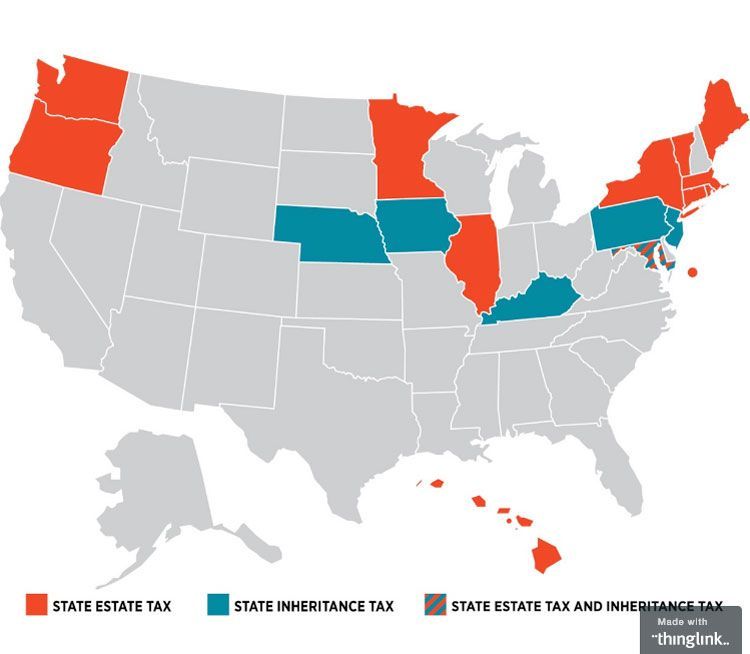

State Taxes Around Inheritance

Although state governments do not count inherited money or property as income, a handful of states have inheritance and estate tax laws. You may have a tax liability to pay if you live in one of the few states that have these taxes in place.

Six states currently have an inheritance tax, while 14 impose an estate tax. Two states, Maryland and New Jersey, have both taxes. Estate taxes are paid by the estate of the deceased, while inheritance taxes are paid by the heirs.

References

What Is An Inheritance Tax And Do I Have To Pay It

8 Min Read | Nov 10, 2022

Aunt Edna always said you were her favorite . And when she died, she left you $10,000 and her collection of Precious Moments figurines. Youd give it all up just to spend an hour chatting with her at her kitchen table.

Losing a loved one is tough, and an inheritance is little comfort when it comes to grief. But to top it all off, you might have to pay an inheritance tax.

Whether youve received an inheritance, or youre considering leaving an inheritance and wondering how taxes could affect it, well walk you through how it works.

Lets start with the basics.

Read Also: Is Ein And Tax Id The Same

How Much Money Can You Inherit Before Paying Taxes

How much money can I inherit tax-free? We hear this question from many people who request our services. When you inherit a sum of money, you have many other things on your mind, too. You may still be mourning the loss of the loved one who left you the money, and you may have many issues to deal with related to your family and friends, too.

Researching the answer to your probate-related questions can take up your precious time. You want answers to your questions quickly, but first, you need to understand a few basic finance-related concepts.

After A Death Some Await An Inheritance How Much Must Be Passed Before It Is Taxed In California New York Texas And Other States

In recent years, estate taxes, or those paid on the assets and wealth of those who have passed, have been weakened significantly in the United States. These legal changes have allowed enormous transfers of wealth between familial generations to occur that further evergrowing economic inequalities.

The assets of the deceased are calculated based on the total value of their assets. In the case of properties, art, jewelry, or other physical assets, the value is based on the fair market value not necessarily what you paid for them or what their values were when you acquired them. The total is what is known as the Gross Estate.

Once the value of the Gross Estate has been calculated, those who are required to submit a tax return can see if they are able to make any deductions. However, estates that are relatively simple, such as those that are made up of cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property do not require the filing of an estate tax return.

Read more:

You May Like: When Are Tax Returns Sent Out

Do I Pay Tax On Gift Money From Parents

You do not pay tax on a cash gift, but you may pay tax on any income that arises from the gift for example bank interest. You are entitled to receive income in your own right no matter what age you are. You also have your own personal allowance to set against your taxable income and your own set of tax bands.

Does Inheritance Affect Social Security

Social Security Disability, like Social Security, is not a means-tested program. Therefore, your Social Security Disability benefits will not be affected by any change in your assets or your income. Furthermore, receiving an inheritance will not have any effect on your monthly Social Security Disability benefits.

You May Like: How Are Social Security Taxes Calculated

How Do You Report Your Inheritance On Your Taxes

Since an inheritance isn’t considered taxable income, you do not need to report it on your tax return. However, any income you receive from an estate or that’s generated from the property you inherit will be treated as taxable income or capital gains. You’ll need to report this on the relevant forms on your tax return.

