How Do I Pay My Tourist Tax In Florida

The Department of Revenues website at floridarevenue allows you to register to collect, report, and pay sales tax, discretionary sales surtax, and transient rental tax. Taxes.com/taxes/registration. You will be guided through a series of questions that will help you determine your tax obligations through the online system.

How 2022 Sales Taxes Are Calculated In Florida

The state general sales tax rate of Florida is 6%. Florida cities and/or municipalities don’t have a city sales tax.Every 2022 combined rates mentioned above are the results of Florida state rate , the county rate . There is no city sale tax for the Florida cities. There is no special rate for Florida.The Florida’s tax rate may change depending of the type of purchase. Some of the Florida tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Florida website for more sales taxes information.

Who Pays Florida Income Tax

Florida taxes all wages and income earned by residents who meet taxation requirements. That includes wages, interest income, capital gains, rental property income, and self-employment income . Regardless of where you live or work in Florida , you must pay tax on your entire taxable income.

Starting with your first paycheck in Florida, you’ll have to deal with a small income tax withholding and payments. You’ll also have to figure out how to file your taxes each year by April 15th of the following year, and if you’re self-employed, you may have to deal with estimated quarterly payments during certain times of the year.

There are more than 6 million taxpayers in Florida. But not all of them pay income tax. The reason for that is simple: There are multiple types of taxes in Florida, and most people dont have to pay all of them. If youre a resident or part-year resident, you owe state income tax if your taxable income meets or exceeds certain limits that apply based on your filing status and other factors.

Read Also: Iowa State Tax Refund Status

Potential Tax Concerns For Inheritances

As mentioned, the estate tax is only an issue for people dying with over $12.06 million . The individual heirs are generally not responsible for the taxes as the duty to collect and pay the estate tax is the responsibility of the executor or successor Trustee. As of 2022, states that impose inheritance tax include Minnesota, Pennsylvania, New Jersey, Nebraska, Maryland, and Iowa. Here is a link to those states that have an estate tax over and above the Federal estate tax.

Some other situations in which Florida beneficiaries may have to pay some form of taxes on inheritances include:

Overview Of Florida Taxes

Florida is known for having low taxes. Delving into the numbers, the state mostly lives up to the reputation. Despite having no income tax, though, there are some taxes that Florida residents still have to pay.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Read Also: How Does Tax Write Off Work

Three Types Of Taxes Relating To Florida Real Estate

- First, all properties in Florida are assessed a taxable value and owners pay an annual Florida property tax based on this value . This tax is paid to the local municipality

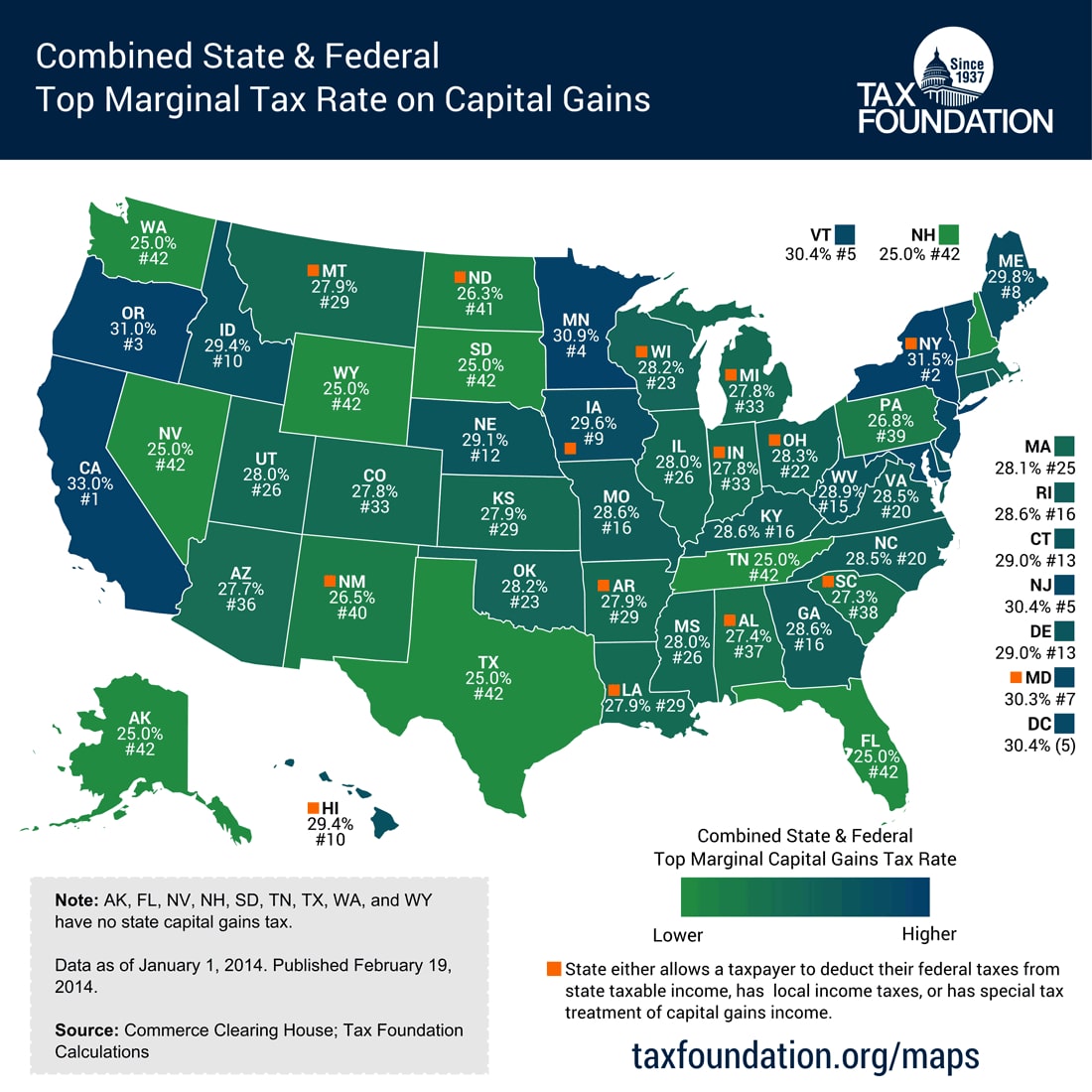

- Second, if you sell your home, there may be a capital gains tax on the profit realized from the sale. For this scenario, there are federal guidelines set forth for global buyers under the Foreign Investment in Real Property Tax Act .

Because FIRPTA is a rather complex Act, we discuss it at length in our article FIRPTA and the Case of the Foreign Seller. We strongly recommend global buyers reference this article as well as it is something you should definitely be aware of for your future tax planning purposes, especially since it is an important topic to discuss with your tax advisor in your initial meeting.

- The third tax category only applies to rental properties. If there is net profit on the rental income, there may be a federal tax on the profit generated from renting out a vacation home or other investment property. In addition, for short-term rentals, there is a sales tax which is generally charged to the renter and submitted to the local government.

In this section we will discuss Florida property tax, since it is applicable to all property owners on a recurring annual basis and capital gain tax, as it is applicable to all property owners when considering the sale of their property.

Capital Gains Tax Calculator

A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation. You can use a capital gains tax rate table to manually calculate them, as shown above.

For example, if a person earns $50,000 per year and earns a capital gain of $1,000, they will have to pay $150 in capital gains taxes to the IRS.

Read Also: How Much Do You Need To Make To File Taxes

Benefits Of Florida Income Tax

When it comes to your state income tax, you might think of the Internal Revenue Service as the only organization that collects taxesbut in Florida, you’ll also be subject to paying taxes to the Florida Department of Revenue . If you live in Florida and make more than $12,000 annually, you need to pay Florida income tax.

While this might sound like a hassle at first, there are plenty of benefits to paying Florida income tax, including getting certain credits and deductions that can reduce your overall tax burden even if you don’t live in the Sunshine State year-round. Below are more benefits of Florida incomes tax:

What Percentage Of The Cost Of Gas In Florida Comes From Taxes And Gas Station Profit

The diagram above shows how the prices of an average gallon of gasoline and diesel fuel are broken down among various components, including the cost of the crude oil, refining, distribution / marketing, and taxes. In most areas, state and federal excise taxes amount to about 13% of the cost of a gallon of gas. Gas stations generally only profit a few cents per gallon.

Also Check: Montgomery County Texas Tax Office

Determine Your Florida Businesss Employment Taxes

Florida employers pay a reemployment tax. Many states call this an unemployment tax.The initial Florida business tax rate for reemployment is 2.7%. After the employer has reported taxes for 10 quarters, the state does some math. The new rate is calculated by dividing the total benefits charges to the account by the taxable payroll reported for the first seven of the last nine quarters immediately preceding the quarter in which the rate becomes effective.

There is an exception for businesses that transfer ownership. The new owner may choose to accept the tax rate of the previous employer. They will also be responsible for paying any outstanding taxes.

Reemployment taxes are due every quarter by the following dates:

What Is The Federal Tax On $65000

Income tax calculator California If you make $65,000 a year living in the region of California, USA, you will be taxed $16,060. That means that your net pay will be $48,940 per year, or $4,078 per month. Your average tax rate is 24.7% and your marginal tax rate is 41.1%.

What is the sales tax on $500 in Florida?