How Many States Tax Inherited Wealth

The federal government has levied an estate tax since 1916. Until 2001, every state also levied a tax that allowed them to pick up a share of federal estate tax revenues. The pick-up taxes didnt increase an estates total estate tax liability because estates received a dollar-for-dollar federal credit that reduced their federal estate tax liability by the amount they paid to the state. In addition, a dozen states levied a separate inheritance tax.

In 2001, policymakers cut the federal estate tax and eliminated the federal credit. Most states had set their estate taxes to equal the amount of the federal credit, and after its elimination, a number of states simply allowed their estate taxes to disappear as well, while others affirmatively either repealed or retained their estate taxes. As of June 2021, only 17 states and the District of Columbia still levy an estate or inheritance tax. These taxes generate about $5 billion per year. If all states reinstated an estate tax, they could generate an additional $3.7 to $15 billion.

Don’t Miss: Tax Refund When To Expect

How Do I Pay My Iht

In most cases, the deceased designates an executor to administer the estate in their Will. The executor can be a professional, or even just a family member, as long as they are over 18 years old. The executors role in the process is to ensure that all assets in the Will are accounted for, along with transferring these assets to the named beneficiaries, and that all the debts of the deceased are paid off, including any taxes. Therefore, it is usually the executor who pays the IHT on behalf of the estate. If there is no will, you will have to appoint someone to administer the estate until it is passed to the beneficiaries it can also be you.

If the person you inherit the estate didnt set up a trust, then the tax amount will be taken out of the inheritance directly. You need to set up a payment reference number first and make the payment either by bank transfer from your or the deceased persons bank account.

Wills Vs Trusts: Key Differences

|

Wills |

||

|---|---|---|

|

Provides guardianship for minor children? |

Yes. |

|

|

Process and costs |

Straightforward process. Average cost ranges from $0 to $1,000, depending on the complexity and size of the estate and how it is created . |

More complex process, with more paperwork. Average cost for a simple trust is up to $1,500. Complex trusts have an average cost of around $3,000. |

|

Contestability |

More likely to be successfully challenged. |

Less likely to be successfully challenged due to its ongoing nature. |

|

Precedence |

Generally take precedence over wills. |

|

|

Tax benefits |

||

|

Read Also: How Is Property Tax Paid

How Much Can You Inherit From Your Parents Without Paying Taxes

The United States government has a complicated tax system, and its not easy to know how much can you inherit from your parents without paying taxes in the US. The Internal Revenue Service says that any amount of money between Dollars 600,000 and Dollars 5,450,000 is exempt from Estate Taxes.

However, that doesnt mean you wont have to pay taxes on the inheritance. You will still have to declare the amount of your estate when you file your income tax return. Inheritance in the United States is taxed as property.

If you are over 18, your parents can give away their estate before they die, Its not taxable when they pass it to you, but if you sell it, the profit is taxable. If you are a child of parents that live in the United States, you can inherit up to Dollars five point four five million in cash or assets without paying any taxes on it.

The rules only apply if your parents both died before July 31st 2010, and only if they were not your stepparents or parents-in-law. Your parents are not stuck with just one estate, but can leave as much as Dollars five point four nine million to any of their children without paying taxes on it.

They can also leave up to Dollars ten point nine eight million to a spouse and up to Dollars five point four nine million to their grandchildren without paying taxes on it. The amount of inheritance you can receive without paying taxes is limited to Dollars five point four five million per person, or Dollars ten point nine million total.

Do Beneficiaries Have To Pay Taxes On Inheritance

It depends on their familial relationship to the deceased and on the state where the decedent lived or owned property. Only estates or property located in one of six states that impose inheritance taxes may be subject to them.

Surviving spouses are always exempt from inheritance taxes. Other immediate relatives, like the deceased’s parents, children, and siblings, are exempt to varying degrees, depending on the state. They may be entitled to inherit a certain sum tax-free and to pay a lower tax rate on the remainder.

Inheritance taxes mainly affect more distant relatives and unrelated heirs.

You May Like: Tax Deductions For Home Office

Can The Irs Tax Inheritances

So far, we have been discussing state-level inheritance taxes. Only a few states impose an inheritance tax, and California is not among them. However, you will still need to be concerned about federal taxes if you inherit assets from a deceased friend or loved one. For federal taxes, the IRS will not treat your inheritance as income. There is no federal inheritance tax, per se, but a federal estate tax could affect you.

Suppose your grandmother left you $1 million. You will not have to claim that money as income to file federal income tax on April 15th. An IRS agent will not come after you to try to take a portion of your inheritance. This rule applies whether you have inherited cash, stocks, property, or even a family business.

The 3 Main Types Of Inheritance Taxes

When someone talks about inheritance taxes , what theyre really referring to is the grouping of different taxes that can affect an inheritance. There is an inheritance tax specifically, but its just one of the different taxes that are assessed by the IRS and state governments.