So, divide 7.5 by 100 to get 0.075. Divide the final amount by the value above to find the original amount before the tax was added. In this example: 537.5 / 1.075 = 500. This is the price excluding taxes.Sales Taxes Chart.

| State |

|---|

What is the Florida sales tax rate for 2021?

6%2021 List of Florida Local Sales Tax Rates. Florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. There are a total of 301 local tax jurisdictions across the state, collecting an average local tax of 1.011%.

What is Floridas sales tax rate 2021?

What is FL sales tax rate?

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Floridas general state sales tax rate is 6% with the following exceptions: 4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity.

How much would I save in taxes if I moved to Florida?

The savings from moving to Florida could be as much as 13.30% on taxable income on top of lower property.

Read Also: Highest Sales Tax By State

How Do Florida Property Taxes Work

The first step in the Florida property tax process is property appraisal, which is the act of placing a value on a piece of real estate. Every county in Florida has a property appraiser, which is an elected official who’s responsible for the annual appraisal of every lot in the county. In general, this person does this through a mass appraisal, or a systematic analysis of market data in order to assign values to multiple properties at once.

Property tax rates are applied to the assessed value, not the appraised value, of a home. Assessed value takes into account exemptions, including the Save Our Homes assessment limitation.

The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property taxes, creditors and challenges that arise from the death of a homeowner spouse. It frees the first $25,000 of the homes assessed value from all property taxes, and it exempts another $25,000 from non-school property taxes. This can get confusing, so heres an example:

Lets say you have a home with an assessed value of $80,000. The first $25,000 would be exempt from all property taxes. The next $25,000 is subject to taxes. Then, the next $25,000 is exempt from all taxes except school district taxes. The remaining $5,000 in assessed value is taxable, though.

How Much Florida Homeowners Pay In Property Taxes Each Year

- Samuel Stebbins, 24/7 Wall St. via The Center Square

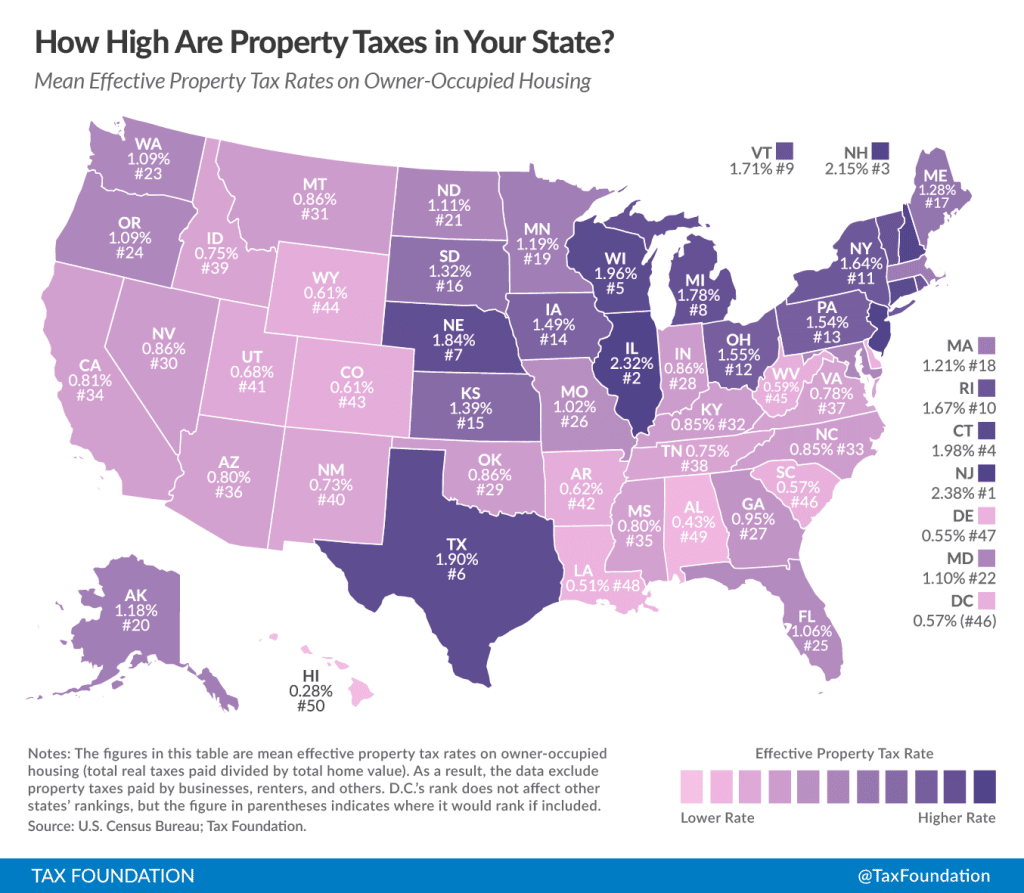

Property taxes are the lifeblood of local governments and municipalities across the United States, accounting for over 70% of all local tax revenue. Property taxes – such as taxes levied on homeowners and landowners – go to fund schools, parks, roads, and other public works and services.