Whats even more confusing is that some taxes are imposed at the federal level, while others are not. To add to the confusion, only a number of state governments levy these taxes.

Clear as mud? We thought so. Dont worry because were here to break down the 3 main types of inheritance taxes so that you can walk away feeling confident:

- Inheritance Tax

You May Like: Earned Income Tax Credit Table

What Makes Sense For You

When it comes to deciding which estate planning tool, or combination of tools, works best for you, understanding the differences between the various types of wills and trusts can help make a more clear-cut decision. Most people need a will, but not everyone requires a trust.

If you arent sure, consulting with an estate planning attorney often with input from your tax advisor and financial advisor can provide a second opinion on how best to achieve your estate planning goals while highlighting any details you might not have considered.

Though planning for how to pass assets on after your death might not be pleasant to think about, fleshing out your intentions means that your family and friends can execute on your behalf without second-guessing during an emotional time. It is one of the best gifts you can give to your loved ones and to yourself, as youll gain peace of mind knowing that those you care about will be well looked after.

About the author:Tiffany Lam-Balfour is a former investing writer for NerdWallet. Previously she was a senior financial advisor and sales manager at Merrill Lynch.Read more

Will Vs Trust: Know The Differences

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Wills and trusts are legal instruments that ensure assets are passed down to heirs as per your wishes, helping to provide for the people and causes close to your heart. While each can be a pillar of estate planning, wills and trusts have key differences to consider, from when they take effect to whether or how much they can be contested. Depending upon your situation, you might need only one or the other, but some people end up using both to help achieve different outcomes.

Well cover the ins and outs of wills and trusts, including the different types of each, as well as when you might need one or both. Heres an overview of the key differences with more details explained below.

Read Also: Federal Capital Gains Tax Rates

How To Avoid Inheritance Tax

There are a few ways to minimize the tax bite on handed-down assets. Getting help from a qualified tax expert can be key, but one common element of estate planning is to give assets away before dying. Many states dont tax gifts. Keep in mind that gifts dont have to be cash stocks, bonds, cars or other assets count, too.

Beneficiaries can only do so much to avoid inheritance taxes once theyve inherited an estate. However, those leaving the estate can take steps ahead of time to ensure beneficiaries are in the best situation possible. These estate-planning vehicles include living trusts, irrevocable trusts and grantor retained annuity trusts.

How Do You Avoid Inheritance Tax

15 best ways to avoid inheritance tax in 2022

You May Like: How Much Is Unemployment Tax

State Estate Taxes And Federal Estate Taxes

State and federal estate taxes might also come due. The good news here is that the 2022 federal estate tax exemption is $12.06 million. An estate won’t owe any estate tax if its value is less than this.

Twelve states and the District of Columbia also collect an estate tax at the state level as of 2022: Connecticut, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, and Washington.

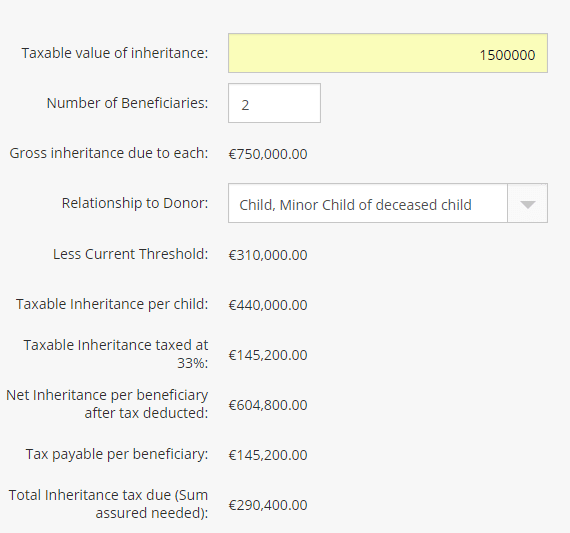

How Inheritance Taxes Are Calculated

An inheritance tax, if due, is applied only to the portion of an inheritance that exceeds an exemption amount. Above those thresholds, tax is usually assessed on a sliding basis. Rates typically begin in the single digits and rise to between 15% and 18%. Both the exemption you receive and the rate you’re charged may vary with your relationship to the deceasedmore so than with the value of assets you are inheriting.

As a rule, the closer your familial relationship to the deceased, the higher the exemption and the lower the rate you’ll pay. Surviving spouses are exempt from inheritance tax in all six states. Domestic partners, too, are exempt in New Jersey. Descendants are only subject to an inheritance tax in Nebraska and Pennsylvania.

Life insurance payable to a named beneficiary is not typically subject to an inheritance tax. It may be subject to an estate tax if the estate or a revocable trust was the beneficiary of the policy.

Don’t Miss: New Jersey Tax Refund Status