While states typically impose a minimum property tax, property taxes are mostly determined at the local level – and are often a percentage of a property or home’s overall value. Depending on where you choose to buy a home, property taxes can range from negligible amounts to nearly matching a mortgage payment.

Across Florida, the effective annual property tax rate stands at 0.86%, the 25th lowest among states. For context, homeowners in the U.S. pay an average of 1.03% of their housing value in property taxes a year.

The effective property tax rate is calculated by taking the total amount of taxes paid on owner-occupied homes in a given area as a share of the total value of those homes. While an effective property tax rate is useful for comparing taxes at the state level, it is important to note that property tax rates can still vary considerably within a given state.

All data in this story is from the Tax Foundation, a tax policy research organization, and the U.S. Census Bureau’s 2019 American Community Survey.

You May Like: Can I Still File My 2017 Taxes Electronically In 2021

Florida Sales Tax Rates By City

The state sales tax rate in Florida is 6.000%. With local taxes, the total sales tax rate is between 6.000% and 7.500%.

Florida has recent rate changes .

Select the Florida city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Florida was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Federal Income Tax In Florida

Floridians low tax burden is due to the absence of an income tax, making Florida one of seven states without an income tax. Even though Floridians pay federal income taxes, the Florida constitution prohibits this tax.

Depending on your filing status, you pay federal income tax at a rate of 22% on your taxable income.

You can deduct the most common personal deductions to lower your taxable income. The total value of these deductions cannot exceed $6,100 for single filers and $12,200 for married filing jointly.

Don’t Miss: Out Of State Sales Tax

Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019, Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Read Also: Where Is My California Tax Refund

Florida State Income Tax

Florida has a population of over 21 million and is famous for its miles of beautiful beaches. The median household income is $52,594 .

Brief summary of Florida state income tax:

- zero state income tax

Florida tax year starts from July 01 the year before to June 30 the current year. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Total Tax Burden: 819%

The Lone Star State loathes personal income taxes so much that it decided to forbid them in the states constitution. Still, because infrastructure and services must be paid for somehow, Texas relies on income from sales and excise taxes to foot the bill.

Sales tax can be as high as 8.25% in some jurisdictions. Property taxes are also higher than in most states, the net result of which is a total tax burden of 8.19% of personal income. Nevertheless, Texans overall tax bite is still one of the lowest in the U.S., with the state ranking 19th. Texas is average for affordability at 22nd in the nation, but it was ranked 31st by U.S. News & World Report on the Best States to Live In list.

Texas spent $9,827 per pupil on education in 2019, ranking it below average among the 17 Southern states, and it received a D grade for its school funding distribution in 2015. In 2021 the ASCE awarded it a grade of C for its infrastructure. Texas spent $6,998 per capita on healthcare in 2014, the seventh-lowest amount in the U.S.

One advantage of living in a no-tax state is that the $10,000 cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act will likely not have as great an impact as it does on residents of high-tax states, such as California and New York.

Also Check: Exempt From Federal Income Tax

Tax On Rebates & Dealer Incentives

Rebates and other dealer incentives are commonly offered to encourage buyers to purchase certain vehicles. For example, a $1,500 cash rebate may be offered on a $15,000 vehicle, dropping the out-of-pocket cost to $13,500.

In Florida, vehicle sales tax is applied before manufacturer incentives or rebates. In the example above, you would pay taxes on the $15,000 price of the vehicle, since this is the price before incentives.

However, the sales tax is applied minus dealer incentives. Imagine the incentive above is from the dealer, not the manufacturer. In that case, the car buyer would pay the sales tax on the car price of $13,500.

Can You Deduct Transfer Taxes

Usually, you can’t deduct transfer taxes when it comes time to file your tax return. However, there are two potential situations in which you can still capture some tax savings.

Firstly, if you’re using the property in question as a rental home or investment property, you can sometimes write it off as a business expense. If that’snot possible, you can wrap those taxes into the cost basis of the property.

The cost basis of the property is basically what you had to pay in order to acquire the property, and is used to arrive at the amount of capital gains taxes you’ll owe. Your capital gains are arrived by deducting the cost basis of your property from the total price, so including the cost of the Doc Stamps can be helpful in lowering these taxes.

Recommended Reading: When Is Tax Returns Due

Florida Property Tax Rates

Property taxes are collected on a county level, and each county in Florida has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Florida.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Florida. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Florida.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Florida property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Florida Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Florida.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.